Quantitative analysis of the stockpiling strategy

Author: The Little Dream, Created: 2016-12-08 10:54:28, Updated:Quantitative analysis of the stockpiling strategy

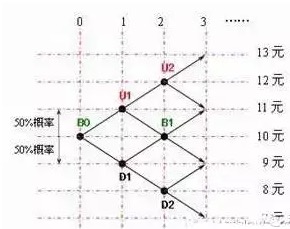

Let's first imagine a random walk through price fluctuations (see the chart below, the famous binary tree diagram): B0 is the starting point, the corresponding price is 10 yuan. At B0 the price is 10 yuan. After opening the trade, the price has a 50% probability of rising from 10 yuan to 11 yuan (reaching U1 point), and there is a 50% probability of falling to 9 yuan (reaching D1 point).

After reaching the U1 point, the price is also 50% more likely to rise from $11 to $12 ((reaching the U2 point), 50% more likely to fall back to $10 ((reaching the B1 point)... So, it is easy to calculate that if you open a position at B0, whether open or closed, then the expected return is zero, which means that as long as the time is long enough, the trader can only save at most.

-

1, when the expected return is zero, the leverage is useless, for example: suppose you open one more hand at B0;

-

(1) The Pyramid of Goodwill For example, if the price drops to D1, the stop loss closes; if it rises to U1, the raise is 0.5 hands... then the expected return of this bullish pyramid raise can be calculated as: The probability of 1:50% drops to D1, a loss of 1 yuan, because the probability is 50%, so the expected return is 50% × ((-1) = -0.5;

The probability of 2:50% rises to U1, when the position is raised by 0.5 hands, and after the raise: The probability of 2.1:50% falls back to B1, with a loss of 0.5 yuan, because the probability is ((50%) 2 = 25%, so the expected return is 25% x ((-0.5) = -0.125; The probability of 2.2:50% is going to be U2, and the total profit is $2.5 because the probability is also 25%, so expect a return of 25% x 3 = 0.625.

So the total expected return = -0.5-0.125 0.625 = 0, which is still zero.

-

(2) The reversal of the pyramid stock For example, if the price rises to U1, the lever stops; if it drops to D1, the lever raises 2 hands... then: The probability of 1:50% rises to U1, profit 1 yuan, the probability is 50%, so expect a return of 50% x 1 = 0.5;

The probability of 2:50% falls to D1, and then you raise 2 hands, and after that: The probability of a 2.1:50% probability is that B1 will return a profit of 2 yuan, and the probability is ((50%) 2 = 25%, so the expected return is 25% x 2 = 0.5; The probability of 2.2:50% falls to D2, the total loss is 4 yuan, because the probability is also 25%, so the expected return is 25% × ((-4) = -1

So, the total expected return = 0.5 0.5-1 = 0, or zero.

-

-

2, the nature of bullish and bearish bullish

In the same way, the examples of large-scale stockpiling:

-

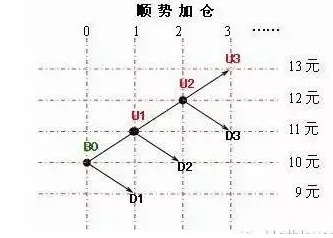

(1) The upside

In the same way, there is a good and a bad side to this trend.

1) It's good that it can control the size of losses while maximizing profits. Because if you want to achieve a raise, then the first position must be a light position. For example, if you plan to raise 5 times in advance, then in the same scale, you should divide the funds into 5 parts, and only 20% of the excess funds in the B0 in the diagram above should be invested, so that if the price falls to D1, although the fall is 10%, the total capital loses only 2%. But if the price can go all the way to U3, then in U1 and U2 the two places will have equal positions, respectively, and the cumulative return on total capital will be about 12% in this way.

2) The downside is that a bullish bullish position will significantly reduce the number of profitable trades. For example, if the assumption in the graph above is that buying more at B0 without leverage is profitable on average 500 times out of every 1,000, the price will rise to U1.

However, after a sequential leverage, assuming an equal-scale leverage, on average 500 out of every 1,000 times after buying 1 hand more at B0 the price will rise to U1 and after leverage 1 hand at U1: on average 250 out of these 500 times will return to D2, although the price will only return to 10 yuan, but because of leverage 1 hand at U1, the overall loss will be 1 yuan.

On the other hand, an average of 250 positions will continue to rise to U2, and as a rule, a 1 hand will continue to rise at U2. After the second position: an average of 125 positions will fall to D3, this time although the position opened at B0 is a profit of 1 yuan, the position increased at U2 is a loss of 1 yuan, so it is only flat overall; another average of 125 positions will continue to rise to U3, if the position is held, a profit of 6 yuan can be achieved overall.

