概述

该策略是一个多维度的技术分析交易系统,结合了动量指标(RSI、MACD)、趋势指标(EMA)、波动率指标(布林带、ATR)以及价格结构指标(斐波那契回调),通过多维度信号的协同配合来捕捉市场机会。策略设计以15分钟时间周期为基准,采用ATR动态止损止盈,具有较强的风险控制能力。

策略原理

策略的核心逻辑包括以下几个维度: 1. 趋势确认:使用9/21周期EMA交叉判断趋势方向 2. 动量验证:结合RSI超卖超买(55⁄45)以及MACD柱状图来验证动量 3. 波动率参考:通过布林带(20周期,2倍标准差)来衡量价格波动 4. 支撑阻力:利用100周期高低点计算的斐波那契0.382⁄0.618⁄0.786水平 5. 风险管理:基于14周期ATR的1.5倍止损和3倍止盈

多个维度信号协同触发后才进行交易,提高了交易的准确性。

策略优势

- 多维度信号交叉验证,显著降低虚假信号

- 动态的ATR止损止盈,适应不同市场环境

- 结合经典技术指标,易于理解和维护

- 精确的入场时机选择,提高胜率

- 风险收益比为1:2,符合专业交易标准

- 适合波动剧烈的市场环境

策略风险

- 参数优化可能导致过度拟合

- 多重信号条件可能错过部分行情

- 固定倍数止损可能在极端行情下失效

- 对计算资源要求较高

- 交易成本可能影响策略表现

策略优化方向

- 引入成交量因素验证信号强度

- 动态调整RSI阈值以适应不同市场

- 增加趋势强度过滤器

- 优化止损止盈倍数

- 加入时间过滤避免震荡市

- 考虑引入机器学习动态优化参数

总结

该策略通过多维度技术指标的协同配合,构建了一个稳健的交易系统。其核心优势在于信号的交叉验证和动态风险控制,但也需要注意参数优化和市场环境适应性的问题。后续优化方向主要集中在动态参数调整和信号质量提升上。

