JavaScript version of the SuperTrend policy

Author: The Little Dream, Created: 2020-04-17 16:36:24, Updated: 2023-10-09 22:46:56

JavaScript version of the SuperTrend policy

There are several versions of the SuperTrend indicator on the TV, looking for a relatively easy to understand algorithm ported, compared to the inventor's Quantitative Trading Platform Retesting System SuperTrend indicator loaded on the TV chart, found a slight difference, for the time being do not understand the reason, hoping for the guidance of the readers, I first throw the dice.

SuperTrend indicator JavaScript version of the algorithm

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// 测试指标用的main函数,并非交易策略

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

The test code is backtested:

A simple strategy with the SuperTrend indicator

The trading logic part, which is simpler, is to open more positions when the bullish trend turns into a bullish trend. Opening a short position when the bullish trend turns into the bullish trend.

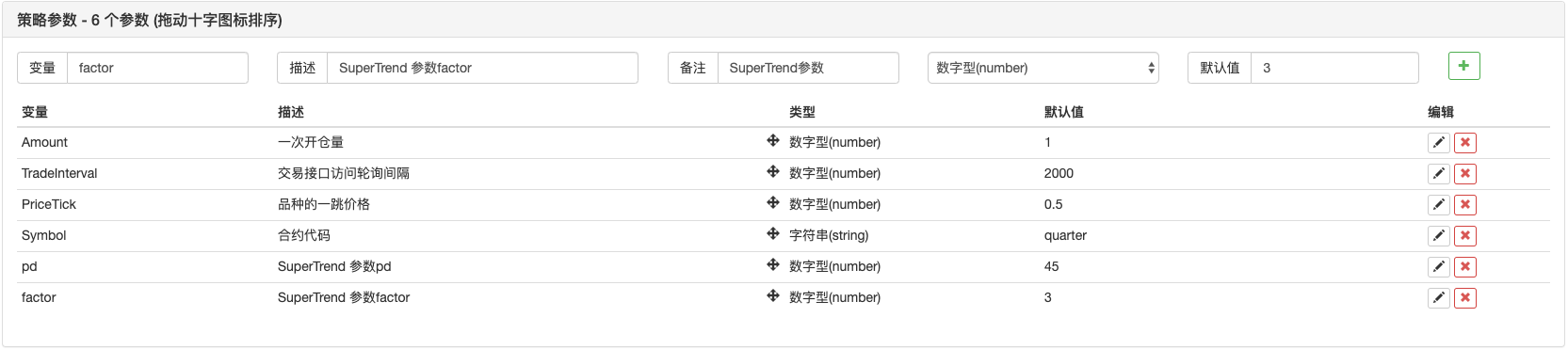

The policy parameters:

SuperTrend trading strategies

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// 全局变量

var OpenAmount = 0 // 开仓后持仓的数量

var KeepAmount = 0 // 保留仓位

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// 交易逻辑部分

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // 处理交易

if(Type == OPENLONG || Type == OPENSHORT){ // 处理开仓

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // 处理平仓

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // 开多仓

pos = GetPosition(PD_LONG) // 检查持仓

// 判断是不是 满足状态,如果满足 修改状态

if(pos[1] >= Amount){ // 持仓超过或者等于参数设置的 开仓量

Sleep(1000)

$.PlotFlag(currBar.Time, "开多仓", 'OL') // 标记

OpenAmount = pos[1] // 记录开仓数

State = LONG // 标记为 做多状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // 计算价格

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // 下单函数 (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // 开空仓

pos = GetPosition(PD_SHORT) // 检查持仓

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "开空仓", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // 处理平多仓

pos = GetPosition(PD_LONG) // 获取持仓信息

if(pos[1] == 0){ // 判断持仓是否为 0

$.PlotFlag(currBar.Time, "平多仓", '----CL') // 标记

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // 处理做多仓

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "平空仓", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // 部分平多仓

pos = GetPosition(PD_LONG) // 获取持仓

if(pos[1] <= KeepAmount){ // 持仓小于等于 保持量,本次平仓完成

$.PlotFlag(currBar.Time, "平多仓,保留:" + KeepAmount, '----CL') // 标记

State = pos[1] == 0 ? IDLE : LONG // 更新状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "平空仓,保留:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

The policy address:https://www.fmz.com/strategy/201837

Re-tested performance

Parameter setting, K-line cycle, reference: homily of the Great GodSuperTrend V.1 - Supertrend line systemK-line cycle set to 15 minutes, SuperTrend parameter set to 45.3; retrospective OKEX futures quarter contract time of the most recent year, set to one contract per trade, since the set to only one contract per trade, so the utilization of funds is low, do not consider the Sharp value.

The tactics are for learning only, but be careful with them.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- SuperTrend V.1 - Supertrend line system

- [Millennium War] Currency exchange multi-currency hedging strategies Recent recaps and results of the minute-level K-line review ((Part 4)

- Hands-on teaches you how to implement a data collector

1070278998@qq.comWhat does the algorithm return (up, down) mean, what does the content look like, is the supertrend not also a number, do you want to use this function, no.

skyfffireThe dream is to be a bully

violainThe difference with the TV should be the problem of ATR calculation in the FMZ package, for example the input cycle is 7, calculating out the first 6 values of ATR should be zero, but actually it is not

The Little Dream$.PlotLine is an interface function for the drawing line library, which can be copied to Strategy Square.

1070278998@qq.com$2. PlotRecords (r, "K") .PlotLine (("L", st[0][st[0].length - 2], r[r.length - 2].Time) $.PlotLine (("S", st[1][st[1].length - 2], r[r.length - 2].Time) What does the code after the L mean, and if it's a lower line, does the r after it need to be used in conjunction with it to represent the time when the L appeared?

1070278998@qq.com$2. PlotRecords (r, "K") .PlotLine (("L", st[0][st[0].length - 2], r[r.length - 2].Time) $.PlotLine (("S", st[1][st[1].length - 2], r[r.length - 2].Time) What does the code after the L mean, if it's a lower line, does the r after it need to be used in conjunction with it?

The Little DreamWhat sp?

The Little Dreamup[up.length - 1], the first digit of the exponent, corresponding to the first bar of the exponent of the K line.

1070278998@qq.comHow do we determine the period of sp, which parameters do we need to change?

1070278998@qq.com Up.length-1就是上边线最近的一个数字吗

The Little DreamReturns a two-dimensional array, up is the line above, down is the line below. Returns the entire indicator data.

The Little DreamWell, let's take a closer look at the algorithm in Tradingview below.

violainYes, the dam confirms where the problem is, it's a bit confusing, I don't know which one to use.

The Little DreamOK, thank you, but I'm using ATR from the Talib library, and the calculations don't seem to be right, and the data that comes out of the direct implementation of ATR by the algorithm is also slightly different.