Swing High/Low Indicator w/ MACD and EMA Confirmations by KaizenTraderB

I designed this indicator to be used with a market structure break strategy. It labels swing highs and lows that are confirmed by the MACD . It also displays a higher timeframe Fast and Slow EMA to determine directional bias. Also provides alerts that signal Swing Low breaks in downtrends and Swing High Breaks in uptrends. It draws a horizontal line on the last Swing High and Low.

Display this indicator on your entry timeframe and choose your Higher Timeframe in settings. You can also change lookback period for Swing Highs and Lows and EMA’s.

When I use this I am looking for the Swing High/Low break in direction of HTF Trend Then look for pullback between price level of break and areas of liquidity (wicks, order blocks, price congestion) for entry in direction of EMA trend.

backtest

/*backtest

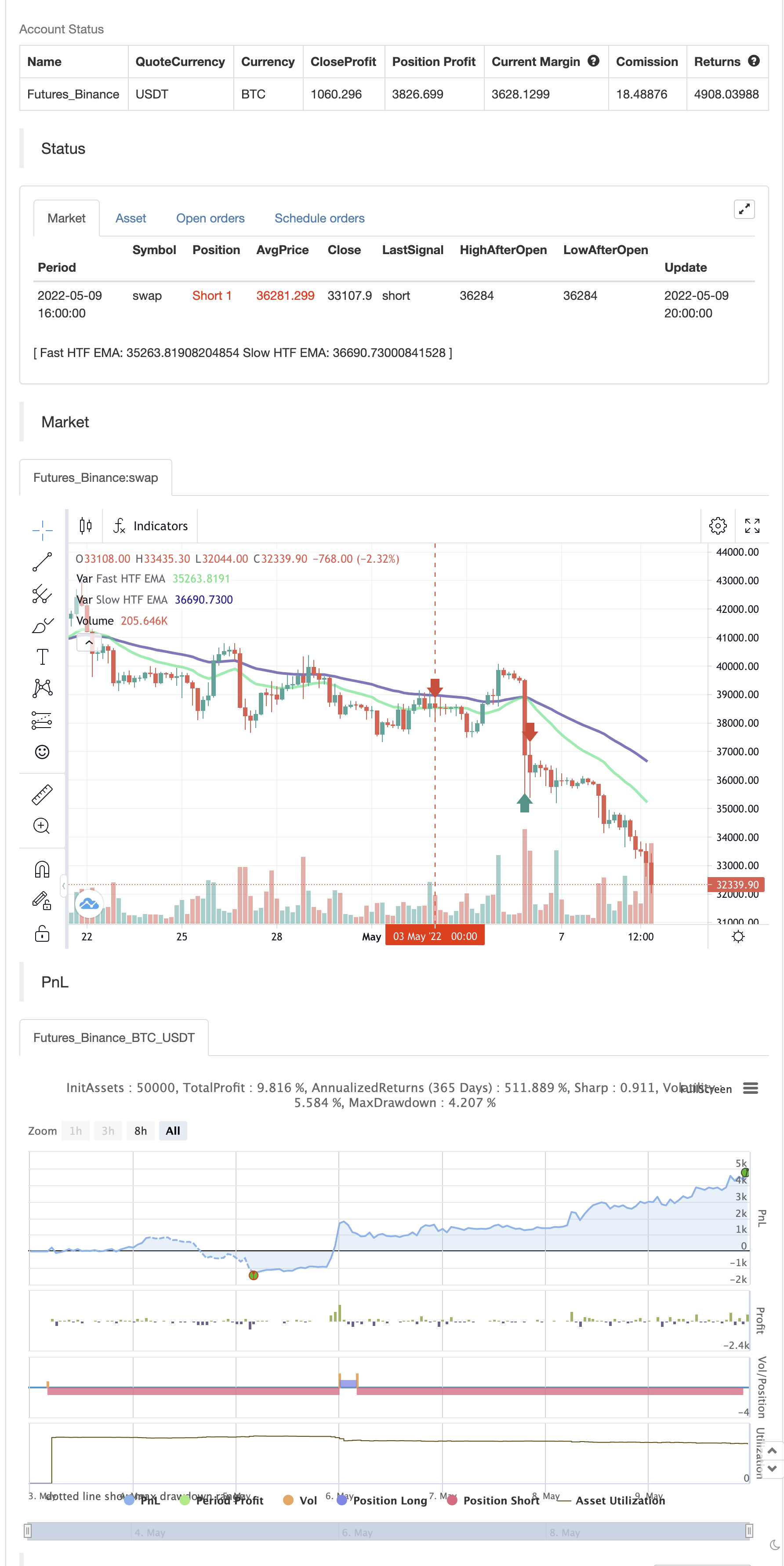

start: 2022-05-03 00:00:00

end: 2022-05-09 23:59:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Swing High/Low Indicator w/ MACD and EMA Confirmations by KaizenTraderB

//

//I designed this indicator to be used with a market structure break strategy.

