The super-falling super-high super-bull version

Author: ChaoZhang, Date: 2020-04-10 21:37:24Tags:

4.13 Updated content

Stop_loss set to 0.8 indicates when the funds reach below 80% of the initial funds, stop loss, empty all positions, stop strategy. As the strategy runs, Stop_loss can be set to greater than 1 (reset effect), for example from 1000 to 1500, Stop_loss set to 1.3, then back to 1300 yuan stop loss.

Max_diff and Min_diff limit the degree of deviation, which needs to be determined based on one's trade_value, total capital and risk tolerance.

For a simple example, if 20 coins are being traded, one of the coins will gradually increase in value to a deviation of 0.4 and will no longer be traded, while the other coins will remain unchanged, losing 7 times the trade_value.

var Stop_loss = 0.8

var Max_diff = 0.4 //当偏差diff大于0.4时,不继续加空仓, 自行设置

var Min_diff = -0.3 //当diff小于-0.3时,不继续加多仓, 自行设置

4.10 Updated content

Copy the policy code to the local policy, overwrite it directly to save, restart the machine to take effect, and keep the original position.

Binance futures do a lot of overshooting and do a lot of overshooting strategies important to optimize notebook code address:https://www.fmz.com/bbs-topic/5364

The main problem is the comparison between the latest price and the initial price at which the strategy was launched, which will deviate more and more over time, a coin may hold a lot of positions, the risk is high, and will eventually hold a lot of positions, increasing the risk and the drawback.

The latest index = mean (sum) /EMA (coin price/bitcoin price) is more flexible, can track the latest price changes, is more flexible, and is found to reduce the strategy holdings and also reduce the drawdown. More stable. Most importantly, the original strategy is very high risk, very likely to break out, but is now almost unaffected if several unusual trading pairs are added.

For seamless upgrades, two of the parameters are written in the first two lines of the policy code, which can be changed as needed.

Alpha = 0.04 Index Moving equilibrium Alpha parameter, the larger the set, the more sensitive the benchmark price tracking, the fewer trades, the lower the final holding, lowering the leverage, but lowering the returns, lowering the maximum drawdown, can increase the turnover, specifically need to weigh themselves according to the results of the retest. Update_base_price_time_interval = 30*60 The longer a benchmark price is updated, in units of seconds, and related to the Alpha parameter, the smaller the Alpha setting, the smaller the interval that can be set

If you read the article and want to trade all currencies, here is the listETH,BCH,XRP,EOS,LTC,TRX,ETC,LINK,XLM,ADA,XMR,DASH,ZEC,XTZ,BNB,ATOM,ONT,IOTA,BAT,VET,NEO,QTUM,IOST

This is important!

- I'm sure you'll want to read this study first.https://www.fmz.com/digest-topic/5294■ Understand a range of issues such as strategy principles, risks, how to screen trades, how to set parameters, opening positions and the ratio of total capital.

- The previous research report needs to be downloaded and uploaded to your own research environment. The actual modification runs again. If you have read this report, you have recently updated the latest week's data.

- The strategy cannot be directly retested, it needs to be retested in the research environment.。

- The policy code and the default parameters are for research purposes only, and real-time operation requires caution.The risks。

- Strategy can't be profitable every day, you can look back at history, 1-2 weeks of crossovers and pullbacks are normal and need to be handled correctly.

- The code is open, you can modify it yourself, if there are any problems, welcome feedback, it is best to join the Inventor Binance community (there is a method to join the research report) to get updates

- The strategy only supports binary futures, needs to run in full-stock mode, do not set up bidirectional holding!!, when creating the robot with default trading pairs and K-line cycles, the strategy does not use the K-line

- Tactics and other tactics, as well as manual operations, are in conflict and need to be taken into account.

- In the test phase, you can rent Ali Cloud Hong Kong servers on the platform with one click, and rent them yourself by the month is cheaper ((the minimum configuration is available, deploy the tutorial:https://www.fmz.com/bbs-topic/2848)

- Binance futures and spot currency need to be added separately, Binance futures are

Futures_Binance - This reboot strategy has no effect, but the newly built robot will re-record the historical data.

- The policy may be updated based on user feedback, with direct Ctrl+A to copy the code cover save (generally no parameters are updated), and restart the bot to use the latest code.

- The strategy does not start with trading, the first time it is started, it needs to record data, it needs to wait for the market to change before trading.

