The classic mistakes newcomers make when making options

Author: The Little Dream, Created: 2017-05-04 12:13:03, Updated: 2017-05-04 12:14:42The classic mistakes newcomers make when making options

-

Mistake 1: Buying a null option (OTM) at the beginning

It seems to be a good start: buy a bullish option and wait to see if you pick a winner. Buying a bullish option seems safe because the profit-loss pattern of the bullish option is consistent with your previous trading strategy, which is to buy low and sell high. Many experienced stock traders start and learn to trade in the same way.

However, in the world of options, buying straight into a worthless stock is one of the most difficult strategies to make money on a consistent basis. If you limit yourself to this strategy, you may find yourself losing money on a consistent basis and not making any progress.

What's wrong with buying options?

When you buy a stock, you have a hard time deciding which way to go. But when you buy an option, you need to know not only where the stock is going, but also when it's going to go. If either of these points is wrong, it could lead to your right to the gold standard being lost.

The price of the asset you are buying is fixed all day, and your options are like a block of ice bathed in the sun. Just like the more water that freezes, your option's time value will also disappear as the expiry time approaches. This is even more obvious if you first buy an option that is near expiry and overvalued (this is a favorite option for beginners because they are usually very cheap).

Not surprisingly, however, these options are cheap for a reason. When you buy a nil-priced binary option, they will not automatically increase in value just because the stock moves in the right direction. The option price is related to the probability that the stock price will reach and exceed the execution price.

How can we trade smarter?

Since you are first exposed to an option, you should consider selling a worthless call option on a stock you already hold. This strategy is called a put option. Since you sell a put option, you are obligated to sell the stock at the option's execution price. If the execution price is higher than the stock's current market price, your intention is: if the stock rises above the execution price, if the option buyer wants to go, or if it's not worth taking the stock from me.

To take on this obligation, you exchange the cash for the sale of a worthless call option. This strategy can bring you some cash flow, but since you are optimistic about the stock, you don't care if the stock price is above the execution price at expiration.

The advantage of a put option as an initial strategy is that selling the option does not present you with any additional risk. The risk actually comes from the stock you own, which is a significant risk. The biggest potential loss is the cost of the stock minus the entitlement you get from selling the put option.

While selling a put option does not involve capital risk, it does limit your upside, and therefore introduces opportunity risk. In other words, you do have the risk of having to sell the stock when the option expires at a market price that exceeds the execution price. But because you own the stock (in other words, you are a reserve), it is usually a win-win situation for you because the stock price has already hit the put execution price.

If the market remains unchanged, you will not only have the rights to the option but also the right to hold your stock position. On the other hand, if the stock price falls, you can only buy back the option to clear the option vacancy, and sell the stock to clear the majority of the position. Remember that the stock may generate a small loss when you break even.

As an alternative to buying a put, selling a put is considered a smart, relatively low-risk strategy to earn income and gain insight into the dynamics of the options market. Selling a put allows you to observe an option up close and see how its price reacts to small changes in the stock price and how the price declines over time.

-

Mistake 2: Using a one-size-fits-all strategy for all market conditions

Options trading is very flexible. You can use options to trade effectively against all market conditions. But you only have the edge to use this flexibility by continually learning new strategies.

A buy spread is a good way to deal with different market conditions. When you buy a spread, it is also known as a bullish spread. All new options traders should familiarize themselves with the possibilities of the various price spreads so that you know when to use the various options.

How can we trade smarter?

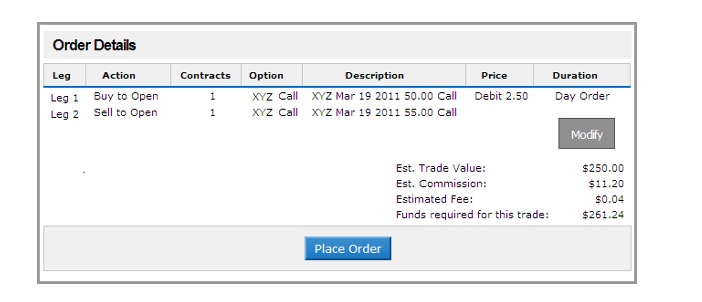

A multi-head spread is a position made up of two options: a higher-cost option to buy and a lower-cost option to sell. These options are very similar to a bear market position (both bear or bear). The only difference between the two options is the execution price.

A trade-off, because you buy one option and sell another option at the same time, the time loss affecting one leg may actually help the other leg. This means that the trade-off is more or less time-loss-neutral for the net benefit of buying a single option.

The disadvantage of this spread is that your potential upside is limited. Frankly, only a small number of buyers of options can really make a very large profit on their trades. Most of the time, if the stock reaches a certain price, they sell the option anyway. So why not set a sell target when you enter the trade?

Although the maximum potential profit is limited, the maximum potential loss is also limited. The maximum risk for over 50-55 put options is the purchase of 50 put options less the sale of 55 put options.

There are two caveats to keep in mind. First, because these price differences involve multiple options trades, they generate multiple commissions. Second, as with any new strategy, you need to know your risk before paying.

-

Mistake 3: There is no definite exit plan before the deadline

You've heard it a thousand times before. Options trading, like stocks, is the most critical control of your emotions. That doesn't mean you have to put up with every fear like a superhuman. It's much simpler than that: write a plan and do it.

How to plan for an exit is not just about how to minimize your losses. You should have an exit plan, even if things go your way. You need to choose your up and down exits in advance, and the timing of each exit point.

What if you quit too early and left behind some potential gains?

This is a classic trader's concern. I can think of the best counter: how do you keep your profits going, reduce your losses and sleep well at night?

How can we trade smarter?

Whether you are buying or selling options, an exit plan is essential. Determine in advance what kind of returns you will be satisfied with. But also decide how bad losses you can tolerate. If you reach your profit target, clear your position and take your profit.

As time changes, the temptation to go against this advice may become stronger. Stick to it. You have to make a plan and execute it. Too many traders set up a plan and then, when the trade starts, abandon the plan at will.

Translated from Options House

- What about the futures trading strategies of the little guy?

- The Black Swan Effect

- Three things to understand when making a long-term lease

- Statistics 7 - The average number of cheaters

- Why is the difference in the area a measure of the degree of dissociation?

- How to determine the failure of a procedural transaction model

- BitMEX exchange API note BitMEX exchange API terms of use

- Extreme trading in trend trading exposed

- How to use code to fine-tune the filter feedback system to set the filter by default

- High frequency strategy

- How Bitcoin's High-Frequency Harvester Strategy 1 was implemented

- Understanding the various stakeholders in the futures market

- The trend is backtracking.

- Three graphs to understand machine learning: basic concepts, five genres and nine common algorithms

- The consistency of the dividend that determines profitability

- 2.14 How to call an exchange's API

- What do you think of the latest Ethereum and Ethereum platforms?

- null

- Six tips to keep your futures safe overnight

- The gold standard for overnight futures trading (trend trading)