The deepest road in the world is your path: dig deep into the pits of the Sutlej River

Author: The Little Dream, Created: 2017-03-22 10:23:37, Updated:The deepest road in the world is your path: dig deep into the pits of the Sutlej River

> Arbitrage, also known as price difference trading, refers to the practice of buying or selling one electronic trading contract at the same time as selling or buying another contract. Arbitrage trading is the practice of trading in the opposite direction of the price difference between relevant markets or related electronic contracts, in the expectation that the difference will change. Many people think of arbitrage as a risk-free or even low-risk action, but in practice arbitrage is often a dead end.

In the current futures market, the oilseed industry includes 7 varieties of soybean, soybean oil, soy sauce, soy sauce, soy sauce, soybean oil, palm oil, and soybean oil.

There is a premium between soybean oil and soybean oil, a premium between soybean oil and soybean oil, a premium between soybean oil and soybean oil, a premium between soybean oil and soybean oil, and an alternative between soybean oil and soybean oil and soybean oil, making it the most attractive premium in the futures market.

However, based on my own experience in the market over the years, these strategies are far from being as good as they appear.

-

Pressure-reduced

For the oil companies, soybean is the raw material, soybean oil and soybean meal is the downstream product, soybean is pressed to produce soybean meal and soybean oil, and there is a clear price interaction between the three, and the core of this relationship is pressing profit.

When pressurized profit margins are high (i.e. low soybean prices, relatively high soybean oil and soybean oil prices), enterprises have enough incentive to expand production, increase demand for soybeans, increase supply of soybean oil and soybean oil, resulting in a relative rise in soybean prices and a relative fall in soybean oil and soybean oil prices.

For futures traders, there is an opportunity to buy soybeans and sell soybean oil, commonly referred to as soybean oil leasing or forward leasing.

Similarly, when pressurized soybean profits decline or even fall into a loss (i.e. high soybean prices, relatively low soybean oil and soybean oil prices), the oil companies will usually reduce production, partially or completely shut down production lines, thus reducing the demand for soybeans, while reducing the market supply of soybean oil and soybean oil, which will lead to a relative decrease in the price of soybeans and a relative increase in the price of soybean oil and soybean oil over time.

For futures investors, this is an opportunity to buy soybean oil and sell soybean oil at the same time, which is commonly referred to as reverse oil leasing or reverse pressing leasing.

What, does this logic sound familiar? Well, it's very similar to the steel mills in the black zone.

Under this logic, the following formula can be used to monitor the emergence of leverage opportunities:

Domestic soybean pressing profit = soybean meal price × 0.80+ soybean oil price × 0.166- soybean meal price-100 ((processing costs) ((i.e. 1 ton of soybeans pressed into a paste produces 0.8 tons of soybean meal and 0.166 tons of soybean oil)

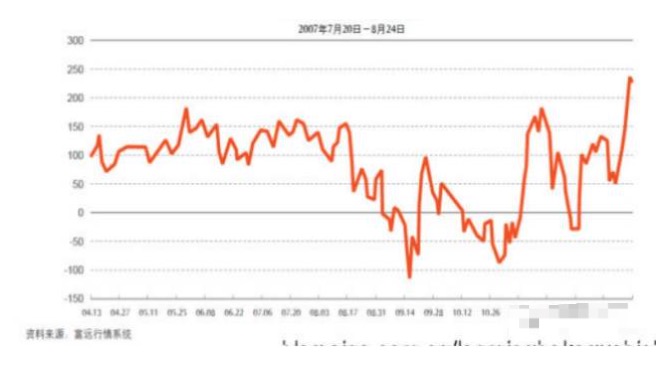

To give you a better idea, I looked up a historical graph of the profit margin of the soybean crop from an online interest rate scheme, which suggests that when the profit margin of the soybean crop was around 150 in mid-November 2007, the profit margin of the crop was significantly higher, and the operations of buying soybeans, selling soybean oil and soybean oil were completed shortly afterwards, and the profit could be in the range below 50.

