概述

多周期动态波动率跟踪策略是一个结合了快速/慢速指数移动平均线(EMA)交叉与相对强弱指数(RSI)过滤器的短线交易系统。该策略专注于在主导短期趋势内寻找回调机会进行交易,通过多重确认机制减少噪音交易。其核心特点包括基于平均真实波幅(ATR)的风险控制、自适应跟踪止损、基于交易量的止损调整以及三级部分获利目标。此外,策略还采用了更高时间框架的RSI检查作为提前预警退出机制,避免在不利趋势中过度停留。

策略原理

该策略运行原理基于多层信号堆栈架构: 1. 趋势识别:通过快速EMA与慢速EMA的交叉判断微观趋势方向。当快速EMA在慢速EMA上方时,识别为看涨趋势;反之则为看跌趋势。 2. 动量健康度过滤:防止追逐过度延伸的行情。只有在RSI低于超买水平时才允许做多;只有在RSI高于超卖水平时才允许做空。 3. K线确认机制:要求信号条件连续多根K线成立,有效过滤市场噪音。 4. 入场触发:当完成确认窗口的K线出现时发出市场订单。 5. 初始止损:基于ATR的波动率调整,并根据相对交易量进行动态调整。 6. 跟踪止损逻辑:结合枢轴点和ATR基础止损的最优化方案,实现利润锁定。 7. 高时间框架RSI监控:提供市场背景退出信号,避免逆势交易。 8. 分级获利目标:设置三个基于ATR的目标位置,实现逐步减仓。 9. 交易限制器:每个趋势阶段限制最大交易次数,防止过度交易。

