概述

该策略是一个结合了趋势跟踪和波动率过滤的智能交易系统。它通过指数移动平均线(EMA)识别市场趋势,利用真实波动幅度(TR)和动态波动率过滤器来确定入场时机,并采用基于波动性的动态止盈止损机制管理风险。策略支持两种交易模式:短线(Scalp)和波段(Swing),可以根据不同的市场环境和交易风格灵活切换。

策略原理

策略的核心逻辑包含以下几个关键组成部分: 1. 趋势识别:使用50周期EMA作为趋势过滤器,只在价格位于EMA之上做多,位于EMA之下做空。 2. 波动率过滤:计算真实波动幅度(TR)的EMA,并使用可调节的过滤系数(默认1.5)来过滤市场噪音。 3. 入场条件:结合连续3根K线的形态分析,要求价格运动具有持续性和加速特征。 4. 止盈止损:在短线模式下基于当前TR设置,波段模式下基于前期高低点设置,实现动态风险管理。

策略优势

- 自适应性强:通过动态波动率过滤和趋势跟踪相结合,能够适应不同市场环境。

- 风险管理完善:提供两种交易模式的动态止盈止损机制,可根据市场特征灵活选择。

- 参数可调性好:关键参数如过滤系数、趋势周期等都可以根据交易品种特点进行优化。

- 可视化效果佳:提供清晰的买卖信号标记和止盈止损位显示,便于交易监控。

策略风险

- 趋势反转风险:在趋势转折点可能出现连续止损。

- 假突破风险:在波动率突增时可能触发虚假信号。

- 参数敏感性:过滤系数设置不当可能导致信号过多或过少。

- 滑点影响:在快速市场中可能面临较大滑点,影响策略表现。

策略优化方向

- 增加趋势强度过滤:可引入ADX等指标评估趋势强度,提高趋势跟踪效果。

- 优化止盈止损:可考虑引入移动止损,保护更多利润。

- 完善波段模式:可加入更多波段交易特有的判断条件,提高中长期持仓能力。

- 增加成交量分析:结合成交量变化来确认突破的有效性。

总结

该策略通过将趋势跟踪、波动率过滤和动态风险管理有机结合,构建了一个完整的交易系统。策略的优势在于其适应性强、风险可控,同时提供了较大的优化空间。通过合理设置参数和选择合适的交易模式,该策略能够在不同市场环境下保持稳定表现。建议交易者在实盘使用前,进行充分的回测和参数优化,并根据具体交易品种的特点做出相应调整。

