概述

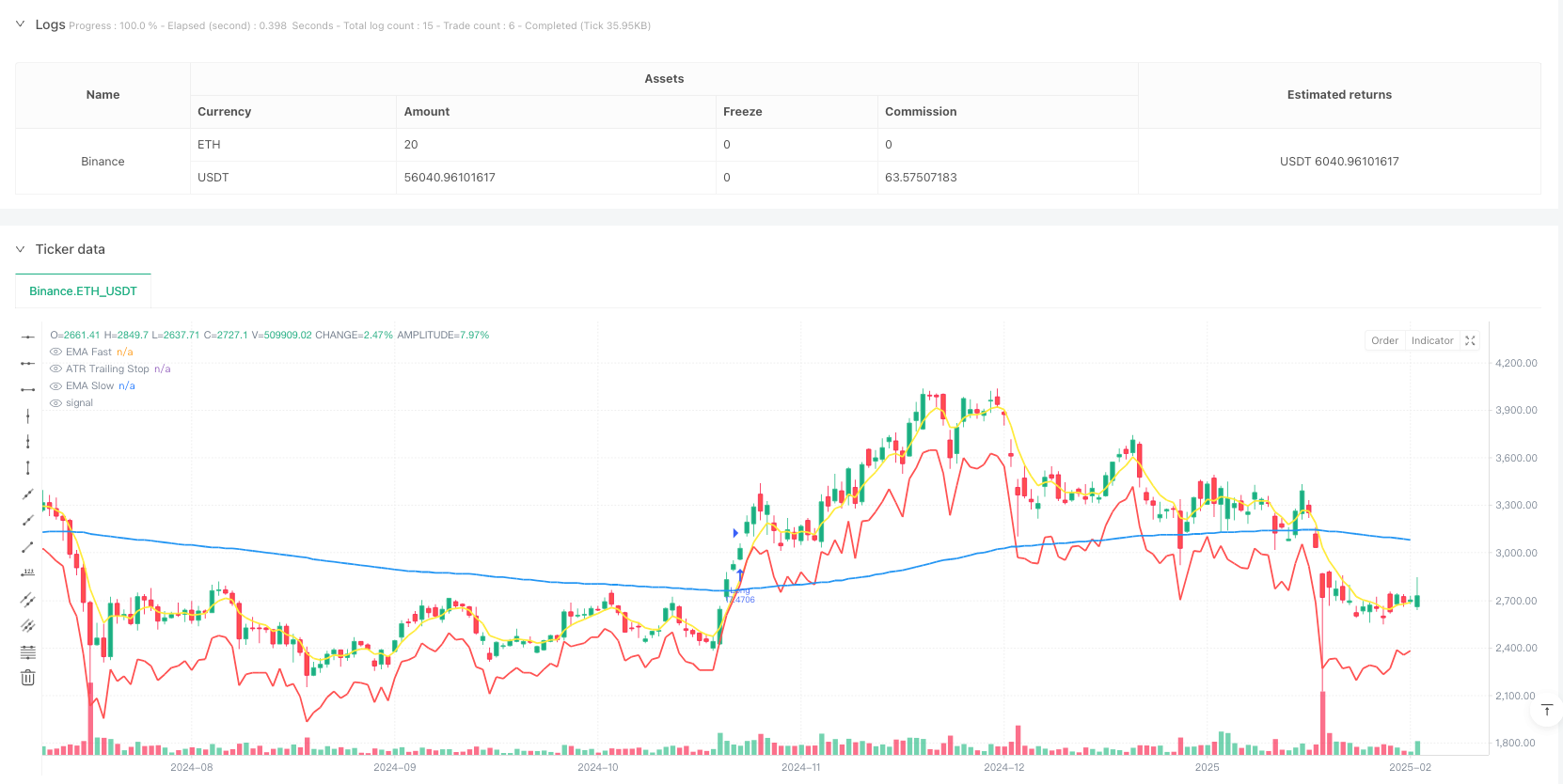

该策略是一个基于均线交叉和动态止损的趋势追踪系统。核心逻辑是通过快速均线(EMA5)与慢速均线(EMA200)的金叉来捕捉上涨趋势的起点,并结合ATR动态止损来保护盈利。策略还设置了固定百分比的止盈目标,以实现风险收益的平衡。