Join the WeChat group to get updates on the Battle of the Binance Gang

If you add the following micro-signal, you will automatically be dragged into the group:

The Principles of Strategy

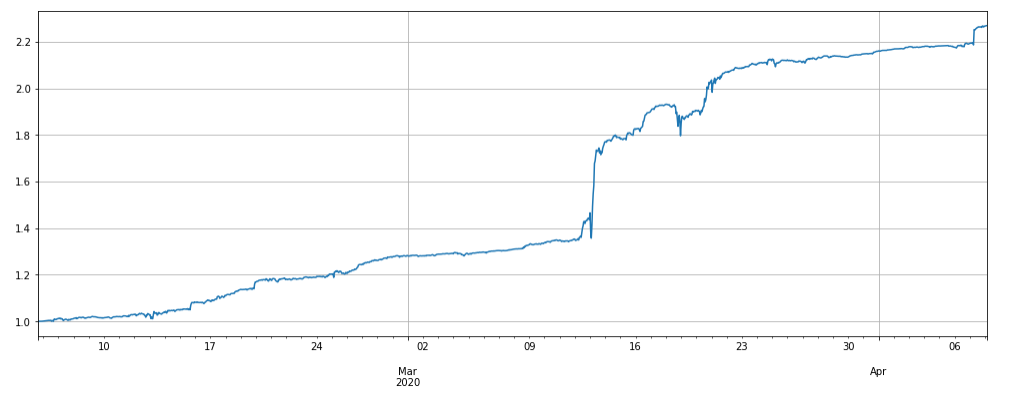

Coins that are above the Bitcoin-Coin Price Index and below the Index will be made to default, and the greater the deviation, the larger the position. This strategy does not hedge asymmetric positions with BTC, but can also include BTC in the trading pair. Performance in the last two months (leverage around 3 times, data updated to 4.8):

Strategic logic

1. update the market and account holdings, the first run will record the initial price (newly added currencies are calculated according to the time of joining)

2. update the index, the index is the coin-bitcoin price index = mean ((sum))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))

3. Judging by the deviation index, doing more work, judging the position according to the deviation size

4. The order and quantity of the order will be determined by the Ice Mountain commission, according to the transaction price of the counterparty (buy and sell at the same price).The following order is immediately canceled (so you'll see a lot of unsuccessful canceled cells 400: {

Leverage in the status bar represents collateral that has been accounted for and needs to be kept low to meet new openings

Policy parameters

- Trade_symbols: Currencies traded, needing to be screened by the research platform themselves, can also join BTC

- Trade_value: Trade_value: The price of Bitcoin (BTC) has a value of 1% per deviation of the index, and it is recommended to set it at 3-10% of the total capital depending on the total capital invested and risk preferences. The size of the leverage can be reviewed by reviewing the research environment, and the Trade_value can be less than the Adjust_value, such as half of the Adjust_value, which is equivalent to a holding value of 2% deviation of the index.

- Adjust_value: Adjust the deviation value of the contract. When the index deviates from * Trade_value - current holdings > Adjust_value, the difference between the target holdings and the current holdings exceeds this value, the trade will begin. Too much adjustment is slow, too little trading is frequent, can not be less than 10, otherwise the minimum transaction will not be reached, it is recommended to set it to more than 40% of the Trade_value.

- Ice_value: Ice_value, also can not be less than 10, in fact, select Adjust_value and Ice_value the smaller one, if more funds can be set relatively large some such adjustment is faster, it is recommended not less than 20% of the Adjust_value, so 5 times the iceberg can complete the transaction, of course, when the Trade_value is not large, Ice_value can be set relatively large, one or two times can be adjusted to the place.

- Interval: Cyclic sleep time, which can be set to be smaller, such as 1s, but cannot exceed the binary frequency limit.

- Reset: Reset historical data, resets the initial price of the policy reference to the current price, generally without setting

Strategic risks

Note that if a coin goes out of the independent market, for example, if it rises several times relative to the index, it will accumulate a large number of empty positions on the currency, and the same large decline will also make the strategy do a lot more.

