概述

Ruda动量趋势交易策略是一个基于动量和趋势指标的量化交易策略。该策略使用OBV(On Balance Volume)、EMA(Exponential Moving Average)和K线实体比例等指标来判断买入和卖出时机。当短期EMA上穿长期EMA,OBV创新高,且K线实体比例大于设定阈值时,策略会在次日开盘价买入;当价格跌破止损价或收盘价跌破短期EMA时,策略会平仓。

策略原理

- 计算两条EMA线,短期EMA参数为5,长期EMA参数为21。当短期EMA上穿长期EMA时,认为趋势向上,反之则趋势向下。

- 计算OBV指标,当OBV创10日新高时,认为多头动能强劲。

- 计算K线实体占比,当实体占比大于设定阈值(默认50%)时,认为趋势确立。

- 当趋势向上、多头动能强劲且趋势确立时,策略在次日开盘价买入,止损价为当日最低价和开盘价-1%的最小值。

- 当价格跌破止损价或收盘价跌破短期EMA时,策略平仓。

优势分析

- 结合趋势和动量指标,能够捕捉强势品种。

- 使用次日开盘价买入和动态止损,可以避免部分假突破。

- 止损和止盈条件明确,风险可控。

风险分析

- 趋势和动量指标存在滞后性,可能出现追高买入和止损过早的情况。

- 参数固定,缺乏自适应性,不同市场状态下表现可能差异较大。

- 单一市场和品种回测,策略稳定性和适用性有待进一步验证。

优化方向

- 对趋势和动量指标的参数进行优化,提高指标灵敏度和有效性。

- 引入市场状态判断,根据当前市场特征动态调整参数。

- 扩大回测范围,增加不同市场和品种的测试,提高策略稳健性。

- 考虑引入仓位管理和风险控制模块,提高收益风险比。

总结

Ruda动量趋势交易策略是一个简单易用的量化交易策略,通过趋势和动量指标的结合,能够捕捉强势品种和趋势机会。但该策略也存在一定局限性,如指标滞后、参数固定等问题。未来可以从优化指标参数、引入自适应机制、扩大回测范围和加强风险管理等方面对策略进行优化和改进,以提高策略的稳健性和盈利能力。

