-

善

|

创建于:2019-04-12 09:48:38

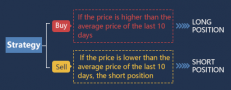

1.4 What are the elements of a complete strategy?Summary A complete strategy is actually a set of rules that traders give themselves. It includes all aspects of the trading, and does not leave a little room for subjective imagination. Every choic

善

|

创建于:2019-04-12 09:48:38

1.4 What are the elements of a complete strategy?Summary A complete strategy is actually a set of rules that traders give themselves. It includes all aspects of the trading, and does not leave a little room for subjective imagination. Every choic

0

1600

-

fmzero

|

创建于:2019-04-11 22:33:43

HttpQuery 返回如果失败,会是什么类型?HttpQuery 如果失败,返回会是什么类型? NULL?还是什么东西?

fmzero

|

创建于:2019-04-11 22:33:43

HttpQuery 返回如果失败,会是什么类型?HttpQuery 如果失败,返回会是什么类型? NULL?还是什么东西?3

1883

-

善

|

创建于:2019-04-11 10:05:43

1.3 What are needed for quantitative trading?Summary A complete quantitative trading life cycle is more than just the trading strategy itself. It consists of at least six parts, including: strategy design, model building, backtesting tuning,

善

|

创建于:2019-04-11 10:05:43

1.3 What are needed for quantitative trading?Summary A complete quantitative trading life cycle is more than just the trading strategy itself. It consists of at least six parts, including: strategy design, model building, backtesting tuning,

0

1658

-

2020-01-08 18:28:48

小草

|

创建于:2019-04-10 16:38:02

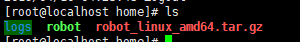

Linux托管者最佳升级实践升级步骤 登陆到服务器托管者所在目录(如果没有更改过,一般是SSH登陆后默认目录)执行ls查看文件 可看到logs robot robot_linux_amd64.tar.gz ,其中logs为日志文件夹,robot为托管者执行程序,robot_linux_amd64.tar.gz为原

小草

|

创建于:2019-04-10 16:38:02

Linux托管者最佳升级实践升级步骤 登陆到服务器托管者所在目录(如果没有更改过,一般是SSH登陆后默认目录)执行ls查看文件 可看到logs robot robot_linux_amd64.tar.gz ,其中logs为日志文件夹,robot为托管者执行程序,robot_linux_amd64.tar.gz为原

3

3442

-

2019-04-10 14:28:45

善

|

创建于:2019-04-10 14:23:00

1.2 Why choose quantitative tradingSummary Many people think complex trading strategies as a starting point when discussing quantitative trading, and inadvertently put a layer of mystery on quantitative trading. In this section, we

善

|

创建于:2019-04-10 14:23:00

1.2 Why choose quantitative tradingSummary Many people think complex trading strategies as a starting point when discussing quantitative trading, and inadvertently put a layer of mystery on quantitative trading. In this section, we

0

1617

-

善

|

创建于:2019-04-09 16:01:03

1.1 What is quantitative trading?Summary As a product of the combination of science and machine, quantitative trading is changing the pattern of modern financial markets. Many investors have turned their attention to this field. H

善

|

创建于:2019-04-09 16:01:03

1.1 What is quantitative trading?Summary As a product of the combination of science and machine, quantitative trading is changing the pattern of modern financial markets. Many investors have turned their attention to this field. H

0

1750

-

2019-05-10 09:46:36

善

|

创建于:2019-04-09 15:59:47

Quantitative trading quick startQuantitative trading quick start Content Part 1, the basis of quantitative trading What is quantitative trading? Why choose quantitative trading

善

|

创建于:2019-04-09 15:59:47

Quantitative trading quick startQuantitative trading quick start Content Part 1, the basis of quantitative trading What is quantitative trading? Why choose quantitative trading

0

1785

-

2024-02-06 17:35:38

小草

|

创建于:2019-04-09 11:29:07

FMZ beginer tutorial1.Start with FMZ platform Thanks for using our platform. This is a basic instruction for beginners, for a full version of our API documentation, ch

小草

|

创建于:2019-04-09 11:29:07

FMZ beginer tutorial1.Start with FMZ platform Thanks for using our platform. This is a basic instruction for beginners, for a full version of our API documentation, ch

1

6370

-

2019-04-17 16:57:58

afanxingzhou | 创建于:2019-04-09 11:24:14

请求交易所API,偶尔出现 Timeout火币策略之前一直运行正常, 突然出现这个提示用我这边处理不? 我的托管者运行在香港阿里云上, 连接地址用的也是 -hk的2

2557

-

善

|

创建于:2019-04-08 10:56:11

Implementing MACD in PythonMACD is a popularly used technical indicator in trading stocks, currencies, cryptocurrencies, etc. Basics of MACD MACD is used and discussed in many different trading circles. Moving Average Conve

善

|

创建于:2019-04-08 10:56:11

Implementing MACD in PythonMACD is a popularly used technical indicator in trading stocks, currencies, cryptocurrencies, etc. Basics of MACD MACD is used and discussed in many different trading circles. Moving Average Conve