/*

* @Description: 加分号版,首先这是一个山寨版,添加的功能已经在下面,没有动过逻辑上的内容

* @Version: 0.1.3

* @Author: RedSword

* @Email: redsword@gamil.com

* @Date: 2020-04-10 11:48:38

* @LastEditors: Home RedSword

* @LastEditTime: 2020-04-18 19:49:28

*

* 运行之前,一定要仔细的看草神的文章,地址 https://www.fmz.com/strategy/195226

*

* 添加功能

*

* 2020-04-18

* 1.添加草神的均衡对冲功能

* 2.修改了默认Alpha值和基准价格更新时间,Alpha改为了0.001,基准价格更新时间改为了1分钟

* 3.添加强平距离以及百分比

* 4.修改偏离平均和各币种的预估胜率放到了币指数信息里

* 5.屏蔽了Log收益的功能,省点空间

*

* 2020-04-16

* 1.修复了月亮走我也走的BUG

* 2.修复了添加新币种出错的BUG

*

* 2020-04-15

* 1.添加账户资产信息

* 2.添加币种指数信息

* 3.添加各币种的胜率

* 4.添加单币种投降功能

* 5.感谢fmzero开源的代码

*

* 2020-04-13

* 1.添加交易相关的统计,感谢豆子开源的代码

* 2.带预估字样的,都是不准的,只能做大概的参考

* 3.加入草神最新的止损逻辑

* 4.删除原有Max_amount的止损方法

* 5.添加显示绝对收益的开关

* 6.显示原版策略的提示,在盈利统计加了止损的提示

*

* 2020-04-12

* 1.添加了最大开仓量限制,0为不限制

* 2.持仓价值显示绝对值,不显负号

* 3.显示当前币种杠杆倍数和持仓强平价格

* 4.添加币种的开仓模式,全仓或者逐仓

* 5.修正重置不起作用的BUG

* 6.修改运行时间不准的BUG

* 7.修改保证金显示,和官方一至

* 8.保证金不显示比例,改为比率,和官方一至

*

* 2020-04-10

* 1.给强迫症加了分号

* 2.添加了盈利统计

* 3.添加了开仓方向,并对持仓方向和持仓盈亏做了颜色区分

*/

var Alpha = 0.001; //指数移动平均的Alpha参数,设置的越大,基准价格跟踪越敏感,最终持仓也会越低,降低了杠杆,但会降低收益,具体需要根据回测结果自己权衡

var Update_base_price_time_interval = 60; //多久更新一次基准价格, 单位秒,和Alpha参数相关,Alpha 设置的越小,这个间隔也可以设置的更小

//Stop_loss设置为0.8表示当资金达到低于初始资金的80%时,止损,清空所有仓位,停止策略。

//随着策略运行,Stop_loss可以设置大于1(重启生效),比如从1000赚到1500,Stop_loss设置为1.3,则回撤到1300元止损。不想止损可以把这个参数设置的很小。

//风险是大家都用这种止损会形成踩踏,加大亏损。

//初始资金在状态栏的init_balance字段,注意提现等操作会影响,别不小心止损了。

//如果还是怕黑天鹅事件,比如某个币归0等,可以手动提现出来。

var Stop_loss = 0.8;

var Max_diff = 0.4; //当偏差diff大于0.4时,不继续加空仓, 自行设置

var Min_diff = -0.3; //当diff小于-0.3时,不继续加多仓, 自行设置

var Version = '0.1.3';

var Show = false; //默认为false累计收益显示是账户余额,改为true累计收益显示为收益,如果之前是显示的账户余额,你使用LogProfitReset()来清空图表

var Funding = 0; //账户初始金额,为0的时候,自动获取,非0为自定义

var Success = '#5cb85c'; //成功颜色

var Danger = '#ff0000'; //危险颜色

var Warning = '#f0ad4e'; //警告颜色

var RunTime; //运行时间

var SelfFee = '0.04'; //https://www.binance.com/cn/fee/futureFee

var TotalLong;

var TotalShort;

var UpProfit = 0;

var accountAssets = []; //保存资产

var WinRateData = {}; //保存所有币种的胜率及开仓次数

if (IsVirtual()) {

throw '不能回测,回测参考 https://www.fmz.com/digest-topic/5294 ';

}

if (exchange.GetName() != 'Futures_Binance') {

throw '只支持币安期货交易所,和现货交易所不同,需要单独添加,名称为Futures_Binance';

}

var trade_symbols = Trade_symbols.split(',');

var symbols = trade_symbols;

var index = 1; //指数

if (trade_symbols.indexOf('BTC') < 0) {

symbols = trade_symbols.concat(['BTC']);

}

var update_profit_time = 0;

var update_base_price_time = Date.now();

var assets = {};

var init_prices = {};

var trade_info = {};

function init() {

InitRateData();

var exchange_info = HttpQuery('https://fapi.binance.com/fapi/v1/exchangeInfo');

if (!exchange_info) {

throw '无法连接币安网络,需要海外托管者';

}

exchange_info = JSON.parse(exchange_info);

for (var i = 0; i < exchange_info.symbols.length; i++) {

if (symbols.indexOf(exchange_info.symbols[i].baseAsset) > -1) {

assets[exchange_info.symbols[i].baseAsset] = {

amount: 0,

hold_price: 0,

value: 0,

bid_price: 0,

ask_price: 0,

btc_price: 0,

btc_change: 1,

btc_diff: 0,

realised_profit: 0,

margin: 0,

unrealised_profit: 0,

leverage: 20,

positionInitialMargin: 0,

liquidationPrice: 0

};

trade_info[exchange_info.symbols[i].baseAsset] = {

minQty: parseFloat(exchange_info.symbols[i].filters[1].minQty),

priceSize: parseInt((Math.log10(1.1 / parseFloat(exchange_info.symbols[i].filters[0].tickSize)))),

amountSize: parseInt((Math.log10(1.1 / parseFloat(exchange_info.symbols[i].filters[1].stepSize))))

};

}

}

}

assets.USDT = {

unrealised_profit: 0,

margin: 0,

margin_balance: 0,

total_balance: 0,

leverage: 0,

update_time: 0,

margin_ratio: 0,

init_balance: 0,

stop_balance: 0,

short_value: 0,

long_value: 0,

profit: 0

};

function updateAccount() { //更新账户和持仓

var account = exchange.GetAccount();

var pos = exchange.GetPosition();

if (account == null || pos == null) {

Log('update account time out');

return;

