Giới thiệu môi trường nghiên cứu khoa học dữ liệu lượng tử FMZ

Tác giả:Tốt, Tạo: 2019-10-12 15:28:43, Cập nhật: 2023-11-06 20:02:30

Thuật ngữ

Hầu hết các giao dịch phòng ngừa rủi ro đều dựa trên sự khác biệt giá của hai loại giao dịch. Khái niệm, nguyên tắc và chi tiết của giao dịch phòng ngừa rủi ro có thể không rõ ràng đối với các nhà giao dịch vừa bước vào lĩnh vực giao dịch định lượng.

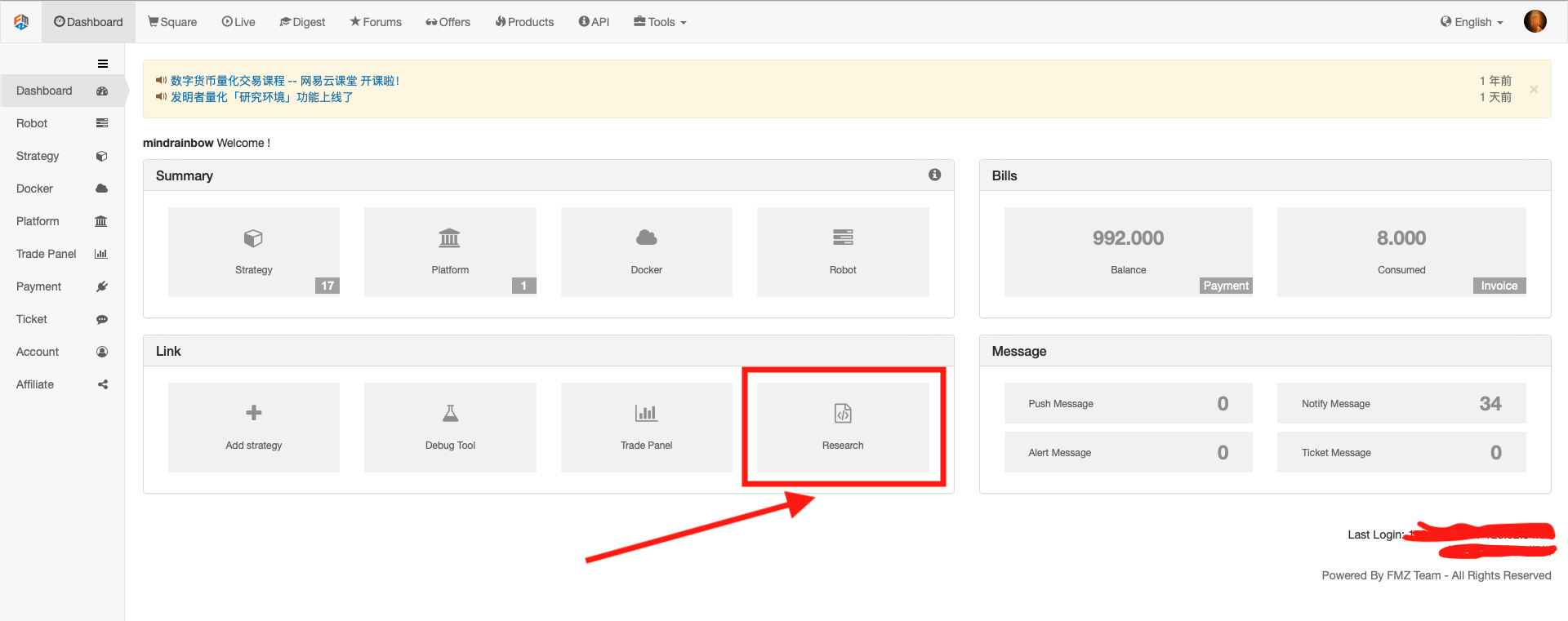

Trên trang Dashboard của trang web FMZ Quant, nhấp vào

Ở đây tôi đã tải lên tập tin phân tích này trực tiếp:

Tài liệu phân tích này là một phân tích về quá trình mở và đóng các vị trí trong giao dịch phòng hộ Spot-Futures. Sàn giao dịch tương lai là OKEX và hợp đồng là hợp đồng hàng quý; Sàn giao dịch mặt điểm là giao dịch điểm OKEX. Cặp giao dịch là BTC_USDT, Tài liệu môi trường phân tích cụ thể sau đây chứa hai phiên bản của nó, cả Python và JavaScript.