策略源码

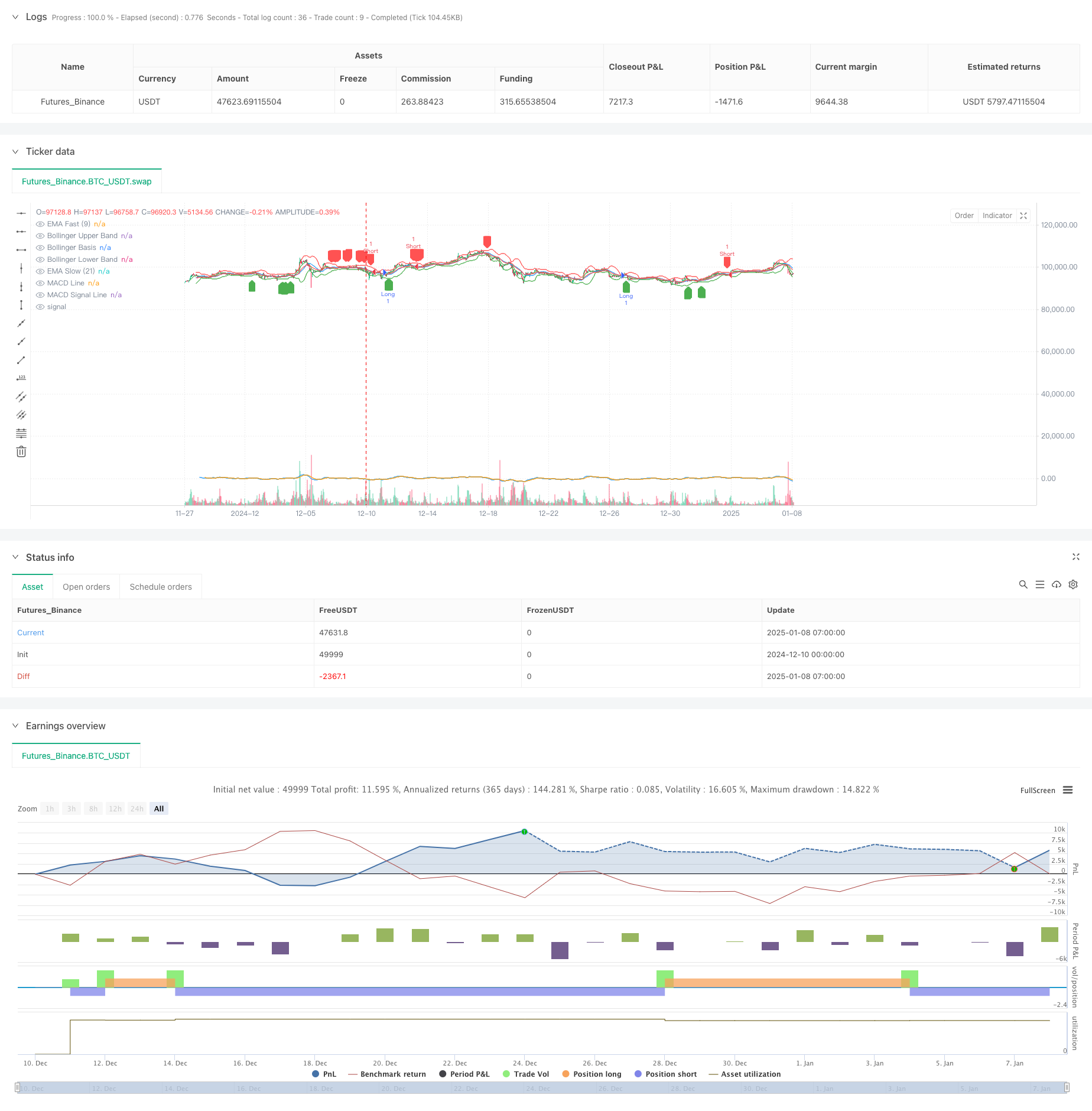

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Optimized Advanced Strategy", overlay=true)

// Bollinger Bandı

length = input(20, title="Bollinger Band Length")

src = close

mult = input.float(2.0, title="Bollinger Band Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// RSI

rsi = ta.rsi(close, 14)

// MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// EMA

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 21)

// ATR

atr = ta.atr(14)

// Fibonacci Seviyeleri

lookback = input(100, title="Fibonacci Lookback Period")

highPrice = ta.highest(high, lookback)

lowPrice = ta.lowest(low, lookback)

fiboLevel618 = lowPrice + (highPrice - lowPrice) * 0.618

fiboLevel382 = lowPrice + (highPrice - lowPrice) * 0.382

fiboLevel786 = lowPrice + (highPrice - lowPrice) * 0.786

// Kullanıcı Ayarlı Stop-Loss ve Take-Profit

stopLossATR = atr * 1.5

takeProfitATR = atr * 3

// İşlem Koşulları

longCondition = (rsi < 55) and (macdLine > signalLine) and (emaFast > emaSlow) and (close >= fiboLevel382 and close <= fiboLevel618)

shortCondition = (rsi > 45) and (macdLine < signalLine) and (emaFast < emaSlow) and (close >= fiboLevel618 and close <= fiboLevel786)

// İşlem Girişleri

if (longCondition)

strategy.entry("Long", strategy.long, stop=close - stopLossATR, limit=close + takeProfitATR, comment="LONG SIGNAL")

if (shortCondition)

strategy.entry("Short", strategy.short, stop=close + stopLossATR, limit=close - takeProfitATR, comment="SHORT SIGNAL")

// Bollinger Bandını Çizdir

plot(upper, color=color.red, title="Bollinger Upper Band")

plot(basis, color=color.blue, title="Bollinger Basis")

plot(lower, color=color.green, title="Bollinger Lower Band")

// Fibonacci Seviyelerini Çizdir

// line.new(x1=bar_index[1], y1=fiboLevel382, x2=bar_index, y2=fiboLevel382, color=color.blue, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel618, x2=bar_index, y2=fiboLevel618, color=color.orange, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel786, x2=bar_index, y2=fiboLevel786, color=color.purple, width=1, style=line.style_dotted)

// Göstergeleri Görselleştir

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="MACD Signal Line")

plot(emaFast, color=color.green, title="EMA Fast (9)")

plot(emaSlow, color=color.red, title="EMA Slow (21)")

// İşlem İşaretleri

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Long Entry")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Short Entry")

相关推荐