概述

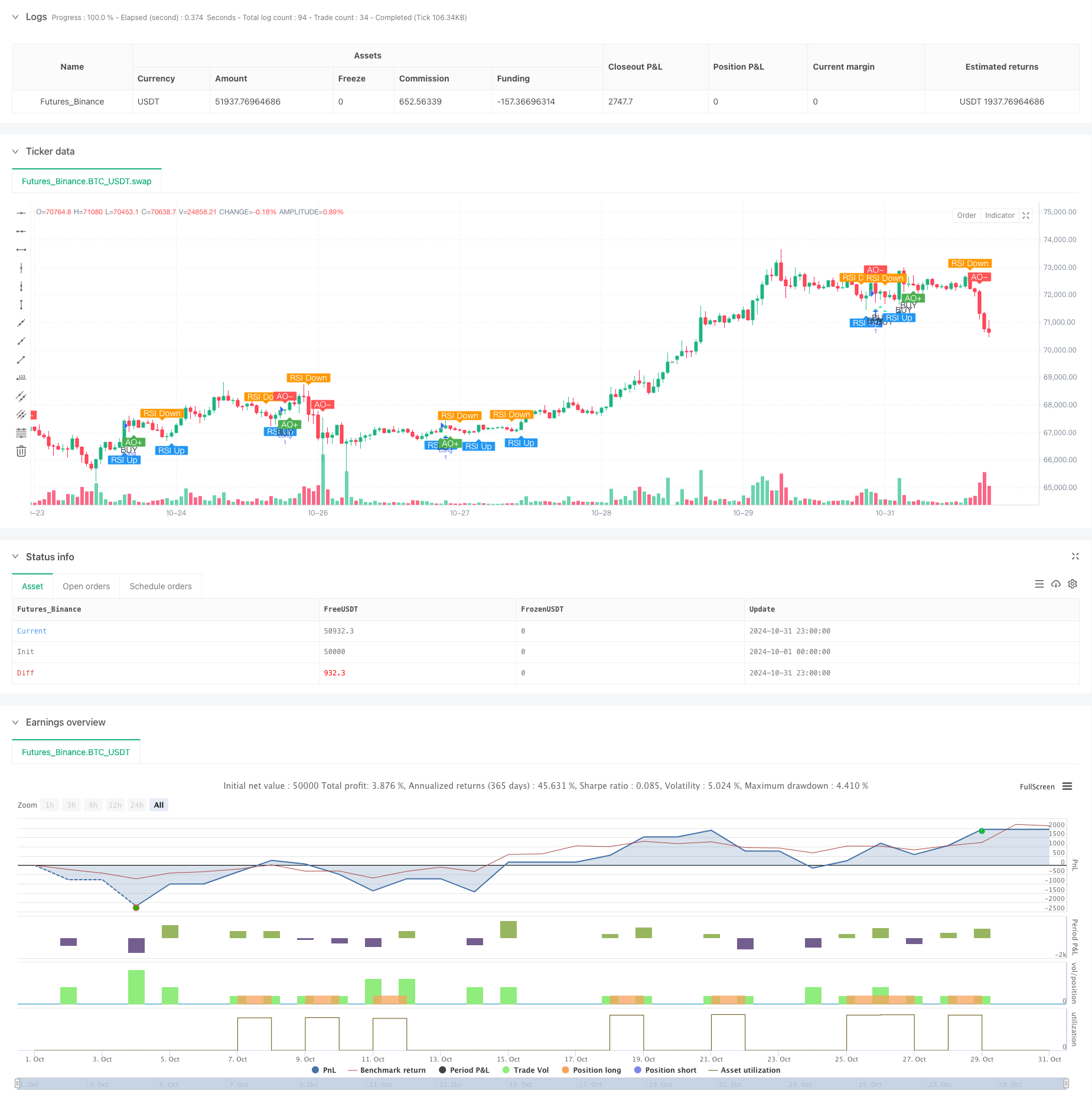

该策略是一个基于相对强弱指标(RSI)和动能振荡器(AO)协同作用的量化交易策略。策略主要通过捕捉RSI突破50水平线与AO处于负值区域的配合信号来识别潜在的做多机会。策略采用百分比止盈止损机制来管理风险,默认使用账户10%的资金进行交易。

策略原理

策略的核心逻辑基于两个技术指标的协同配合: 1. RSI指标:使用14周期的RSI指标监测价格动量,当RSI突破50中轴线时视为上涨动能确立。 2. AO指标:通过对比5周期和34周期的移动平均线计算价格动量,当AO为负值时表明市场处于超卖区域。 3. 入场条件:当RSI突破50且AO为负值时开仓做多,这意味着捕捉到价格在超卖区域出现反转信号。 4. 出场条件:采用2%的止盈和1%的止损设置,确保每笔交易的风险收益比合理。

