概述

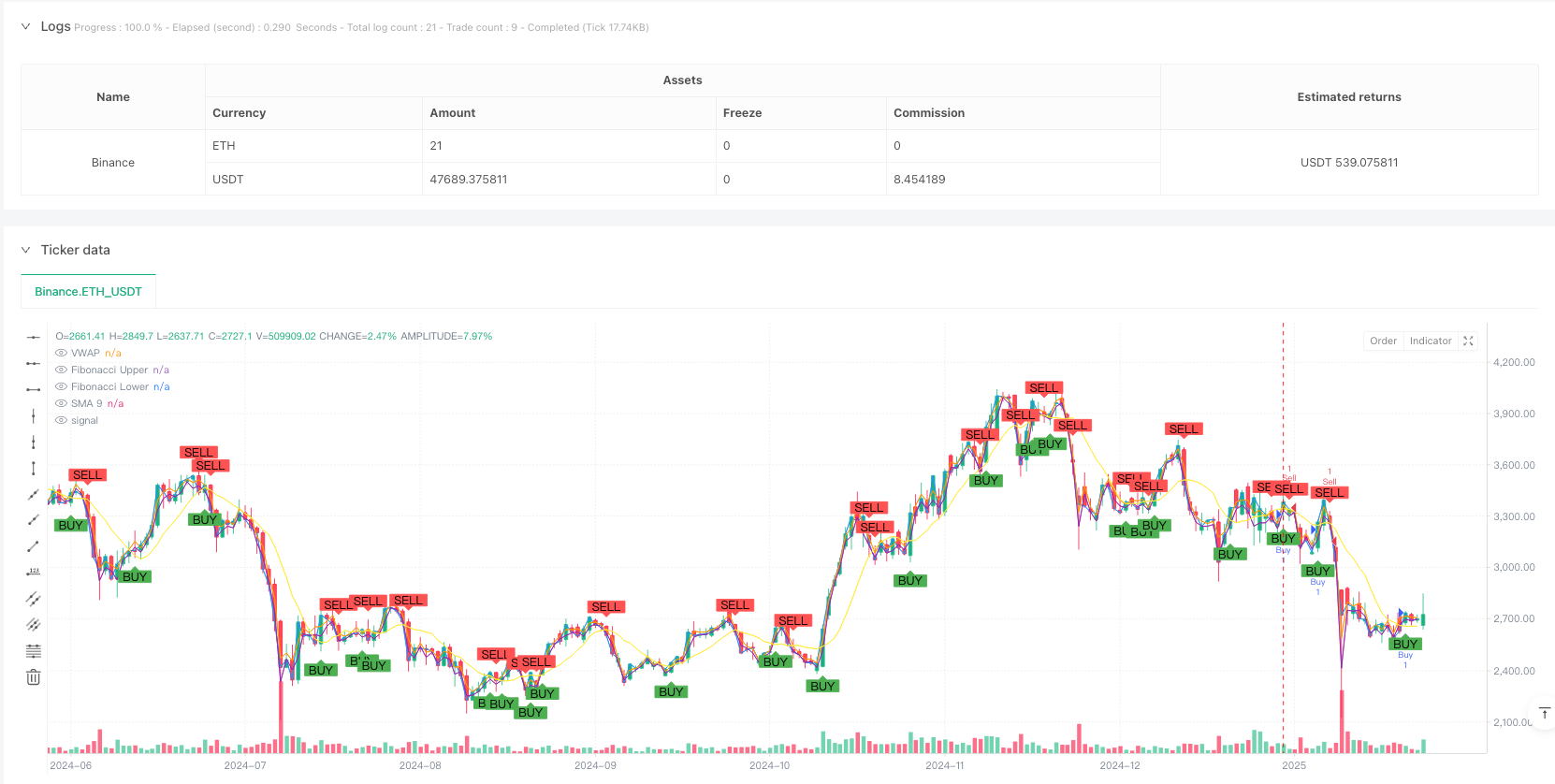

这是一个将多个技术指标有机结合的日内量化交易策略,通过整合成交量加权平均价(VWAP)、斐波那契回调水平、相对强弱指标(RSI)和简单移动平均线(SMA),构建了一个多维度的交易信号系统。该策略通过对不同指标的协同配合,在市场波动中寻找高概率的交易机会。

