Strategi lindung nilai dinamik Delta Options Deribit

Penulis:Lydia, Dicipta: 2022-11-01 17:49:07, Dikemas kini: 2023-09-15 20:49:52

Strategi yang dibawa FMZ Quant adalah strategi Deribit Options Delta Dynamic Hedging, atau pendeknya DDH (Dynamic Delta Hedging).

Untuk kajian perdagangan opsyen, kita biasanya perlu menguasai konsep-konsep ini:

· Model penetapan harga opsyen, model B-S, harga opsyen ditentukan berdasarkan [harga subjek], [harga kuasa], [masa yang tersisa hingga tamat tempoh], [vokaliti tersirat], dan [ kadar bebas risiko].

· Eksposur opsyen:

-Delta

Penjelasan strategi DDH:

· Penjelasan prinsip DDH Arahan perdagangan yang netral risiko dicapai dengan menyamakan Delta opsyen dan niaga hadapan. Selepas mengambil kedudukan dalam kontrak opsyen dan menyeimbangkan Delta dengan lindung nilai niaga hadapan, keseluruhan Delta akan menjadi tidak seimbang lagi apabila harga subjek bergerak. Gabungan pilihan dan kedudukan niaga hadapan sedemikian memerlukan lindung nilai dinamik berterusan untuk menyamakan Delta.

· Sebagai contoh: Apabila kita membeli pilihan panggilan, kita memegang kedudukan dalam arah panjang pada ketika ini. Pada masa ini, adalah perlu untuk pergi pendek niaga hadapan untuk lindung nilai Delta pilihan, mencapai keseluruhan Delta neutral (0 atau dekat dengan 0). Mari kita abaikan masa yang tersisa untuk tamat tempoh kontrak opsyen, turun naik dan faktor lain. Skenario 1: Apabila harga subjek naik, Delta pilihan meningkat, dan keseluruhan Delta bergerak ke nombor positif, dan niaga hadapan perlu lindung nilai lagi. (Sebelum menyeimbangkan semula, Delta opsyen adalah besar, manakala masa hadapan adalah agak kecil. Keuntungan marginal opsyen panggilan melebihi kerugian marginal kedudukan kontrak pendek, dan keseluruhan portfolio akan menghasilkan.)

Skenario 2: Apabila harga subjek jatuh, bahagian opsyen Delta menurun dan keseluruhan Delta bergerak ke nombor negatif, menutup sebahagian daripada kedudukan niaga hadapan pendek dan membawa keseluruhan Delta ke keseimbangan semula. (Sebelum menyeimbangkan semula, pada masa ini, Delta opsyen adalah kecil, manakala masa hadapan adalah agak besar. Kerugian marginal opsyen panggilan adalah kurang daripada keuntungan marginal jawatan kontrak pendek, dan keseluruhan portfolio masih akan menghasilkan keuntungan.)

Oleh itu, dalam keadaan ideal, peningkatan dan penurunan subjek akan membawa manfaat selagi pasaran turun naik.

Walau bagaimanapun, terdapat juga faktor yang perlu dipertimbangkan: nilai masa, kos transaksi, dan faktor lain.

Oleh itu, penjelasan hotshot di Zhihu dipetik:

The focus of Gamma Scalping is not on delta, dynamic delta hedging is just a way to avoid underlying price risk in the process.

Gamma Scaling focuses on alpha, which is not the alpha of stock selection. Here, alpha=gamma/theta, that is, how much gamma is exchanged for the time loss of unit Theta.

This is the point of concern. It is possible to construct a portfolio that floats both up and down, but it must be accompanied by time loss, and then the problem lies in the cost effectiveness.

Author: Xu Zhe

URL: https://www.zhihu.com/question/51630805/answer/128096385

Penjelasan reka bentuk strategi DDH

· Pengelupasan antara muka pasaran agregat, reka bentuk kerangka kerja · Reka bentuk UI Strategi · Reka bentuk interaksi strategik · Reka bentuk fungsi lindung nilai automatik Kod sumber:

// Construct functions

function createManager(e, subscribeList, msg) {

var self = {}

self.supportList = ["Futures_Binance", "Huobi", "Futures_Deribit"] // of the supported exchanges