Due to work reasons, at first I did not pay much attention to pressing interest rates. I remember that in those two years several friends often did pressing interest rates, and also made a lot of money, and very much admired this interest rate model. It was not until a party in 2009 or 10 years ago that they heard that pressing interest rates were losing a lot, only after asking: most domestic oil and fat factories are imported soya for the production of raw materials, and Dalian futures exchange's No. 1 soybean contract is domestic soybean use, domestic soybean futures contract for pressing interest rates, it's just that mosquito larvae goddess has found the wrong person!

In the past, the price of domestic and imported soybeans was relatively close, so it was possible to make a lot of money, but now the gap between domestic and imported soybeans is getting bigger, and losses are inevitable!

This explanation really made me cry. After that, I started to pay attention to the oil market.

Domestic soybeans are very different from imported soybeans, imported soybeans generally come from the United States, Brazil and Argentina, and are mainly used for cooking oil because of their high yield, low pest risk and high oil yield.

Due to policy restrictions, only non-GMO soybeans can be grown in China, with low yields and low oil yields, which are more suitable for consumption than cooking oil. Combined with the differences in agricultural efficiency and subsidy policies between the two countries, low-priced imported soybeans have long dominated the domestic fat market.

If you look carefully, you will see that all sorts of soybean oil in supermarkets are labeled with the words "GM soybean". In this situation, the Northeast Oil Company, which produces domestic soybeans as the main raw material, has fallen into a state of total loss, while the Southern Port Oil Company, which imports soybeans as the main raw material (mainly for foreign investment), is growing.

To make matters worse, in order to protect the interests of farmers and to secure the area of soybean plantations, the government has implemented a policy of stockpiling domestic soybeans since 2008, which has resulted in domestic soybean prices being much higher than imported soybean prices in Hong Kong.

The consequence of this policy is that on the one hand, low-priced imported soybeans have completely monopolized the market for oilseeds, China's annual imports amount to about 60 million tons, heavily dependent on foreign supplies, and national oilseed enterprises have been severely affected, especially in the northeast oilseed enterprises almost all went bankrupt; on the other hand, the state reserves have accumulated a huge amount of domestic soybeans that cannot be digested, and have to provide subsidies in order to commission the processing of oilseed factories, with huge losses.

As this policy failed to provide much help to farmers in increasing their harvests, the area under soybean cultivation in the country continued to shrink, and finally the policy of soybean storage came to an end in 2014 and was replaced by a policy of targeted price subsidies.

More ironically, until now, there are still many people in the market who use domestic soybean futures to squeeze quotes. There are more and more such quotes on the front page of futures daily newspapers, in the research papers of futures companies, in web articles. Even in some professional journals, the statistics and quantitative analysis of domestic soybean futures quotes are still published.

I am so drunk that after the oil industry has changed so drastically in its structure compared to what it was eight years ago, so many people are still working behind closed doors on such a lucrative solution, irresponsibly promoting it and recommending it publicly to ordinary investors.

Of course, there are also a number of researchers and arbitrageurs close to the oil industry who have started to use the CBOT (Chicago Stock Exchange) soybean futures and the domestic soybean and soybean oil futures to squeeze the market, updating the formula to calculate the squeeze profit because of the different rates of oil production:

Imported soybean pressing profit = soybean meal price × 0.788 + soybean oil price × 0.186- soybean meal price-100 ((processing costs) ((i.e. 1 ton of soybean pressed yields 0.788 tons of soybean meal and 0.186 tons of soybean oil))

Such an arbitrage using the CBOT soybean futures contract is consistent with the actual production conditions of the oilseed industry, and I might have been struck by such a fallacy three or four years ago. However, I no longer have any interest in such a arbitrage logic after being drilled all over the place by various seemingly perfect arbitrage schemes.

Imagine what kind of strange events you would encounter over the years if you were to squeeze the odds according to this seemingly rigid formula.

In the face of the current and future price differences in U.S. soybeans, domestic soybean meal and soybean oil, it is difficult for me as a non-industrial chain company to predict the direction of these price differences and not to profit from them at all.