策略的关键创新点在于将多重技术指标与市场行为指标(如交易量、波动率)有机结合,形成了一个自适应性强的交易系统,能够在不同市场条件下自动调整参数。

策略优势

- 自适应性强:通过ATR调整的止损和目标位,使策略能够适应不同市场波动条件,无需频繁重新优化参数。

- 多层风险管理:结合初始止损、跟踪止损、部分获利和多周期RSI过滤,形成完整的风险控制体系。

- 噪音过滤机制:连续K线确认要求有效减少了假信号,提高了交易质量。

- 流动性感知:通过交易量比率调整止损水平,在低流动性环境中自动收紧风险敞口。

- 趋势成熟度监控:随着趋势发展,自动减少允许的交易次数,避免在趋势后期过度交易。

- 灵活的获利机制:三级部分获利策略允许在价格走势有利时锁定部分利润,同时保留上涨空间。

- 跨周期分析:高时间框架的RSI监控提供了更广阔的市场背景视角,避免在大趋势逆转时执着于微观信号。

- 执行便捷性:通过PineConnector集成,可以轻松实现策略自动化,减少人为干预和情绪影响。

策略风险

- 回撤风险:尽管有多层风险控制,但在极端市场条件下(如跳空、闪崩),策略仍可能面临超出预期的回撤。应对方法是适当减小仓位大小或增加ATR倍数。

- 参数敏感性:某些关键参数如EMA长度和RSI阈值对策略性能有显著影响。过度优化可能导致过拟合风险。建议使用步进前向测试而非样本内优化。

- 高频交易成本:作为短线策略,交易频率较高,累积的交易成本(点差、佣金)可能显著影响实际收益。应在回测中考虑真实交易成本。

- 延迟风险:PineConnector的执行延迟(约100-300毫秒)在高波动市场中可能导致滑点增加。不建议在波动极大或流动性不足的市场中使用。

- 枢轴点重绘:在分钟线以下的超短线图表上,枢轴点可能在实时K线形成过程中重绘,影响止损准确性。

- 趋势识别滞后:基于EMA交叉的趋势识别存在固有滞后性,可能在趋势初期错过部分行情。

- 过度杠杆风险:如果设置过大的仓位乘数,可能导致单笔交易的风险过高,快速耗尽账户资金。

策略优化方向

- 机器学习优化:引入机器学习算法动态调整EMA和RSI参数,根据不同市场条件自适应变化。这可以解决固定参数在不同市场阶段适应性不足的问题。

- 市场状态分类:增加波动率聚类分析,将市场分为高、中、低波动率状态,针对不同状态采用差异化的交易参数。这将提高策略在转换市场中的适应性。

- 多指标共识机制:整合其他动量和趋势指标(如MACD、布林带、KDJ)形成指标共识系统,只有当多数指标达成一致时才产生信号。这有助于减少假信号。

- 智能时间过滤:加入对市场时段和波动模式的分析,避开低效交易时段和已知的高波动性事件(如重要经济数据发布)。

- 动态部分获利比例:根据市场波动率和趋势强度自动调整部分获利的百分比和目标距离,在强趋势中保留更多仓位,在弱趋势中更积极获利。

- 回撤控制增强:引入基于历史回撤模式的风险自适应机制,在检测到类似历史大回撤前兆时自动减少交易频率或增加止损距离。

- 高频数据增强:在条件允许的情况下,整合tick级别数据进行入场优化,减少滑点并改善入场价格。

- 跨市场相关性分析:加入与相关市场的联动分析,利用市场间的领先-滞后关系增强信号质量。

总结

多周期动态波动率跟踪策略是一个将经典技术分析工具与现代量化风险管理方法相结合的短线交易系统。它通过多层信号堆栈架构,结合EMA趋势识别、RSI动量过滤、连续K线确认机制、ATR波动率调整和多周期分析,构建了一个全面的交易决策框架。该策略最显著的特点是其自适应性——能够根据市场波动率、交易量和趋势成熟度自动调整交易参数和风险控制措施。

尽管存在一些固有风险,如参数敏感性、高频交易成本和延迟风险等,但通过合理的资金管理和持续优化,这些风险可以得到有效控制。未来的优化方向主要集中在机器学习参数优化、市场状态分类、多指标共识机制和动态风险管理等方面。

对于希望在短线市场中捕捉趋势内回调机会的交易者,该策略提供了一个结构化的框架,平衡了交易机会捕捉与风险控制的需求。然而,与所有交易策略一样,实际应用时应先在模拟账户上充分测试,并根据个人风险承受能力和资金规模适当调整参数。

