概述

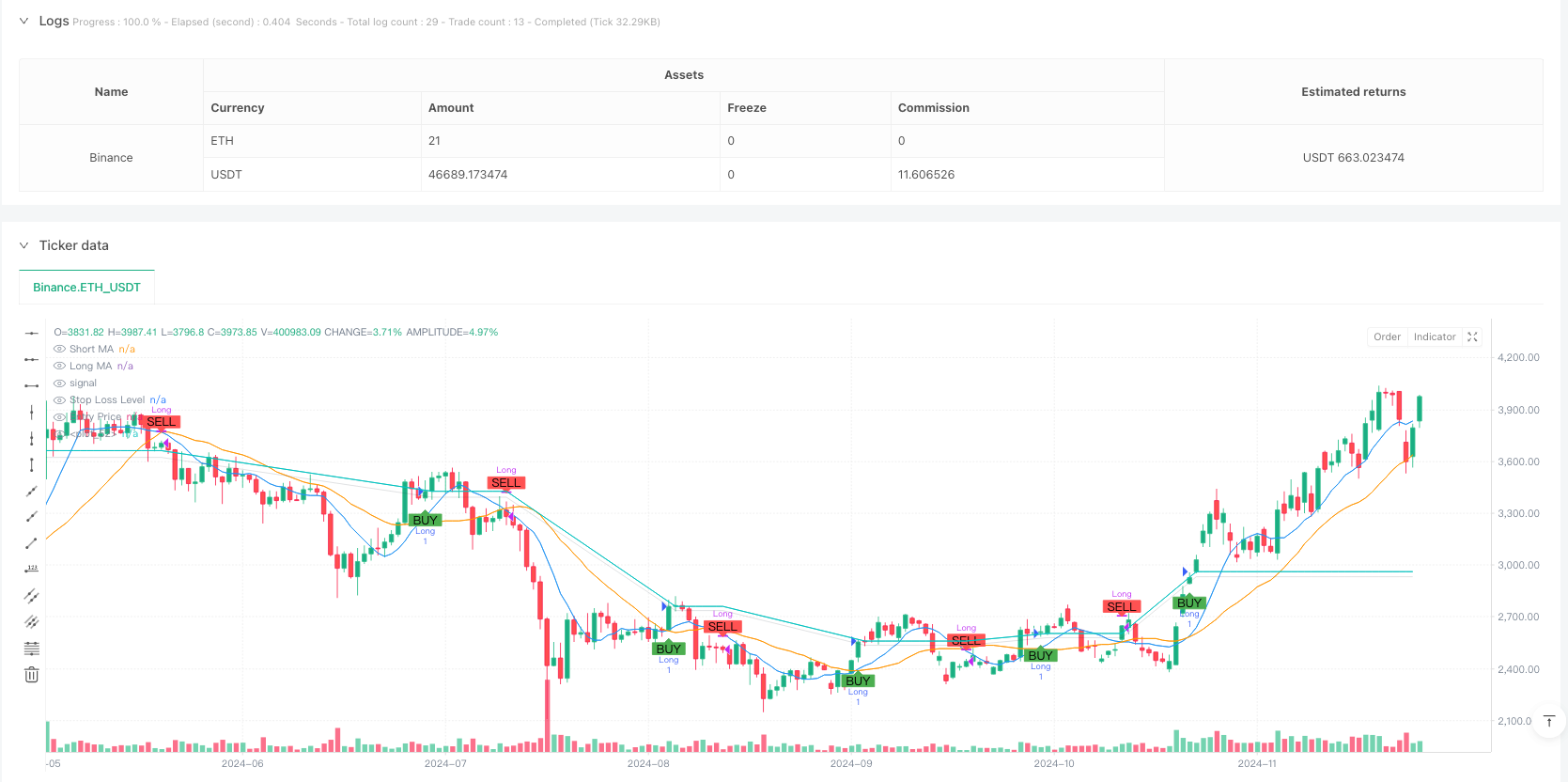

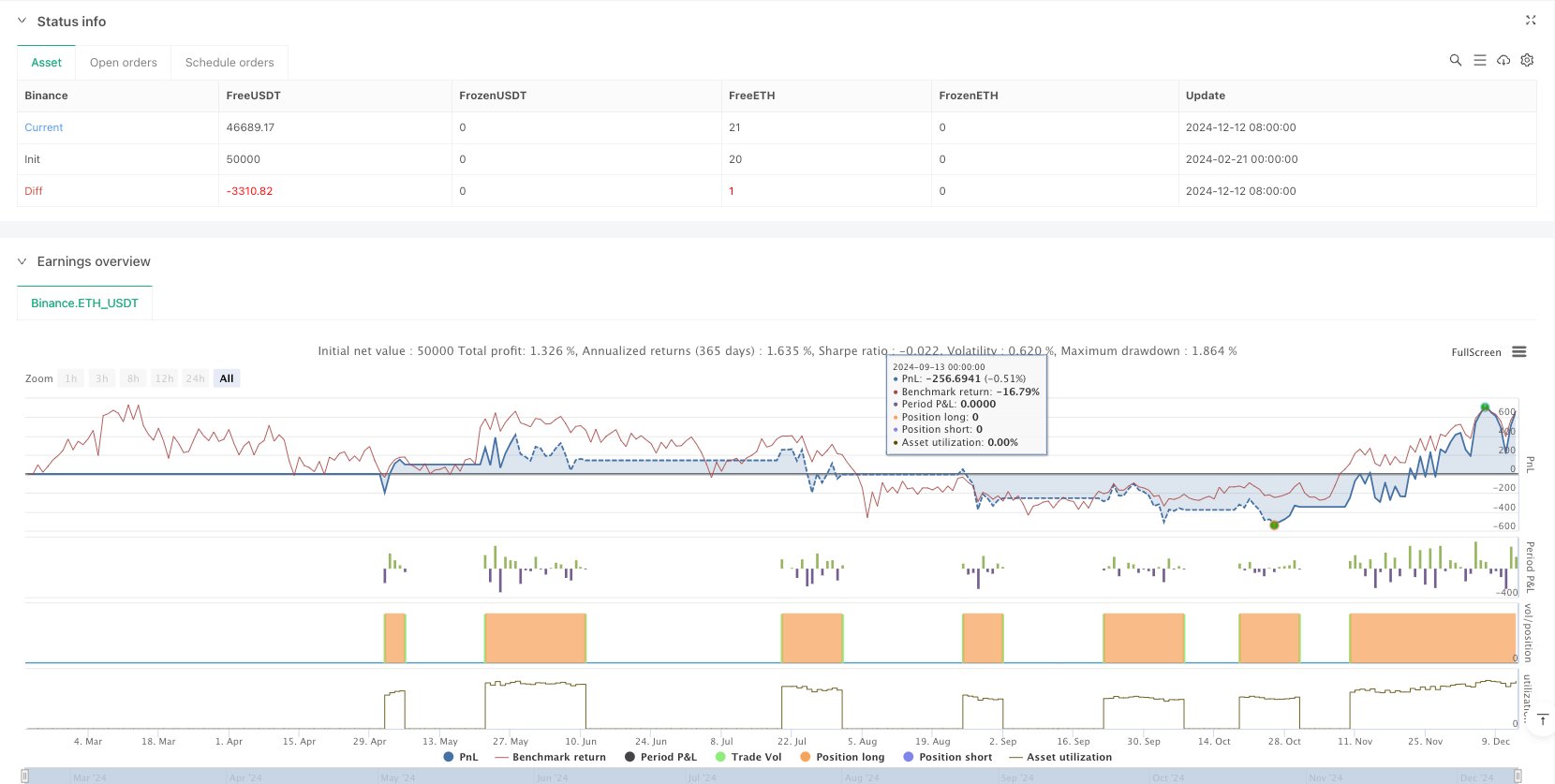

本策略是一个基于双均线交叉的趋势跟踪交易系统,结合了风险管理机制。策略使用9周期和21周期的简单移动平均线(SMA)来捕捉市场趋势,同时设置了1%的止损和止盈来控制风险。系统在短期均线上穿长期均线时进场做多,在短期均线下穿长期均线时平仓出场。

