Quantitative trading strategies with a trade index weighting

Author: Goodness, Created: 2019-07-27 10:49:26, Updated: 2023-10-23 17:36:14

What is the trade weighted index?

A trade-weighted index is an investment index in which the volume of each investment affects the index proportionally to the volume of each of its indices. The volume of each investment added to the index determines the value of the index in addition to the total number of investments. Investments with higher volume of transactions will be given more weight than those with lower volume of transactions and therefore have a greater say in the performance of the index.

Details of the transaction weighted index

In a volume-weighted index, investments from $110 to $120 will have a greater impact on the index than investments from $10 to $20, even if these increases are not as large as the increases at low prices. Investments with higher volumes have a greater impact on the index or overall direction.

For example, the Dow Jones Industrial Average (DIJA) is one of the most popular transaction-weighted investments and is composed of 30 different investments or components. In this index, the higher-trading index has a higher volume of transactions than the lower-trading index, hence it is called the transaction-weighted designation.

Other weighted indices

In addition to the trade weighted index, other basic types of weighted indices include value weighted and unweighted indices. For value weighted indices, such as those in the MSCI Strategic Index series, the number of issued indices is a factor. To determine the weight of each indice in the trade weighted index, the trade weight of the investment indices is multiplied by the number of issued indices. For example, if investment A has 5,000,000 shares issued and traded at $15, its weight in the index is $750,000,000.

In an unweighted index, all investments have the same effect on the index, regardless of their number of investments or the volume of transactions. Any change in transactions in the index is based on the percentage of return for each component. For example, if investment A rises by 30%, investment B rises by 20%, investment C rises by 10%, index rises by 20%, or 30 + 20 + 10/3, i.e. the number of investment tokens in the index.

Another type of weighted index is the market value weighted index, in which the share of each index is based on the market value of the index that has been issued. Other types of weighted indices include income weighted, basic weighted and floating adjustment.