策略源码

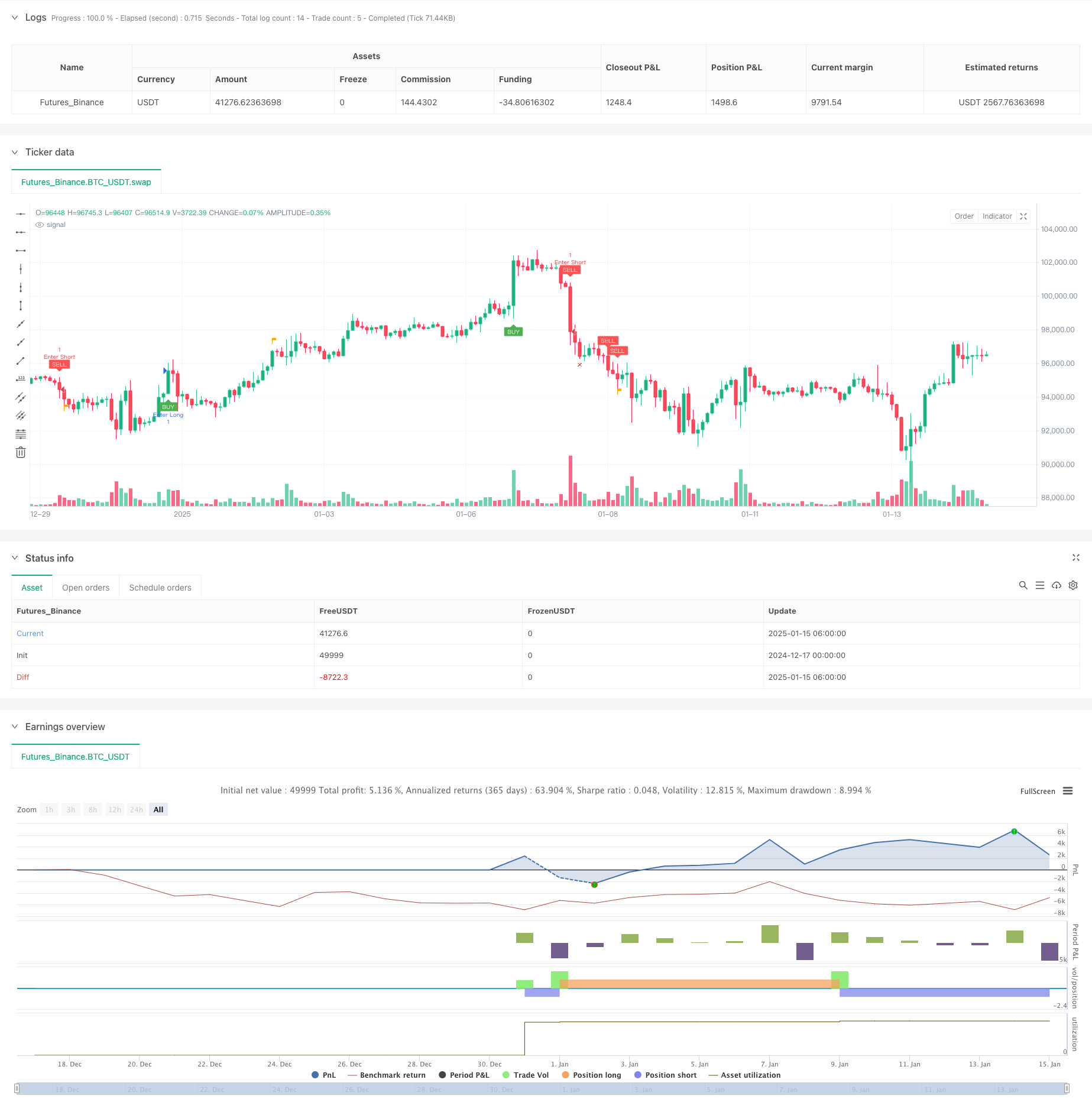

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-15 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Creativ3mindz

//@version=5

strategy("Scalp Slayer (I)", overlay=true)

// Input Parameters

filterNumber = input.float(1.5, "Filter Number", minval=1.0, maxval=10.0, tooltip="Higher = More aggressive Filter, Lower = Less aggressive")

emaTrendPeriod = input.int(50, "EMA Trend Period", minval=1, tooltip="Period for the EMA used for trend filtering")

lookbackPeriod = input.int(20, "Lookback Period for Highs/Lows", minval=1, tooltip="Period for determining recent highs/lows")

colorTP = input.color(title='Take Profit Color', defval=color.orange)

colorSL = input.color(title='Stop Loss Color', defval=color.red)

// Inputs for visibility

showBuyLabels = input.bool(true, title="Show Buy Labels")

showSellLabels = input.bool(true, title="Show Sell Labels")

// Alert Options

alertOnCondition = input.bool(true, title="Alert on Condition Met", tooltip="Enable to alert when condition is met")

// Trade Mode Toggle

tradeMode = input.bool(false, title="Trade Mode (ON = Swing, OFF = Scalp)", tooltip="Swing-mode you can use your own TP/SL.")

// Calculations

tr = high - low

ema = filterNumber * ta.ema(tr, 50)

trendEma = ta.ema(close, emaTrendPeriod) // Calculate the EMA for the trend filter

// Highest and lowest high/low within lookback period for swing logic

swingHigh = ta.highest(high, lookbackPeriod)

swingLow = ta.lowest(low, lookbackPeriod)

