🔱 什么是三叉戟策略?像海神波塞冬的武器一样精准!

你知道吗?这个策略就像古希腊海神波塞冬的三叉戟一样,用三个关键点构建出强大的交易武器!📈 它通过寻找市场中的三个重要转折点(枢轴点),然后画出一个”三叉戟”形状的通道,帮你捕捉价格突破的黄金时机。

想象一下,你在海边用三根木棍搭建一个简易帐篷 🏕️ - 第一根是支撑杆,另外两根形成帐篷的边界。当风(价格)突破帐篷边界时,就是我们行动的信号!

📊 策略核心逻辑:三点定乾坤

划重点! 这个策略的精髓在于: - 🎯 智能枢轴识别:自动找到市场的高低转折点,确保它们交替出现(不会连续两个高点或低点) - 📐 三叉戟构建:用三个点画出中线、上线、下线,形成价格通道 - 💥 突破信号:当价格突破上线做多,跌破下线做空 - 🛡️ 风险控制:止损设在中线,止盈按1:1比例设置

这就像在拥挤的地铁站 🚇,你观察人流的三个关键节点,预判人群会往哪个方向涌动!

🎪 入场时机:抓住突破的瞬间

避坑指南:不是所有突破都值得追!

做多条件: - 价格向上突破三叉戟上线 ⬆️ - 整体趋势向上(中线斜率为正) - 就像排队买奶茶,当队伍突然加速向前时跟上!

做空条件:

- 价格向下跌破三叉戟下线 ⬇️

- 整体趋势向下(中线斜率为负)

- 如同演唱会散场,人群开始向出口涌动时顺势而为

💰 风险管理:每笔交易只冒险1%

这个策略最贴心的地方就是内置了科学的资金管理!🧮

- 风险控制:每笔交易只用账户资金的1%承担风险

- 止损位置:设在三叉戟中线,给价格一定回旋空间

- 止盈目标:1:1风险回报比,稳健而不贪婪

- 仓位计算:根据止损距离自动调整交易量

就像你去游乐园玩过山车 🎢,安全带(止损)必须系好,但也要给自己留点刺激的空间!

🌟 策略优势:为什么它这么受欢迎?