}

accountAssets = account.Info.assets;

assets.USDT.update_time = Date.now();

for (var i = 0; i < trade_symbols.length; i++) {

assets[trade_symbols[i]].margin = 0;

assets[trade_symbols[i]].unrealised_profit = 0;

assets[trade_symbols[i]].hold_price = 0;

assets[trade_symbols[i]].amount = 0;

}

for (var j = 0; j < account.Info.positions.length; j++) {

if (account.Info.positions[j].positionSide == 'BOTH') {

var pair = account.Info.positions[j].symbol;

var coin = pair.slice(0, pair.length - 4);

if (trade_symbols.indexOf(coin) < 0) {

continue;

}

assets[coin].margin = parseFloat(account.Info.positions[j].initialMargin) + parseFloat(account.Info.positions[j].maintMargin);

assets[coin].unrealised_profit = parseFloat(account.Info.positions[j].unrealizedProfit);

assets[coin].positionInitialMargin = parseFloat(account.Info.positions[j].positionInitialMargin);

assets[coin].leverage = account.Info.positions[j].leverage;

}

}

assets.USDT.margin = _N(parseFloat(account.Info.totalInitialMargin) + parseFloat(account.Info.totalMaintMargin), 2);

assets.USDT.margin_balance = _N(parseFloat(account.Info.totalMarginBalance), 2);

assets.USDT.total_balance = _N(parseFloat(account.Info.totalWalletBalance), 2);

if (assets.USDT.init_balance == 0) {

if (_G('init_balance')) {

assets.USDT.init_balance = _N(_G('init_balance'), 2);

} else {

assets.USDT.init_balance = assets.USDT.total_balance;

_G('init_balance', assets.USDT.init_balance);

}

}

assets.USDT.profit = _N(assets.USDT.margin_balance - assets.USDT.init_balance, 2);

assets.USDT.stop_balance = _N(Stop_loss * assets.USDT.init_balance, 2);

assets.USDT.total_balance = _N(parseFloat(account.Info.totalWalletBalance), 2);

assets.USDT.unrealised_profit = _N(parseFloat(account.Info.totalUnrealizedProfit), 2);

assets.USDT.leverage = _N(assets.USDT.margin / assets.USDT.total_balance, 2);

assets.USDT.margin_ratio = (account.Info.totalMaintMargin / account.Info.totalMarginBalance * 100);

pos = JSON.parse(exchange.GetRawJSON());

if (pos.length > 0) {

for (var k = 0; k < pos.length; k++) {

var pair = pos[k].symbol;

var coin = pair.slice(0, pair.length - 4);

if (trade_symbols.indexOf(coin) < 0) {

continue;

}

if (pos[k].positionSide != 'BOTH') {

continue;

}

assets[coin].hold_price = parseFloat(pos[k].entryPrice);

assets[coin].amount = parseFloat(pos[k].positionAmt);

assets[coin].unrealised_profit = parseFloat(pos[k].unRealizedProfit);

assets[coin].liquidationPrice = parseFloat(pos[k].liquidationPrice);

assets[coin].marginType = pos[k].marginType;

}

}

}

function updateIndex() { //更新指数

if (!_G('init_prices') || Reset) {

Reset = false;

for (var i = 0; i < trade_symbols.length; i++) {

init_prices[trade_symbols[i]] = (assets[trade_symbols[i]].ask_price + assets[trade_symbols[i]].bid_price) / (assets.BTC.ask_price + assets.BTC.bid_price);

}

Log('保存启动时的价格');

_G('init_prices', init_prices);

_G("StartTime", null); //重置开始时间

_G("initialAccount_" + exchange.GetLabel(), null); //重置开始资金

_G("tradeNumber", null); //重置交易次数

_G("tradeVolume", null); //重置交易量

_G("buyNumber", null); //重置做多次数

_G("sellNumber", null); //重置做空次数

_G("totalProfit", null); //重置打印次数

_G("profitNumber", null); //重置盈利次数

} else {

init_prices = _G('init_prices');

if (Date.now() - update_base_price_time > Update_base_price_time_interval * 1000) {

update_base_price_time = Date.now();

for (var i = 0; i < trade_symbols.length; i++) { //更新初始价格

init_prices[trade_symbols[i]] = init_prices[trade_symbols[i]] * (1 - Alpha) + Alpha * (assets[trade_symbols[i]].ask_price + assets[trade_symbols[i]].bid_price) / (assets.BTC.ask_price + assets.BTC.bid_price);

}

_G('init_prices', init_prices);

}

var temp = 0;

for (var i = 0; i < trade_symbols.length; i++) {

assets[trade_symbols[i]].btc_price = (assets[trade_symbols[i]].ask_price + assets[trade_symbols[i]].bid_price) / (assets.BTC.ask_price + assets.BTC.bid_price);

if (!(trade_symbols[i] in init_prices)) {

Log('添加新的币种', trade_symbols[i]);

init_prices[trade_symbols[i]] = assets[trade_symbols[i]].btc_price;