Môi trường nghiên cứu Python

from fmz import *

task = VCtx('''backtest

start: 2019-09-19 00:00:00

end: 2019-09-28 12:00:00

period: 15m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD", "stocks":1}, {"eid":"OKEX","currency":"BTC_USDT","balance":10000,"stocks":0}]

''')

# Create a backtest environment

import matplotlib.pyplot as plt

import numpy as np

# Imported drawing library matplotlib and numpy libraryexchanges[0].SetContractType("quarter") # The first exchange object OKEX futures (eid: Futures_OKCoin) calls the function that sets the current contract, set to the quarterly contract

initQuarterAcc = exchanges[0].GetAccount() # Account information at the OKEX Futures Exchange, recorded in the variable initQuarterAcc

initQuarterAcc{'Balance': 0.0, 'FrozenBalance': 0.0, 'Stocks': 1.0, 'FrozenStocks': 0.0}initSpotAcc = exchanges[1].GetAccount() # Account information at the OKEX spot exchange, recorded in the variable initSpotAcc initSpotAcc

{'Balance': 10000.0, 'FrozenBalance': 0.0, 'Stocks': 0.0, 'FrozenStocks': 0.0}quarterTicker1 = exchanges[0].GetTicker() # Get the futures exchange market quotes, recorded in the variable quarterTicker1 quarterTicker1

{'Time': 1568851210000,

'High': 10441.25002,

'Low': 10441.25,

'Sell': 10441.25002,

'Buy': 10441.25,

'Last': 10441.25001,

'Volume': 1772.0,

'OpenInterest': 0.0}spotTicker1 = exchanges[1].GetTicker() # Get the spot exchange market quotes, recorded in the variable spotTicker1 spotTicker1

{'Time': 1568851210000,

'High': 10156.60000002,

'Low': 10156.6,

'Sell': 10156.60000002,

'Buy': 10156.6,

'Last': 10156.60000001,

'Volume': 7.4443,

'OpenInterest': 0.0}quarterTicker1.Buy - spotTicker1.Sell # The price difference between Short selling futures and Buying long spots

284.64999997999985

exchanges[0].SetDirection("sell") # Set up the futures exchange, the trading direction is short

quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) # The futures are short-selled, the order quantity is 10 contracts, and the returned order ID is recorded in the variable quarterId1.

exchanges[0].GetOrder(quarterId1) # Query the order details of the futures order ID is quarterId1{'Id': 1,

'Price': 10441.25,

'Amount': 10.0,

'DealAmount': 10.0,

'AvgPrice': 10441.25,

'Type': 1,

'Offset': 0,

'Status': 1,

'ContractType': b'quarter'}spotAmount = 10 * 100 / quarterTicker1.Buy # Calculate the number of cryptocurrency equivalent to 10 contracts, as the spots amount of the order placed spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) # Spot exchange placing order exchanges[1].GetOrder(spotId1) # Query the order details of the spot order ID as spotId1

{'Id': 1,

'Price': 10156.60000002,

'Amount': 0.0957,

'DealAmount': 0.0957,

'AvgPrice': 10156.60000002,

'Type': 0,

'Offset': 0,

'Status': 1,

'ContractType': b'BTC_USDT_OKEX'}It can be seen that the orders of the order quarterId1 and the spotId1 are all completely filled, that is, the opening position of the hedge is completed.

Sleep(1000 * 60 * 60 * 24 * 7) # Hold the position for a while, wait for the difference to become smaller and close the position.

After the waiting time has elapsed, prepare to close the position. Get the current quotes

quarterTicker2,spotTicker2and print. The trading direction of the futures exchange object is set to close short positions:exchanges[0].SetDirection("closesell")to close the position. Print the details of the closing positions, showing that the closing position is completely done.

quarterTicker2 = exchanges[0].GetTicker() # Get the current market quotes of the futures exchange, recorded in the variable quarterTicker2 quarterTicker2

{'Time': 1569456010000,

'High': 8497.20002,

'Low': 8497.2,

'Sell': 8497.20002,

'Buy': 8497.2,

'Last': 8497.20001,

'Volume': 4311.0,

'OpenInterest': 0.0}spotTicker2 = exchanges[1].GetTicker() # Get the current spot exchange market quotes, recorded in the variable spotTicker2 spotTicker2

