概述

多指标突破与反转交易策略是一种结合技术分析指标与价格行为的量化交易方法,旨在捕捉市场中的两类主要交易机会:价格反转和趋势突破。该策略巧妙地整合了移动平均线、相对强弱指数(RSI)、平均真实范围(ATR)和交易量加权平均价格(VWAP)等多种技术指标,同时引入开盘区间突破(ORB)机制以增强入场信号的可靠性。策略采用双目标止盈设计,并具备自动将止损调整至盈亏平衡点的风险管理机制,特别适合在短时间周期(如2分钟图表)上应用,通过参数调整也可适用于更高的时间周期。

策略原理

该策略的核心原理是通过多重指标过滤和确认,识别三类潜在有利的交易机会:

反转交易信号:

- 多头反转:当价格上穿50期简单移动平均线(SMA50),RSI低于超卖阈值(默认30),且价格低于VWAP,同时总体趋势向上(价格高于SMA200)时触发。

- 空头反转:当价格下穿SMA50,RSI高于超买阈值(默认70),且价格高于VWAP,同时总体趋势向下(价格低于SMA200)时触发。

趋势突破信号:

- 多头突破:当9期指数移动平均线(EMA9)上穿20期指数移动平均线(EMA20),价格高于VWAP,且总体趋势向上时触发。

- 空头突破:当EMA9下穿EMA20,价格低于VWAP,且总体趋势向下时触发。

开盘区间突破(ORB)信号:

- 多头ORB:当价格突破开盘前特定数量柱(默认15柱)形成的最高价,且交易量超过开盘区间平均交易量的预设倍数(默认1.5倍)时触发。

- 空头ORB:当价格跌破开盘前形成的最低价,且交易量满足阈值条件时触发。

策略使用ATR指标计算动态止损位置,通过回溯特定周期(默认7)的最低价/最高价并加减ATR值的倍数(默认0.5)来设定。入场后,策略设置两个止盈目标: - 第一目标(TP1):风险的0.5倍(默认),平仓25%的头寸 - 第二目标(TP2):风险的1.1倍(默认),平仓剩余75%的头寸

