概述

该策略是一个结合了多周期趋势跟踪和风险管理的自动化交易系统。它主要通过5分钟和1分钟两个时间周期的指数移动平均线(EMA)来识别交易机会,同时应用了固定百分比的止损和获利设置来控制风险。该策略特别适合于短线交易者,尤其是那些专注于趋势跟踪的交易者。

策略原理

策略的核心逻辑基于两个时间周期的趋势判断: 1. 使用5分钟周期的200周期EMA作为主要趋势过滤器,只有当价格位于该均线之上时才允许做多,位于均线之下时才允许做空。 2. 在1分钟周期上,使用20周期EMA作为入场触发器。当价格向上穿过该均线时触发做多信号,向下穿过时触发做空信号。 3. 风险管理采用固定比例方法,每次交易的止损设置为入场价格的0.5%,获利目标设置为止损距离的2倍,形成1:2的风险收益比。

策略优势

- 多周期分析提供了更可靠的趋势判断,降低了假突破带来的风险。

- 使用固定比例的风险管理方法,使得资金管理更加规范和系统化。

- 1:2的风险收益比设置,即使胜率只有40%也可能实现盈利。

- 策略逻辑简单明确,易于理解和执行。

- 可视化的交易信号标记便于回测验证。

策略风险

- 快速震荡市场可能导致频繁假信号。

- 在波动率较低的时期,0.5%的止损可能过于紧密。

- 依赖均线交叉可能存在滞后性。

- 高频交易可能带来较高的交易成本。

- 市场快速反转时可能面临较大回撤。

策略优化方向

- 引入波动率指标来动态调整止损距离。

- 增加成交量确认信号来提高入场质量。

- 可以考虑加入趋势强度指标如ADX来过滤弱趋势。

- 在横盘市场增加振荡指标如RSI来过滤信号。

- 根据不同市场特征开发动态的风险收益比设置。

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过结合多周期分析和严格的风险管理,策略在保护资金的同时,能够有效捕捉市场趋势。虽然存在一些优化空间,但策略的基本框架是稳健的,适合作为一个基础策略进行进一步改进和定制。

