Analysis of the application of screw steel, iron ore ratio trading strategies

Author: The Little Dream, Created: 2017-03-28 10:58:28, Updated:Analysis of the application of screw steel, iron ore ratio trading strategies

-

The price fluctuations of the two are the basis of the transaction.

The high correlation between screw steel and iron ore prices stems from the fact that iron ore is the main raw material for the production of steel, so the benefits between the two are also naturally linked to costs and profits. Iron ore is the most important raw material for the production of steel, accounting for about 50% of the cost of steel, and its price changes have a very large impact on steel prices. This article attempts to construct a strategy for doing more or doing less screw to steel ore ratios from the perspective of numerical fluctuations.

-

The angle of the strategy

The high correlation between the price of screw steel and iron ore comes from the fact that iron ore is the main raw material for the production of steel, so the interest rate between the two is also naturally linked to costs and profits. Due to the different conditions of resources, financing, technology and equipment at the disposal of each company, the calculation of costs and profits is also complex and varies, and there is no uniform standard. What do you mean? Firstly, the cost calculation method for screw steel such as aluminum 1.6 x iron ore + 0.5 x coke + 950 tons is too simple and generic, there is a lot of subjectivity in the calculation, and the construction of a single formula is sometimes not very accurate in the calculation of the current profit. What do you mean? Secondly, if, according to the general standards, making more or making a blank profit, should be based on the calculation method of aluminum screw steel-1.6 × iron ore-0.5 × coke alloy, but the profit on the plate contains a large impact on coke price fluctuations, the increase in volatility makes it more difficult to determine the entry and exit points of the trade. What do you mean? Finally, if the volatility of the coke price is excluded, the algorithm for making more or making a flat plate profit is not rigorous, especially in the case of large coke price fluctuations, where a significant increase in coke price will significantly increase the impact on the profit of the screw steel plate. What do you mean? Based on the above three points, we try to propose the idea of doing more or doing less of the ratio of screw steel to iron ore directly from the perspective of the numerical fluctuations, which can both reduce the variables in the strategy and enhance the operability of the strategy.

-

Screw steel, iron ore ratio structure

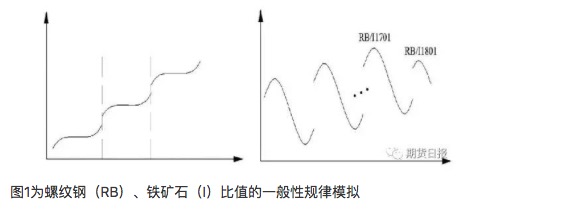

As China's steel demand enters the consolidation or even decline phase, corresponding to the global iron ore production capacity, production is still in the oversupply cycle, in the long run, the screw steel, iron ore ratio should be higher in the long run. If the horizontal axis represents time, the vertical axis represents the ratio of the two changes, according to the above logic, the general law of the ratio should be as shown in Figure 1 left, the screw steel, iron ore stock ratio of the production cycle is constantly higher.

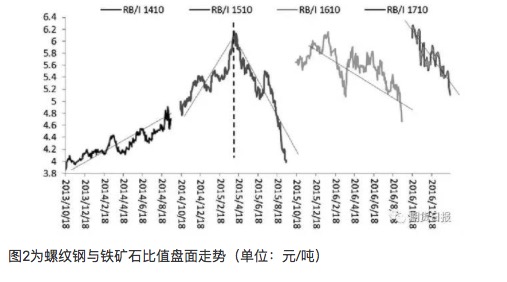

However, the screw-steel/iron ore futures ratios we studied for almost 1 tonne over the past 2 years have shown the path pattern shown in Figure 1 to the right: screw-steel/iron ore futures contracts are indeed up in the overall trend, but the highs of each contract ratio tend to occur early in the listing, and then fluctuate downwards. This law is particularly apparent in the single contract ratio after the 2015 Spring Festival.

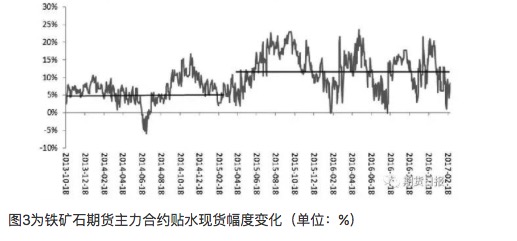

Prior to the 2015 Spring Festival, the increase in the value of screw steel and iron ore corresponded to its decline phase, and the decline in iron ore was larger than that of screw steel, which matched the production cycle of screw steel and iron ore. What do you mean? This is because we have overlooked an important issue, namely that the futures contract contains the expectations of the market participants, and the expectation of excess supply caused by the continuous expansion of iron ore production is reflected in the price differential structure of iron ore (the far-moon presents a significantly watered-down structure). This point is reflected in the fact that after 2015, the expectations of the market participants for the level of long-term iron ore contracts watered down further, as shown in Figure 3.