策略原理

策略采用多层过滤机制来确认交易信号: 1. 使用RSI指标识别超买超卖区域,当RSI突破30进入超卖区域时产生买入信号,突破70进入超买区域时产生卖出信号 2. 通过斐波那契回调水平(0.382和0.618)建立价格运动的参考区间,只在价格处于该区间内时才允许交易 3. 将VWAP作为趋势确认指标,价格在VWAP上方时支持做多,下方时支持做空 4. 引入SMA作为辅助指标,当价格突破SMA时产生额外的交易信号 最终交易信号需要满足RSI条件或SMA条件,并且符合斐波那契区间和VWAP位置要求。

策略优势

- 多重信号确认机制显著提高了交易的可靠性,降低了虚假信号的影响

- 结合了趋势和震荡两种交易思路,既能捕捉趋势性机会,也能进行区间交易

- 通过VWAP的引入,考虑了成交量因素,使策略更贴近市场实际情况

- 斐波那契回调水平的应用帮助确定关键价格区域,提高了入场时机的准确性

- 策略逻辑清晰,各个指标的作用明确,便于监控和调整

策略风险

- 多重条件可能导致错过部分交易机会,特别是在快速行情中

- RSI和SMA可能在剧烈波动市场中产生滞后信号

- 斐波那契回调区间的计算依赖于历史数据,在市场环境发生显著变化时可能失效

- VWAP的参考意义在不同时间周期上可能存在差异

- 需要合理设置止损以控制风险,避免在剧烈波动中遭受过大损失

策略优化方向

- 引入自适应的参数优化机制,根据市场波动状况动态调整各指标参数

- 增加成交量分析维度,在VWAP基础上添加成交量异常识别

- 考虑加入市场波动率指标,在不同波动环境下调整策略激进程度

- 完善止损止盈机制,可以考虑使用动态止损方案

- 增加交易时间过滤,识别不同时间段的市场特征

总结

这是一个综合性强、逻辑严谨的日内交易策略。通过多个技术指标的协同作用,在控制风险的同时追求稳定收益。策略具有较强的实用性和可扩展性,通过合理的参数优化和风险控制,能够适应不同的市场环境。然而,使用者需要深入理解各个指标的特性,合理设置参数,并始终注意风险控制。