_G('init_prices', init_prices);

}

assets[trade_symbols[i]].btc_change = _N(assets[trade_symbols[i]].btc_price / init_prices[trade_symbols[i]], 4);

temp += assets[trade_symbols[i]].btc_change;

}

index = _N(temp / trade_symbols.length, 4);

}

}

function updateTick() { //更新行情

var ticker = HttpQuery('https://fapi.binance.com/fapi/v1/ticker/bookTicker');

try {

ticker = JSON.parse(ticker);

} catch (e) {

Log('get ticker time out');

return;

}

assets.USDT.short_value = 0;

assets.USDT.long_value = 0;

for (var i = 0; i < ticker.length; i++) {

var pair = ticker[i].symbol;

var coin = pair.slice(0, pair.length - 4);

if (symbols.indexOf(coin) < 0) {

continue;

}

assets[coin].ask_price = parseFloat(ticker[i].askPrice);

assets[coin].bid_price = parseFloat(ticker[i].bidPrice);

assets[coin].ask_value = _N(assets[coin].amount * assets[coin].ask_price, 2);

assets[coin].bid_value = _N(assets[coin].amount * assets[coin].bid_price, 2);

if (trade_symbols.indexOf(coin) < 0) {

continue;

}

if (assets[coin].amount < 0) {

assets.USDT.short_value += Math.abs((assets[coin].ask_value + assets[coin].bid_value) / 2);

} else {

assets.USDT.long_value += Math.abs((assets[coin].ask_value + assets[coin].bid_value) / 2);

}

assets.USDT.short_value = _N(assets.USDT.short_value, 0);

assets.USDT.long_value = _N(assets.USDT.long_value, 0);

}

updateIndex();

for (var i = 0; i < trade_symbols.length; i++) {

assets[trade_symbols[i]].btc_diff = _N(assets[trade_symbols[i]].btc_change - index, 4);

}

}

function trade(symbol, dirction, value) { //交易

if (Date.now() - assets.USDT.update_time > 10 * 1000) {

Log('更新账户延时,不交易');

return;

}

var price = dirction == 'sell' ? assets[symbol].bid_price : assets[symbol].ask_price;

var amount = _N(Math.min(value, Ice_value) / price, trade_info[symbol].amountSize);

if (amount < trade_info[symbol].minQty) {

Log(symbol, '合约价值偏离或冰山委托订单的大小设置过小,达不到最小成交, 至少需要: ', _N(trade_info[symbol].minQty * price, 0) + 1);

return;

}

exchange.IO("currency", symbol + '_' + 'USDT');

exchange.SetContractType('swap');

exchange.SetDirection(dirction);

var f = dirction == 'buy' ? 'Buy' : 'Sell';

var id = exchange[f](price, amount, symbol);

if (id) {

exchange.CancelOrder(id); //订单会立即撤销

}

tradingCounter("tradeVolume", price * amount); //保存交易量

tradingCounter("tradeNumber", 1); //保存交易次数

WinRateData[symbol].tradeNumber += 1;

if (dirction == 'buy') {

tradingCounter("buyNumber", 1);

WinRateData[symbol].buyNumber += 1;

} else {

tradingCounter("sellNumber", 1);

WinRateData[symbol].sellNumber += 1;

}

_G("WinRateData", WinRateData); //保存各币种的交易数据

return id;

}

function InitRateData() {

if (Reset) {

_G("WinRateData", null);

}

if (_G("WinRateData")) {

WinRateData = _G("WinRateData");

}

for (var i = 0; i < symbols.length; i++) {

if (typeof WinRateData[symbols[i]] == 'undefined') {

WinRateData[symbols[i]] = {

totalProfit: 0, //统计次数

profitNumber: 0, //盈利次数

tradeNumber: 0, //交易次数

buyNumber: 0, //做多次数

sellNumber: 0 //做空次数

};

}

}

_G("WinRateData", WinRateData);

}

function RunCommand() {

var str_cmd = GetCommand();

if (str_cmd) {

var arrCmd = str_cmd.split(':');

var symbol = arrCmd[1];

var amount = parseFloat(arrCmd[2]);

if (amount == 0) {

Log('亲,你还记得大明湖畔的乔碧萝吗?' + Danger);

return;

}

var f = amount < 0 ? 'Buy' : 'Sell';

var dirction = amount < 0 ? 'buy' : 'sell';

exchange.IO("currency", symbol + '_' + 'USDT');

exchange.SetContractType('swap');

exchange.SetDirection(dirction);

exchange[f](-1, Math.abs(amount), symbol);

}

}

function FirstAccount() {

var key = "initialAccount_" + exchange.GetLabel();

var initialAccount = _G(key);

if (initialAccount == null) {

initialAccount = exchange.GetAccount();