//It labels swing highs and lows that are confirmed by the MACD.

//It also displays a higher timeframe Fast and Slow EMA to determine directional bias.

//Also provides alerts that signal Swing Low breaks in downtrends and Swing High Breaks in uptrends.

//It draws a horizontal line on the last Swing High and Low.

//

//Display this indicator on your entry timeframe and choose your Higher Timeframe in settings.

//You can also change lookback period for Swing Highs and Lows and EMA's.

//

//@version=4

study("Swing High/Low Indicator w/ MACD and HTF EMA's", overlay=true)

barsback = input(5, title='Bars back to check for a swing')

showsig = input(true, title='Show Signal Markers')

res = input(title="EMA Timeframe", defval="240")

flen = input(title="Fast EMA Length", type=input.integer, defval=20)

slen = input(title="Slow EMA Length", type=input.integer, defval=50)

showema = input(title="Show EMA's", type=input.bool, defval=true)

showentry = input(title="Show Swing Break Entry Levels", type=input.bool, defval=true)

//HTF EMA's

fema = ema(close, flen)

sema = ema(close, slen)

rp_security(_symbol, _res, _src, _gaps, _lookahead) => security(_symbol, _res, _src[barstate.isrealtime ? 1 : 0], _gaps, _lookahead)

femaSmooth = rp_security(syminfo.tickerid, res, fema, barmerge.gaps_on, barmerge.lookahead_off)

semaSmooth = rp_security(syminfo.tickerid, res, sema, barmerge.gaps_on, barmerge.lookahead_off)

plot(showema ? femaSmooth : na,"Fast HTF EMA", color.lime, 3)

plot(showema ? semaSmooth : na,"Slow HTF EMA", color.navy, 3)

downtrend = femaSmooth < semaSmooth

uptrend = femaSmooth > semaSmooth

//Swing Highs and Lows

////////////////////////////////////////////////////////////////////////////////

//Thank you Backtest-Rookies.com for the Swing Detection Indicator code

swing_detection(index)=>

swing_high = false

swing_low = false

start = (index*2) - 1 // -1 so we have an even number of

swing_point_high = high[index]

swing_point_low = low[index]

//Swing Highs

for i = 0 to start

swing_high := true

if i < index

if high[i] > swing_point_high

swing_high := false

break

// Have to do checks before pivot and after seperately because we can get

// two highs of the same value in a row. Notice the > and >= difference

if i > index

if high[i] >= swing_point_high

swing_high := false

break

//Swing lows

for i = 0 to start

swing_low := true

if i < index

if low[i] < swing_point_low

swing_low := false

break

// Have to do checks before pivot and after seperately because we can get

// two lows of the same value in a row. Notice the > and >= difference

if i > index

if low[i] <= swing_point_low

swing_low := false

break

[swing_high, swing_low]

// Check for a swing

[swing_high, swing_low] = swing_detection(barsback)

////////////////////////////////////////////////////////////////////////////////

float swing_high_price = na

float swing_low_price = na

if swing_high

swing_high_price := high[barsback]

if swing_low

swing_low_price := low[barsback]

[macdline, signalline, histline] = macd(close,12,26,9)

macpos = histline[barsback] > 0

macneg = histline[barsback] < 0

// Plotting

SHPrice = "SH\n" + str.tostring(swing_high_price)

SLPrice = "SL\n" + str.tostring(swing_low_price)

if swing_high and macpos and showsig

//SHLabel = label.new(bar_index[barsback], swing_high_price, SHPrice, xloc.bar_index, yloc.abovebar, color.red, label.style_arrowdown, textcolor=color.red, size=size.normal)

//SHLine = line.new(bar_index[barsback], swing_high_price, bar_index[barsback] + 20, swing_high_price, xloc.bar_index, extend.none, color.black, width=2)

//line.delete(SHLine[1])

if swing_low and macneg and showsig

//label.new(bar_index[barsback], swing_low_price, SLPrice, xloc.bar_index, yloc.belowbar, color.green, label.style_arrowup, textcolor=color.green)

//SLLine = line.new(bar_index[barsback], swing_low_price, bar_index[barsback] + 20, swing_low_price, xloc.bar_index, extend.none, color.black, width=2)

//line.delete(SLLine[2])

//alerts

alertcondition(uptrend and close > swing_high_price, "Swing High Break in Uptrend", "Swing High Break!")

alertcondition(downtrend and close < swing_low_price, "Swing Low Break in Downtrend", "Swing Low Break!")

if uptrend

strategy.entry("Enter Long", strategy.long)

else if downtrend

strategy.entry("Enter Short", strategy.short)