Quantified trading starting line

Author: N, Created: 2016-04-06 17:27:19, Updated: 2019-08-01 10:48:30Bitcoin was first introduced in 2013, but began trading in November 2015, when it was experiencing a wave of uncertainty (which most people believe was driven by MMM).

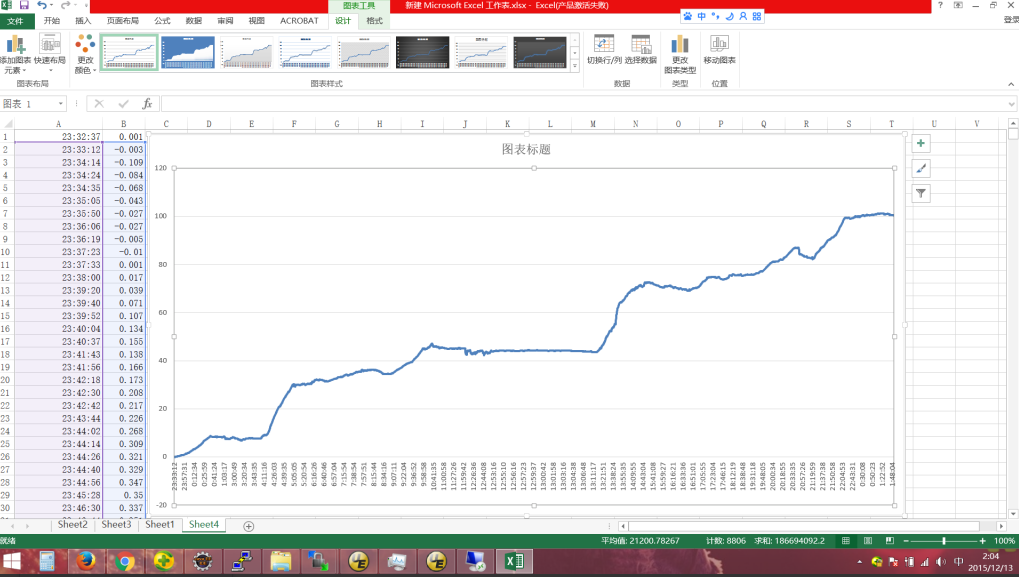

Out of the primitive instinct of the programmer monkey to start studying the API of the exchange, based on the exchange, DEMO wrote its first programmed trading robot, a very simple K-line and even-line trend EA that determines the time of entry and exit, just in time to catch up with the wave of December bullishness, where the price of Bitcoin rose directly from 2100 to more than 3000, the robot gained more than 500 in total in this wave.

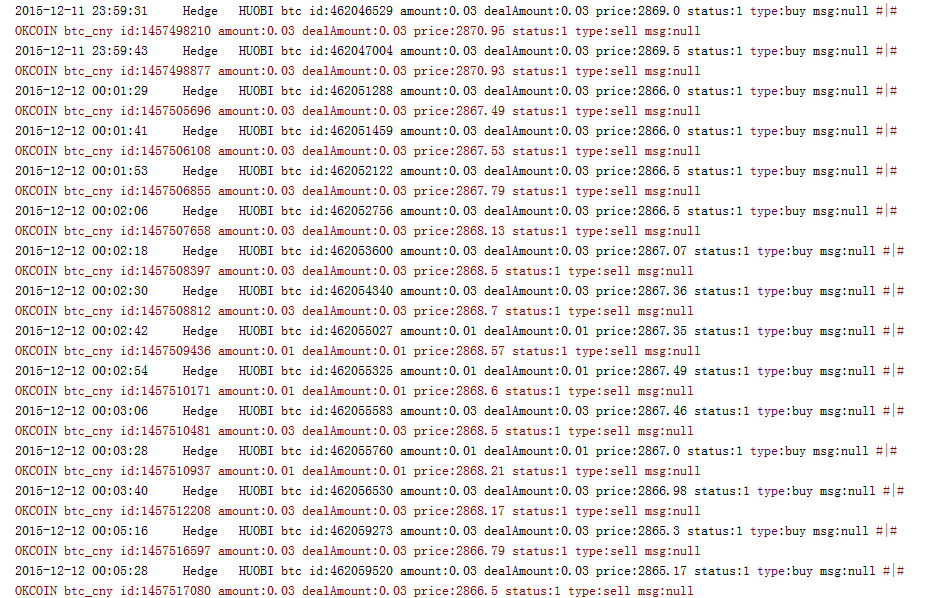

At the same time, overnight and day after day, the special Bitcoin cash hedge spread, which was about 1W total in 2015-12-12 and about 3 cash hedge spread, gained more than 100 more, accounting for more than 1% of the daily gain in money. The exchange log:

The exchange log:

What an unforgettable day. As the market adjusted, the price fluctuation gradually decreased, and during this period, some EA developed did not make money or even lost money, and the QQ group of various exchanges also mourned. I happened to find out from OKCOIN's API group that there is an inventor-quantified quantification platform, and I became interested, registered an account, and studied it carefully. 1) How to manage security flexibly with multiple policies, multiple exchange accounts, multiple servers; 2) how the business codes of the different exchanges are standardized, and how the interfaces of the different exchanges are standardized; 3) How the R&D strategies can bring greater returns to themselves. The platform allows me to focus more on the strategy idea, implement the strategy faster and verify the effectiveness of the strategy. More importantly, I have been inspired a lot by this platform, and the experience of strategizing Square Sharing and quantifying community sharing has taken me further on the path to quantifying transactions.

- Order management, can you add an order time in the order structure?

- Some of the properties of the grid, throwing the cube.

- Inventors quantify that after half a month of sharing a manual intervention strategy, the robot can capture the code of the manual operation information.

- It takes you into the world of quantization -- MACD two-way operation, sliding stop-loss code analysis.

- Inventors Quantify: When will it be available?

- The retest chart adds indicator auto-suggestion, and indicators and parameters used by the strategy can be displayed directly in the chart after retesting is complete.

- Icebreaker (original version) code analysis, please correct if there are errors.

- Bitcoin futures hedging strategy discussed

- On the future review

- The 30 lines of code take you into the world of quantitative investing.

- We've got a list of the most popular sites on Github, and we've got a list of the most popular sites on Github.

- 。。

- You can select the range of the graph when retesting, but it won't work after the real disk (apparently a problem after hosting 3.0)

- ddn

- Is it possible to improve the traceability of the species?

- Added exchanges, can, can, custom select trading currencies

- I'm going to suggest a retest system.

lazypI just calculated that many of the days that we're going to be over 1% yields, up to 6% a day, 2-3% a few days.

lazyp1) How to manage security flexibly with multiple policies, multiple exchange accounts, multiple servers; 2) how the business codes of the different exchanges are standardized, and how the interfaces of the different exchanges are standardized; 3) How the R&D strategies can bring greater returns to themselves. > Can you share your experience on these three points?

The grassMore and more people want to share

ZeroIt's nice to share the harvest and we'll keep working on it.

NI'll have a chance to write more later and experience it.

NI'm so sorry, I didn't know what was going on at the time, I didn't pay attention.

NI'm sure there will be more and more of them.

NI sincerely wish Z's great cause a great success and move forward with you.