{'Time': 1569456114600,

'High': 8444.70000001,

'Low': 8444.69999999,

'Sell': 8444.70000001,

'Buy': 8444.69999999,

'Last': 8444.7,

'Volume': 78.6273,

'OpenInterest': 0.0}quarterTicker2.Sell - spotTicker2.Buy # The price difference of closing position between Short position of futures and the Long position of spot

52.5000200100003

exchanges[0].SetDirection("closesell") # Set the current trading direction of the futures exchange to close short position

quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) # The futures exchange closing positions, and records the order ID, recorded to the variable quarterId2

exchanges[0].GetOrder(quarterId2) # Query futures closing position orders detail{'Id': 2,

'Price': 8497.20002,

'Amount': 10.0,

'DealAmount': 10.0,

'AvgPrice': 8493.95335,

'Type': 0,

'Offset': 1,

'Status': 1,

'ContractType': b'quarter'}spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) # The spot exchange place order to closing positions, and records the order ID, recorded to the variable spotId2 exchanges[1].GetOrder(spotId2) # Query spots closing order details

{'Id': 2,

'Price': 8444.69999999,

'Amount': 0.0957,

'DealAmount': 0.0957,

'AvgPrice': 8444.69999999,

'Type': 1,

'Offset': 0,

'Status': 1,

'ContractType': b'BTC_USDT_OKEX'}nowQuarterAcc = exchanges[0].GetAccount() # Get current futures exchange account information, recorded in the variable nowQuarterAcc nowQuarterAcc

{'Balance': 0.0,

'FrozenBalance': 0.0,

'Stocks': 1.021786026184,

'FrozenStocks': 0.0}nowSpotAcc = exchanges[1].GetAccount() # Get current spot exchange account information, recorded in the variable nowSpotAcc nowSpotAcc

{'Balance': 9834.74705446,

'FrozenBalance': 0.0,

'Stocks': 0.0,

'FrozenStocks': 0.0}Calculate the profit and loss of this hedging operation by comparing the initial account with the current account.

diffStocks = abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0 :

print("profit:", diffStocks * spotTicker2.Buy + diffBalance)

else :

print("profit:", diffBalance - diffStocks * spotTicker2.Buy)收益: 18.72350977580652

Below we look at why the hedge is profitable. We can see the chart drawn, the futures price is the blue line, the spot price is the orange line, both prices are falling, and the futures price is falling faster than the spot price.

xQuarter = [1, 2] yQuarter = [quarterTicker1.Buy, quarterTicker2.Sell] xSpot = [1, 2] ySpot = [spotTicker1.Sell, spotTicker2.Buy] plt.plot(xQuarter, yQuarter, linewidth=5) plt.plot(xSpot, ySpot, linewidth=5) plt.show()

<Figure size 432x288 with 1 Axes>

Let us look at the changes in the price difference. The difference is 284 when the hedge is opened (that is, shorting the futures, longing the spot), reaching 52 when the position is closed (the futures short positions are closed, and the spot long positions are closed). The difference is from big to small.

xDiff = [1, 2] yDiff = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy] plt.plot(xDiff, yDiff, linewidth=5) plt.show()

<Figure size 432x288 with 1 Axes>

Let me give an example, a1 is the futures price of time 1, and b1 is the spot price of time 1. A2 is the futures price at time 2, and b2 is the spot price at time 2.

As long as a1-b1, that is, the futures-spot price difference of time 1 is greater than the futures-spot price difference of a2-b2 of time 2, a1 - a2 > b1 - b2 can be introduced. There are three cases: (the futures-spot holding position are the same size)

-

a1 - a2 is greater than 0, b1 - b2 is greater than 0, a1 - a2 is the difference in futures profit, b1 - b2 is the difference in spot loss (because the spot is long position, the price of opening position is higher than the price of closing position, therefore, the position loses money), but the futures profit is greater than the spot loss. So the overall trading operation is profitable. This case corresponds to the chart in step

In[8]. -

a1 - a2 is greater than 0, b1 - b2 is less than 0, a1 - a2 is the difference of futures profit, b1 - b2 is the difference of spot profit (b1 - b2 is less than 0, indicating that b2 is greater than b1, that is, the price of opening the position is low, the price of selling the position is high, so the position make profit)

-

a1 - a2 is less than 0, b1 - b2 is less than 0, a1 - a2 is the difference of futures losses, b1 - b2 is the difference of spot profit due to a1 - a2 > b1 - b2, the absolute value of a1 - a2 is less than b1 - b2 Absolute value, the profit of the spot is greater than the loss of the futures. So the overall trading operation is profitable.