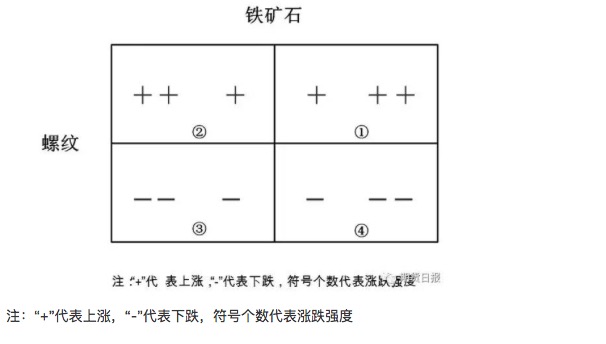

From the viewpoint of the characteristics, the change in the ratio of screw steel and iron ore generally corresponds to four changes in the matrix. The higher the ratio, the more the screw steel rises than the iron ore rises; the lower the ratio, the more the screw steel falls than the iron ore rises.

In general, such as iron ore volatility is greater, the upward trend is more likely to occur iron ore than screw steel, operationally, our choice of strategy is to determine the current and future development of the market is more likely to fall into the matrix, and to do the follow-up. What do you mean? Looking back at all the main contracts with screw steel and iron ore ratios since the introduction of the iron ore futures, we find that they are more prominent than the top (mineral phase lows often also correspond to the highs of the ratios), and then we analyze the empty ratios first.

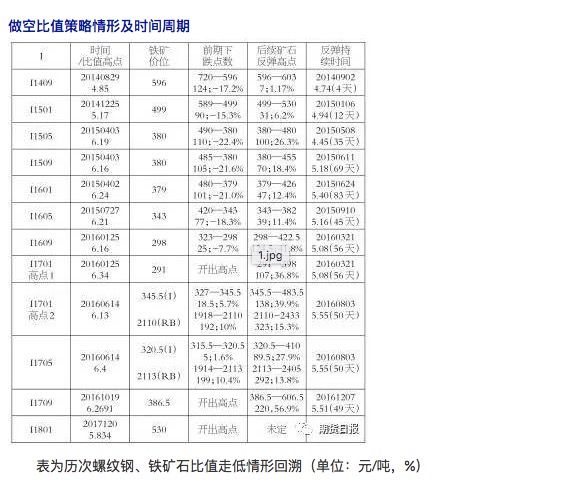

Looking back at the situation of the subsequent fall in the ratio of screw steel and iron ore: The situation of a significant fall in the ratio occurred in the rebound market, followed by the iron ore more than screw steel rebound, leading to the fall in the ratio, corresponding to scenario 1; screw steel bearing drive iron ore down, screw steel more than iron ore fell, corresponding to scenario 3, but this situation is more rare. What do you mean? Time Cycle: Weakening from a ratio high of 6 or higher can be seen, with a range of decreases of 13.46% to 28.1%, with a duration of 2.7 months, roughly the cycle we can establish between 1 and 3 months.

-

Flying

Combined with past historical trends, we can summarize the reasons for the formation of the screw steel, iron ore plate high-value ratio: the static process due to the extreme iron ore adhesion is too large, the ratio created after the opening of new contracts corresponds to the medium to long-term high; the iron ore extreme deep adhesion structure overlapping phase iron ore decline is greater than the screw; iron ore extreme deep adhesion structure overlapping environmental protection or de-productivity factors lead to the upward trend in screw steel much more than iron ore aluminum formed high ratio, the later period of iron ore futures are slowly moving towards the spot price, with a lower value. What do you mean? Therefore, from the point of view of the contract ratios of screw steel, iron ore since 2016, it is generally considered that the screw steel, iron ore ratios are relatively safe when entering the 6.0 tonne and above 6.2 range, and then the ratios will decline to varying degrees.

-

Doing multi-value strategy scenarios and time cycles

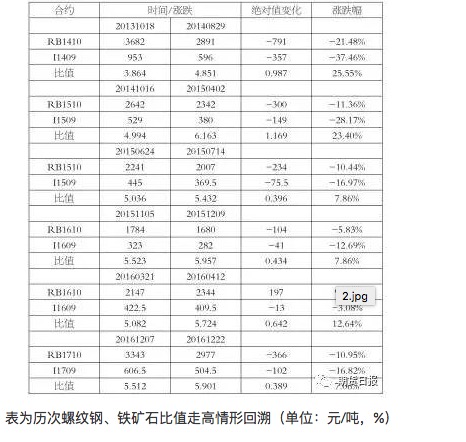

Looking back at the situation of the successive increases in the value of screw steel and iron ore: iron ore is clearly overestimated, the downward drive and potential is more obvious than screw steel, such as before the 2015 Spring Festival, when the iron ore is shallow, its downward drive is more adequate, and the ratio has a high trend; after the increase in the expected level of the water, there is a possibility of a phased rebound in the downward trend in the value of the single contract after 2015. What do you mean? Period: After 2015, the gradual upward trend was 7.06% vs. 12.64%, with a two-week and one-month variation.