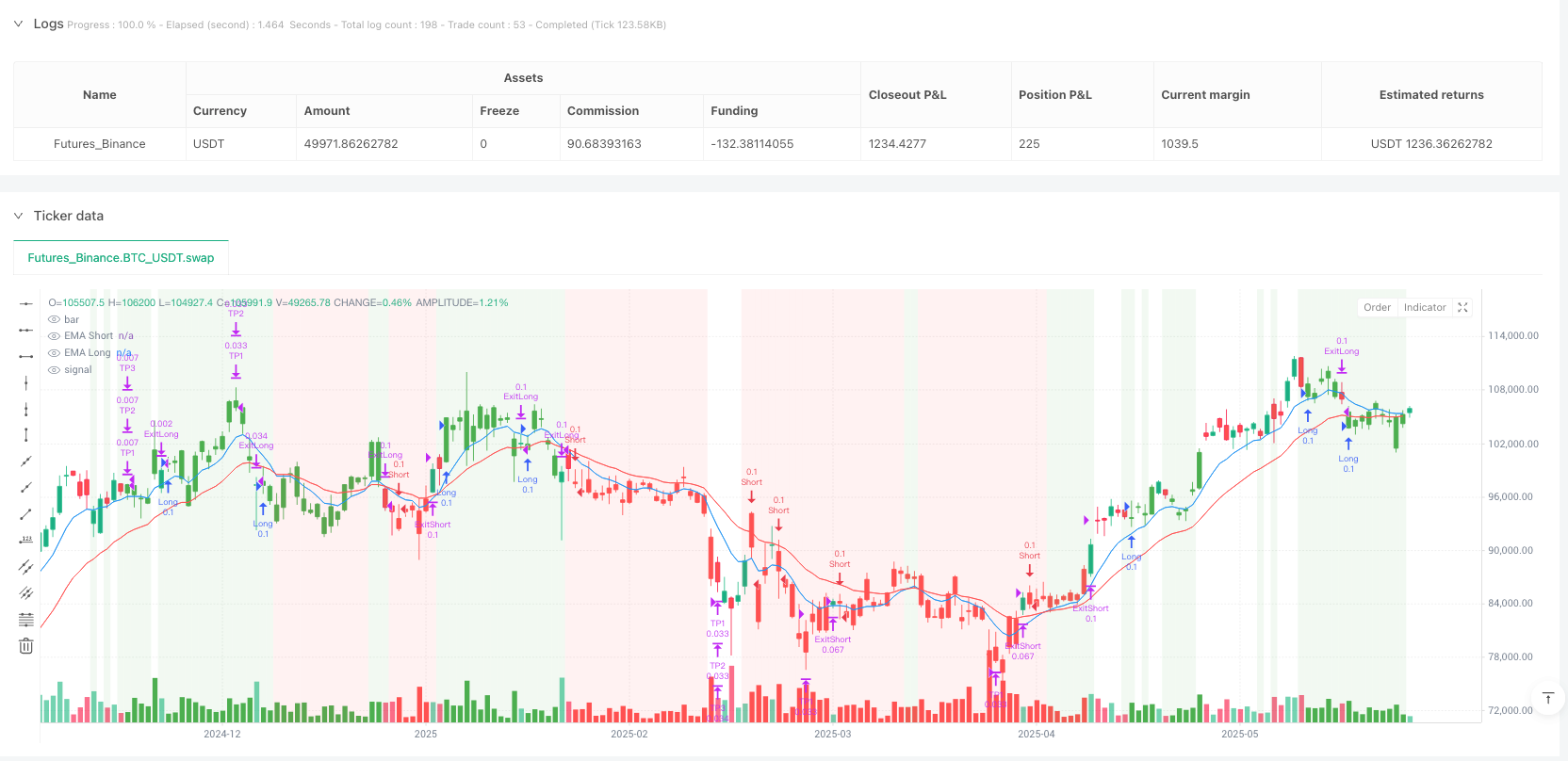

/*backtest

start: 2024-09-15 00:00:00

end: 2025-06-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.comment}}

// © AlgoSystems

strategy("Scalping Trend Power for MT5 - Updated", overlay=true, calc_on_every_tick=false)

//-------------------------------------------------------------------

// Function: confirm a condition for N consecutive bars

//-------------------------------------------------------------------

f_confirm(cond, bars) =>

_ok = true

for i = 0 to bars - 1

_ok := _ok and cond[i]

_ok

//-------------------------------------------------------------------

// Inputs: strategy parameters & PineConnector

//-------------------------------------------------------------------

lotSize = input.float(0.1, title="Lot Size")

lotMultiplier = input.float(1.0, title="Lot Multiplier", minval=0.1, step=0.1)

contractType = input.string("FX", title="Contract Type", options=["FX", "CFD", "Futures"])

// (kept for potential future use)

riskPercentage = input.float(1.0, title="Risk per Trade (%)")

riskRewardRatio = input.float(1.2, title="Risk/Reward Ratio", step=0.1)

trailingStopMultiplier = input.float(1.2, title="Trailing-Stop Multiplier", step=0.1)

emaShortLength = input.int(9, title="EMA Short Length")

emaLongLength = input.int(21, title="EMA Long Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

higherTF = input.timeframe("30", title="Higher Time-Frame for Exit")

higherRsiOverbought = input.int(70, title="Higher-TF RSI Overbought", minval=50)

higherRsiOversold = input.int(30, title="Higher-TF RSI Oversold", minval=10)

pivotLookback = input.int(5, title="Pivot Look-Back Period", minval=2, step=1)

volumeLookback = input.int(20, title="Volume Look-Back Period", minval=5, step=1)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1, step=0.1)

enablePartialExit = input.bool(true, title="Enable Partial Exit")

tp1ProfitMult = input.float(1.0, title="TP1 Profit Multiplier", step=0.1)

tp2ProfitMult = input.float(1.5, title="TP2 Profit Multiplier", step=0.1)

tp3ProfitMult = input.float(2.0, title="TP3 Profit Multiplier", step=0.1)

tp1ExitPercentage = input.float(33, title="TP1 Exit (%)", minval=1, maxval=100, step=1)

tp2ExitPercentage = input.float(33, title="TP2 Exit (%)", minval=1, maxval=100, step=1)

tp3ExitPercentage = input.float(34, title="TP3 Exit (%)", minval=1, maxval=100, step=1)

confirmBars = input.int(2, title="Confirmation Bars", minval=1, step=1)

baseLongTrades = 5

tradeDecreaseFactor = input.int(0, title="Trade Decrease Factor", minval=0)

maxLongTradesPerTrend = math.max(1, baseLongTrades - tradeDecreaseFactor)

activatePineConnector = input.bool(false, title="Activate PineConnector")

pineConnectorLicense = input.string("", title="PineConnector License Code")

