I'm not sure which is better, the low market value or the low price.

Author: The grass, Created: 2023-12-01 16:54:48, Updated: 2023-12-06 09:32:15

Previous postshttps://www.fmz.com/digest-topic/10283 , https://www.fmz.com/digest-topic/10287This article will continue to explore another important factor that affects the price of the coin: the market value of the coin. Readers familiar with quantitative trading should know that the A stock market has the most effective factor: the market value of the coin.

Data processing and collection

This section uses the same data as the previous articles and will not be repeated.

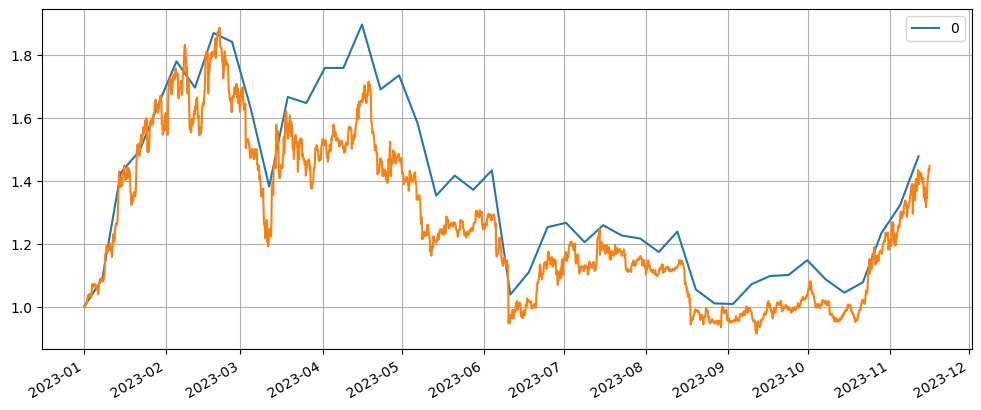

The performance of low-cost currencies

Low-value currencies usually refer to digital currencies with a lower price per unit. These currencies are more attractive to small investors because of their low price, most of whom only see a lot of zeroes in the price and don't care much about how much the market value is, and every minus one zero means 10 times the price, which is very attractive to some people, but at the same time may also come with higher price volatility and risk.

A prime example is the performance of the index, the same two bull markets at the beginning and end of the year. Each week, the 20 lowest-priced currencies are selected, and the results are very close to the index, indicating that low prices do not provide much additional income.

h = 1

lower_index = 1

lower_index_list = [1]

lower_symbols = df_close.iloc[0].dropna().sort_values()[:20].index

lower_prices = df_close.iloc[0][lower_symbols]

date_list = [df_close.index[0]]

for row in df_close.iterrows():

if h % 42 == 0:

date_list.append(row[0])

lower_index = lower_index * (row[1][lower_symbols] / lower_prices).mean()

lower_index_list.append(lower_index)

lower_symbols = row[1].dropna().sort_values()[:20].index

lower_prices = row[1][lower_symbols]

h += 1

pd.DataFrame(data=lower_index_list,index=date_list).plot(figsize=(12,5),grid=True);

total_index.plot(figsize=(12,5),grid=True); #总的指数

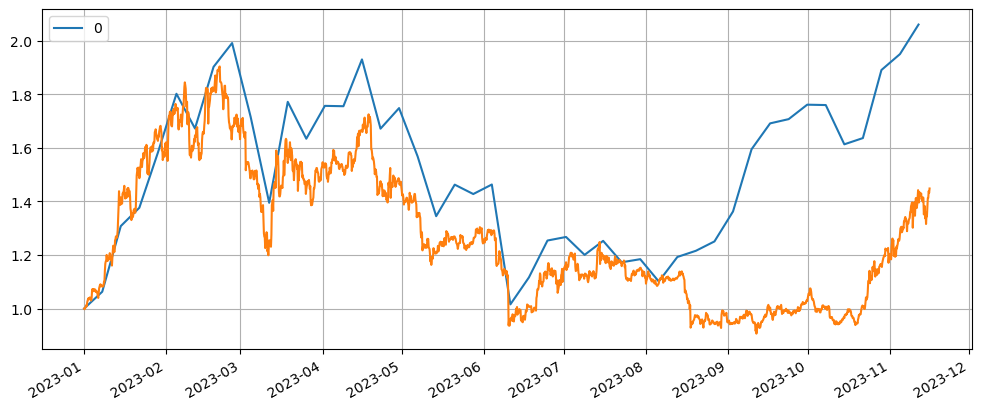

Performance of small-cap currencies

Since circulation is constantly changing, the total supply used to calculate the market value here, data from Coincapmarket, can be requested below. In total, all coins before the market value of 1000 were selected, resulting in a total of 205 coins overlapping with the permanent contract of the coin due to the naming method and unknown total supply.

import requests

def get_latest_crypto_listings(api_key):

url = "https://pro-api.coinmarketcap.com/v1/cryptocurrency/listings/latest?limit=1000"

headers = {

'Accepts': 'application/json',

'X-CMC_PRO_API_KEY': api_key,

}

response = requests.get(url, headers=headers)

if response.status_code == 200:

return response.json()

else:

return f"Error: {response.status_code}"

# 使用你的API密钥

api_key = "xxx"

coin_data = get_latest_crypto_listings(api_key)

supplys = {d['symbol']: d['total_supply'] for d in coin_data['data']}

include_symbols = [s for s in list(df_close.columns) if s in supplys and supplys[s] > 0 ]

The same weekly index of the 10 lowest-valued currencies is drawn and compared with the overall index. It can be seen that the small-valued currencies in the bull market at the beginning of the year were... better than the overall index. But in September and October, the crossover started to rise early, and the final rise was much higher than the overall index.

