Pandora's Box: How financial traders eat risk-free fat

Author: The Little Dream, Created: 2017-07-11 11:26:19, Updated:Pandora's Box: How financial traders eat risk-free fat

Speaking of which, in the first half of 2015, my energy and business focus was on copper, and I was only observing the monkeys touchingly, not expecting to miss a large-scale aggressive bullfighting, which the monkey monkey did not miss in fact. As if the beast smells blood, my interest in cooking grew instantly and I immediately started my cooking business without hesitation. Although the onion is a new variety, with the experience of doing copper spot trade from scratch, it is also easy to drive and quickly becomes a good business.

-

A game of futures, a game of delivery

The last time Russia opened its hands, it was like opening Pandora's box.

It should be noted that about 85% of China's native aluminum consumption is used for the production of stainless steel, but in recent years, the stainless steel process has improved greatly, using cast iron more than pure aluminum plate as a raw material.

In other words, in addition to the low proportion of fields such as electroplating, alloys, batteries, pure aluminum is still to be used in the field of stainless steel, which originally accounted for 85% of consumption, pure aluminum is facing fierce competition from cast iron.

Speculation in the futures market is unstable, and it likes to draw a line between three and five, which makes it possible to maintain the profitability of the imports at that time.

It should be noted that at that time, the financing trade of metals such as copper, nickel and other metals, imports are loss-making, sometimes even larger in scale, preference for imports is profitable, the financing traders naturally do not put this piece of fat to the mouth, have turned to Russian imports.

In addition to the fact that the price of aluminum futures always maintains the status of rising liquidity, the importing traders have been registering the imported rubber stamps on the inventory list, and then either financing the inventory, or directly depositing it to the leverage institutions, so that they can hand over the profit.

In short, the situation at that time was that the spot currency was long overdue, futures stocks were increasing, and subsequent imports of Russian rubber were continuous.

Understanding this industry pattern makes the leverage of the futures extremely simple:

-

The price difference between the two is too small to expand the counter-swap, and the price difference is large enough to make the right one to deliver.

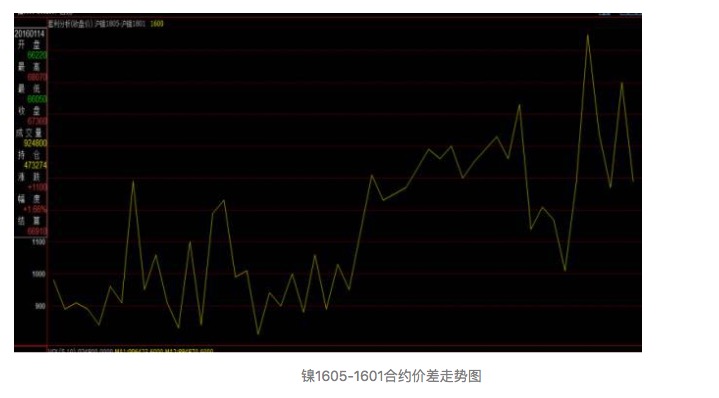

Chart of price movements of the contract for the rubber 1605-1601

For example, the price difference of the 1605-1601 contract in the diagram above, once up to 900 points, but such a small price difference, just can not cover the storage costs of 4 months, capital interest, taxes, etc. costs, who will buy and deliver on the 1601 contract?

After that, the price differential expanded to 1700 up and down. At this time, buying the 1601 and doing the 1605 set, the annualized earnings were 4% - 5%, basically covering various storage costs.

In the case of a mortgage loan, the amount of the loan is between 4% and 5%, and the interest rate is 1.8%, which is equivalent to a fixed interest rate.

If the cash basis strengthens before the May delivery, the order can be converted to cash and sold, which will allow for increased margins.

This is a very cost-effective transaction. More importantly, it is a completely risk-free transaction that is completely in line with the needs of the state enterprise!

The subsequent 5-9 contract, 9-1 contract, also did this in accordance with the painting, and the effect was not good. Especially in the first two deliveries, it was possible to deliver a part of the Kim Kawan-woo.

It should be noted that in the futures market, gold and silver are not branded, and the spot market gold and silver are often more expensive than gold and silver 1000-2000 yuan, which is equivalent to the price of gold and silver.

-

It's a crime to buy cash

I'm not happy with my futures trading, but I'm not happy with my spot trading.

One of the reasons is that there is too little liquidity and limited market capacity.

In terms of the factory, we mainly sell to the alloy companies, for these companies, aluminum is like a flavoring in the dish, the consumption is very small, a factory purchases five or six tons per week is good.

Do it with the traders, the problem circle is too small, the number of people traveling is almost the same, everyone is collecting the goods, everyone is going out. Remember that several times the marginal rate was done well, when you are lucky, the marginal rate earns three to four hundred dollars a week.

But if you want to take the cargo out in a hundred tons, it's difficult, it's not easy to find a few who dare to pick up the cargo, the price is two or three hundred yuan and cut it down; even a collection of twenty tons, they want to cut the price of one or two hundred, and they are just trying to bleed.

I know that in the copper market, if you buy three hundred and fifty tons of copper, the bargain price is one hundred and twenty dollars, which one is that bargain?

Secondly, the liquidity of futures is also poor.

Not to mention that the futures market is only 1, 5, 9 three contracts active, many times people can not do according to the futures price quotes, only to the stainless steel market to bid. Even when it comes to the futures market bid price, in the face of the unpredictable price movement, both sides want to find a stable transaction price is difficult.

It is not easy to determine the price, sometimes the price drops by hundreds of points in an instant, and the purchaser complains that the order was not settled, the loss can be shared...

Every time I encounter this situation, I feel like a thousand arrows piercing my heart.

What a wicked thing it is!

Translated from WeChat

- In a scientific and philosophical sense, how can we believe in a strategy that doesn't have logic?

- The multi-headed trend is backtracking strategy

- The root cause of the decentralization of the market to the extreme is found!

- A sustainable and efficient trading model

- Indices: Please ask about the market for OKEX contracts, is there an index?

- Multi-platform hedge stability of the leverage V2.1 (note)

- Bitcoin is open for ETC trading, inventors quantify, when will ETC support?

- Don't miss out on the advances and breakthroughs in technology!

- Can deep learning be used to quantify transactions?

- The depth of the OKEX futures Why only get 5?

- Newcomer's Question. GetRecords obtained K-line data and the chart of the retest and the actual data are inconsistent.

- Hot summer, tokens and inventors quantify join hands, 5 discount invites you to start quantified trading

- TableTemplate from Python

- Dongjian Tunnel (formerly known as the Turtle System)

- Maximizing trading: Theoretical boundaries and trading systems

- How to customize the set of currencies not shown on the exchange label when creating a digital currency trading robot

- The LogStatus function shown in the Python interface

- The LogStatus function shown in the Python interface

- Exchange fee summary

- Project templates that write their own TypeScript policies, need to be customizable