当第一个止盈目标达成后,策略自动将止损调整至入场价格(盈亏平衡点),有效保护已获得的利润。

策略优势

多样化的入场信号:通过整合反转、突破和开盘区间突破三种不同的入场信号,策略能够适应多种市场环境,有效增加交易机会,同时保持较高的信号质量。

完善的风险管理:策略采用分级止盈机制,允许部分获利同时保留潜在的更大收益。当达到第一个止盈目标时,自动将止损调整至盈亏平衡点,实现”让利润奔跑”的同时保护资本。

动态止损计算:使用ATR指标计算止损位置,使止损水平能够根据市场波动性动态调整,更准确地反映当前市场状况,避免过于紧密或过于宽松的止损设置。

交易量确认:特别在ORB信号中引入交易量确认机制,要求突破时的交易量必须超过开盘区间平均交易量的特定倍数,有效过滤低质量突破。

趋势过滤:通过200期简单移动平均线(SMA200)判断长期趋势方向,确保交易方向与主要趋势一致,提高交易成功率。

资金管理整合:策略内置资金管理机制,限制每个交易使用的资金比例(默认50%的资本),确保资金多元化配置,降低单一交易的风险敞口。

策略风险

- 指标滞后性:策略主要依赖移动平均线等滞后指标,可能导致在快速变化的市场中入场时机延迟,错过较佳入场点或导致不必要的损失。

解决方法:考虑增加前瞻性指标如价格行为模式识别,或缩短较长周期移动平均线的参数,提高对市场变化的敏感性。

- 参数敏感性:大量可调参数(如EMA长度、RSI阈值、ATR系数等)使策略优化变得复杂,且可能导致过度拟合历史数据而在未来市场中表现不佳。

解决方法:采用适当的参数优化方法,如前向验证、蒙特卡洛模拟,避免过度优化;或者使用固定参数,专注于更加稳健的规则设计。

- 多信号冲突:在某些市场环境下,不同的入场信号可能产生相互矛盾的交易建议,导致策略表现不稳定。

解决方法:建立更严格的信号优先级系统,或引入额外的确认机制,确保只在高概率情况下执行交易。

- 止损跳空风险:在波动较大或流动性较低的市场中,价格可能跳空越过止损位置,导致实际损失超过预期。

解决方法:考虑使用期权对冲策略,或在高波动性市场条件下增加止损距离,甚至临时降低头寸规模。

- 系统性风险敞口:策略同时运行多个相关交易,可能在市场剧烈波动时面临系统性风险,导致多个交易同时亏损。

解决方法:实施全局风险控制,限制总体头寸规模,或在不同资产类别间分散交易,降低相关性风险。

策略优化方向

- 引入机器学习模型:将机器学习算法应用于指标权重优化或市场环境分类,可自动调整不同市场条件下各指标的相对重要性,提高策略的适应性。

优化理由:传统的固定权重指标组合难以适应不同市场阶段,而机器学习可以从历史数据中自动学习最优的指标组合模式。

- 整合市场情绪指标:加入波动率指数(VIX)或高频市场情绪指标,帮助策略更好地识别市场环境,调整入场条件和风险参数。

优化理由:市场情绪对短期价格走势有显著影响,整合这类指标可以提前捕捉市场转折点,优化入场和出场时机。

- 动态调整止盈比例:基于历史波动性或支撑阻力水平自动调整止盈目标,使策略在不同波动环境中都能获取合理的利润。

优化理由:固定的风险回报比在不同市场环境中可能不够灵活,动态调整可以在高波动市场中设置更远的目标,低波动市场中设置更保守的目标。

- 引入时间过滤器:加入基于市场时段的过滤机制,避免在低波动或不利时段交易,如市场开盘后的前几分钟或流动性较低的午间时段。

优化理由:市场活动在一天中不同时段表现出明显差异,时间过滤可以帮助策略专注于最具优势的交易时段。

- 优化头寸规模计算:从固定资金比例转为基于波动性的头寸规模计算,在高波动时期自动减小头寸,低波动时期适当增加头寸。

优化理由:风险与市场波动性直接相关,动态头寸管理可以保持更一致的风险水平,改善长期风险调整后收益。

总结

多指标突破与反转交易策略是一个融合多种技术分析方法的综合性量化交易系统,通过整合反转、趋势突破和开盘区间突破信号,结合完善的风险管理和资金管理机制,旨在捕捉各种市场环境下的交易机会。策略的核心优势在于信号多元化、风险控制完善以及参数可定制性强,特别适合短周期交易。同时,策略也面临指标滞后性、参数敏感性和信号冲突等潜在风险,需要通过引入机器学习、市场情绪分析、动态止盈设置等方向进行进一步优化。总体而言,这是一个设计全面、思路清晰的交易策略框架,为量化交易者提供了良好的起点,通过持续改进和适当的风险管理,有潜力成为一个稳健可靠的交易系统。