Small marketable currencies are generally considered to have higher growth potential. Because of their low market value, even relatively small inflows of capital can cause significant price changes. This potential high return attracts the attention of investors and speculators. When the market is bullish at the bottom, small marketable currencies tend to be able to start early due to low upside resistance, and may even predict the impending start of this bullish market.

df_close_include = df_close[include_symbols]

df_norm = df_close_include/df_close_include.fillna(method='bfill').iloc[0] #归一化

total_index = df_norm.mean(axis=1)

h = 1

N = 10

lower_index = 1

lower_index_list = [1]

lower_symbols = df_close_include.iloc[0].dropna().multiply(pd.Series(supplys)[include_symbols], fill_value=np.nan).sort_values()[:N].index

lower_prices = df_close_include.iloc[0][lower_symbols]

date_list = [df_close_include.index[0]]

for row in df_close_include.iterrows():

if h % 42 == 0:

date_list.append(row[0])

lower_index = lower_index * (row[1][lower_symbols] / lower_prices).mean()

lower_index_list.append(lower_index)

lower_symbols = row[1].dropna().multiply(pd.Series(supplys)[include_symbols], fill_value=np.nan).sort_values()[:N].index

lower_prices = row[1][lower_symbols]

h += 1

pd.DataFrame(data=lower_index_list,index=date_list).plot(figsize=(12,5),grid=True);

total_index.plot(figsize=(12,5),grid=True);

Summary

The analysis of the data shows that low-priced coins do not provide additional returns, and that they perform close to the market index. The performance of small market-valued coins significantly exceeds the increase in the total index. The following is a list of contract coins with a market value of less than 100 million U for reference, although they are now in the bull market.

‘HOOK’: 102007225, ‘SLP’: 99406669, ‘NMR’: 97617143, ‘RDNT’: 97501392, ‘MBL’: 93681270, ‘OMG’: 89129884, ‘NKN’: 85700948, ‘DENT’: 84558413, ‘ALPHA’: 81367392, ‘RAD’: 80849568, ‘HFT’: 79696303, ‘STMX’: 79472000, ‘ALICE’: 74615631, ‘OGN’: 74226686, ‘GTC’: 72933069, ‘MAV’: 72174400, ‘CTK’: 72066028, ‘UNFI’: 71975379, ‘OXT’: 71727646, ‘COTI’: 71402243, ‘HIGH’: 70450329, ‘DUSK’: 69178891, ‘ARKM’: 68822057, ‘HIFI’: 68805227, ‘CYBER’: 68264478, ‘BADGER’: 67746045, ‘AGLD’: 66877113, ‘LINA’: 62674752, ‘PEOPLE’: 62662701, ‘ARPA’: 62446098, ‘SPELL’: 61939184, ‘TRU’: 60944721, ‘REN’: 59955266, ‘BIGTIME’: 59209269, ‘XVG’: 57470552, ‘TLM’: 56963184, ‘BAKE’: 52022509, ‘COMBO’: 47247951, ‘DAR’: 47226484, ‘FLM’: 45542629, ‘ATA’: 44190701, ‘MDT’: 42774267, ‘BEL’: 42365397, ‘PERP’: 42095057, ‘REEF’: 41151983, ‘IDEX’: 39463580, ‘LEVER’: 38609947, ‘PHB’: 36811258, ‘LIT’: 35979327, ‘KEY’: 31964126, ‘BOND’: 29549985, ‘FRONT’: 29130102, ‘TOKEN’: 28047786, ‘AMB’: 24484151

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- WexApp, the FMZ Quant Cryptocurrency Demo Exchange, is Newly Launched

- Detailed Explanation of Perpetual Contract Grid Strategy Parameter Optimization

- Teach You to Use the FMZ Extended API to Batch Modify Parameters of the Bot

- Teach you how to use the FMZ Extension API to modify disk parameters in bulk

- Optimization of the parameters of the permanent contract grid strategy

- Instructions for Installing Interactive Brokers IB Gateway in Linux Bash

- How to install the penetration security IB GATEWAY under Linux bash

- Which is More Suitable for Bottom Fishing, Low Market Value or Low Price?

- Bayes - Decoding the Mystery of Probability, Exploring the Mathematical Wisdom Behind Decision Making

- Bayes - the mystery of decoding probability, exploring the mathematical wisdom behind decision making

- The Advantages of Using FMZ's Extended API for Efficient Group Control Management in Quantitative Trading

- Price Performance After the Currency is Listed on Perpetual Contracts

- Efficient cluster management using FMZ's extended API is an advantage in quantitative trading

- The price performance after the currency went live

- The Correlation Between the Rise and Fall of Currencies and Bitcoin

- Relation between currency declines and Bitcoin

- A Brief Discussion on the Balance of Order Books in Centralized Exchanges

- Measuring Risk and Return - An Introduction to Markowitz Theory

marvingundamCan the FMZ implement a small market cap strategy?