There is no case where a1 - a2 is less than 0 and b1 - b2 is greater than 0, because a1 - a2 > b1 - b2 have been defined. Similarly, if a1 - a2 is equal to 0, since a1 - a2 > b1 - b2 is defined, b1 - b2 must be less than 0. Therefore, as long as the futures are short position and the spot are long position in a long-term hedging method, which meets the conditions a1 - b1 > a2 - b2, the opening and closing position operation is the profit hedging.

For example, the following model is one of the cases:

a1 = 10

b1 = 5

a2 = 11

b2 = 9

if a1 - b1 > a2 - b2:

print(a1 - a2 > b1 - b2)

xA = [1, 2]

yA = [a1, a2]

xB = [1, 2]

yB = [b1, b2]

plt.plot(xA, yA, linewidth=5)

plt.plot(xB, yB, linewidth=5)

plt.show()True <Figure size 432x288 with 1 Axes>

Môi trường nghiên cứu Tệp ngôn ngữ JavaScript

Môi trường nghiên cứu không chỉ hỗ trợ Python, mà còn hỗ trợ JavaScript Dưới đây tôi cũng đưa ra một ví dụ về môi trường nghiên cứu JavaScript:

// Import the required package, click "Save Backtest Settings" on the FMZ Quant "Strategy Editing Page" to get the string configuration and convert it to an object.

var fmz = require("fmz") // Automatically import talib, TA, plot library after import

var task = fmz.VCtx({

start: '2019-09-19 00:00:00',

end: '2019-09-28 12:00:00',

period: '15m',

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD","stocks":1},{"eid":"OKEX","currency":"BTC_USDT","balance":10000,"stocks":0}]

})exchanges[0].SetContractType("quarter") // The first exchange object OKEX futures (eid: Futures_OKCoin) calls the function that sets the current contract, set to the quarterly contract

var initQuarterAcc = exchanges[0].GetAccount() // Account information at the OKEX Futures Exchange, recorded in the variable initQuarterAcc

initQuarterAcc{ Balance: 0, FrozenBalance: 0, Stocks: 1, FrozenStocks: 0 }var initSpotAcc = exchanges[1].GetAccount() // Account information at the OKEX spot exchange, recorded in the variable initSpotAcc initSpotAcc

{ Balance: 10000, FrozenBalance: 0, Stocks: 0, FrozenStocks: 0 }var quarterTicker1 = exchanges[0].GetTicker() // Get the futures exchange market quotes, recorded in the variable quarterTicker1 quarterTicker1

{ Time: 1568851210000,

High: 10441.25002,

Low: 10441.25,

Sell: 10441.25002,

Buy: 10441.25,

Last: 10441.25001,

Volume: 1772,

OpenInterest: 0 }var spotTicker1 = exchanges[1].GetTicker() // Get the spot exchange market quotes, recorded in the variable spotTicker1 spotTicker1

{ Time: 1568851210000,

High: 10156.60000002,

Low: 10156.6,

Sell: 10156.60000002,

Buy: 10156.6,

Last: 10156.60000001,

Volume: 7.4443,

OpenInterest: 0 }quarterTicker1.Buy - spotTicker1.Sell // the price difference between Short selling futures and long buying spot

284.64999997999985

exchanges[0].SetDirection("sell") // Set up the futures exchange, the trading direction is shorting

var quarterId1 = exchanges[0].Sell(quarterTicker1.Buy, 10) // The futures are short-selled, the order quantity is 10 contracts, and the returned order ID is recorded in the variable quarterId1.

exchanges[0].GetOrder(quarterId1) // Query the order details of the futures order ID is quarterId1{ Id: 1,

Price: 10441.25,

Amount: 10,

DealAmount: 10,

AvgPrice: 10441.25,

Type: 1,

Offset: 0,

Status: 1,

ContractType: 'quarter' }var spotAmount = 10 * 100 / quarterTicker1.Buy // Calculate the number of cryptocurrency equivalent to 10 contracts, as the amount of the order placed var spotId1 = exchanges[1].Buy(spotTicker1.Sell, spotAmount) // Spot exchange placing order exchanges[1].GetOrder(spotId1) // Query the order details of the spot order ID as spotId1

{ Id: 1,

Price: 10156.60000002,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 10156.60000002,

Type: 0,

Offset: 0,

Status: 1,

ContractType: 'BTC_USDT_OKEX' }It can be seen that the orders of the order quarterId1 and the spotId1 are all completely filled, that is, the opening of the hedge is completed.

