🎯 这是什么神仙策略?

你知道吗?这个策略就像是给市场装了一个”情绪探测器”!📡 它通过双极平滑振荡器来感知市场的”喜怒哀乐”,当市场过于兴奋(超买)或过于沮丧(超卖)时,就会发出交易信号。划重点!这不是普通的振荡器,而是经过”双重美颜”处理的高级版本,能有效过滤掉市场噪音,让你看清真正的趋势方向。

💡 工作原理大揭秘

想象一下,这个策略就像一个超级敏感的”市场体温计”🌡️。首先,它计算价格偏离25周期均线的程度,然后进行标准化处理(就像把不同身高的人都换算成标准身高比例)。接下来是关键的”双重平滑”过程,就像给照片连续用两次美颜滤镜,让信号变得更加清晰可靠。当振荡器突破设定阈值时,策略就会果断出手!

⚡ 这个策略的超能力

避坑指南来了!这个策略最厉害的地方是它的”反向信号平仓”机制 - 就像开车时看到红灯就立刻刹车一样聪明!🚦 当出现相反信号时,策略会立即平仓,不会死扛到底。同时还有5周期固定止损保护,就像给你的资金加了一道”安全气囊”。最贴心的是,它还自带完整的交易统计功能,让你随时掌握策略表现!

🚨 风险提醒不能少

划重点!虽然这个策略很优秀,但也不是万能的。在强趋势市场中,振荡器可能会”迷路”,就像在高速公路上用市区导航一样不太合适。固定阈值设置在不同市场环境下可能水土不服,需要你根据实际情况灵活调整。记住,任何策略都需要配合良好的风险管理,不要把所有鸡蛋放在一个篮子里!