When you think that imported soybean presses are losing and you should reverse the pressing interest rate, maybe in two months you'll find that oil companies are full of money because of the yuan's appreciation.

When you think you're losing money on American soybeans, it may be two or three months before you find out that the oil mills are using lower-priced South American soybeans, or that the importers are selling at a loss in the country because of the need for credit card financing.

When you think that South American soybeans will be imported at a lower price, it may take two or three months before you realize that South America is in trouble due to the arrival of the rainy season, the strike of port workers, political unrest, currency fluctuations, etc., which has led to slow loading, the failure of the soybean shipment, and the factories are forced to buy high-priced soybeans to maintain production.

Just when you thought that the price of soybean oil was too low to recover, you might later find that Argentine soybean oil is being dumped on the international market, or that the surge in palm oil inventories has produced a strong alternative to soybean oil.

In short, if you spend a lot of time in the futures market, you'll find that the Mariana Trench in the Pacific Ocean is nothing compared to all the potholes in the futures market!

So, if you are a corporate customer who specializes in the oil industry, and you combine factors such as exchange rate fluctuations, current account deficits, logistics transportation conditions, port inventory fluctuations, competition for alternatives, etc. to create a leverage, then OK, I believe you have the ability to win more or lose less, and the ultimate victory is yours!

In addition to the pressurized oil market, there are two commonly used strategies: oil substitution and oil-in-oil coupled.

-

Oil substitution subsidies

Among the various options strategies in the field of petroleum products, oilseed substitution options account for the largest proportion. Due to the clarity of the industry logic, the price differential laws are obvious, and the mathematical statistical verification, it has attracted great attention from futures brokers and researchers, and the corresponding research literature and investment reports are also the richest.

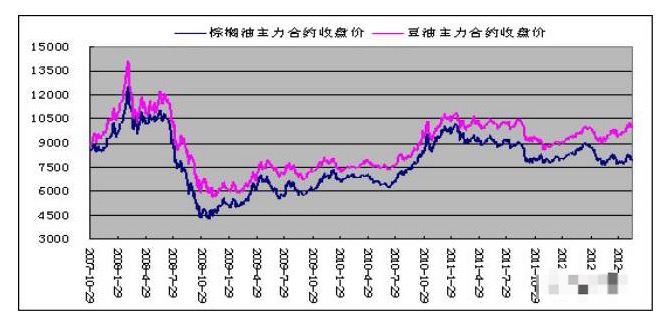

Bean oil, soybean oil and palm oil are the main oil varieties in the country, and from the point of view of the consumption terminal, the three of them have a reciprocal relationship, the varieties also show a high correlation between them, and the price trends of the three are very close.

Due to the country's stockpiling of rapeseed oil in recent years, which has interfered with the price difference between rapeseed oil and beetroot oil and palm oil, and the relatively low volume of rapeseed oil trading, only alternative pricing between beetroot oil and palm oil is analyzed here.

In the vegetable oil consumption market in China, beetroot oil and palm oil account for 40% and 20% respectively of the total consumption, and are the main varieties of vegetable oil consumption in China. Although they have different fundamentals, the two have a strong interchangeability, making the price of the two highly correlated, with the price correlation of beetroot oil and palm oil statistically reaching more than 95%.

The chart below shows the historical data of the main futures contracts for beetroot oil and palm oil between October 29, 2007 and September 12, 2012, which can be intuitively seen from the chart.

At the same time, the seasonal variation in the price difference between beet oil and palm oil is due to the different production and consumption characteristics, which creates opportunities for a trade-off between beet oil and palm oil.

China's main source of soybean oil is the direct import of pressed soybean oil and some soybean oil from imported soybeans. Due to the decreasing proportion of domestic soybean oil pressed from year to year, Dalian soybean oil futures are increasingly associated with CBOT soybean and soybean oil prices. China's soybean imports mainly come from the United States, Brazil and Argentina.