Sleep(1000 * 60 * 60 * 24 * 7) // Hold the position for a while, wait for the difference to become smaller and close the position.

等待时间过后,准备平仓。获取当前的行情

quarterTicker2、spotTicker2并且打印。 期货交易所对象的交易方向设置为平空仓:exchanges[0].SetDirection("closesell")下单平仓。 打印平仓订单的详情,显示平仓订单完全成交,平仓完成。

var quarterTicker2 = exchanges[0].GetTicker() // Get the current market quote of the futures exchange, recorded in the variable quarterTicker2 quarterTicker2

{ Time: 1569456010000,

High: 8497.20002,

Low: 8497.2,

Sell: 8497.20002,

Buy: 8497.2,

Last: 8497.20001,

Volume: 4311,

OpenInterest: 0 }var spotTicker2 = exchanges[1].GetTicker() // Get the current spot exchange market quotes, recorded in the variable spotTicker2 spotTicker2

{ Time: 1569456114600,

High: 8444.70000001,

Low: 8444.69999999,

Sell: 8444.70000001,

Buy: 8444.69999999,

Last: 8444.7,

Volume: 78.6273,

OpenInterest: 0 }quarterTicker2.Sell - spotTicker2.Buy // the price difference between the short position of futures and the long position of spot

52.5000200100003

exchanges[0].SetDirection("closesell") // Set the current trading direction of the futures exchange to close short position

var quarterId2 = exchanges[0].Buy(quarterTicker2.Sell, 10) // The futures exchange place orders to close position, and records the order ID, recorded to the variable quarterId2

exchanges[0].GetOrder(quarterId2) // Query futures closing position order details{ Id: 2,

Price: 8497.20002,

Amount: 10,

DealAmount: 10,

AvgPrice: 8493.95335,

Type: 0,

Offset: 1,

Status: 1,

ContractType: 'quarter' }var spotId2 = exchanges[1].Sell(spotTicker2.Buy, spotAmount) // The spot exchange place orders to close position, and records the order ID, recorded to the variable spotId2 exchanges[1].GetOrder(spotId2) // Query spot closing position order details

{ Id: 2,

Price: 8444.69999999,

Amount: 0.0957,

DealAmount: 0.0957,

AvgPrice: 8444.69999999,

Type: 1,

Offset: 0,

Status: 1,

ContractType: 'BTC_USDT_OKEX' }var nowQuarterAcc = exchanges[0].GetAccount() // Get current futures exchange account information, recorded in the variable nowQuarterAcc nowQuarterAcc

{ Balance: 0,

FrozenBalance: 0,

Stocks: 1.021786026184,

FrozenStocks: 0 }var nowSpotAcc = exchanges[1].GetAccount() // Get current spot exchange account information, recorded in the variable nowSpotAcc nowSpotAcc

{ Balance: 9834.74705446,

FrozenBalance: 0,

Stocks: 0,

FrozenStocks: 0 }Calculate the profit and loss of this hedging operation by comparing the initial account with the current account.

var diffStocks = Math.abs(nowQuarterAcc.Stocks - initQuarterAcc.Stocks)

var diffBalance = nowSpotAcc.Balance - initSpotAcc.Balance

if (nowQuarterAcc.Stocks - initQuarterAcc.Stocks > 0) {

console.log("profit:", diffStocks * spotTicker2.Buy + diffBalance)

} else {

console.log("profit:", diffBalance - diffStocks * spotTicker2.Buy)

}收益: 18.72350977580652

Below we look at why the hedge is profitable. We can see the chart drawn, the futures price is the blue line, the spot price is the orange line, both prices are falling, and the futures price is falling faster than the spot price.

var objQuarter = {

"index" : [1, 2], // The index 1 for the first moment, the opening position time, and 2 for the closing position time.