策略原理

策略运作基于以下核心机制: 1. 入场信号由EMA5上穿EMA200触发,表明短期动能突破长期趋势 2. 动态止损基于ATR指标计算,止损价格设定为收盘价减去ATR值乘以倍数 3. 止盈目标设定为入场价格的固定百分比(默认5%) 4. 持仓期间,ATR止损价会随着价格上涨而上移,形成跟踪止损 5. 当价格触及止损线或达到止盈目标时,策略自动平仓

策略优势

- 趋势捕捉能力强 - EMA交叉系统能有效识别趋势初期阶段

- 风险管理灵活 - ATR动态止损可根据市场波动性自适应调整

- 执行力稳定 - 系统化的入场出场规则,避免人为情绪干扰

- 参数可调整性强 - 均线周期、ATR倍数和止盈比例都可根据需求优化

- 操作逻辑清晰 - 策略规则简单明确,易于理解和执行

策略风险

- 假突破风险 - 横盘市场可能产生多个无效的交叉信号

- 回撤风险 - 趋势突然逆转时可能承受较大回撤

- 滑点风险 - 快速波动市场中止损或止盈订单可能面临滑点

- 参数敏感性 - 不同市场环境下最优参数可能存在较大差异

- 资金管理风险 - 固定仓位比例可能在某些情况下风险过大

策略优化方向

- 增加趋势过滤器 - 可引入ADX等趋势强度指标,过滤弱势行情

- 优化止损机制 - 可考虑结合支撑位或波动率百分比设置止损

- 动态调整止盈 - 根据市场波动性或趋势强度动态调整止盈目标

- 增加时间过滤 - 避开波动性较大的时间段

- 完善仓位管理 - 引入动态仓位管理机制,根据市场风险度调整

总结

这是一个结合经典技术指标与现代风险管理的趋势追踪策略。通过均线交叉捕捉趋势,利用ATR动态止损保护盈利,在趋势市场中表现出色。虽然存在一定的假信号风险,但通过参数优化和增加过滤器可以显著提升策略的稳定性。策略的核心优势在于其系统化的操作逻辑和灵活的风险管理机制,适合作为中长期趋势交易的基础策略框架。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// -----------------------------------------------------------

// Title: EMA5 Cross-Up EMA200 with ATR Trailing Stop & Take-Profit

// Author: ChatGPT

// Version: 1.1 (Pine Script v6)

// Notes: Enter Long when EMA(5) crosses above EMA(200).

// Exit on either ATR-based trailing stop or

// specified % Take-Profit.

// -----------------------------------------------------------

//@version=6

strategy(title="EMA5 Cross-Up EMA200 ATR Stop", shorttitle="EMA5x200_ATRStop_v6", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity,default_qty_value=100)

// -- 1) Inputs

emaFastLength = input.int(5, "Fast EMA Length")

emaSlowLength = input.int(200, "Slow EMA Length")

atrPeriod = input.int(14, "ATR Period")

atrMult = input.float(2.0,"ATR Multiplier", step=0.1)

takeProfitPerc = input.float(5.0,"Take-Profit %", step=0.1)

// -- 2) Indicator Calculations

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

atrValue = ta.atr(atrPeriod)

// -- 3) Entry Condition: EMA5 crosses above EMA200

emaCrossUp = ta.crossover(emaFast, emaSlow)

// -- 4) Determine a dynamic ATR-based stop loss (for trailing)

longStopPrice = close - (atrValue * atrMult)

// -- 5) Take-Profit Price

// We store it in a variable so we can update it when in position.

var float takeProfitPrice = na

var float avgEntryPrice = na

if strategy.position_size > 0

// If there is an open long, get the average fill price:

avgEntryPrice := strategy.position_avg_price

takeProfitPrice := avgEntryPrice * (1 + takeProfitPerc / 100)

else

// If no open position, reset

takeProfitPrice := na

avgEntryPrice := na

// -- 6) Submit Entry Order

if emaCrossUp

strategy.entry(id="Long", direction=strategy.long)

// -- 7) Submit Exit Orders (Stop or Take-Profit)

strategy.exit(id = "Exit Long",stop = longStopPrice,limit = takeProfitPrice)

// -- 8) (Optional) Plotting for Visuals

plot(emaFast, color=color.new(color.yellow, 0), linewidth=2, title="EMA Fast")

plot(emaSlow, color=color.new(color.blue, 0), linewidth=2, title="EMA Slow")

plot(longStopPrice, color=color.red, linewidth=2, title="ATR Trailing Stop")

相关推荐