-

Driving more

In conjunction with the production cycle of screw steel and iron ore, if the iron ore is clearly overvalued and there are signs of weakening after a strong current market, it is an opportunity to increase the trend of the rise in the value of the ratio; With the development of steel production capacity, if the demand for iron ore drops sharply, the fall in iron ore is greater than that of screw steel, leading to a breakthrough in the ratio; Due to the phased environmental protection requirements, the production limits of steel plants have a short-term impact on the formation of the ratio.

-

The comparison problem

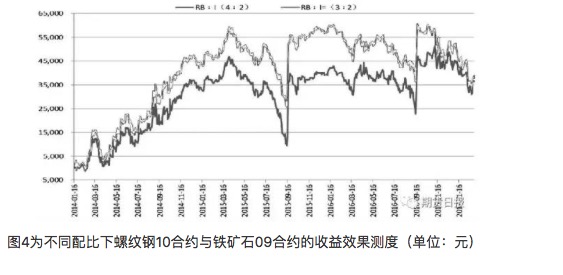

From the point of view of over- or empty-screw steel plate profitability, the ratio between screw steel and iron ore is 1 tonne to 1.6 tonnes (the ratio is about 6 tonnes to 1 tonnes), but the exposure risk of this combination is significantly higher than that of biased screw steel. From the screw and steel ore respective volatility factors, we use the historical data of the plate to determine the relative volatility ratio between iron ore and screw steel at about 1.50 tonnes to 1.87, we prefer to capture the change in volatility, and the volatility risk should be reduced in the process of leverage, but not completely cover the volatility. What do you mean? From the perspective of capital equivalence and past experience, a ratio of 2 tonnes 1 or 3 tonnes 2 can be roughly used. These two ratios can then be used as an argument for profit and risk effects in the case of a screw steel 10/iron ore 09 contract.

In terms of the capital ratio, if the number of fixed iron ore hands is the same, the ratio of screw steel: iron ore ((2

-

Applied analytics

In the previous section we analyzed four cases where the ratio of screw steel and iron ore is 1, 3, and 2, respectively. According to the laws of history and combined with the laws of iron ore volatility is greater than that of screw steel, the probability of forming 1, 4, and 2 cases is greater, so we prefer to choose the ratio that fits these two cases. What do you mean? In terms of iron ore, the long-term over-supply is an objective fact, and from the 4th quarter of 2016 to the 1st quarter of 2017, the main reasons for the strength of iron ore prices are still concentrated in structural problems that tend to purchase medium and high grade ore under the high profitability of steel plants. From the current basics, iron ore port inventories are at a historical high, high-low structural problems remain, but with later changes in the volume of shipments, structural problems or gradual easing. What do you mean? In terms of steel, the overall supply and demand in 2017 tended to a slight decrease in demand for aluminum steel + a pattern of high production thresholds at the supply end. The contradiction of phased steel will still be more prominent at the supply end (de-capacity + environmental protection) in the absence of large changes expected at the demand end. What do you mean? The current high level of social inventories is no longer the biggest factor of profit on the supply side, mainly due to the following: first, downstream demand has shown signs of warming, 1st, real estate and infrastructure in February were all above expectations, and social inventories continued to decline; second, due to the strong steel prices, traders' willingness to buy significantly increased compared to last year, the overall dump was small, and there was no panic selling. What do you mean? Overall, if the current iron ore is again strongly pushed up, it is suspected that it is overvalued, and the short-term ratio falls into the matrix scenario 2 or 4 mainly due to oscillations. If the after-market demand is uncertain, the demand for screw steel and iron ore as a whole will fall, combined with the iron ore volatility is greater than that of screw steel, the scenario 4 is more likely to occur. What do you mean? From the medium and long-term perspective, if the newly opened contract of screw steel is not large, and the corresponding iron ore contract maintains a deep-stick structure, it can maintain the strategy of doing empty ratios, as the later iron ore is gradually repaired and the volatility is greater than screw steel, the latter is likely to fall into scenario 1, it is still a strategy to be focused on.

Translated from Cinderella Futures

- Exchange API Special Issue Summary (Unfinished...)

- 7 issues to consider when dealing in virtual currency

- We hope to support the Bitmex platform

- Support for Coinbase and itbit

- MacD, please look at this.

- Indicator of the performance of trading algorithms -- Sharpe ratio

- A new kind of grid trading law

- I feel like you guys cut the cabbage, and I'm still holding the coin.

- Systematically learn regular expressions (a): basic essay

- Python and the Simple Bayes Application

- Commodity futures retrospective data

- How to analyze the volatility of options?

- Programmatic application of options

- Time and Cycle

- Support vector machines in the brain

- Talk about being a marketer and a mother.

- The deepest road in the world is your path: dig deep into the pits of the Sutlej River

- Read the probability statistics over the threshold and the simplest probability theories you never thought of.

- This is the third installment of the Money Management Trilogy: Format First.

- I can make money by adding, I never use multiplication.