Use of inventor-quantified platforms in trade index weighting strategies

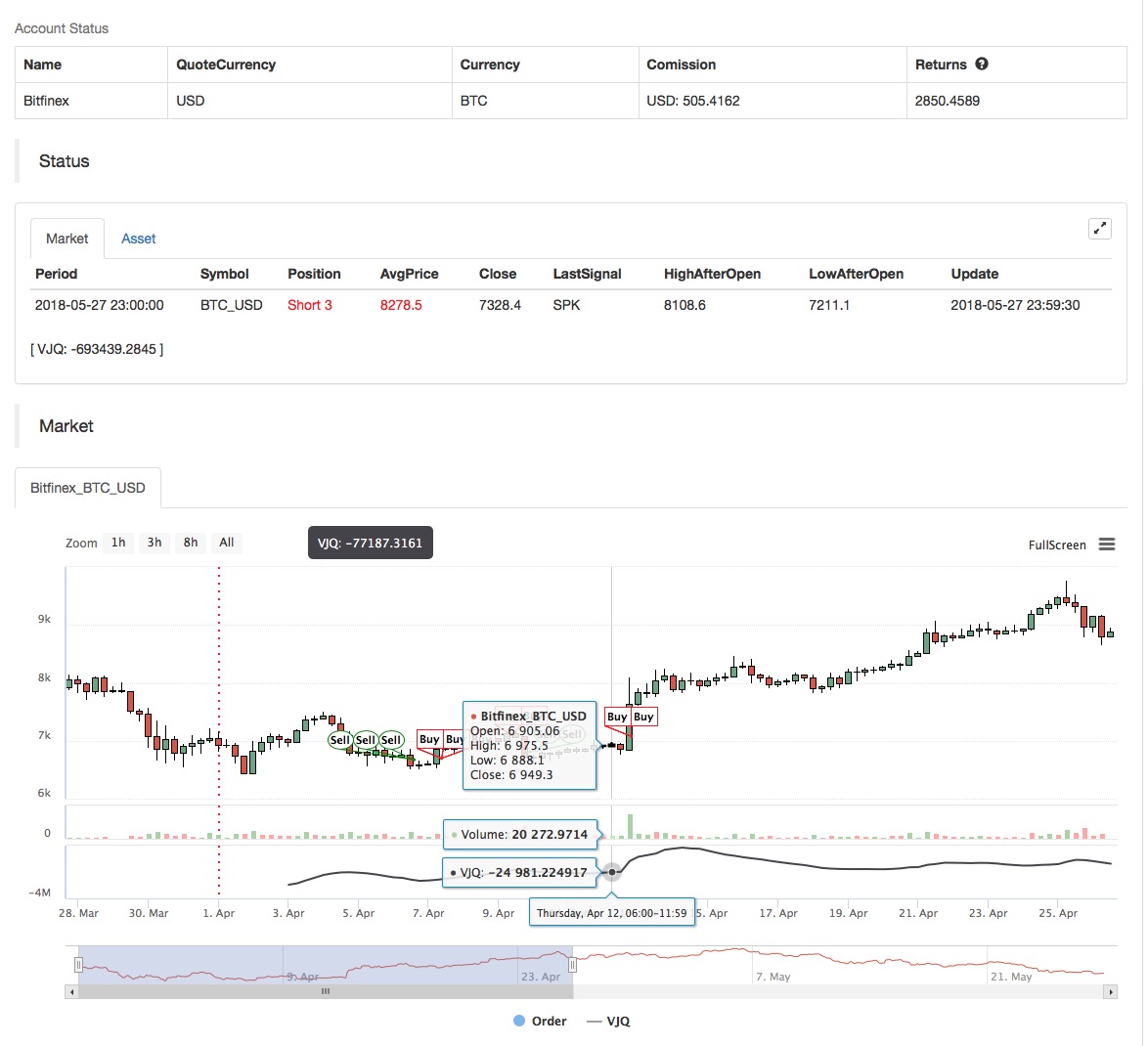

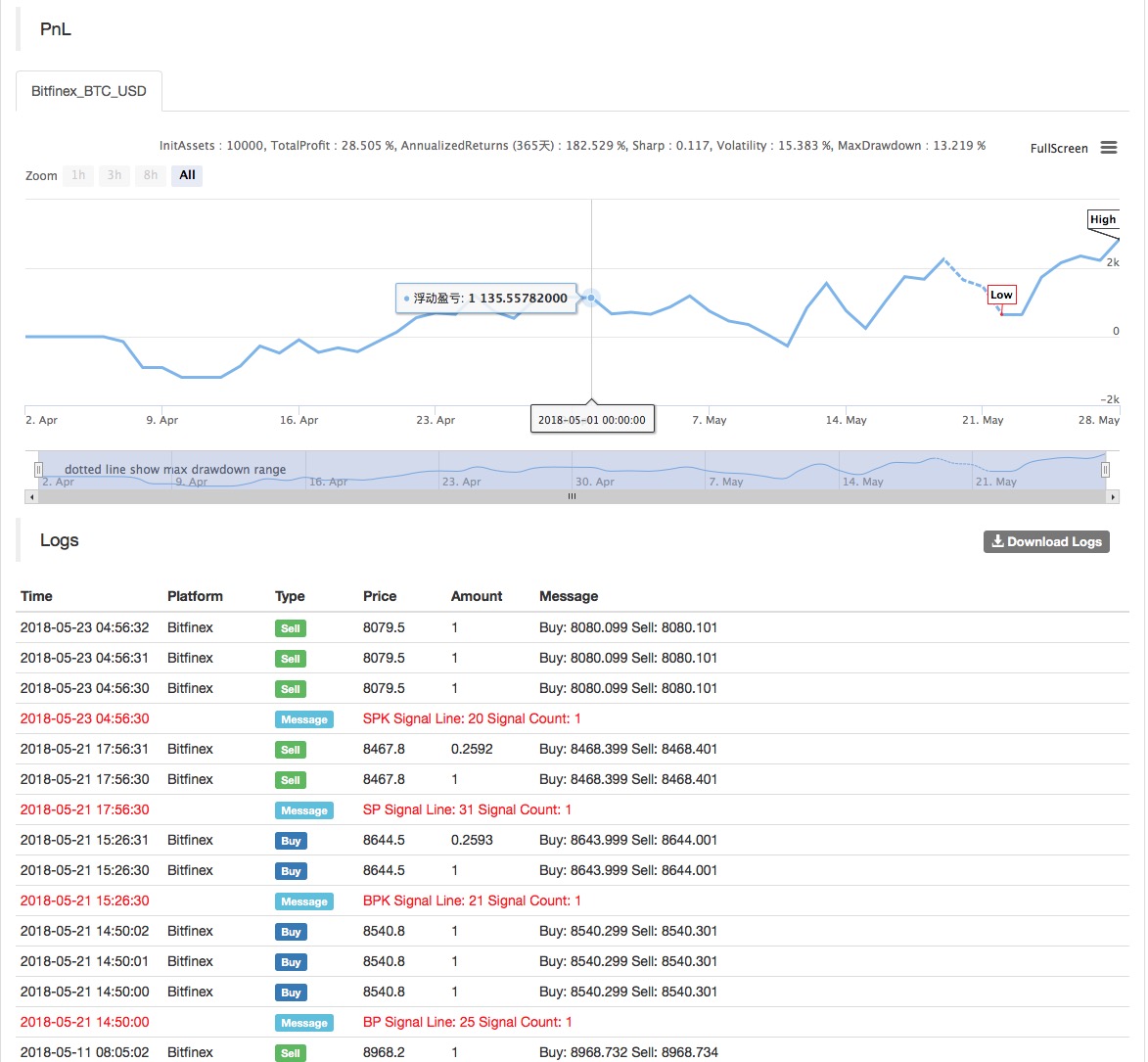

Based on the basic concepts above, we probably already understand the basic principles and mechanisms of this strategy. Next, we will deploy it to the inventor quantification platform to implement this strategy in the digital currency market. We still program using the simple and easy-to-use My language.

-

Data cycle: Multiple cycles

-

The index is backed by OKEX futures.

-

Contract type: this_week

MAN^^MA(C,N);

B_MA:=C>MAN;

S_MA:=C<MAN;

S_K1:=SUM((H-C)*V,N)/SUM((H-L)*V,N)>0.5;

B_K1:=SUM((C-L)*V,N)/SUM((H-L)*V,N)>0.5;

CO:=IF(C>O,C-O,0);

OC:=IF(C<O,O-C,0);

S_K2:=SUM(OC*V,N)/SUM(ABS(C-O)*V,N)>0.5;

B_K2:=SUM(CO*V,N)/SUM(ABS(C-O)*V,N)>0.5;

B_K1 AND B_K2 AND B_MA AND H>=HHV(H,N),BPK;

S_K1 AND S_K2 AND S_MA AND L<=LLV(L,N),SPK;

STOPLOSS:=M*MA(H-L,N);

C<BKPRICE-STOPLOSS,SP(BKVOL);

C>SKPRICE+STOPLOSS,BP(SKVOL);

S_MA AND BKHIGH>BKPRICE+STOPLOSS,SP(BKVOL);

B_MA AND SKLOW<SKPRICE-STOPLOSS,BP(SKVOL);

For the source code of the policy, please see:https://www.fmz.com/strategy/128125

- Quantifying Fundamental Analysis in the Cryptocurrency Market: Let Data Speak for Itself!

- Quantified research on the basics of coin circles - stop believing in all kinds of crazy professors, data is objective!

- The inventor of the Quantitative Data Exploration Module, an essential tool in the field of quantitative trading.

- Mastering Everything - Introduction to FMZ New Version of Trading Terminal (with TRB Arbitrage Source Code)

- Get all the details about the new FMZ trading terminal (with the TRB suite source code)

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (II)

- How to Exploit Brainless Selling Bots with a High-Frequency Strategy in 80 Lines of Code

- FMZ quantification: common demands on the cryptocurrency market design example analysis (II)

- How to exploit brainless robots for sale with high-frequency strategies of 80 lines of code

- FMZ Quant: An Analysis of Common Requirements Design Examples in the Cryptocurrency Market (I)

- FMZ quantification: common demands of the cryptocurrency market design instance analysis (1)