策略源码

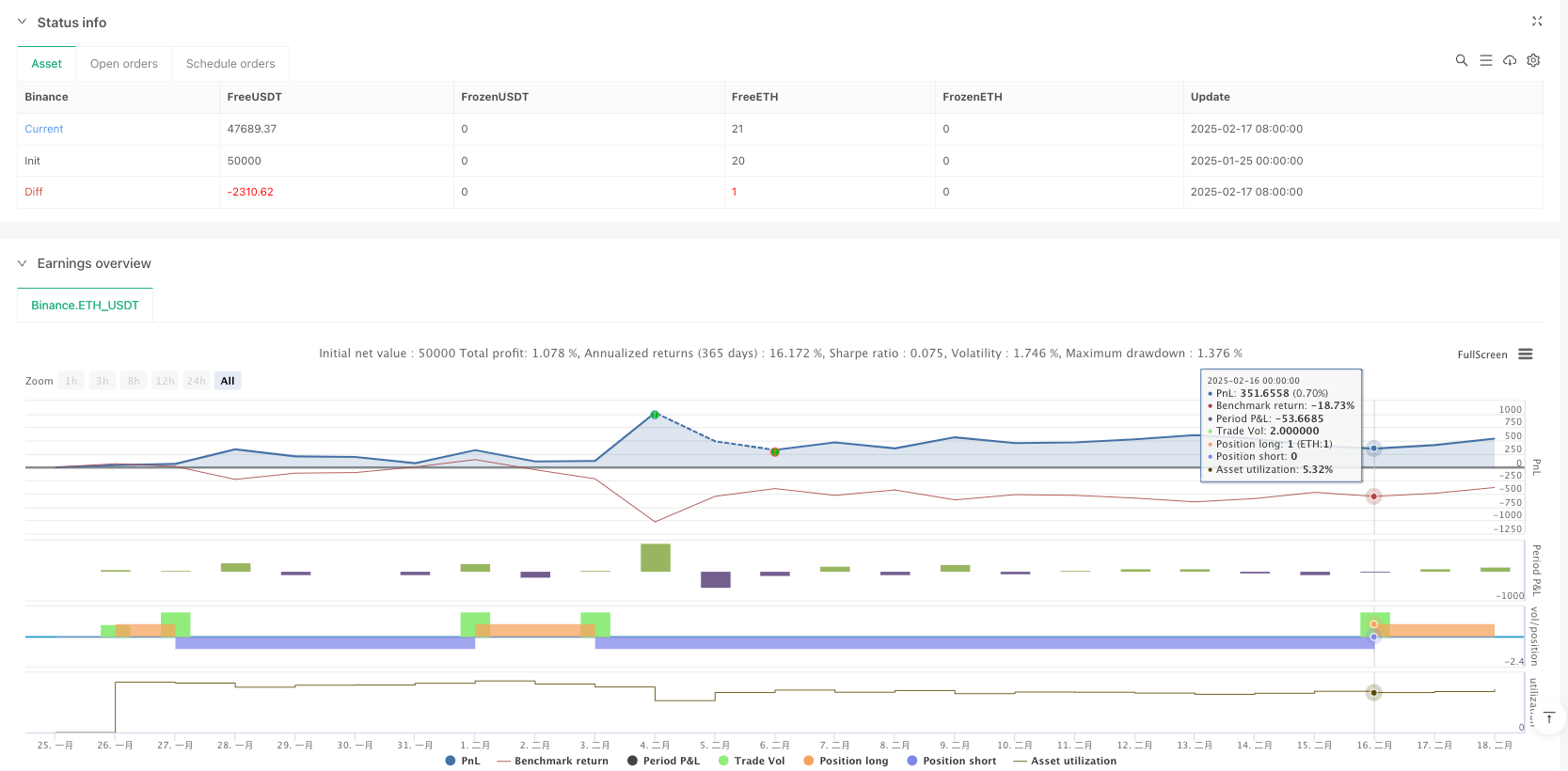

/*backtest

start: 2025-01-25 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// Pine Script v5 kodu

//@version=5

strategy("Intraday Strategy with VWAP, Fibonacci, RSI, and SMA", shorttitle="Intraday Strategy", overlay=true)

// Input settings

lengthRSI = input.int(14, title="RSI Length")

lengthFib = input.int(5, title="Fibonacci Lookback Period")

timeframeVWAP = input.timeframe("", title="VWAP Timeframe")

smaLength = input.int(9, title="SMA Length")

rsi = ta.rsi(close, lengthRSI)

sma = ta.sma(close, smaLength)

[fibHigh, fibLow] = request.security(syminfo.tickerid, timeframe.period, [high, low])

upper = fibHigh - (fibHigh - fibLow) * 0.382

lower = fibHigh - (fibHigh - fibLow) * 0.618

vwav = request.security(syminfo.tickerid, timeframeVWAP, ta.vwap(close))

price_above_vwap = close > vwav

// Trading conditions

buySignalRSI = ta.crossover(rsi, 30) and close > lower and close < upper and price_above_vwap

sellSignalRSI = ta.crossunder(rsi, 70) and close < upper and close > lower and not price_above_vwap

buySignalSMA = ta.crossover(close, sma)

sellSignalSMA = ta.crossunder(close, sma)

finalBuySignal = buySignalRSI or buySignalSMA

finalSellSignal = sellSignalRSI or sellSignalSMA

// Execute trades

if finalBuySignal

strategy.entry("Buy", strategy.long)

if finalSellSignal

strategy.entry("Sell", strategy.short)

// Plot signals

plotshape(finalBuySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(finalSellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot VWAP, SMA, and levels

plot(vwav, color=color.blue, title="VWAP")

plot(sma, color=color.yellow, title="SMA 9")

lineUpper = plot(upper, color=color.orange, title="Fibonacci Upper")

lineLower = plot(lower, color=color.purple, title="Fibonacci Lower")

相关推荐