// Object attributes

self.e = e

self.msg = msg

self.name = e.GetName()

self.type = self.name.includes("Futures_") ? "Futures" : "Spot"

self.label = e.GetLabel()

self.quoteCurrency = ""

self.subscribeList = subscribeList // subscribeList : [strSymbol1, strSymbol2, ...]

self.tickers = [] // All market data obtained by the interface, define the data format: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.subscribeTickers = [] // The required market data, define the data format: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.accData = null

self.pos = null

// Initialize the function

self.init = function() {

// Judge if the exchange is supported

if (!_.contains(self.supportList, self.name)) {

throw "not support"

}

}

self.setBase = function(base) {

// Switching base address for switching to analog bot

self.e.SetBase(base)

Log(self.name, self.label, "switch to analog bot:", base)

}

// Judging data precision

self.judgePrecision = function (p) {

var arr = p.toString().split(".")

if (arr.length != 2) {

if (arr.length == 1) {

return 0

}

throw "judgePrecision error, p:" + String(p)

}

return arr[1].length

}

// Update assets

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

// Update positions

self.updatePos = function(httpMethod, url, params) {

var pos = self.e.IO("api", httpMethod, url, params)

var ret = []

if (!pos) {

return false

} else {

// Organize data

// {"jsonrpc":"2.0","result":[],"usIn":1616484238870404,"usOut":1616484238870970,"usDiff":566,"testnet":true}

try {

_.each(pos.result, function(ele) {

ret.push(ele)

})

} catch(err) {

Log("Error:", err)

return false

}

self.pos = ret

}

return true

}

// Update the market data

self.updateTicker = function(url, callBackFuncGetArr, callBackFuncGetTicker) {

var tickers = []

var subscribeTickers = []

var ret = self.httpQuery(url)

if (!ret) {

return false

}

// Log("test", ret)// test

try {

_.each(callBackFuncGetArr(ret), function(ele) {

var ticker = callBackFuncGetTicker(ele)

tickers.push(ticker)

if (self.subscribeList.length == 0) {

subscribeTickers.push(ticker)

} else {

for (var i = 0 ; i < self.subscribeList.length ; i++) {

if (self.subscribeList[i] == ticker.symbol) {

subscribeTickers.push(ticker)

}

}

}

})

} catch(err) {

Log("Error:", err)

return false

}

self.tickers = tickers

self.subscribeTickers = subscribeTickers

return true

}

self.getTicker = function(symbol) {

var ret = null

_.each(self.subscribeTickers, function(ticker) {

if (ticker.symbol == symbol) {

ret = ticker

}

})

return ret

}

self.httpQuery = function(url) {

var ret = null

try {

var retHttpQuery = HttpQuery(url)

ret = JSON.parse(retHttpQuery)

} catch (err) {

// Log("Error:", err)

ret = null

}

return ret

}

self.returnTickersTbl = function() {

var tickersTbl = {

type : "table",

title : "tickers",

cols : ["symbol", "ask1", "bid1"],

rows : []

}

_.each(self.subscribeTickers, function(ticker) {

tickersTbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1])

})

return tickersTbl

}

// Back to the position table

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "pos|" + self.msg,

cols : ["instrument_name", "mark_price", "direction", "size", "delta", "index_price", "average_price", "settlement_price", "average_price_usd", "total_profit_loss"],

rows : []

}

/* Format of the position data returned by the interface

{

"mark_price":0.1401105,"maintenance_margin":0,"instrument_name":"BTC-25JUN21-28000-P","direction":"buy",

"vega":5.66031,"total_profit_loss":0.01226105,"size":0.1,"realized_profit_loss":0,"delta":-0.01166,"kind":"option",

"initial_margin":0,"index_price":54151.77,"floating_profit_loss_usd":664,"floating_profit_loss":0.000035976,

"average_price_usd":947.22,"average_price":0.0175,"theta":-7.39514,"settlement_price":0.13975074,"open_orders_margin":0,"gamma":0

}

*/

_.each(self.pos, function(ele) {

if(ele.direction != "zero") {

posTbl.rows.push([ele.instrument_name, ele.mark_price, ele.direction, ele.size, ele.delta, ele.index_price, ele.average_price, ele.settlement_price, ele.average_price_usd, ele.total_profit_loss])

}

})

return posTbl

}

self.returnOptionTickersTbls = function() {

var arr = []

var arrDeliveryDate = []