//-------------------------------------------------------------------

// Indicator calculations

//-------------------------------------------------------------------

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

rsiValue = ta.rsi(close, rsiLength)

atrValue = ta.atr(atrLength)

// ATR-based TP & SL

dynamicTP = atrValue * riskRewardRatio

dynamicSL = atrValue * trailingStopMultiplier

rawLongSignal = emaShort > emaLong and rsiValue < rsiOverbought

rawShortSignal = emaShort < emaLong and rsiValue > rsiOversold

longSignal = f_confirm(rawLongSignal, confirmBars)

shortSignal = f_confirm(rawShortSignal, confirmBars)

//-------------------------------------------------------------------

// Dynamic ticker symbol (remove exchange prefix if any)

//-------------------------------------------------------------------

var string dynSymbol = na

if bar_index == 0

parts = str.split(syminfo.tickerid, ":")

dynSymbol := array.size(parts) > 1 ? array.get(parts, 1) : syminfo.tickerid

//-------------------------------------------------------------------

// PineConnector messages (no "lots=" or "contract=" – updated syntax)

// The value after risk= is interpreted as LOTS if EA’s VolumeType = "Lots".

//-------------------------------------------------------------------

prefix = activatePineConnector and (pineConnectorLicense != "") ? pineConnectorLicense + "," : ""

calculatedLot = lotSize * lotMultiplier // actual order volume

// ENTRY messages

riskValue = str.tostring(calculatedLot) // risk= interpreted as lots

txtBuy = prefix + "buy," + dynSymbol + ",risk=" + riskValue

txtSell = prefix + "sell," + dynSymbol + ",risk=" + riskValue

// CLOSE FULL messages

txtCloseLong = prefix + "closelong," + dynSymbol

txtCloseShort = prefix + "closeshort," + dynSymbol

// Helper to compute risk= for partial exits

f_partialRisk(pct) => str.tostring(calculatedLot * pct / 100)

// PARTIAL EXIT messages

msgTP1Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

msgTP1Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

//-------------------------------------------------------------------

// Higher-time-frame RSI request

//-------------------------------------------------------------------

higherRsi = request.security(syminfo.tickerid, higherTF, ta.rsi(close, rsiLength))

//-------------------------------------------------------------------

// State variables

//-------------------------------------------------------------------

var bool inLongTrade = false

var bool inShortTrade = false

var int longTradeCount = 0

var float trailingStopLevel = na

var bool tp1_exited = false

var bool tp2_exited = false

var bool tp3_exited = false

//-------------------------------------------------------------------

// Entry/Exit logic

//-------------------------------------------------------------------

if barstate.isconfirmed

avgVol = ta.sma(volume, volumeLookback)

volRatio = avgVol != 0 ? volume / avgVol : 1.0

adjSL = dynamicSL / (volRatio * volumeMultiplier)

pivotH = ta.pivothigh(high, pivotLookback, pivotLookback)

pivotL = ta.pivotlow(low, pivotLookback, pivotLookback)

// LONG entry

if longSignal and not inLongTrade and not inShortTrade and longTradeCount < maxLongTradesPerTrend

strategy.entry("Long", strategy.long, qty=calculatedLot, comment="Long Entry")

if activatePineConnector

alert(txtBuy, alert.freq_once_per_bar)

inLongTrade := true

inShortTrade := false

longTradeCount += 1

trailingStopLevel := low - adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// SHORT entry

if shortSignal and not inShortTrade and not inLongTrade

strategy.entry("Short", strategy.short, qty=calculatedLot, comment="Short Entry")

if activatePineConnector

alert(txtSell, alert.freq_once_per_bar)

inShortTrade := true

inLongTrade := false

trailingStopLevel := high + adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// Trailing-stop update

if inLongTrade

baseStop = close - adjSL

trailingStopLevel := (not na(pivotL) and pivotL > trailingStopLevel) ? pivotL : math.max(trailingStopLevel, baseStop)

if inShortTrade

baseStop = close + adjSL

trailingStopLevel := (not na(pivotH) and pivotH < trailingStopLevel) ? pivotH : math.min(trailingStopLevel, baseStop)