_G(key, initialAccount);

}

return initialAccount;

}

function StartTime() {

var StartTime = _G("StartTime");

if (StartTime == null) {

StartTime = _D();

_G("StartTime", StartTime);

}

return StartTime;

}

function RuningTime() {

var ret = {};

var dateBegin = new Date(StartTime());

var dateEnd = new Date(_D());

var dateDiff = dateEnd.getTime() - dateBegin.getTime();

var dayDiff = Math.floor(dateDiff / (24 * 3600 * 1000));

var leave1 = dateDiff % (24 * 3600 * 1000);

var hours = Math.floor(leave1 / (3600 * 1000));

var leave2 = leave1 % (3600 * 1000);

var minutes = Math.floor(leave2 / (60 * 1000));

ret.dayDiff = dayDiff;

ret.hours = hours;

ret.minutes = minutes;

ret.str = "运行时间: " + dayDiff + " 天 " + hours + " 小时 " + minutes + " 分钟";

return ret;

}

function AppendedStatus() {

var accountTable = {

type: "table",

title: "盈利统计",

cols: ["运行天数", "初始资金", "现有资金", "保证金余额", "已用保证金", "保证金比率", "止损", "总收益", "预计年化", "预计月化", "平均日化"],

rows: []

};

var feeTable = {

type: 'table',

title: '交易统计',

cols: ["策略指数", '交易次数', '做多次数', '做空次数', '预估胜率', '预估成交额', '预估手续费', "未实现盈利", '持仓总值', '做多总值', '做空总值'],

rows: []

};

var runday = RunTime.dayDiff;

if (runday == 0) {

runday = 1;

}

if (Funding == 0) {

Funding = parseFloat(FirstAccount().Info.totalWalletBalance);

}

var profitColors = Danger;

var totalProfit = assets.USDT.total_balance - Funding; //总盈利

if (totalProfit > 0) {

profitColors = Success;

}

var dayProfit = totalProfit / runday; //天盈利

var dayRate = dayProfit / Funding * 100;

accountTable.rows.push([

runday,

'$' + _N(Funding, 2),

'$' + assets.USDT.total_balance,

'$' + assets.USDT.margin_balance,

'$' + assets.USDT.margin,

_N(assets.USDT.margin_ratio, 2) + '%',

_N(assets.USDT.stop_balance, 2) + Danger,

_N(totalProfit / Funding * 100, 2) + "% = $" + _N(totalProfit, 2) + (profitColors),

_N(dayRate * 365, 2) + "% = $" + _N(dayProfit * 365, 2) + (profitColors),

_N(dayRate * 30, 2) + "% = $" + _N(dayProfit * 30, 2) + (profitColors),

_N(dayRate, 2) + "% = $" + _N(dayProfit, 2) + (profitColors)

]);

var vloume = _G("tradeVolume") ? _G("tradeVolume") : 0;

feeTable.rows.push([

index, //指数

_G("tradeNumber") ? _G("tradeNumber") : 0, //交易次数

_G("buyNumber") ? _G("buyNumber") : 0, //做多次数

_G("sellNumber") ? _G("sellNumber") : 0, //做空次数

_N(_G("profitNumber") / _G("totalProfit") * 100, 2) + '%', //胜率

'$' + _N(vloume, 2) + ' ≈ ฿' + _N(vloume / ((assets.BTC.bid_price + assets.BTC.ask_price) / 2), 6), //成交金额

'$' + _N(vloume * (SelfFee / 100), 4), //手续费

'$' + _N(assets.USDT.unrealised_profit, 2) + (assets.USDT.unrealised_profit >= 0 ? Success : Danger),

'$' + _N(TotalLong + Math.abs(TotalShort), 2), //持仓总价值

'$' + _N(TotalLong, 2) + Success, //做多总值

'$' + _N(Math.abs(TotalShort), 2) + Danger, //做空总值

]);

var assetTable = {

type: 'table',

title: '账户资产信息',

cols: ['编号', '资产名', '起始保证金', '维持保证金', '保证金余额', '最大可提款金额', '挂单起始保证金', '持仓起始保证金', '持仓未实现盈亏', '账户余额'],

rows: []

};

for (var i = 0; i < accountAssets.length; i++) {

var acc = accountAssets[i];

assetTable.rows.push([

i + 1,

acc.asset, acc.initialMargin, acc.maintMargin, acc.marginBalance,

acc.maxWithdrawAmount, acc.openOrderInitialMargin, acc.positionInitialMargin,

acc.unrealizedProfit, acc.walletBalance

]);

}

var indexTable = {

type: 'table',

title: '币指数信息',

cols: ['编号', '币种信息', '当前价格', 'BTC计价', 'BTC计价变化(%)', '偏离平均', '交易次数', '做空次数', '做多次数', '预估胜率'],

rows: []