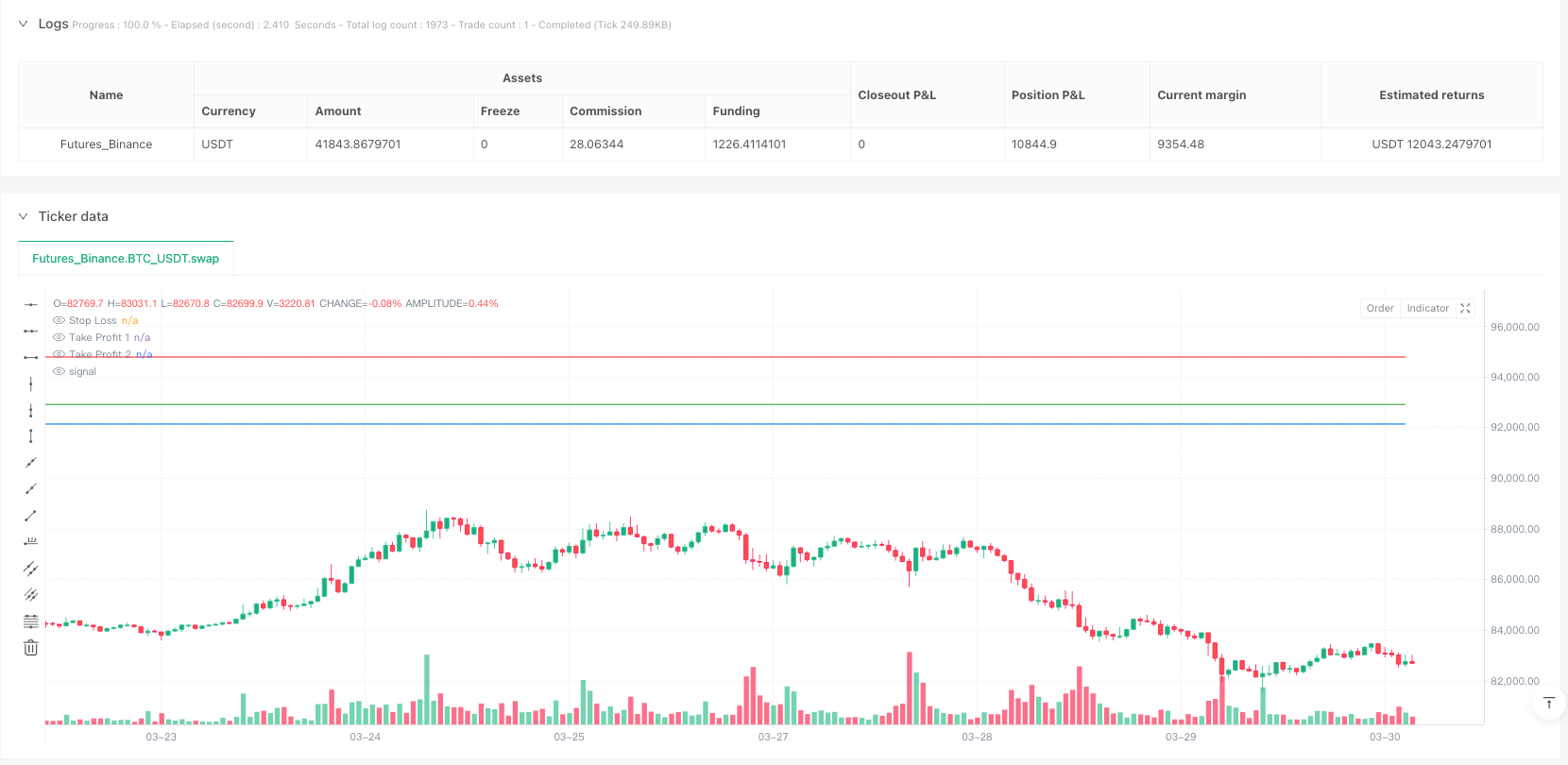

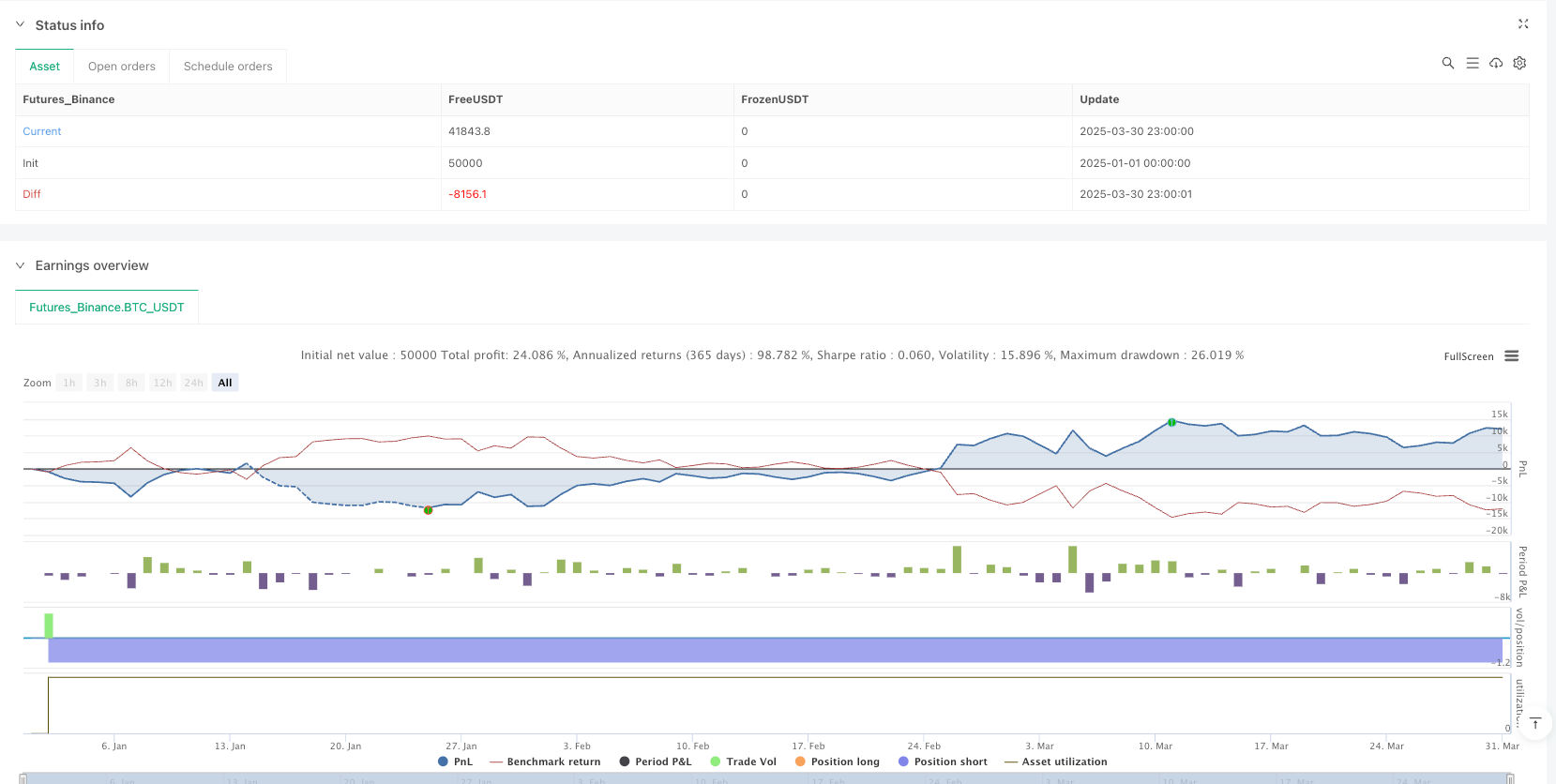

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-31 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Reversal & Breakout Strategy with ORB", overlay=true, pyramiding=2, initial_capital=50000)

// --- Inputs ---

ema9Length = input.int(9, "9 EMA Length", minval=1)

ema20Length = input.int(20, "20 EMA Length", minval=1)

sma50Length = input.int(50, "50 SMA Length", minval=1)

sma200Length = input.int(200, "200 SMA Length", minval=1)

rsiLength = input.int(14, "RSI Length", minval=1)

rsiOverbought = input.int(70, "RSI Overbought", minval=0, maxval=100)

rsiOversold = input.int(30, "RSI Oversold", minval=0, maxval=100)

atrLength = input.int(14, "ATR Length", minval=1)

stopMulti = input.float(0.5, "Stop Loss ATR Multiplier", minval=0.1, step=0.1)

stopLookback = input.int(7, "Stop Loss Lookback", minval=1)

rr1 = input.float(0.5, "Risk:Reward Target 1", minval=0.1, step=0.1)

rr2 = input.float(1.1, "Risk:Reward Target 2", minval=0.1, step=0.1)

target1Percent = input.float(25, "Profit % Target 1", minval=0, maxval=100)

orbBars = input.int(15, "Opening Range Bars", minval=1, tooltip="Number of bars to define the opening range (e.g., 15 bars = 30 min on 2-min chart)")

volThreshold = input.float(1.5, "Volume Threshold Multiplier", minval=1.0, step=0.1, tooltip="Volume must be this multiple of the opening range average")

// --- Indicators ---

// Moving Averages

ema9 = ta.ema(close, ema9Length)