// Dynamic TPs & partial exits

if enablePartialExit and strategy.position_size != 0

avgPrice = strategy.position_avg_price

direction = strategy.position_size > 0 ? 1 : -1

tp1 = avgPrice + direction * dynamicTP * tp1ProfitMult

tp2 = avgPrice + direction * dynamicTP * tp2ProfitMult

tp3 = avgPrice + direction * dynamicTP * tp3ProfitMult

// TP1

if not tp1_exited and f_confirm(direction > 0 ? close >= tp1 : close <= tp1, confirmBars)

strategy.exit("TP1", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp1ExitPercentage, limit=tp1, comment=direction>0 ? msgTP1Long : msgTP1Short)

if activatePineConnector

alert(direction>0 ? msgTP1Long : msgTP1Short, alert.freq_once_per_bar)

tp1_exited := true

// TP2

if not tp2_exited and f_confirm(direction > 0 ? close >= tp2 : close <= tp2, confirmBars)

strategy.exit("TP2", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp2ExitPercentage, limit=tp2, comment=direction>0 ? msgTP2Long : msgTP2Short)

if activatePineConnector

alert(direction>0 ? msgTP2Long : msgTP2Short, alert.freq_once_per_bar)

tp2_exited := true

// TP3

if not tp3_exited and f_confirm(direction > 0 ? close >= tp3 : close <= tp3, confirmBars)

strategy.exit("TP3", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp3ExitPercentage, limit=tp3, comment=direction>0 ? msgTP3Long : msgTP3Short)

if activatePineConnector

alert(direction>0 ? msgTP3Long : msgTP3Short, alert.freq_once_per_bar)

tp3_exited := true

// FULL exit (trailing stop or opposite signals)

exitCondLong = inLongTrade and (close < trailingStopLevel or rsiValue > rsiOverbought or higherRsi > higherRsiOverbought)

exitCondShort = inShortTrade and (close > trailingStopLevel or rsiValue < rsiOversold or higherRsi < higherRsiOversold)

if exitCondLong and f_confirm(exitCondLong, confirmBars)

strategy.exit("ExitLong", from_entry="Long", stop=trailingStopLevel, comment=txtCloseLong)

if activatePineConnector

alert(txtCloseLong, alert.freq_once_per_bar)

inLongTrade := false

if exitCondShort and f_confirm(exitCondShort, confirmBars)

strategy.exit("ExitShort", from_entry="Short", stop=trailingStopLevel, comment=txtCloseShort)

if activatePineConnector

alert(txtCloseShort, alert.freq_once_per_bar)

inShortTrade := false

// Reset counter when the bullish trend ends

if not rawLongSignal

longTradeCount := 0

//-------------------------------------------------------------------

// Plot & styling

//-------------------------------------------------------------------

plot(emaShort, color=color.blue, linewidth=1, title="EMA Short")

plot(emaLong , color=color.red , linewidth=1, title="EMA Long")

barcolor(inLongTrade ? color.new(color.green,0) : inShortTrade ? color.new(color.red,0) : na)

bgcolor(rawLongSignal ? color.new(color.green,90) : rawShortSignal ? color.new(color.red,90) : na)

// Signal arrows disabled (user request):

// plotshape(longSignal , title="Long signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

// plotshape(shortSignal, title="Short signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//-------------------------------------------------------------------

// HOW TO USE with PineConnector (quick checklist):

// 1. Attach this script to the chart.

// 2. Click the “Alert” bell → Create Alert.

// 3. Condition: “Scalping Trend Power … (Any alert() call)” (or “Order fills only”).

// 4. Webhook URL: https://webhook.pineconnector.com

// 5. Leave the Message box empty – the script fills it.

// 6. On MT5, run the PineConnector EA on the same symbol (dynSymbol) and keep VolumeType = Lots.

// 7. Enter your License ID in the input and tick “Activate PineConnector”.

//-------------------------------------------------------------------