};

for (var i = 0; i < symbols.length; i++) {

var price = _N((assets[symbols[i]].ask_price + assets[symbols[i]].bid_price) / 2, trade_info[symbols[i]].priceSize);

if (symbols.indexOf(symbols[i]) < 0) {

indexTable.rows.push([i + 1, symbols[i], price, assets[symbols[i]].btc_price, _N((1 - assets[symbols[i]].btc_change) * 100), assets[symbols[i]].btc_diff], 0, 0, 0, '0%');

} else {

var rateData = _G("WinRateData");

var winRate = _N(rateData[symbols[i]].profitNumber / rateData[symbols[i]].totalProfit * 100, 2);

indexTable.rows.push([

(i + 1),

symbols[i] + Warning,

price,

_N(assets[symbols[i]].btc_price, 6),

_N((1 - assets[symbols[i]].btc_change) * 100),

assets[symbols[i]].btc_diff + (assets[symbols[i]].btc_diff >= 0 ? Success : Danger),

rateData[symbols[i]].tradeNumber,

rateData[symbols[i]].sellNumber,

rateData[symbols[i]].buyNumber,

(rateData[symbols[i]].profitNumber > 0 && rateData[symbols[i]].totalProfit > 0 ? winRate : '0') + '%' + (winRate >= 50 ? Success : Danger), //胜率

]);

}

}

var retData = {};

retData.upTable = RunTime.str + '\n' + "最后更新: " + _D() + '\n' + 'Version:' + Version + '\n' + '`' + JSON.stringify([accountTable, assetTable]) + '`\n' + '`' + JSON.stringify(feeTable) + '`\n';

retData.indexTable = indexTable;

return retData;

}

function WinRate() {

for (var i = 0; i < symbols.length; i++) {

var unrealised = assets[symbols[i]].unrealised_profit;

WinRateData[symbols[i]].totalProfit += 1;

if (unrealised != 0) {

if (unrealised > 0) {

WinRateData[symbols[i]].profitNumber += 1;

}

}

}

_G("WinRateData", WinRateData);

}

function tradingCounter(key, newValue) {

var value = _G(key);

if (!value) {

_G(key, newValue);

} else {

_G(key, value + newValue);

}

}

function updateStatus() { //状态栏信息

var table = {

type: 'table',

title: '交易对信息',

cols: ['编号', '[模式][倍数]', '币种信息', '开仓方向', '开仓数量', '持仓价格', '当前价格', '强平价格', '强平差价', '持仓价值', '保证金', '未实现盈亏', '投降'],

rows: []

};

TotalLong = 0;

TotalShort = 0;

for (var i = 0; i < symbols.length; i++) {

var direction = '空仓';

var margin = direction;

if (assets[symbols[i]].amount != 0) {

direction = assets[symbols[i]].amount > 0 ? '做多' + Success : '做空' + Danger;

margin = (assets[symbols[i]].marginType == 'cross' ? '全仓' : '逐仓');

}

var price = _N((assets[symbols[i]].ask_price + assets[symbols[i]].bid_price) / 2, trade_info[symbols[i]].priceSize);

var value = _N((assets[symbols[i]].ask_value + assets[symbols[i]].bid_value) / 2, 2);

if (value != 0) {

if (value > 0) {

TotalLong += value;

} else {

TotalShort += value;

}

}

// var rateData = _G("WinRateData");

var infoList = [

i + 1,

"[" + margin + "] [" + assets[symbols[i]].leverage + 'x] ',

symbols[i],

direction,

Math.abs(assets[symbols[i]].amount),

assets[symbols[i]].hold_price,

price,

assets[symbols[i]].liquidationPrice, //强平价格

assets[symbols[i]].liquidationPrice == 0 ? '0' : '$' + _N(assets[symbols[i]].liquidationPrice - price, 5) + ' ≈ ' + _N(assets[symbols[i]].liquidationPrice / price * 100, 2) + '%' + Warning, //强平价格

Math.abs(value),

_N(assets[symbols[i]].positionInitialMargin, 2),

// assets[symbols[i]].btc_diff,

_N(assets[symbols[i]].unrealised_profit, 3) + (assets[symbols[i]].unrealised_profit >= 0 ? Success : Danger),

// (rateData[symbols[i]].profitNumber > 0 && rateData[symbols[i]].totalProfit > 0 ? _N(rateData[symbols[i]].profitNumber / rateData[symbols[i]].totalProfit * 100, 2) : '0') + '%', //胜率

{

'type': 'button',

'cmd': '说好的没有撤退可言呢???:' + symbols[i] + ':' + assets[symbols[i]].amount + ':',

'name': symbols[i] + ' 投降'

}

];

table.rows.push(infoList);

}

delete assets.USDT.update_time; //时间戳没什么用,不要了

var logString = JSON.stringify(assets.USDT) + '\n';

var StatusData = AppendedStatus();