"arrPrice" : [quarterTicker1.Buy, quarterTicker2.Sell],

}

var objSpot = {

"index" : [1, 2],

"arrPrice" : [spotTicker1.Sell, spotTicker2.Buy],

}

plot([{name: 'quarter', x: objQuarter.index, y: objQuarter.arrPrice}, {name: 'spot', x: objSpot.index, y: objSpot.arrPrice}])Let us look at the changes in the price difference. The difference is 284 when the hedge is opened (that is, shorting the futures, longing the spot), reaching 52 when the position is closed (the futures short positions are closed, and the spot long positions are closed). The difference is from big to small.

var arrDiffPrice = [quarterTicker1.Buy - spotTicker1.Sell, quarterTicker2.Sell - spotTicker2.Buy] plot(arrDiffPrice)

Let me give an example, a1 is the futures price of time 1, and b1 is the spot price of time 1. A2 is the futures price at time 2, and b2 is the spot price at time 2.

As long as a1-b1, that is, the futures-spot price difference of time 1 is greater than the futures-spot price difference of a2-b2 of time 2, a1 - a2 > b1 - b2 can be introduced. There are three cases: (the futures-spot holding position are the same size)

-

a1 - a2 is greater than 0, b1 - b2 is greater than 0, a1 - a2 is the difference in futures profit, b1 - b2 is the difference in spot loss (because the spot is long position, the price of opening position is higher than the price of closing position, therefore, the position loses money), but the futures profit is greater than the spot loss. So the overall trading operation is profitable. This case corresponds to the chart in step

In[8]. -

a1 - a2 is greater than 0, b1 - b2 is less than 0, a1 - a2 is the difference of futures profit, b1 - b2 is the difference of spot profit (b1 - b2 is less than 0, indicating that b2 is greater than b1, that is, the price of opening the position is low, the price of selling the position is high, so the position make profit)

-

a1 - a2 is less than 0, b1 - b2 is less than 0, a1 - a2 is the difference of futures losses, b1 - b2 is the difference of spot profit due to a1 - a2 > b1 - b2, the absolute value of a1 - a2 is less than b1 - b2 Absolute value, the profit of the spot is greater than the loss of the futures. So the overall trading operation is profitable.

There is no case where a1 - a2 is less than 0 and b1 - b2 is greater than 0, because a1 - a2 > b1 - b2 have been defined. Similarly, if a1 - a2 is equal to 0, since a1 - a2 > b1 - b2 is defined, b1 - b2 must be less than 0. Therefore, as long as the futures are short position and the spot are long position in a long-term hedging method, which meets the conditions a1 - b1 > a2 - b2, the opening and closing position operation is the profit hedging.

For example, the following model is one of the cases:

var a1 = 10

var b1 = 5

var a2 = 11

var b2 = 9

// a1 - b1 > a2 - b2 get : a1 - a2 > b1 - b2

var objA = {

"index" : [1, 2],

"arrPrice" : [a1, a2],

}

var objB = {

"index" : [1, 2],

"arrPrice" : [b1, b2],

}

plot([{name : "a", x : objA.index, y : objA.arrPrice}, {name : "b", x : objB.index, y : objB.arrPrice}])- Xác định số lượng phân tích cơ bản trong thị trường tiền điện tử: Hãy để dữ liệu nói cho chính nó!

- Các nghiên cứu định lượng cơ bản của vòng đồng tiền - đừng tin vào những giáo viên mờ nhạt, nói khách quan về dữ liệu!

- Một công cụ thiết yếu trong lĩnh vực giao dịch định lượng - nhà phát minh mô-đun khám phá dữ liệu định lượng

- Kiểm soát mọi thứ - giới thiệu về FMZ Phiên bản mới của Terminal giao dịch (với mã nguồn TRB Arbitrage)

- Có tất cả các thông tin về FMZ phiên bản mới của giao dịch đầu cuối (được thêm mã nguồn TRB)

- FMZ Quant: Phân tích các ví dụ thiết kế yêu cầu chung trong thị trường tiền điện tử (II)

- Làm thế nào để khai thác robot bán hàng không có não với một chiến lược tần số cao trong 80 dòng mã

- FMZ định lượng: Phân tích các trường hợp thiết kế nhu cầu phổ biến của thị trường tiền điện tử (II)

- Cách khai thác robot vô trí tuệ để bán bằng chiến lược tần số cao 80 dòng mã

- FMZ Quant: Phân tích các ví dụ thiết kế yêu cầu chung trong thị trường tiền điện tử (I)

- FMZ định lượng: Các nhu cầu phổ biến của thị trường tiền điện tử