策略源码

/*backtest

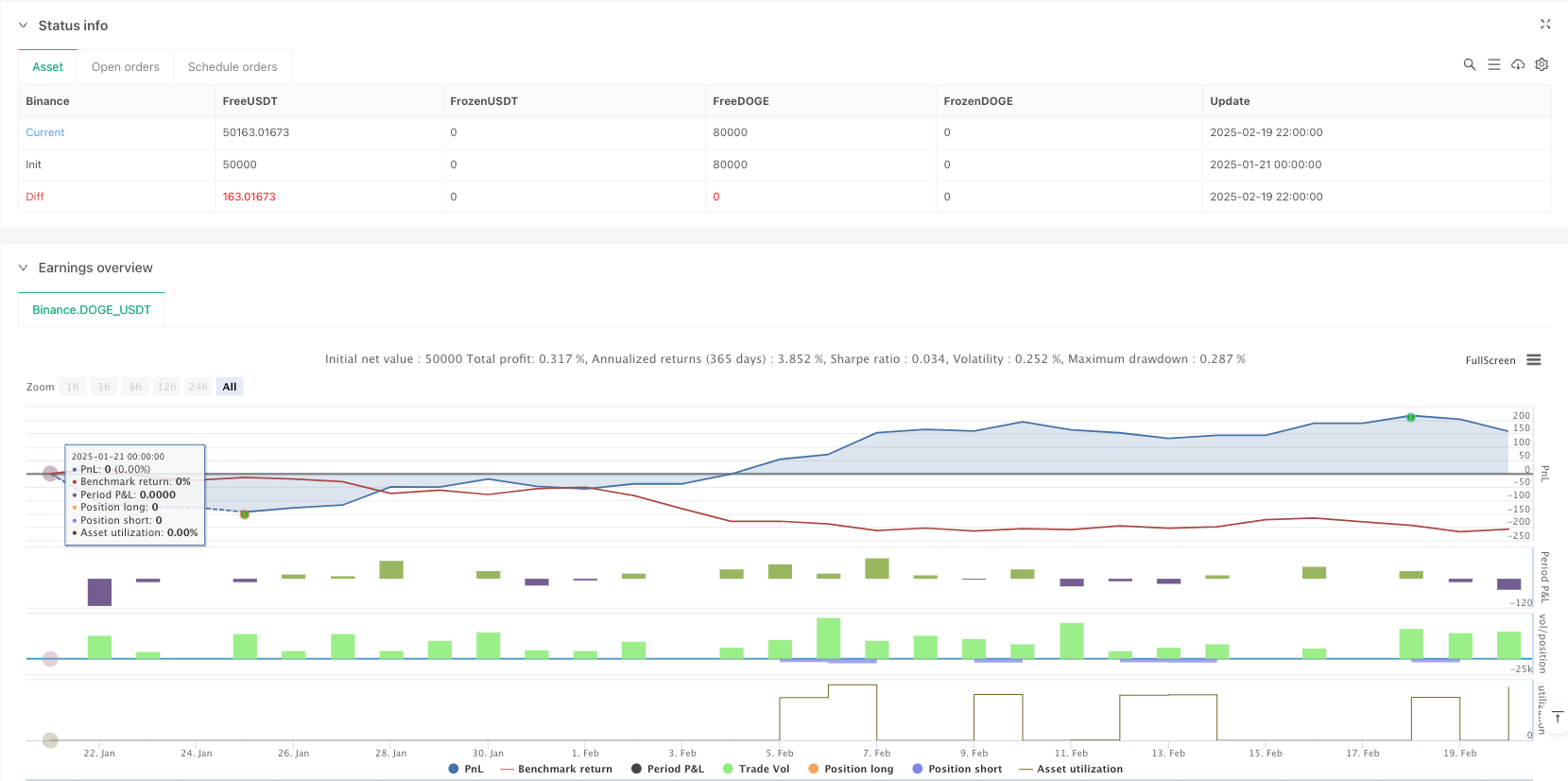

start: 2025-01-21 00:00:00

end: 2025-02-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Scalping Strategy: 1-min Entries with 5-min 200 EMA Filter", overlay=true, initial_capital=10000, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=5, calc_on_every_tick=true)

// --- Higher Timeframe Trend Filter ---

// Get the 200-period EMA on a 5-minute timeframe

ema200_5 = request.security(syminfo.tickerid, "5", ta.ema(close, 200), lookahead=barmerge.lookahead_on)

plot(ema200_5, color=color.purple, title="5-min 200 EMA")

// --- Local (1-Minute) Indicators ---

// On a 1-minute chart, calculate a 20-period EMA for entry triggers

ema20_1 = ta.ema(close, 20)

plot(ema20_1, color=color.yellow, title="1-min 20 EMA")

// --- Entry Conditions ---

// For long entries:

// - The overall trend is bullish: current close > 5-min 200 EMA

// - The 1-min candle closes and crosses above its 20 EMA

longCondition = (close > ema200_5) and ta.crossover(close, ema20_1)

// For short entries:

// - Overall bearish trend: current close < 5-min 200 EMA

// - 1-min candle crosses below its 20 EMA

shortCondition = (close < ema200_5) and ta.crossunder(close, ema20_1)

// --- Risk Management Settings ---

// For scalping, use a tight stop loss. Here we set risk at 0.5% of the entry price.

var float riskPerc = 0.005 // 0.5% risk per trade

// Declare global variables for stop loss and take profit so they can be used outside the if-blocks

var float longStop = na

var float longTP = na

var float shortStop = na

var float shortTP = na

// --- Trade Execution ---

if (longCondition)

entryPrice = close

// Stop loss for long: 0.5% below entry

longStop := entryPrice * (1 - riskPerc)

// Take profit: twice the risk distance (1:2 risk-reward)

longTP := entryPrice + 2 * (entryPrice - longStop)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTP)

if (shortCondition)

entryPrice = close

// Stop loss for short: 0.5% above entry

shortStop := entryPrice * (1 + riskPerc)

// Take profit: twice the risk distance

shortTP := entryPrice - 2 * (shortStop - entryPrice)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTP)

// --- Visual Debug Markers ---

// Plot a green triangle below bars when a long signal is generated

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.tiny)

// Plot a red triangle above bars when a short signal is generated

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.tiny)

相关推荐