策略优势

- 信号可靠性高:通过RSI和AO的双重确认,提高了交易信号的可靠性。

- 风险控制完善:设置了固定百分比的止盈止损,有效控制每笔交易的风险。

- 资金管理科学:使用账户资金的固定比例进行交易,避免了过度杠杆。

- 逻辑清晰简单:策略规则直观易懂,便于理解和执行。

- 可视化效果好:在图表上清晰标注了各类信号,便于交易者识别和确认。

策略风险

- 假突破风险:RSI突破50可能出现假突破,需要配合其他技术指标确认。

- 止损过小:1%的止损幅度可能过小,容易被市场波动触及。

- 单向交易限制:策略仅做多不做空,可能错过空头市场的机会。

- 滑点影响:在市场波动剧烈时,可能面临较大的滑点风险。

- 参数敏感性:策略效果受RSI和AO参数设置影响较大。

策略优化方向

- 信号过滤:建议添加成交量确认机制,提高信号可靠性。

- 动态止损:可将固定止损改为跟踪止损,更好地保护利润。

- 参数优化:建议对RSI周期和AO参数进行历史回测优化。

- 市场筛选:添加市场趋势判断,在大趋势向上时才开启交易。

- 仓位管理:可根据信号强度动态调整开仓比例。

总结

这是一个结合RSI和AO指标的趋势追踪策略,通过捕捉超卖区域的反转信号进行做多交易。策略设计合理,风险控制到位,但仍有优化空间。建议交易者在实盘使用前进行充分的历史回测,并根据实际市场情况调整参数设置。策略适合风险承受能力较强、对技术分析有一定理解的交易者使用。

策略源码

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="🐂 BUY Only - RSI Crossing 50 + AO Negative", shorttitle="🐂 AO<0 RSI+50 Strategy", overlay=true)

// -----------------------------

// --- User Inputs ---

// -----------------------------

// RSI Settings

rsiPeriod = input.int(title="RSI Period", defval=14, minval=1)

// AO Settings

aoShortPeriod = input.int(title="AO Short Period", defval=5, minval=1)

aoLongPeriod = input.int(title="AO Long Period", defval=34, minval=1)

// Strategy Settings

takeProfitPerc = input.float(title="Take Profit (%)", defval=2.0, minval=0.0, step=0.1)

stopLossPerc = input.float(title="Stop Loss (%)", defval=1.0, minval=0.0, step=0.1)

// -----------------------------

// --- Awesome Oscillator (AO) Calculation ---

// -----------------------------

// Calculate the Awesome Oscillator

ao = ta.sma(hl2, aoShortPeriod) - ta.sma(hl2, aoLongPeriod)

// Detect AO Crossing Zero

aoCrossOverZero = ta.crossover(ao, 0)

aoCrossUnderZero = ta.crossunder(ao, 0)

// -----------------------------

// --- Relative Strength Index (RSI) Calculation ---

// -----------------------------

// Calculate RSI

rsiValue = ta.rsi(close, rsiPeriod)

// Detect RSI Crossing 50

rsiCrossOver50 = ta.crossover(rsiValue, 50)

rsiCrossUnder50 = ta.crossunder(rsiValue, 50)

// -----------------------------

// --- Plotting Arrows and Labels ---

// -----------------------------

// Plot AO Cross Over Arrow (AO+)

plotshape(series=aoCrossOverZero,

location=location.belowbar,

color=color.green,

style=shape.labelup,

title="AO Crosses Above Zero",

text="AO+",

textcolor=color.white,

size=size.small)

// Plot AO Cross Under Arrow (AO-)

plotshape(series=aoCrossUnderZero,

location=location.abovebar,

color=color.red,

style=shape.labeldown,

title="AO Crosses Below Zero",

text="AO-",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Over Arrow (RSI Up)

plotshape(series=rsiCrossOver50,

location=location.belowbar,

color=color.blue,

style=shape.labelup,

title="RSI Crosses Above 50",

text="RSI Up",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Under Arrow (RSI Down)

plotshape(series=rsiCrossUnder50,

location=location.abovebar,

color=color.orange,

style=shape.labeldown,

title="RSI Crosses Below 50",

text="RSI Down",

textcolor=color.white,

size=size.small)

// -----------------------------

// --- Buy Signal Condition ---

// -----------------------------

// Define Buy Signal: AO is negative and previous bar's RSI > 50

buySignal = (ao < 0) and (rsiValue[1] > 50)

// Plot Buy Signal

plotshape(series=buySignal,

location=location.belowbar,

color=color.lime,

style=shape.triangleup,

title="Buy Signal",

text="BUY",

textcolor=color.black,

size=size.small)

// -----------------------------

// --- Strategy Execution ---

// -----------------------------

// Entry Condition

if buySignal

strategy.entry("Long", strategy.long)

// Exit Conditions

// Calculate Stop Loss and Take Profit Prices

if strategy.position_size > 0

// Entry price

entryPrice = strategy.position_avg_price

// Stop Loss and Take Profit Levels

stopLevel = entryPrice * (1 - stopLossPerc / 100)

takeProfitLevel = entryPrice * (1 + takeProfitPerc / 100)

// Submit Stop Loss and Take Profit Orders

strategy.exit("Exit Long", from_entry="Long", stop=stopLevel, limit=takeProfitLevel)

相关推荐