- 客观性强:完全基于价格行为,不受情绪影响

- 适应性好:任何周期都能使用,从分钟到周线

- 风险可控:内置资金管理,不会因为一次失误伤筋动骨

- 操作简单:信号清晰明确,新手也能快速上手

记住,交易就像学骑自行车 🚴♀️,一开始可能会摔跤,但掌握平衡后就能自由驰骋!这个三叉戟策略就是你的”辅助轮”,帮你在市场中保持平衡前行。

策略源码

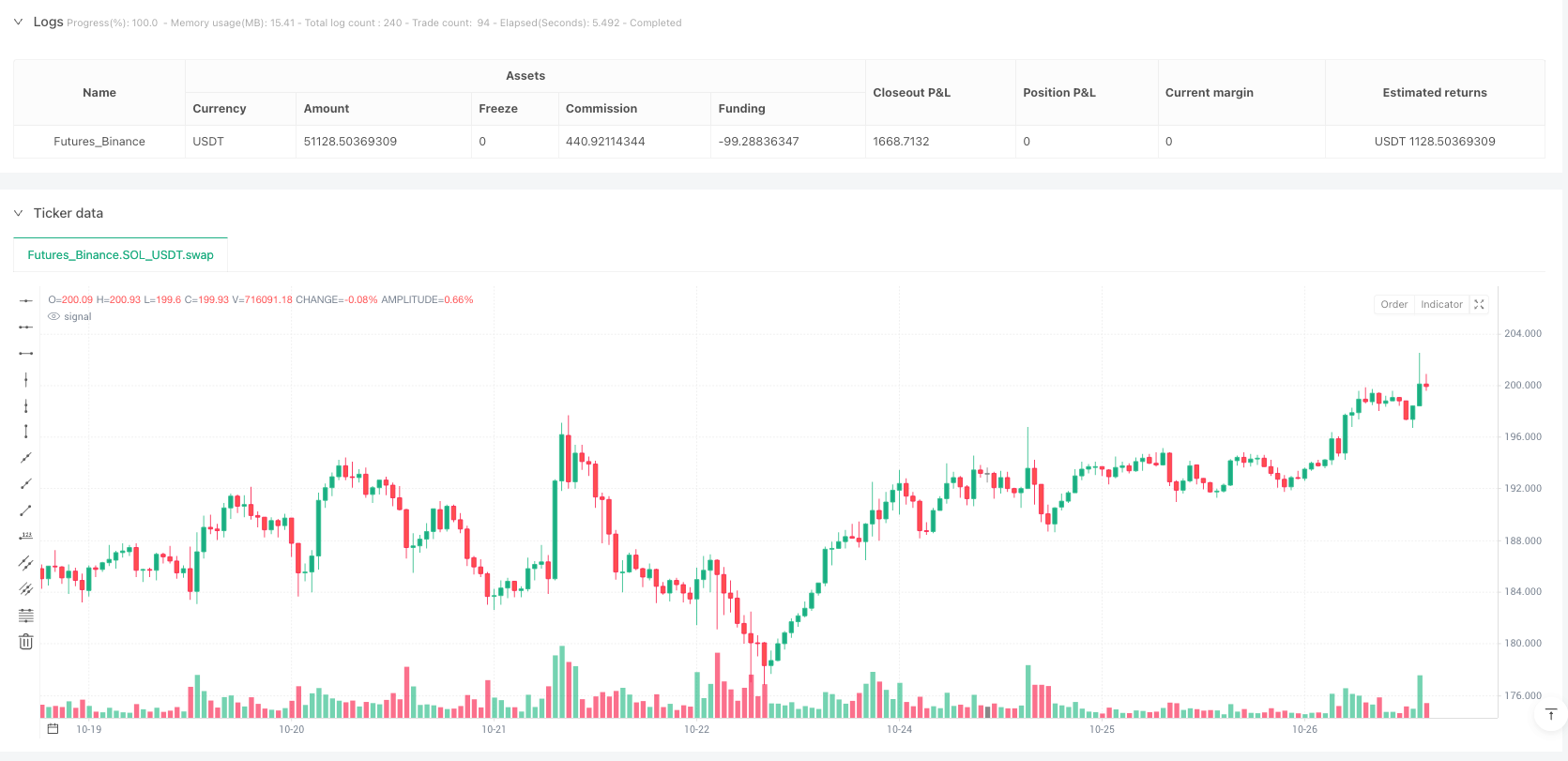

/*backtest

start: 2024-10-29 00:00:00

end: 2025-10-27 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Pitchfork Trading Friends",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100) // We will calculate size manually

// === 1. INPUTS ===

leftBars = input.int(10, "Pivot Left Bars", minval=1)

rightBars = input.int(10, "Pivot Right Bars", minval=1)

riskPercent = input.float(1.0, "Risk Per Trade %", minval=0.1, step=0.1)

// === 2. PIVOT DETECTION & STORAGE ===

// Find pivot points

float ph = ta.pivothigh(high, leftBars, rightBars)

float pl = ta.pivotlow(low, leftBars, rightBars)

// Store the last 3 pivots (P1, P2, P3)

var float p1_price = na

var int p1_bar = na

var float p2_price = na

var int p2_bar = na

var float p3_price = na

var int p3_bar = na

var int lastPivotType = 0 // 0=none, 1=high, -1=low

// Update pivots when a new one is found, ensuring they alternate

if not na(ph) and lastPivotType != 1

p1_price := p2_price

p1_bar := p2_bar

p2_price := p3_price

p2_bar := p3_bar

p3_price := ph

p3_bar := bar_index[rightBars]

lastPivotType := 1

if not na(pl) and lastPivotType != -1

p1_price := p2_price

p1_bar := p2_bar

p2_price := p3_price

p2_bar := p3_bar

p3_price := pl

p3_bar := bar_index[rightBars]

lastPivotType := -1

// === 3. PITCHFORK CALCULATION & DRAWING ===

// We need 3 valid points to draw

bool has3Pivots = not na(p1_bar) and not na(p2_bar) and not na(p3_bar)

// Declare lines

var line medianLine = na

var line upperLine = na

var line lowerLine = na

// Declare line prices for strategy logic

var float ml_price = na

var float ul_price = na

var float ll_price = na

if (has3Pivots)

// P1, P2, P3 coordinates

p1_y = p1_price

p1_x = p1_bar

p2_y = p2_price

p2_x = p2_bar

p3_y = p3_price

p3_x = p3_bar

// Calculate midpoint of P2-P3

mid_y = (p2_y + p3_y) / 2.0

mid_x = (p2_x + p3_x) / 2.0

// Calculate Median Line (ML) slope

float ml_slope = (mid_y - p1_y) / (mid_x - p1_x)

// Calculate price on current bar for each line

// y = m*(x - x_n) + y_n

ml_price := ml_slope * (bar_index - p1_x) + p1_y

// Identify which pivot is high (P2 or P3)

float highPivot_y = p2_y > p3_y ? p2_y : p3_y

int highPivot_x = p2_y > p3_y ? p2_x : p3_x

float lowPivot_y = p2_y < p3_y ? p2_y : p3_y

int lowPivot_x = p2_y < p3_y ? p2_x : p3_x

// Upper/Lower line prices

ul_price := ml_slope * (bar_index - highPivot_x) + highPivot_y

ll_price := ml_slope * (bar_index - lowPivot_x) + lowPivot_y

// === 4. STRATEGY LOGIC ===

// Define trend by pitchfork slope

bool trendUp = ml_slope > 0

bool trendDown = ml_slope < 0

// Entry Conditions

bool longEntry = ta.crossover(close, ul_price) // Breakout

bool shortEntry = ta.crossunder(close, ll_price) // Breakdown

// Risk Calculation

float capital = strategy.equity

float riskAmount = (capital * riskPercent) / 100

// --- LONG TRADE ---

if (longEntry and trendUp)

float sl_price = ml_price // SL at median line

float stop_loss_pips = close - sl_price

float tp_price = close + stop_loss_pips // 1:1 TP

// Calculate position size

float positionSize = riskAmount / (stop_loss_pips * syminfo.pointvalue)

if (positionSize > 0)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("SL/TP Long", from_entry="Long", stop=sl_price, limit=tp_price)

// --- SHORT TRADE ---

if (shortEntry and trendDown)

float sl_price = ml_price // SL at median line

float stop_loss_pips = sl_price - close

float tp_price = close - stop_loss_pips // 1:1 TP

// Calculate position size

float positionSize = riskAmount / (stop_loss_pips * syminfo.pointvalue)

if (positionSize > 0)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("SL/TP Short", from_entry="Short", stop=sl_price, limit=tp_price)

相关推荐