策略源码

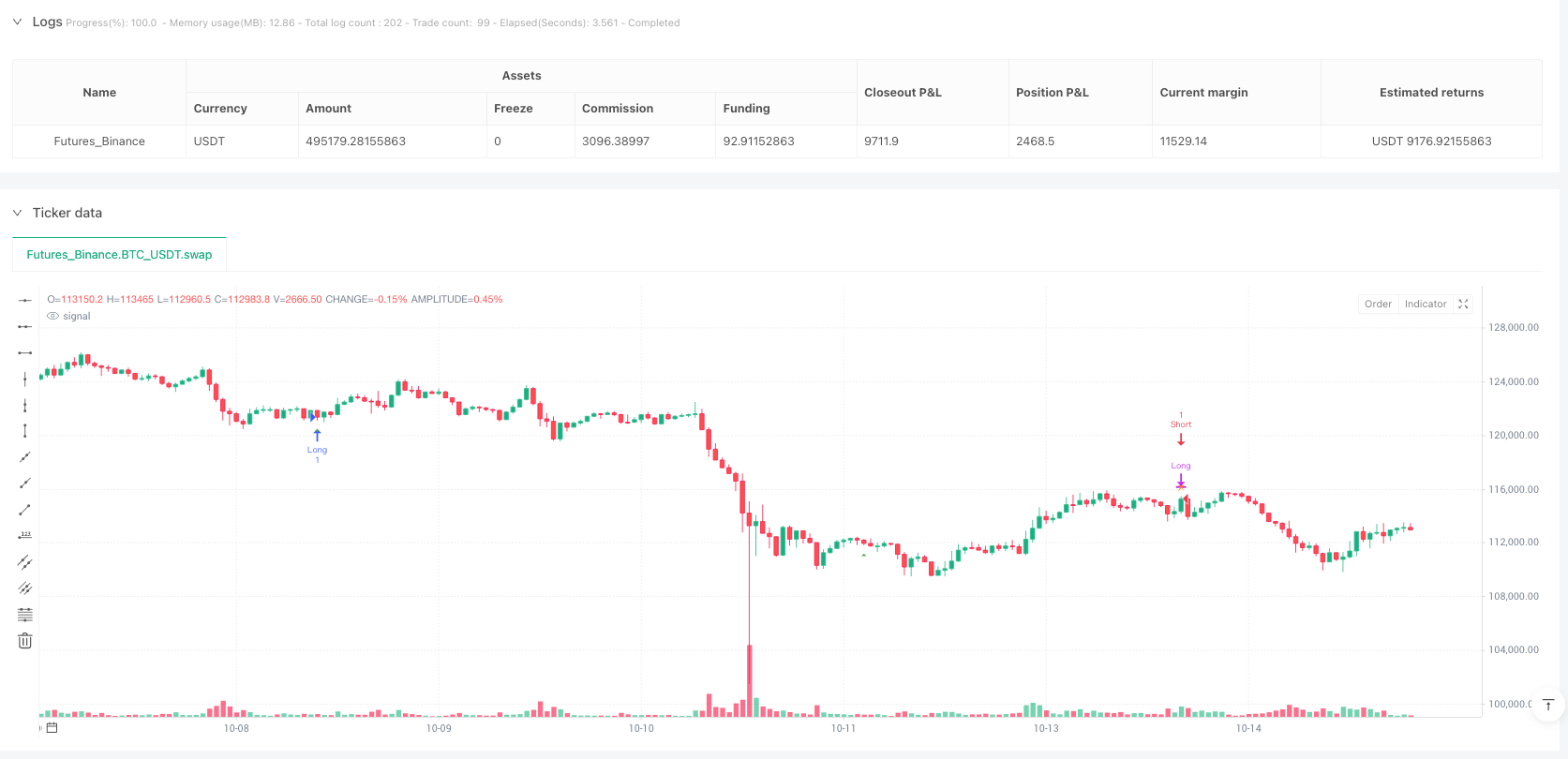

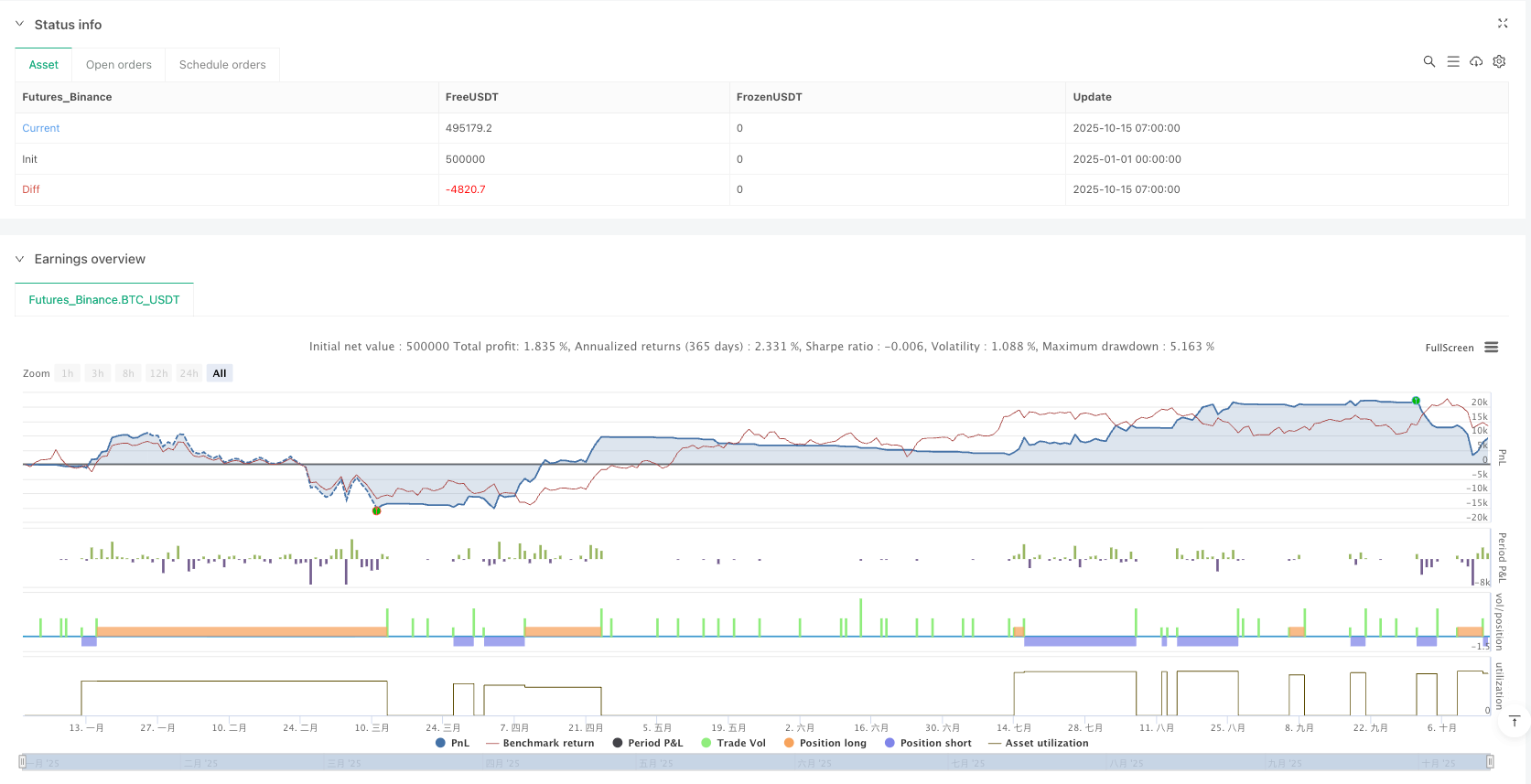

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":500000}]