0

2118

-

aawww | 创建于:2019-04-07 13:07:04

OKEX get depth 报错如题,我下载了最新的托管者,但是还是会得到这个错误,GetDepth: Invalid depth: {“Info”:null,“Asks”:[{“Price”:2.49,“Amount”:1536.043919},{“Price”:2.5,“Amount”:11024.0209491

1735

-

2019-04-05 23:21:21

willmaker | 创建于:2019-04-05 23:01:28

回测问题请教请问会测试提示:Uncaught RangeError: WebAssembly.Memory(): could not allocate memory 关掉网页,重新回测就好了,这是什么原因呢?1

2276

-

酱油瓶子zz | 创建于:2019-04-05 19:40:08

ZBG交易所不能用看到可添加的交易所里有ZBG,但是试了下,目前的接口都不能用,看到有通用协议的接入文档,但是貌似挺麻烦的。想问下,现在如果只需要几个简单功能(比如单纯的下单功能)的话,是否有比较简单的实现办法?比如我看到有个exchange.IO是否能用上?(ZBG的交易API貌似只有HTTP的)5

1878

-

AIlin | 创建于:2019-04-04 16:58:34

小白问题,怎么用blockly可视化编程下市价交易单?不懂编程只能用可视化..请问怎么用blockly可视化编程下期货的市价交易单?1

1953

-

2024-02-05 20:09:52

小草

|

创建于:2019-04-04 11:40:52

BitMEX exchange API noteBitMEX 交易所API使用事项 (BitMEX exchange API note) The FMZ platform API Doc [Join us on telegram group](https://t

小草

|

创建于:2019-04-04 11:40:52

BitMEX exchange API noteBitMEX 交易所API使用事项 (BitMEX exchange API note) The FMZ platform API Doc [Join us on telegram group](https://t

0

2874

-

2019-12-04 10:41:25

小草

|

创建于:2019-04-01 11:06:09

发明者数字货币量化平台websocket使用指南(Dial函数升级后详解)基本上所有数字货币交易所都支持websocket发送行情,部分交易所支持websocket更新账户信息。相比于rest API, websocket一般具有延时低,频率高,不受平台rest API频率限制等有带你,缺点是有中断问题,处理不直观。关于websocket简介,可以参考我曾经的这篇文章: https://zhuanlan.zhihu.com/p/22693475 本文将主要介绍在FMZ

小草

|

创建于:2019-04-01 11:06:09

发明者数字货币量化平台websocket使用指南(Dial函数升级后详解)基本上所有数字货币交易所都支持websocket发送行情,部分交易所支持websocket更新账户信息。相比于rest API, websocket一般具有延时低,频率高,不受平台rest API频率限制等有带你,缺点是有中断问题,处理不直观。关于websocket简介,可以参考我曾经的这篇文章: https://zhuanlan.zhihu.com/p/22693475 本文将主要介绍在FMZ

5

5941

-

afanxingzhou | 创建于:2019-03-31 14:37:36

获取robotdetail接口里的参数3是啥意思“strategy_exchange_pairs” => “[3,[43793],[“BTC_USDT”]]”1

1692

-

善

|

创建于:2019-03-30 15:13:14

How can newcomers go through the road, how to capture trends and make profits last?In trading, a single transaction result with win or loss is not the focus of quantitative traders, so what are they most concerned about? The answer is the result of trading the system after 800 or 10

善

|

创建于:2019-03-30 15:13:14

How can newcomers go through the road, how to capture trends and make profits last?In trading, a single transaction result with win or loss is not the focus of quantitative traders, so what are they most concerned about? The answer is the result of trading the system after 800 or 10

0

1713

-

善

|

创建于:2019-03-30 11:17:42

Beginner's Guide to Time Series AnalysisOver the last few years we’ve looked at various tools to help us identify exploitable patterns in asset prices. In particular we have considered basic econometrics, statistical machine learning and Ba

善

|

创建于:2019-03-30 11:17:42

Beginner's Guide to Time Series AnalysisOver the last few years we’ve looked at various tools to help us identify exploitable patterns in asset prices. In particular we have considered basic econometrics, statistical machine learning and Ba0

1621

-

善

|

创建于:2019-03-29 14:24:50

Backtesting a Forecasting Strategy for the S&P500 in Python with pandasMature Python libraries such as matplotlib, pandas and scikit-learn also reduce the necessity to write boilerplate code or come up with our own implementations of well known algorithms. The Foreca

善

|

创建于:2019-03-29 14:24:50

Backtesting a Forecasting Strategy for the S&P500 in Python with pandasMature Python libraries such as matplotlib, pandas and scikit-learn also reduce the necessity to write boilerplate code or come up with our own implementations of well known algorithms. The Foreca0

2681

-

善

|

创建于:2019-03-29 11:19:52

“Always understand when to quit” – 6 exit strategiesNo matter how much time, effort, and money you put into an investment, if you don’t have a predetermined exit strategy, everything can be gone. For this reason, investment guru never invests without k

善

|

创建于:2019-03-29 11:19:52

“Always understand when to quit” – 6 exit strategiesNo matter how much time, effort, and money you put into an investment, if you don’t have a predetermined exit strategy, everything can be gone. For this reason, investment guru never invests without k0