// Variables to track the entry prices and SL/TP levels

var float entryPriceLong = na

var float entryPriceShort = na

var float targetPriceLong = na

var float targetPriceShort = na

var float stopLossLong = na

var float stopLossShort = na

var bool tradeActive = false

// Buy and Sell Conditions with Trend Filter

buyCondition = close > trendEma and // Buy only if above the trend EMA

close[2] > open[2] and close[1] > open[1] and close > open and

(math.abs(close[2] - open[2]) > math.abs(close[1] - open[1])) and

(math.abs(close - open) > math.abs(close[1] - open[1])) and

close > close[1] and close[1] > close[2] and tr > ema

sellCondition = close < trendEma and // Sell only if below the trend EMA

close[2] < open[2] and close[1] < open[1] and close < open and

(math.abs(close[2] - open[2]) > math.abs(close[1] - open[1])) and

(math.abs(close - open) > math.abs(close[1] - open[1])) and

close < close[1] and close[1] < close[2] and tr > ema

// Entry Rules

if (buyCondition and not tradeActive)

entryPriceLong := close // Track entry price for long position

stopLossLong := tradeMode ? ta.lowest(low, lookbackPeriod) : swingLow // Scalping: recent low, Swing: lowest low of lookback period

targetPriceLong := tradeMode ? close + tr : swingHigh // Scalping: close + ATR, Swing: highest high of lookback period

tradeActive := true

if (sellCondition and not tradeActive)

entryPriceShort := close // Track entry price for short position

stopLossShort := tradeMode ? ta.highest(high, lookbackPeriod) : swingHigh // Scalping: recent high, Swing: highest high of lookback period

targetPriceShort := tradeMode ? close - tr : swingLow // Scalping: close - ATR, Swing: lowest low of lookback period

tradeActive := true

// Take Profit and Stop Loss Logic

signalBuyTPPrint = (not na(entryPriceLong) and close >= targetPriceLong)

signalSellTPPrint = (not na(entryPriceShort) and close <= targetPriceShort)

signalBuySLPrint = (not na(entryPriceLong) and close <= stopLossLong)

signalSellSLPrint = (not na(entryPriceShort) and close >= stopLossShort)

if (signalBuyTPPrint or signalBuySLPrint)

entryPriceLong := na // Reset entry price for long position

targetPriceLong := na // Reset target price for long position

stopLossLong := na // Reset stop-loss for long position

tradeActive := false

if (signalSellTPPrint or signalSellSLPrint)

entryPriceShort := na // Reset entry price for short position

targetPriceShort := na // Reset target price for short position

stopLossShort := na // Reset stop-loss for short position

tradeActive := false

// Plot Buy and Sell Labels with Visibility Conditions

plotshape(showBuyLabels and buyCondition, "Buy", shape.labelup, location=location.belowbar, color=color.green, text="BUY", textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and sellCondition, "Sell", shape.labeldown, location=location.abovebar, color=color.red, text="SELL", textcolor=color.white, size=size.tiny)

// Plot Take Profit Flags

plotshape(showBuyLabels and signalBuyTPPrint, title="Take Profit (buys)", text="TP", style=shape.flag, location=location.abovebar, color=colorTP, textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and signalSellTPPrint, title="Take Profit (sells)", text="TP", style=shape.flag, location=location.belowbar, color=colorTP, textcolor=color.white, size=size.tiny)

// Plot Stop Loss "X" Marker

plotshape(showBuyLabels and signalBuySLPrint, title="Stop Loss (buys)", text="X", style=shape.xcross, location=location.belowbar, color=colorSL, textcolor=color.white, size=size.tiny)

plotshape(showSellLabels and signalSellSLPrint, title="Stop Loss (sells)", text="X", style=shape.xcross, location=location.abovebar, color=colorSL, textcolor=color.white, size=size.tiny)

// Alerts

alertcondition(buyCondition and alertOnCondition, title="Buy Alert", message='{"content": "Buy {{ticker}} at {{close}}"}')

alertcondition(sellCondition and alertOnCondition, title="Sell Alert", message='{"content": "Sell {{ticker}} at {{close}}"}')

alertcondition(signalBuyTPPrint and alertOnCondition, title="Buy TP Alert", message='{"content": "Buy TP {{ticker}} at {{close}}"}')

alertcondition(signalSellTPPrint and alertOnCondition, title="Sell TP Alert", message='{"content": "Sell TP {{ticker}} at {{close}}"}')

alertcondition(signalBuySLPrint and alertOnCondition, title="Buy SL Alert", message='{"content": "Buy SL {{ticker}} at {{close}}"}')

alertcondition(signalSellSLPrint and alertOnCondition, title="Sell SL Alert", message='{"content": "Sell SL {{ticker}} at {{close}}"}')

if buyCondition

strategy.entry("Enter Long", strategy.long)

else if sellCondition

strategy.entry("Enter Short", strategy.short)

相关推荐