Get all the details about the new FMZ trading terminal (with the TRB suite source code)

Author: The grass, Created: 2024-01-01 18:01:05, Updated: 2024-01-28 22:56:05

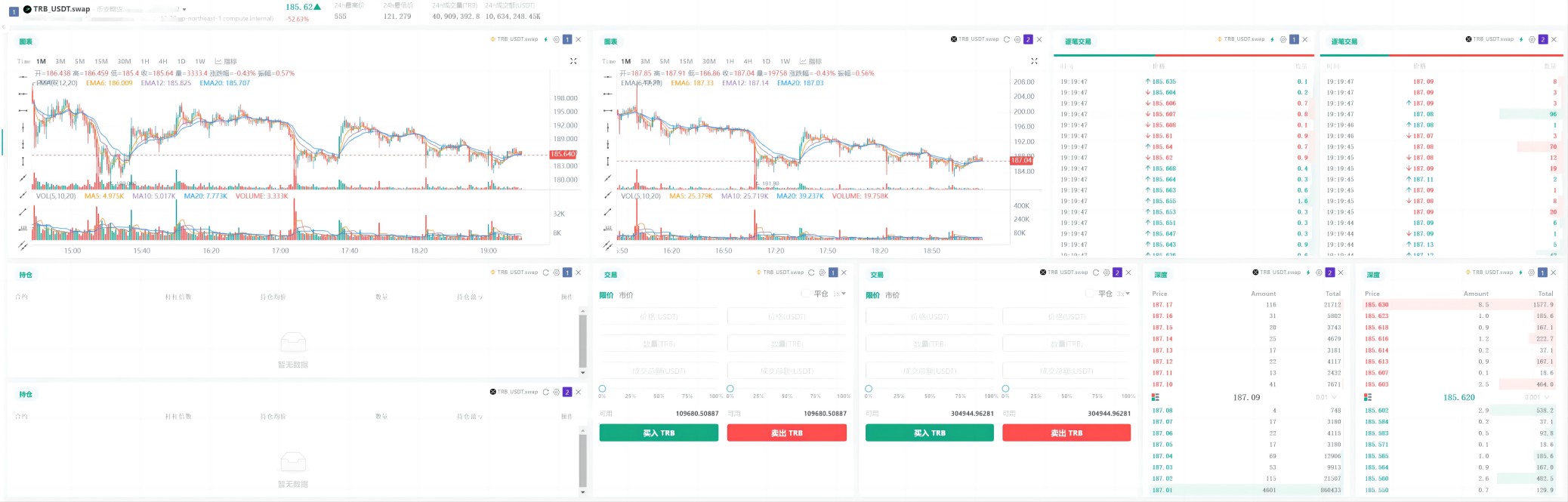

After weeks of intensive development, the new version of FMZ's trading terminal is finally online, supported by both the web and mobile APP, which is absolutely the most powerful and convenient, welcome feedback, the trading terminal is still evolving.

Improving the original intent of the transaction terminal

FMZ's quantified trading terminal was initially a simple trading interface, only for the temporary use of programmatic traders. However, over the years, the number of exchange accounts and sub-accounts in the user's hands has increased, which makes it very inconvenient to manage if the login exchange is very convenient, requires frequent switching of accounts, and cannot be operated on the same page. To solve this pain point, FMZ uses the flexibility of the framework to develop a new enhanced version of the trading terminal, which facilitates people's needs to help with transactions, manage multiple accounts, etc.

New version of the trading terminal

- Custodian-exchange-transaction pairing is grouped

This function is central to the core function of the transaction terminal. Click on a small square with a color and a number in the upper right corner of each module to access the page shown below. The numbers represent the group id, and the colors are intuitively identified as belonging to that group.

Users can set up pre-sorting for common exchanges and trading pairs (for the binding of IPs, be careful to bind the correct host). If a module's binding information is modified, the terminal page refreshes the information. Once the partition is completed, the data is saved and can be used directly the next time it is entered.

- The free layout of transactional information

This is another core feature. The puzzler icon in the upper right corner can be operated by clicking on it. The transaction generally requires information such as K-line data, order book, transaction order flow, account information, holding information, orders, etc. The transaction terminal displays the various information in the transaction interface as a separate module plugin that can be added on demand.

Imagine: with a big screen display, you can simultaneously look at dozens of currencies, open multiple sub-accounts and trade at any time, without switching browser tags or switching accounts, which is also very convenient for manual traders.

- Plugins for tools

Open the tool in the system plug-in, you can see the official FMZ prepared plug-in, can be understood as a small program. Such as cool order flow display diagram, as well as a button to query the mainstream exchange funds rate sum, etc., it is highly recommended that you try to use.Articles

It also supports debugging tools, allowing you to debug the API by looking at the market and accounts, and directly execute some simple commands, which is convenient. Additionally, plugins can be executed automatically at fixed intervals, which is a complement to functions such as monitoring, scheduling, etc.

- Other details

For market information, mainstream exchanges support websocket data push via browser; and the experience of logging in to the exchange is consistent, data is updated quickly and instantly. Some information can also be refreshed periodically, accessed through the API of the custodian and returned, such as account information. A well-defined layout can be imported and exported.

The TRB's advantage is real

In order to write this article, I prepared a set of leverage layouts as a demonstration, and I didn't expect to encounter the rare leverage market of TRB just set up. Since the TRB fee is charged once every 4 hours, 2% each time, and OKX8h charges once every 1.5% ((later changed to 2%), so if you do more in Bitcoin permanently, OKX permanently does nothing, you can theoretically get a single exchange fee return of 2 * 6 * 1.5 * 3 = 7.5% every day.

Due to the excellent liquidity of the OKX and Binance pairs, very high positions can be opened. However, the low TRB turnover is actually highly controlled, and the next thing we all know is the opening game of the year 2024: Binance pulls all the way from 250+ to a maximum of 555, OKX pulls up to 738, such a large spread and rise, even with 1x leverage, there is a risk of a breakout.

I woke up to find that the spread had been reduced to 30-20. The opportunity for such a leverage had to jump up and down on OKX and Binance if it was handled manually, and the spread changed momentarily, even with a delay of a few seconds, which was very unfavorable, and the exclusive leverage layout of my trading terminal was put to use. I looked at the TRB on OKX and Binance simultaneously on one page, and put the trading module in one place, so that it could be opened almost simultaneously.

Finally, the spread fell back to less than 10, and the spread was not so urgent, so I wrote a small strategy to flatten the spread, gradually flattening it at 5 pieces of the spread, and eventually raised about 5000U because of the boldness of opening a large position. This small strategy, which helps in the binan and okx permanent arbitrage, has been made public, and can be automatically checked to open a flat position at the set price, when the difference changes relatively quickly, faster and more stable than the manual operation.https://www.fmz.com/strategy/437254

Summary

The FMZ new version of the trading terminal is such a tool, not only convenient for programmatic traders, but also convenient for manual traders.

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)

- WexApp, the FMZ Quant Cryptocurrency Demo Exchange, is Newly Launched

- Detailed Explanation of Perpetual Contract Grid Strategy Parameter Optimization

- Teach You to Use the FMZ Extended API to Batch Modify Parameters of the Bot

- Teach you how to use the FMZ Extension API to modify disk parameters in bulk

My heart is still.I've been trying to get a real deal.