ema20 = ta.ema(close, ema20Length)

sma50 = ta.sma(close, sma50Length)

sma200 = ta.sma(close, sma200Length)

// VWAP

vwapValue = ta.vwap(close)

// RSI

rsi = ta.rsi(close, rsiLength)

// ATR

atr = ta.atr(atrLength)

// --- Opening Range Breakout ---

var float openingRangeHigh = na

var float openingRangeLow = na

var float openingRangeAvgVol = na

if bar_index < orbBars

openingRangeHigh := na

openingRangeLow := na

openingRangeAvgVol := na

else if bar_index == orbBars

openingRangeHigh := ta.highest(high, orbBars)

openingRangeLow := ta.lowest(low, orbBars)

openingRangeAvgVol := ta.sma(volume, orbBars)

orbLong = not na(openingRangeHigh) and ta.crossover(close, openingRangeHigh) and volume > openingRangeAvgVol * volThreshold

orbShort = not na(openingRangeLow) and ta.crossunder(close, openingRangeLow) and volume > openingRangeAvgVol * volThreshold

// --- Trend Detection ---

trendUp = close > sma200

trendDown = close < sma200

// --- Reversal Conditions ---

reversalLong = ta.crossover(close, sma50) and rsi < rsiOversold and close < vwapValue and trendUp

reversalShort = ta.crossunder(close, sma50) and rsi > rsiOverbought and close > vwapValue and trendDown

// --- Range Breakout Conditions ---

breakoutLong = ta.crossover(ema9, ema20) and close > vwapValue and trendUp

breakoutShort = ta.crossunder(ema9, ema20) and close < vwapValue and trendDown

// Combine conditions

longCondition = (reversalLong or breakoutLong or orbLong)

shortCondition = (reversalShort or breakoutShort or orbShort)