_.each(self.subscribeTickers, function(ticker) {

if (self.name == "Futures_Deribit") {

var arrInstrument_name = ticker.symbol.split("-")

var currency = arrInstrument_name[0]

var deliveryDate = arrInstrument_name[1]

var deliveryPrice = arrInstrument_name[2]

var optionType = arrInstrument_name[3]

if (!_.contains(arrDeliveryDate, deliveryDate)) {

arr.push({

type : "table",

title : arrInstrument_name[1],

cols : ["PUT symbol", "ask1", "bid1", "mark_price", "underlying_price", "CALL symbol", "ask1", "bid1", "mark_price", "underlying_price"],

rows : []

})

arrDeliveryDate.push(arrInstrument_name[1])

}

// Iterate through arr

_.each(arr, function(tbl) {

if (tbl.title == deliveryDate) {

if (tbl.rows.length == 0 && optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

return

} else if (tbl.rows.length == 0 && optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

return

}

for (var i = 0 ; i < tbl.rows.length ; i++) {

if (tbl.rows[i][0] == "" && optionType == "P") {

tbl.rows[i][0] = ticker.symbol

tbl.rows[i][1] = ticker.ask1

tbl.rows[i][2] = ticker.bid1

tbl.rows[i][3] = ticker.mark_price

tbl.rows[i][4] = ticker.underlying_price

return

} else if(tbl.rows[i][5] == "" && optionType == "C") {

tbl.rows[i][5] = ticker.symbol

tbl.rows[i][6] = ticker.ask1

tbl.rows[i][7] = ticker.bid1

tbl.rows[i][8] = ticker.mark_price

tbl.rows[i][9] = ticker.underlying_price

return

}

}

if (optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

} else if(optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

}

}

})

}

})

return arr

}

// Initialization

self.init()

return self

}

function main() {

// Initialization, clear logs

if(isResetLog) {

LogReset(1)

}

var m1 = createManager(exchanges[0], [], "option")

var m2 = createManager(exchanges[1], ["BTC-PERPETUAL"], "future")

// Switch to analog bot

var base = "https://www.deribit.com"

if (isTestNet) {

m1.setBase(testNetBase)

m2.setBase(testNetBase)

base = testNetBase

}

while(true) {

// Options

var ticker1GetSucc = m1.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=option",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name, underlying_price: ele.underlying_price, mark_price: ele.mark_price}})

// Perpetual futures

var ticker2GetSucc = m2.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=future",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name}})

if (!ticker1GetSucc || !ticker2GetSucc) {

Sleep(5000)

continue

}

// Update positions

var pos1GetSucc = m1.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=option")

var pos2GetSucc = m2.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=future")

if (!pos1GetSucc || !pos2GetSucc) {

Sleep(5000)

continue

}

// Interactions

var cmd = GetCommand()

if(cmd) {

// Handle interactions

Log("Interaction commands", cmd)

var arr = cmd.split(":")

// cmdClearLog

if(arr[0] == "setContractType") {

// parseFloat(arr[1])

m1.e.SetContractType(arr[1])

Log("exchanges[0] contract set by exchange object.", arr[1])

} else if (arr[0] == "buyOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("buy")

m1.e.Buy(price, amount)

Log("execution price: ", price, "execution amount: ", amount, "execution direction: ", arr[0])

} else if (arr[0] == "sellOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("sell")

m1.e.Sell(price, amount)

Log("execution price: ", price, "execution amount: ", amount, "execution direction: ", arr[0])

} else if (arr[0] == "setHedgeDeltaStep") {

hedgeDeltaStep = parseFloat(arr[1])

Log("set the parameter hedgeDeltaStep:", hedgeDeltaStep)

}

}

// Obtain the future contract prices

var perpetualTicker = m2.getTicker("BTC-PERPETUAL")

var hedgeMsg = " PERPETUAL:" + JSON.stringify(perpetualTicker)

// Obtain the total delta value from the account data

var acc1GetSucc = m1.updateAcc(function(self) {

self.e.SetCurrency("BTC_USD")

return self.e.GetAccount()