In this way, the percentage of loss-making trades increases to 75% due to the progressive positioning, and another 12.5% of trades can only flatten, and only 12.5% of trades can achieve profits, although profits will be large. In another perspective, when not trading, profits can be achieved as long as the price rises, but after the progressive positioning, as analyzed here, prices must rise at least three consecutive stages in order to achieve profits; two consecutive stages can only flatten; if only one stage can be raised, then the final result is the same as the beginning of the fall.

In the process of trading, the use of stop loss will reduce the success rate of the trade, causing wear and tear on the trader's psychology. However, with the use of progressive leverage method, the extent of the reduction in the ratio of profit trading will be much more stop loss, causing a greater wear and tear on the trader's psychology. In the example I gave about stop loss, the maximum loss is 22 consecutive times, but if you use progressive leverage, you will have a small loss of 22 consecutive trades.

So, it is often good to see someone say that the number of profitable trades can reach 30%. People who say this are almost certainly using the sequential leverage method. For those who use the sequential leverage method, the number of profitable trades can reach 30% is already quite excellent. You see, in this hypothetical example analyzed here, the number of profits can only reach 12.5%, this ratio can already flatten the funds, if you can increase to 30%, profitability is conceivable.

Therefore, it is understandable that if you want to use a successive leverage approach, you must have a prior estimate of the up and down spaces of the trading varieties. At least, you should enter when you estimate that the space can accommodate more than three leverages.

Of course, since the adoption of such a scale sequential leverage will make the profitability drop too much, so there is a positive pyramid leverage, each time the increase in the position is smaller than the previous position.

-

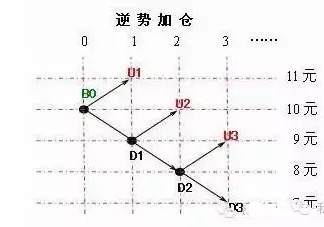

(2) The reversal is accelerating In addition to the positive, there is also a negative side to the downward trend.

1) It's good to be able to increase profits significantly. For example, the method of scaled reversal bullishness, as shown above, after opening 1 hand more at B0, on average 500 times 1000 times will rise to U1, profit 1 yuan;

Another 500 times will fall to D1; 1 hand will be raised at D1, after the raise: On average, 250 out of 500 positions will rise to U2, although the price is back to the starting point, but the position added at D1 can bring a profit of 1 yuan, and flatten the position increased at D1, which can reduce the holding cost from 10 yuan to 9 yuan; The other 250 will continue to fall to D2, continue to raise 1 hand, and after raising:

On average, 125 of them will rise to U3, at which time, although the position in B0 will lose 1 yuan, the position in D2 will bring a profit of 1 yuan, making it still flat overall. At this time, if you flatten the 2nd hand position in D1 and D2, you can reduce the holding cost from 10 yuan to 9 yuan.

However, 125 times will continue to fall to D3, this time it is worse, although the price has fallen by only 3 yuan, but the total loss has skyrocketed to 6 yuan.

So, with a reversal leverage, you can increase the profit margin from the original 50% to 75%, and there will be 12.5% of the number of times you can flatten, only 12.5% of the number of times you will lose.

If you want to continue to increase the percentage of profits, then double or even higher pyramid positions, and increase the position by one or more times each time the price drops, so that at least you can increase the profits to more than 90%, making the loss completely a small probability event, but the cost is loss once it happens is destruction.

2) The bad part is that if there is no loss, then it is a big loss. This is like many traders, it usually works well, but it is a disaster.

-

-

3rd, is it bullish or bearish?

More people will recommend bullish bullish because it will not jeopardize survival. But as I said before, in the example of this expected return assumed here at zero, neither bullish bullish nor bearish bullish will make money in the end. So bullish is first of all just a technique to change the profit and loss distribution of the trade, bullish plus and bearish plus, each with its short duration.

In military law, the use of soldiers to talk about compliance, should be profitable. Hoarding as a method of using funds in trend trading, as well as using soldiers, should also be used to consider the conditions of the day, the conditions of the terrain, and should not be closed eyes in any conditions either success or failure. For example, counter-hoarding, as mentioned above, can greatly increase the number of profits in the trade, has the absolute ability to compress small losses into probability events.

The problem is that the compression loss is like the spring, once lost, the loss will explode in a deadly way. However, the spring must bounce back with a hard surface, and if the spring is pressed in the sand, the spring has no chance of bouncing back at all. This is the effect of leverage.