1626

-

2019-07-31 17:24:04

fmzero

|

创建于:2019-03-28 23:19:31

FMZ公众号互动现在Log(@)可以推送消息到FMZ公众号。 能不能在FMZ公众号发消息给托管者,做对应的get command操作?

fmzero

|

创建于:2019-03-28 23:19:31

FMZ公众号互动现在Log(@)可以推送消息到FMZ公众号。 能不能在FMZ公众号发消息给托管者,做对应的get command操作?4

1801

-

善

|

创建于:2019-03-28 14:43:59

What are the Different Types of Quant Funds?Institutional asset managers specialize in a particular asset class, style, sector, or geography, based on their expertise or domain knowledge. This is reflected in the investment products they offer

善

|

创建于:2019-03-28 14:43:59

What are the Different Types of Quant Funds?Institutional asset managers specialize in a particular asset class, style, sector, or geography, based on their expertise or domain knowledge. This is reflected in the investment products they offer0

1483

-

善

|

创建于:2019-03-28 10:51:06

Backtesting An Intraday Mean Reversion Pairs Strategy Between SPY And IWMIn this article we are going to consider our first intraday trading strategy. It will be using a classic trading idea, that of “trading pairs”. In this instance we are going to be making use of two Ex

善

|

创建于:2019-03-28 10:51:06

Backtesting An Intraday Mean Reversion Pairs Strategy Between SPY And IWMIn this article we are going to consider our first intraday trading strategy. It will be using a classic trading idea, that of “trading pairs”. In this instance we are going to be making use of two Ex

0

2537

-

善

|

创建于:2019-03-27 15:11:40

Backtesting a Moving Average Crossover in Python with pandasIn this article we will make use of the machinery we introduced to carry out research on an actual strategy, namely the Moving Average Crossover on AAPL. Moving Average Crossover Strategy The Movi

善

|

创建于:2019-03-27 15:11:40

Backtesting a Moving Average Crossover in Python with pandasIn this article we will make use of the machinery we introduced to carry out research on an actual strategy, namely the Moving Average Crossover on AAPL. Moving Average Crossover Strategy The Movi

0

2489

-

善

|

创建于:2019-03-27 11:08:57

How to Identify Algorithmic Trading StrategiesIn this article I want to introduce you to the methods by which I myself identify profitable algorithmic trading strategies. Our goal today is to understand in detail how to find, evaluate and select

善

|

创建于:2019-03-27 11:08:57

How to Identify Algorithmic Trading StrategiesIn this article I want to introduce you to the methods by which I myself identify profitable algorithmic trading strategies. Our goal today is to understand in detail how to find, evaluate and select0

1901

-

善

|

创建于:2019-03-26 16:38:59

Event-Driven Backtesting with Python - Part VIIIIt’s been a while since we’ve considered the event-driven backtester, which we began discussing in this article. In Part VI I described how to code a stand-in ExecutionHandler model that worked for a

善

|

创建于:2019-03-26 16:38:59

Event-Driven Backtesting with Python - Part VIIIIt’s been a while since we’ve considered the event-driven backtester, which we began discussing in this article. In Part VI I described how to code a stand-in ExecutionHandler model that worked for a0

1709

-

善

|

创建于:2019-03-26 11:52:11

Blockchain Quantitative Investment Series - Dynamic Balance StrategyOriginal: FMZ Quant www.fmz.com The “real stuff” of quantitative trading gathering place where you can truly benefit from. NO.1 Warren Buffett’s mentor, Benjamin Graham, once mentioned in the book

善

|

创建于:2019-03-26 11:52:11

Blockchain Quantitative Investment Series - Dynamic Balance StrategyOriginal: FMZ Quant www.fmz.com The “real stuff” of quantitative trading gathering place where you can truly benefit from. NO.1 Warren Buffett’s mentor, Benjamin Graham, once mentioned in the book

0

1826

-

善

|

创建于:2019-03-26 10:52:49

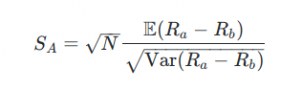

Event-Driven Backtesting with Python - Part VIIIn the last article on the Event-Driven Backtester series we considered a basic ExecutionHandler hierarchy. In this article we are going to discuss how to assess the performance of a strategy post-bac

善

|

创建于:2019-03-26 10:52:49

Event-Driven Backtesting with Python - Part VIIIn the last article on the Event-Driven Backtester series we considered a basic ExecutionHandler hierarchy. In this article we are going to discuss how to assess the performance of a strategy post-bac

0

1935

-

善

|

创建于:2019-03-26 09:13:08

Event-Driven Backtesting with Python - Part VIThis article continues the discussion of event-driven backtesters in Python. In the previous article we considered a portfolio class hierarchy that handled current positions, generated trading orders

善

|

创建于:2019-03-26 09:13:08

Event-Driven Backtesting with Python - Part VIThis article continues the discussion of event-driven backtesters in Python. In the previous article we considered a portfolio class hierarchy that handled current positions, generated trading orders0

2453