})

if (!acc1GetSucc) {

Sleep(5000)

continue

}

var sumDelta = m1.accData.Info.result.delta_total

if (Math.abs(sumDelta) > hedgeDeltaStep && perpetualTicker) {

if (sumDelta < 0) {

// Hedging futures go short if delta is greater than 0

var amount = _N(Math.abs(sumDelta) * perpetualTicker.ask1, -1)

if (amount > 10) {

Log("Exceed the hedging threshold, current total delta:", sumDelta, "Buy futures")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("buy")

m2.e.Buy(-1, amount)

} else {

hedgeMsg += ", hedging order volume less than 10"

}

} else {

// Hedging futures go long if delta is less than 0

var amount = _N(Math.abs(sumDelta) * perpetualTicker.bid1, -1)

if (amount > 10) {

Log("Exceed the hedging threshold, current total delta:", sumDelta, "Sell futures")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("sell")

m2.e.Sell(-1, amount)

} else {

hedgeMsg += ", hedging order volume less than 10"

}

}

}

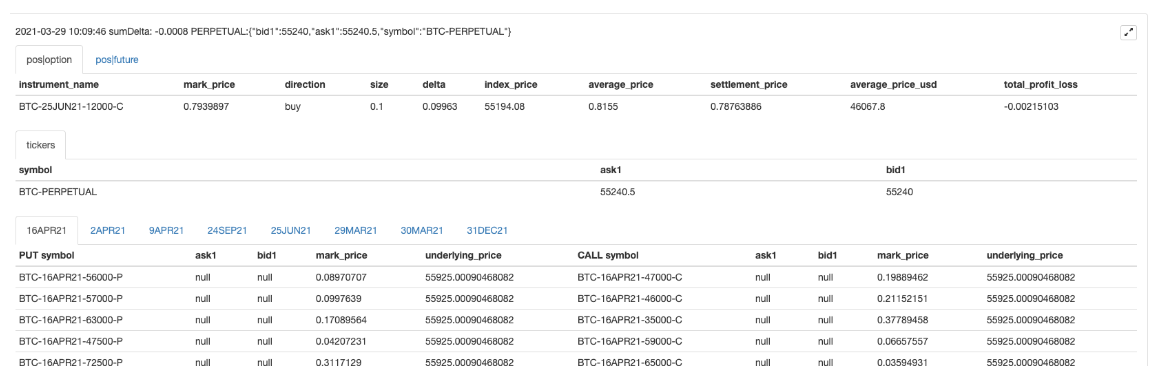

LogStatus(_D(), "sumDelta:", sumDelta, hedgeMsg,

"\n`" + JSON.stringify([m1.returnPosTbl(), m2.returnPosTbl()]) + "`", "\n`" + JSON.stringify(m2.returnTickersTbl()) + "`", "\n`" + JSON.stringify(m1.returnOptionTickersTbls()) + "`")

Sleep(10000)

}

}

Alamat Strategi:https://www.fmz.com/strategy/265090

Operasi strategi:

Strategi ini adalah strategi tutorial, berorientasikan pembelajaran, sila gunakan dengan berhati-hati dalam bot sebenar.

- Mengukur Analisis Dasar di Pasaran Cryptocurrency: Biarkan Data Bercakap Sendiri!

- Perbincangan mengenai kajian kuantitatif asas dalam lingkaran mata wang - jangan mempercayai guru-guru sihir yang bodoh, data adalah objektif!

- Alat penting dalam bidang transaksi kuantitatif - Pencipta modul pencarian data kuantitatif

- Menguasai Semuanya - Pengenalan kepada FMZ Versi Baru Terminal Dagangan (dengan Kod Sumber Arbitraj TRB)

- Menguasai segala-galanya FMZ versi baru terminal perdagangan pengenalan (tambahan kod sumber TRB suite)

- FMZ Quant: Analisis Contoh Reka Bentuk Keperluan Umum di Pasaran Cryptocurrency (II)

- Bagaimana untuk mengeksploitasi bot jualan tanpa otak dengan strategi frekuensi tinggi dalam 80 baris kod

- FMZ Kuantitatif: Penyelesaian contoh reka bentuk permintaan biasa di pasaran mata wang kripto (II)

- Bagaimana untuk mengeksploitasi robot tanpa otak yang dijual dengan strategi frekuensi tinggi 80 baris kod

- FMZ Quant: Analisis Contoh Reka Bentuk Keperluan Umum di Pasaran Cryptocurrency (I)

- FMZ Kuantitatif: Penyelesaian contoh reka bentuk permintaan biasa di pasaran mata wang kripto