*/

//@version=6

strategy("Two-Pole Threshold Entries + Opposite-Signal & Stop Exits + Stats",

overlay=true,

max_labels_count=500)

// === Inputs ===

length = input.int(20, minval=1, title="Filter Length")

buyTrig = input.float(-0.8, title="Buy Threshold (osc ↑)")

sellTrig = input.float( 0.8, title="Sell Threshold (osc ↓)")

stopLossPts = input.int(10, minval=1, title="Stop Loss (pts)")

// === Two-Pole Oscillator ===

sma25 = ta.sma(close, 25)

dev = (close - sma25) - ta.sma(close - sma25, 25)

norm = dev / ta.stdev(close - sma25, 25)

alpha = 2.0 / (length + 1)

var float s1 = na

var float s2 = na

s1 := na(s1) ? norm : (1 - alpha) * s1 + alpha * norm

s2 := na(s2) ? s1 : (1 - alpha) * s2 + alpha * s1

osc = s2

prevOsc = osc[4]

// === Trigger Cross Signals ===

isLongSig = ta.crossover(osc, buyTrig) and barstate.isconfirmed

isShortSig = ta.crossunder(osc, sellTrig) and barstate.isconfirmed

// === State & Stats Vars ===

var int tradeDir = 0 // 1=long, -1=short, 0=flat

var float entryPrice = na

var int entryBar = na

var int buyTotal = 0

var int buyFailed = 0

var float sumMoveB = 0.0

var int cntMoveB = 0

var float sumPLptsB = 0.0

var int sellTotal = 0

var int sellFailed = 0

var float sumMoveS = 0.0

var int cntMoveS = 0

var float sumPLptsS = 0.0

// === Exit Marker Flags ===

var bool longStopHit = false

var bool shortStopHit = false

var bool longSigExit = false

var bool shortSigExit = false

longStopHit := false

shortStopHit := false

longSigExit := false

shortSigExit := false

// === 1) Opposite-Signal Exit ===

if tradeDir == 1 and isShortSig

float ptsL = close - entryPrice

sumMoveB += ptsL

sumPLptsB += ptsL

cntMoveB += 1

strategy.close("Long")

longSigExit := true

tradeDir := 0

if tradeDir == -1 and isLongSig

float ptsS = entryPrice - close

sumMoveS += ptsS

sumPLptsS += ptsS

cntMoveS += 1

strategy.close("Short")

shortSigExit := true

tradeDir := 0

// === 2) 5-Bar, Bar-Close 10-pt Stop Exit ===

inWindow = (tradeDir != 0) and (bar_index <= entryBar + 5)

longStopPrice = entryPrice - stopLossPts

shortStopPrice = entryPrice + stopLossPts

if tradeDir == 1 and inWindow and close <= longStopPrice

buyFailed += 1

sumPLptsB -= stopLossPts

strategy.close("Long")

longStopHit := true

tradeDir := 0

if tradeDir == -1 and inWindow and close >= shortStopPrice

sellFailed += 1

sumPLptsS -= stopLossPts

strategy.close("Short")

shortStopHit := true

tradeDir := 0

// === 3) New Entries (only when flat) ===

if tradeDir == 0 and isLongSig

buyTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Long", strategy.long)

tradeDir := 1

if tradeDir == 0 and isShortSig

sellTotal += 1

entryPrice := close

entryBar := bar_index

strategy.entry("Short", strategy.short)

tradeDir := -1

// === Stats Computation ===

float avgMoveB = cntMoveB > 0 ? sumMoveB / cntMoveB : na

float successPctB = buyTotal > 0 ? (buyTotal - buyFailed) / buyTotal * 100 : na

float pnlUSD_B = sumPLptsB * 50.0

float avgMoveS = cntMoveS > 0 ? sumMoveS / cntMoveS : na

float successPctS = sellTotal > 0 ? (sellTotal - sellFailed) / sellTotal * 100 : na

float pnlUSD_S = sumPLptsS * 50.0

string tf = timeframe.period

// === On-Chart Markers ===

plotshape(isLongSig, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(isShortSig, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

plotshape(longSigExit, title="Exit on Sell Sig", style=shape.xcross, location=location.abovebar, color=color.orange, size=size.tiny)

plotshape(shortSigExit, title="Exit on Buy Sig", style=shape.xcross, location=location.belowbar, color=color.orange, size=size.tiny)

plotshape(longStopHit, title="Stop Exit Long", style=shape.xcross, location=location.abovebar, color=color.purple, size=size.tiny)

plotshape(shortStopHit, title="Stop Exit Short", style=shape.xcross, location=location.belowbar, color=color.purple, size=size.tiny)

相关推荐