Thermometer strategies in the practice and application of inventor quantization platforms

Author: Goodness, Created: 2019-07-20 14:34:05, Updated: 2023-10-23 17:30:02

Why is it called a thermometer? We named the system after its adaptability to conversion and trading in both market, volatility and trend modes. The system was derived from our observation of the success of a particular system in a particular market area.

First, we create a function to help determine the market pattern. Based on the output of this function, the thermostat switches from following to short oscillation mode.

The trend tracking pattern uses a trend tracking mechanism similar to the one in the Brynne band. The short swing system is an open breakthrough that includes pattern recognition. The function compares the distance of the market's swing to the actual distance of the market's move:

Abs (closing price - closing price[29])/ (highest price) (30) - lowest price (lowest price, 30 days) * 100

The function generates a value between 0 and 100. The larger the value, the less crowded the current market is. If the function returns a value less than 20, the system enters short-swing mode.

Essentially, most markets are showing a swinging movement, with the system trying to grab the fluctuations and make a meager profit out of them. The thermometer tries to accomplish this feat by buying/selling small market impulses. If the fluctuations are large enough, the system switches modes.

Through in-depth analysis of short-term volatility, we find that sometimes it is better to buy than to sell, and vice versa. These times can be determined by simple visual patterns. If today's closing price is higher than yesterday's high, low, and closing price (also known as the key point of the day), then we think that tomorrow's market action is likely to be bearish. However, if today's closing price is lower than yesterday's average high, low, and closing price, then today's market may be bearish.

In the inventor quantification platform, the thermostat strategy is a very popular strategy, where the user adds some additional trading logic according to their needs, to make the strategy perform better.

-

The main image: The formula for the trajectory is: TOP^^MAC+N_TMPTMP;//Brin channel trajectory Bottom of the track: Bottom of the track

-

This is the second image: CMI formula: CMI:ABS ((C-REF ((C,N_CMI-1))/HHV ((H,N_CMI) -LLV ((L,N_CMI)) *100;//0-100 The larger the value, the stronger the trend, and the CMI <20 is the shocking pattern, and the CMI>20 is the trend.

-

Code ((My language):

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP; // 布林通道上轨

BOTTOM^^MAC-N_TMP*TMP; // 布林通道下轨

BBOLL:=C>MAC;

SBOLL:=C<MAC;

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100; //0-100 取值越大,说明趋势越强,CMI<20震荡模式,CMI>20为趋势

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100; //收盘价与N周期最低值做差,N周期最高值与N周期最低值做差,两差之间做比值。

K:=SMA(RSV,M1,1); //RSV的移动平均值

D:=SMA(K,M2,1); //K的移动平均值

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

// 震荡模式

BUYPK1:=CMI < 20 AND BKD; //震荡多单买平开

SELLPK1:=CMI < 20 AND SKD; //震荡空单卖平开

// 趋势模式下原有震荡持仓的处理

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D; //震荡多单止盈

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D; //震荡空单止盈

// 趋势模式

BUYPK2:=CMI >= 20 AND C > TOP; // 趋势多单买平开

SELLPK2:=CMI >= 20 AND C < BOTTOM; // 趋势空单卖平开

// 趋势模式下原有震荡持仓的处理

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//趋势多单止盈

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//趋势空单止盈

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//趋势多单止损

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//趋势空单止损

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

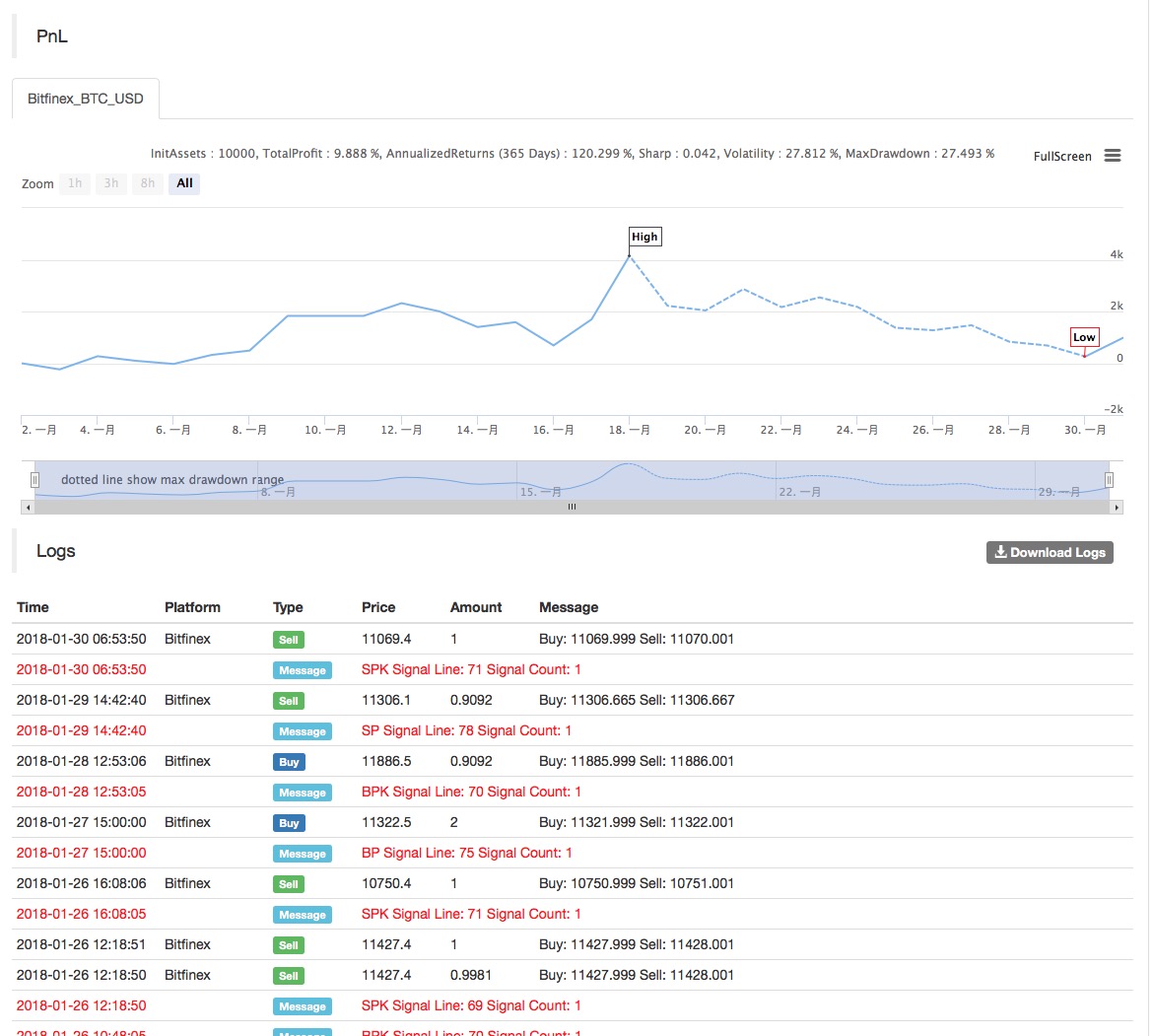

The results of the strategy were as follows:

For more information, please see:https://www.fmz.com/strategy/129086

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)