Palm oil is mainly imported from abroad, mainly from Malaysia and Indonesia. According to the point of view, the palm oil imported in our country is mainly refined at no more than 24 ° C, but also imports crude palm oil, which is imported to the domestic port and refined and sold. The pricing process is mainly based on trade negotiation prices, which are relatively influenced by the futures price of Malaysian crude palm oil.

Due to the high melting point of palm oil, it solidifies and freezes at low temperatures, which leads to poor appearance and is not conducive to sales. Therefore, consumption of palm oil is seasonal, with a high summer consumption and a high substitution for soybean oil; winter consumption is relatively small, with a low substitution for soybean oil.

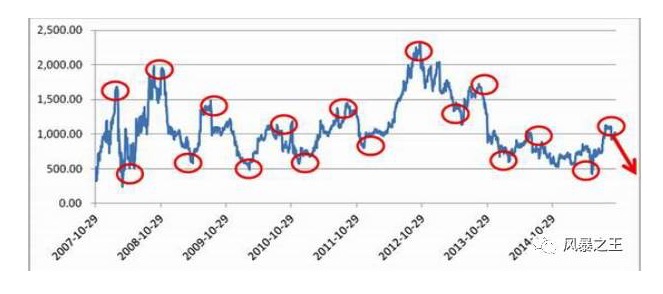

Using Wind data to analyze the price differential between October 2007 and 2015, the historical lowest price difference between the two main futures contracts for palm oil and soybean oil was 524 on 8 March 2010, the highest difference between the two was 2198 on 31 October 2012, and the average price difference was 1166, with a 95% probability of the difference operating in the 594 tonne-1738 range.

And there is a certain law of seasonal variation in the price difference, that is, the highs of the two price differences generally occur in the third quarter of each year, which is more likely to occur in August and September; the lows of the two price differences generally occur in one quarter, which is more likely to occur in February and March.

Do you ever feel like this is a sort of a betting machine that can be used as a betting machine, week in and week out, just by pressing the betting machine as shown in the diagram above?

I think that these static statistics are nothing more than post-election bullshit, and that the people who follow this strategy often end up in the same predicament as the pigs before the elections.

For example, you know that there is a 95% probability that the price difference between soybean oil and palm oil will be in the 594 ton 1738 range, but how do you decide when to enter and when to leave?

If you use 1738 as the entry point for buying palm oil, then you have absolutely no chance to enter in the years '09, '10, '11, '14 and '15, because the peak of palm oil and palm oil in these years is also more than 1,400 points or even less than 1,000 points; and in the year '08 and '12 you will intervene too early because the peak of the two years is around 2000 and 2200 points respectively.

In terms of the return on equity, we can look at the extreme markets of low prices of soybean oil and palm oil in 2012.

In that year, the State Administration of Quality Inspection issued a notice on further strengthening the inspection of imported edible vegetable oils, stating that imported edible vegetable oils that were not tested in accordance with China's current national food safety standards were not allowed to be imported.

As the manufactured edible beans oil and rapeseed oil imported from China are of good quality and basically meet the national food safety standards, but the acidity price of edible grade palm oil imported from China does not meet the national standards, so there is a big impact on the domestic palm oil imports. For non-standard palm oil will no longer be able to be imported as edible vegetable oil, but can still be imported as raw oil, after import must be re-refined in coastal ports and then put back into circulation, which will cause the cost of edible grade palm oil to increase by about 150 yuan / ton, and the financing cycle of large-scale importers will be extended, increasing the difficulty of financing.

In order to avoid the restrictions imposed by the policy, most companies expanded their palm oil imports in the second half of 2012 and stockpiled the palm oil needed for the next year in advance, which resulted in domestic palm oil port inventories more than doubling from the same historical period.

At the same time, the market expects a drop in South American soybean production and the price of soybean oil to continue to rise, leading to a continuing rise in the gap between soybean oil and palm oil, which has set new historical records.

Thus, many investors with a dividend are entering the market in the range of 1700 to 2000 points, hoping that the price differential will return to below 1500. Unsurprisingly, the huge imports of palm oil, combined with the expectation of future export tariffs on Malaysia and Indonesia, continue to weaken, and the price difference between the 1301 and 1301 contracts continues to rise, reaching a historical high of about 2800 by mid-January.