// --- Calculate Position Size ---

equityPerPosition = 25000.0 // $50,000 / 2 positions

positionSizeLong = math.floor(equityPerPosition / close)

positionSizeShort = math.floor(equityPerPosition / close)

// --- Stop Loss Calculation ---

longStop = ta.lowest(low, stopLookback) - (atr * stopMulti)

shortStop = ta.highest(high, stopLookback) + (atr * stopMulti)

// --- Variables to Store Trade Levels ---

var float tradeStop = na

var float tradeTarget1 = na

var float tradeTarget2 = na

var float initialPositionSize = na

var bool breakEvenSet = false // Track if stop has been moved to break-even

var float stopLevel = na // Dedicated variable for stop loss in exits

var float target1Level = na // Dedicated variable for first take profit

var float target2Level = na // Dedicated variable for second take profit

var float qtyTotal = na // Track total quantity

// --- Reset Levels Before New Trade ---

var bool newTrade = false

if longCondition or shortCondition

newTrade := true

else

newTrade := false

if strategy.position_size == 0 and newTrade

tradeStop := na

tradeTarget1 := na

tradeTarget2 := na

stopLevel := na

target1Level := na

target2Level := na

initialPositionSize := na

qtyTotal := na

breakEvenSet := false

// --- Strategy Entries ---

if longCondition and strategy.position_size == 0

strategy.entry("Long", strategy.long, qty=positionSizeLong * 2)

tradeStop := longStop

stopLevel := longStop

stopDistance = close - tradeStop

tradeTarget1 := close + (stopDistance * rr1)

tradeTarget2 := close + (stopDistance * rr2)

target1Level := tradeTarget1

target2Level := tradeTarget2

initialPositionSize := positionSizeLong * 2

qtyTotal := positionSizeLong * 2

breakEvenSet := false // Reset break-even flag

if shortCondition and strategy.position_size == 0

strategy.entry("Short", strategy.short, qty=positionSizeShort * 2)

tradeStop := shortStop

stopLevel := shortStop

stopDistance = tradeStop - close

tradeTarget1 := close - (stopDistance * rr1)

tradeTarget2 := close - (stopDistance * rr2)

target1Level := tradeTarget1

target2Level := tradeTarget2

initialPositionSize := positionSizeShort * 2

qtyTotal := positionSizeShort * 2

breakEvenSet := false // Reset break-even flag

// --- Trade Exits ---

if strategy.position_size > 0

qty_tp1 = qtyTotal * (target1Percent / 100)

qty_tp2 = qtyTotal * ((100 - target1Percent) / 100)

strategy.exit("Long Exit 1", "Long", qty=qty_tp1, stop=stopLevel, limit=target1Level)

strategy.exit("Long Exit 2", "Long", qty=qty_tp2, stop=stopLevel, limit=target2Level)

if strategy.position_size < 0

qty_tp1 = qtyTotal * (target1Percent / 100)

qty_tp2 = qtyTotal * ((100 - target1Percent) / 100)

strategy.exit("Short Exit 1", "Short", qty=qty_tp1, stop=stopLevel, limit=target1Level)

strategy.exit("Short Exit 2", "Short", qty=qty_tp2, stop=stopLevel, limit=target2Level)

// --- Move Stop to Break-even ---

if strategy.position_size != 0 and not na(initialPositionSize) and not breakEvenSet

if math.abs(strategy.position_size) < math.abs(initialPositionSize)

tradeStop := strategy.position_avg_price

stopLevel := strategy.position_avg_price

tradeTarget1 := na // Clear first target for plotting

breakEvenSet := true // Mark break-even as set

// --- Manual Close Fallback ---

if strategy.position_size > 0

if close >= target2Level or close <= stopLevel

strategy.close("Long", qty=qtyTotal, comment="Manual Close")

if strategy.position_size < 0

if close <= target2Level or close >= stopLevel

strategy.close("Short", qty=qtyTotal, comment="Manual Close")

// --- Reset Levels When No Position ---

if strategy.position_size == 0 and not newTrade

tradeStop := na

tradeTarget1 := na

tradeTarget2 := na

stopLevel := na

target1Level := na

target2Level := na

initialPositionSize := na

qtyTotal := na

breakEvenSet := false

// --- Plotting ---

plot(tradeStop, title="Stop Loss", color=color.red, linewidth=1, style=plot.style_linebr)

plot(tradeTarget1, title="Take Profit 1", color=color.green, linewidth=1, style=plot.style_linebr)

plot(tradeTarget2, title="Take Profit 2", color=color.blue, linewidth=1, style=plot.style_linebr)