LogStatus(StatusData.upTable + '`' + JSON.stringify([table, StatusData.indexTable]) + '`\n' + logString);

if (Date.now() - update_profit_time > Log_profit_interval * 1000) {

var balance = assets.USDT.margin_balance;

if (Show) {

balance = assets.USDT.margin_balance - Funding;

}

LogProfit(_N(balance, 3), '&');

update_profit_time = Date.now();

if (UpProfit != 0 && (_N(balance, 0) != UpProfit)) { //第一次不计算,并且小数点面的不进行胜率计算

tradingCounter("totalProfit", 1); //统计打印次数, 胜率=盈利次数/打印次数*100

if (_N(balance, 0) > UpProfit) {

tradingCounter("profitNumber", 1); //盈利次数

}

WinRate();

}

UpProfit = _N(balance, 0);

}

}

function stopLoss() { //止损函数

while (true) {

if (assets.USDT.margin_balance < Stop_loss * assets.USDT.init_balance && assets.USDT.init_balance > 0) {

Log('触发止损,当前资金:', assets.USDT.margin_balance, '初始资金:', assets.USDT.init_balance);

Ice_value = 200; //止损的快一些,可修改

updateAccount();

updateTick();

var trading = false; //是否正在交易

for (var i = 0; i < trade_symbols.length; i++) {

var symbol = trade_symbols[i];

if (assets[symbol].ask_price == 0) {

continue;

}

if (assets[symbol].bid_value >= trade_info[symbol].minQty * assets[symbol].bid_price) {

trade(symbol, 'sell', assets[symbol].bid_value);

trading = true;

}

if (assets[symbol].ask_value <= -trade_info[symbol].minQty * assets[symbol].ask_price) {

trade(symbol, 'buy', -assets[symbol].ask_value);

trading = true;

}

}

Sleep(1000);

if (!trading) {

throw '止损结束,如果需要重新运行策略,需要调低止损';

}

} else { //不用止损

return;

}

}

}

function onTick() { //策略逻辑部分

for (var i = 0; i < trade_symbols.length; i++) {

var symbol = trade_symbols[i];

if (assets[symbol].ask_price == 0) {

continue;

}

var aim_value = -Trade_value * _N(assets[symbol].btc_diff / 0.01, 3);

if (aim_value - assets[symbol].ask_value >= Adjust_value && assets[symbol].btc_diff > Min_diff && assets.USDT.long_value - assets.USDT.short_value <= 1.1 * Trade_value) {

trade(symbol, 'buy', aim_value - assets[symbol].ask_value);

}

if (aim_value - assets[symbol].bid_value <= -Adjust_value && assets[symbol].btc_diff < Max_diff && assets.USDT.short_value - assets.USDT.long_value <= 1.1 * Trade_value) {

trade(symbol, 'sell', -(aim_value - assets[symbol].bid_value));

}

}

}

function main() {

SetErrorFilter("502:|503:|tcp|character|unexpected|network|timeout|WSARecv|Connect|GetAddr|no such|reset|http|received|EOF|reused|Unknown");

while (true) {

RunTime = RuningTime();

RunCommand(); //捕获交互命令

updateAccount(); //更新账户和持仓

updateTick(); //行情

stopLoss(); //止损

onTick(); //策略逻辑部分

updateStatus(); //输出状态栏信息

Sleep(Interval * 1000);

}

}

- Buy and sell on a rotating basis

- Binance Sustainable Multicurrency Hedging Strategy (Doing a lot of overshooting to do a lot of overshooting) (Python version)

- The SuperTrend Strategy is taught.

- Three lines of code implementing Argos machine learning to quickly interpret industry news

- Locally stored

- The coin-throwing strategy (●'

'●) - SuperTrend V1

- This is the first time that the U.S. government has taken a similar approach.

- RecordsCollector (teaching)

- A complicated example of a hybrid graph

- Binance Strategy Two: Removing highs and lows

- Ordered the contract

- Binance Sustainable Multicurrency Hedging Strategy Original version (Doing more overshooting do more overshooting) 13th April latest stop loss module

- Binance Sustainable Multicurrency Hedging Strategy (Do or Do Multi-Currency Index) 10 April Improved Bug, needs to be updated

- MACD low buy high sell automatically slide stop loss

- The first time a new currency was posted on the exchange

- Multiplatform hedging to stabilize leverage

- A straight line of trends

- The beach

- Simple Iceberg order to sell (Copy)

The wind blows the strategy of the bunkerWeChat is not included.

Lieutenant Jaya.Is this tactic still relevant today?

High suction low throwIn the function AppendedStatus (() in the coin index information table, this code cannot be read if (symbols.indexOf ((symbols[i]) < 0) { indexTable.rows.push (([i + 1, symbols[i], price, assets[symbols[i].btc_price, _N((1 - assets[symbols[i]].btc_change) * 100), assets[symbols[i].btc_diff, 0, 0, 0, '0%'); I'm not sure.

The Big Black Horse of the CircleCan Super Brother come up with an OKEX version?

fmzeroIt needs to be customized.