If the extreme market in 2012 is an exception, the recent price differential of the 1701 and 1701 palm oil contracts (see below) is another extreme price differential and an extreme exception to the spread spread of the price differential.

Between August and November 2016, at a time of historically high price differentials, the number of beet oil 1701 and palm oil 1701 contracts fell from around 1,000 to a minimum of about 460. During this period, many people made spreads of around 800, 700 and 600 (such investment suggestions are now available), hoping for the spread to rise to above 1,000 points or even higher.

After all, according to the previous industry logic analysis, palm oil is not suitable for consumption in winter, and at the peak of production each year, its price should be much lower than that of beans.

However, the reality is harsh: the price of palm oil has been soaring due to the expected decrease in production in Malaysia and the fact that domestic stocks have fallen sharply, while the price of soybean oil has been under pressure from stock pressures, the rise is slow and the difference between the two prices has reached a historic low in the off-season.

Even during the peak season of palm oil consumption, the summer when there are many alternatives to beans, the price of beans and palm oil rarely falls below 500!

Looking at the trend of low prices of soybean oil and palm oil at the end of 2012 and in November 2016, how much confidence do you have in the upcoming Bitcoin bubble?

-

Soyabean oil and soybean oil

Beet pulp and beet oil, as the main pressing products of domestic oil factories, are co-products, and the supply factors of both are basically the same, except for the impact of imported beet oil.

In the downstream consumption, soybean oil is mainly used for edible oil, soybean meal is mainly used for feed processing, which in turn is mainly used for pig feed. The consistency of the two at the supply side and the difference at the consumer side, resulting in their price movements have this long-term relationship.

Theoretically, if the price of soybean oil rises driven by demand, it will inevitably lead to an increase in production at the refinery, while the production of soybean oil at a fixed rate may cause an oversupply in the fat market, thus suppressing the price of soybean oil. This phenomenon is known as peanut butter leakage, which in turn is known as peanut butter leakage.

Therefore, the pattern of strong and weak differentiation between the price changes of soybean oil and soybean meal in a broadly convergent direction, due to various fundamental supply and demand effects, is the basis for the feasibility of a trade-off between oil and soybean meal.

However, in reality, the historical performance of the oil and gas leasing is almost identical to that of the oil leasing.

To summarize the various interest rates in the field of oil, I would say that whether it is the pressurization rate, the oil substitution rate or the co-incidence rate between the oil pumps, the logic is based on the profit balance of the oil plant or the relative substitution of the prices of consumers, assuming that the producer (oil plant) or the consumer plays a dominant role in the price movement of the corresponding product.

In reality, the prices of soybean, soybean oil, palm oil, soybean oil, etc. are influenced not only by the influence of the producers (oil plants) or consumers, but also by production expectations, stock levels, maritime transport, exchange rate fluctuations, import and export policies, biodiesel policies, financing traders and futures market financing.

Translated by Poker Investors

- I feel like you guys cut the cabbage, and I'm still holding the coin.

- Systematically learn regular expressions (a): basic essay

- Python and the Simple Bayes Application

- Analysis of the application of screw steel, iron ore ratio trading strategies

- Commodity futures retrospective data

- How to analyze the volatility of options?

- Programmatic application of options

- Time and Cycle

- Support vector machines in the brain

- Talk about being a marketer and a mother.

- Read the probability statistics over the threshold and the simplest probability theories you never thought of.

- This is the third installment of the Money Management Trilogy: Format First.

- I can make money by adding, I never use multiplication.

- Easton deals with fraud

- Commonly used terms for machine learning and data mining

- No prediction, only reflection of price changes

- Ali Cloud Linux host is running the host, the host restarted, how to get back to the original host?

- High volatility means high risk? Value investing defines risk differently than you think.

- I wanted to ask you about the platforms that virtual currency disks can support and the currencies that can be traded.

- Zero and negative markets

xiahaohuan001Subjective interest is also a matter of knowing the basics and the financial side.