策略原理

策略的核心逻辑基于市场趋势的连续性特征。通过观察短期(9周期)和长期(21周期)移动平均线的交叉来判断趋势的转换点。当短期均线上穿长期均线时形成”金叉”,表明上升趋势开始,系统发出做多信号;当短期均线下穿长期均线时形成”死叉”,表明上升趋势可能结束,系统平仓出场。同时,策略引入了1%的止损和止盈机制,以便在市场出现不利走势时及时止损,或在获得预期收益时锁定利润。

策略优势

- 趋势把握能力强:通过双均线交叉捕捉趋势转换点,能够较好地把握市场主要趋势。

- 风险控制完善:设置了固定比例的止损和止盈,有效控制单笔交易的风险。

- 自动化程度高:系统完全自动化运行,无需人工干预。

- 可视化效果好:通过图形界面清晰展示交易信号和风险控制区间。

- 参数优化灵活:均线周期和止损止盈比例可根据不同市场特征进行调整。

策略风险

- 震荡市场风险:在横盘震荡市场中,频繁的均线交叉可能导致虚假信号。

- 滑点风险:在市场波动剧烈时,实际成交价格可能与信号价格产生较大偏差。

- 趋势反转风险:强趋势突然反转时,固定止损可能不足以应对大幅波动。

- 参数依赖性:策略表现对均线周期和止损止盈参数设置较为敏感。

策略优化方向

- 引入趋势过滤器:可添加ADX等趋势强度指标,在趋势明确时才开仓。

- 动态止损机制:可使用ATR或波动率来动态调整止损幅度。

- 增加成交量确认:将成交量作为交易信号的辅助确认指标。

- 优化参数自适应:根据市场波动特征动态调整均线周期。

- 增加趋势强度过滤:可结合RSI等指标判断趋势强度。

总结

该策略通过双均线交叉捕捉趋势,并结合止损止盈机制进行风险控制,是一个较为完整的趋势跟踪交易系统。虽然在震荡市场中可能产生虚假信号,但通过合理的参数优化和增加辅助指标,可以进一步提高策略的稳定性和盈利能力。策略的核心优势在于自动化程度高、风险控制完善,适合作为中长期趋势跟踪的基础策略框架。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2024-12-13 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Moving Average Crossover with Stop Loss and Take Profit", overlay=true)

// Parameters for moving averages

short_length = input.int(9, title="Short Moving Average Length") // Optimized for 15-minute time frame

long_length = input.int(21, title="Long Moving Average Length") // Optimized for 15-minute time frame

// Parameters for risk management

stop_loss_percent = input.float(1.0, title="Stop Loss (%)") / 100 // 1% stop loss

take_profit_percent = input.float(1.0, title="Take Profit (%)") / 100 // 1% take profit

// Calculate moving averages

short_ma = ta.sma(close, short_length)

long_ma = ta.sma(close, long_length)

// Plot moving averages

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Entry and exit conditions

long_condition = ta.crossover(short_ma, long_ma) // Golden Cross

short_condition = ta.crossunder(short_ma, long_ma) // Death Cross

// Execute strategy with stop loss and take profit

if (long_condition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", stop=strategy.position_avg_price * (1 - stop_loss_percent), limit=strategy.position_avg_price * (1 + take_profit_percent) )

if (short_condition)

strategy.close("Long") // Close long position on Death Cross

// Plot Buy/Sell Signals

plotshape(series=long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Draw 1% stop loss level as a transparent red rectangle

var float stop_loss_level = na

var float entry_price = na

if (strategy.position_size > 0) // Only update when in a trade

stop_loss_level := strategy.position_avg_price * (1 - stop_loss_percent)

entry_price := strategy.position_avg_price

// Create transparent colors

transparent_red = color.new(color.black, 90) // 90% transparency

transparent_green = color.new(color.green, 90) // 90% transparency

// Plot stop loss and entry levels conditionally

plot(strategy.position_size > 0 ? stop_loss_level : na, color=transparent_red, title="Stop Loss Level", linewidth=1)

plot(strategy.position_size > 0 ? entry_price : na, color=transparent_green, title="Entry Price", linewidth=1)

// Fill the area between stop loss and entry price conditionally

fill( plot(strategy.position_size > 0 ? stop_loss_level : na), plot(strategy.position_size > 0 ? entry_price : na), color=transparent_red)

相关推荐