Simply put, divide this up to 1 yuan falling space into 2 segments, 0.5 yuan per segment as a counter-trend plus position, and divide the funds into 3 segments, invest 1 capital build at the current price, 0.5 yuan raise at each fall, 0.5 yuan raise at each rebound flatten the increased position. After everything is properly arranged, you can make money steadily no matter how the price changes.

To talk about this, you should already be able to feel that the progressive build-up is like an offensive war, and the counter-strike build-up is like a defensive war. To play an offensive war, naturally, there is a need for a large offensive space in front; to play a defensive war, there is a need for land-based conditions to be relied upon.

The ideal, of course, is to find a cutting-edge point, with a huge area to attack in front, and a solid terrain to rely on behind, so that even if the terrain is not good, you can still rely on the terrain to resist, slowly accumulate strength; once the terrain warms up, you have become a strongman in the defense, you can easily move from counterbalancing to advancing, and achieve the conversion from defense to offense. If you think about it, whether it's an offensive build-up or a defensive build-up, both of these build-up methods are part of positional warfare.

The first step is to choose an entry point as the initial position, and then start from this position, either layered advance, or rhythm resistance. Both of these approaches, to complete a game, are time-consuming, and also require a large amount of funds for deployment. So, these two approaches, first of all, to examine the conditions of the battlefield, choose an initial starting position that can be attacked, retreated and defended, and then deploy the troops according to the time, terrain, carefully deploy troops, develop a deployment plan.

-

4, how many times should I add?

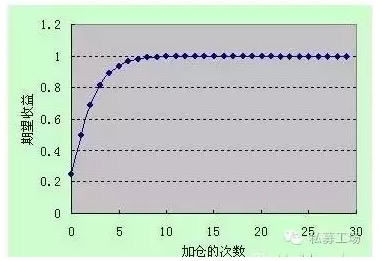

The above example of the design of the number of counter-trend raises is already illustrated, as for the trend raises, consider this example: still using the first binary tree, but now it is changed to the assumption that at each node, the probability of a rise and the probability of a fall are still 50%, but the rise is 1 yuan and the fall is only 0.5 yuan. This change is intended to make the expected return positive.

For simplicity's sake, the following graph shows the expected returns of the various incremental orders of magnitude.

Obviously, the more times you go up, the higher the expected returns. This is a reflection of a widely circulated saying in the market, that once you go up, the best option is not to stop the trend, but to keep adding.

However, in this graph, it is also clear that by the time the number of hoardings reaches the 10th time, the growth in expected returns is extremely close to the limit, and then the hoarding continues to decline, and the increase in expected returns is negligible. Due to the fact that it is impossible to divide the funds into 100s and 1000s to implement the plan of continuous hoarding, and the nature of the sequential hoarding also indicates that it has little meaning to do so.

At the same time, it is because the amount of own funds is limited, that the habit of using a progressive leverage is almost certainly to do collateral trading. Because only collateral trading allows the progressive leverage to continue to have unlimited leverage without paying interest.

-

5. Capital curve under the leverage approach

This graph shows the growth curve of capital produced by the use of some kind of progressive leverage. This curve is typical: the growth process of capital, first a continuous slow decline for a long time, then a sudden appearance of one or several large profits, raising the level of capital to a new height, then a long continuous decline, then a sudden appearance of a large profit, making the capital jump to a higher height again... This capital curve is not easily accepted by everyone.

Based on the above analysis, a reasonable assessment of the effect should be made in advance if the above-mentioned aggregation method is used in quantitative transactions.

Translated from private workshop

- The price strategy of the Fiat 4

- Interesting quantitative short stories - multiple heads and blank heads

- Distribution options that simulate retesting use their own servers to prompt errors

- Changing the month of the main futures contract

- Aberration policy

- The 10 most basic utility algorithms that programmers should know and their explanations

- Trading philosophy in probability

- Where do you need to enter the funds password?

- GetRecords is not available on BTCTRADE.com

- The price of the stock is flat, buying options and losing money!

- Fun machine learning: the most concise introductory guide

- The law of the merchant

- Visual intuition 7 commonly used sorting algorithms (writing strategies commonly used)

- High-frequency trading strategy: Triangle leverage

- 20 Tips for Developing a Creative Mind

- Machine learning compares the 8 major algorithms

- Investing in winners: the secret to counter-intuitive thinking

- The basic requirements of a trading system

- The true amplitude of the ATR indicator used

- Is there a bot error code query?