策略源码

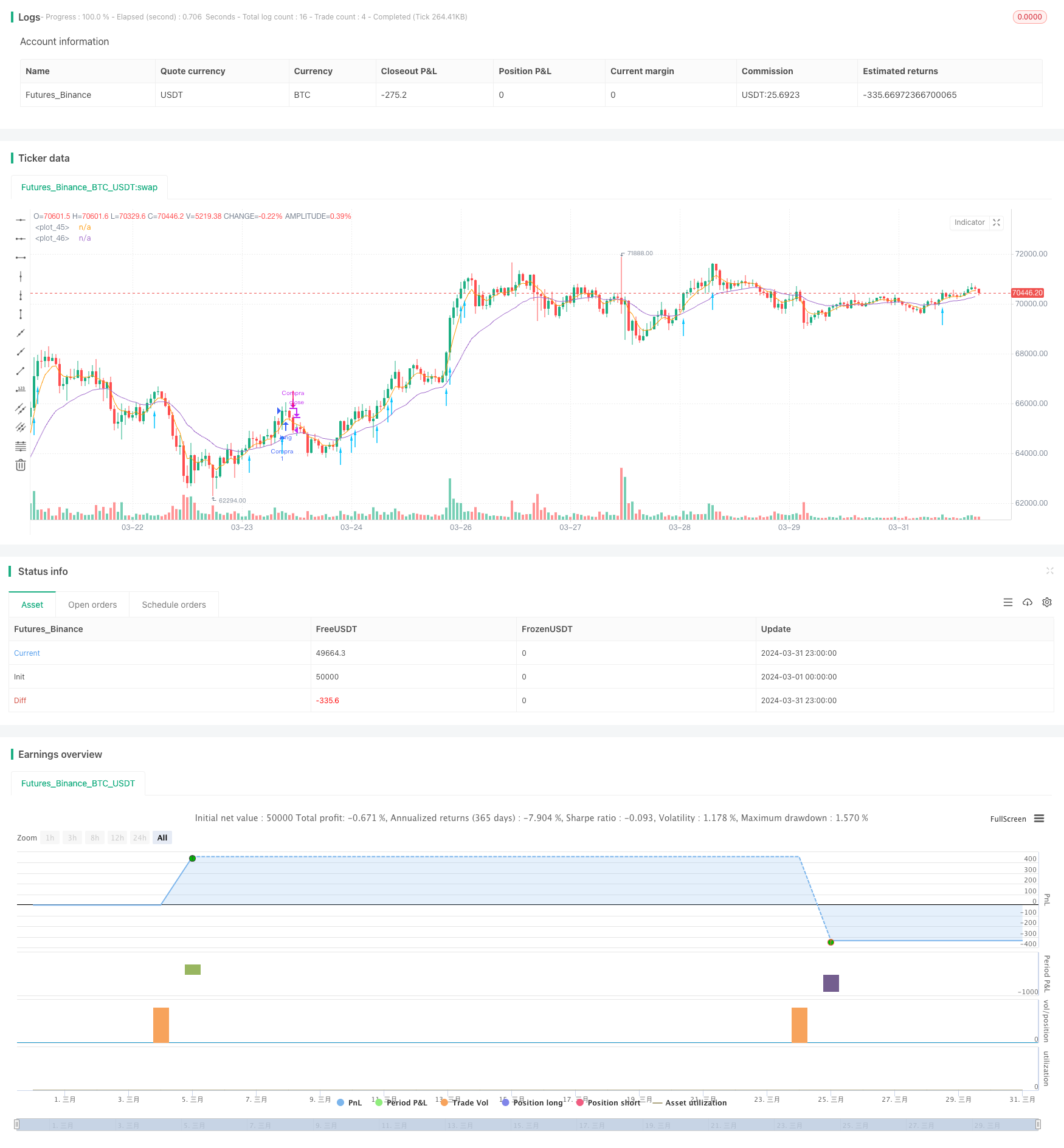

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © lhcbenac

//@version=5

strategy('Ruda_Strategy', overlay=true , initial_capital=5000 , pyramiding = 3, commission_type = strategy.commission.cash_per_contract , commission_value = 1 )

//

//

////////////////////////////////////////////////////////

// //

// //

// Otimizações //

// //

// //

////////////////////////////////////////////////////////

//

//

////////////////////////////////////////////////////////

// //

// //

// Codigo Operacional //

// //

// //

////////////////////////////////////////////////////////

//

//

// Indica situação de Compra ou Venda

// Condição True or False

YEAR_BT= input.int(1,title="Nº Anos ", group = "Backtest")

INPUT_ME1 = input.int(5,title="Momentum ", group = "RUDA")

INPUT_ME2 = input.int(21,title="Trend ", group = "RUDA")

INPUT_CORPO = input.int(50,title="CORPO ", group = "RUDA")/100

v_obv = ta.obv

v_med1 = ta.ema(close , INPUT_ME1)

v_med2 = ta.ema(close , INPUT_ME2)

valid_1 = v_med1 > v_med2

valid_2 = v_obv >= ta.highest(v_obv[1], 10)

valid_3 = math.abs(close - open) / (high-low) > INPUT_CORPO

plot(v_med1)

plot(v_med2)

compra = valid_1 and valid_2 and strategy.position_size == 0 and valid_3

var float v_minima_ref = na

dataInicio = timestamp(year(timenow) - YEAR_BT, month(timenow), dayofmonth(timenow), 00, 00)

// Variáveis globais

var float preco_entrada = na

var float preco_stop = na

if compra and time >= dataInicio and ta.change(time("D")) != 0 and ta.change(compra)

v_minima_ref := low

preco_entrada := open

preco_stop := math.min(low, open - 0.01 * open)

strategy.entry("Compra", strategy.long , stop = preco_stop )

if (not na(preco_entrada) and not na(preco_stop))

label.new(x=bar_index, y= low * 0.9, text= "Dia: " + str.tostring(dayofmonth) + "\nPreço de Entrada: " + str.tostring(preco_entrada) + "\nPreço de Stop Loss: " + str.tostring(preco_stop), style=label.style_label_up, color=color.green)

// Lógica de saída

// Saída no stop loss

if (not na(preco_stop) and low < preco_stop and ta.change(low) < 0)

strategy.close("Compra", comment="Saída no Stop")

// Saída no lucro

if (close < v_med1 and ta.change(close) < 0)

strategy.close("Compra", comment="Saída na Media")

venda =( (not na(preco_stop) and low < preco_stop and ta.change(low) < 0) or (close < v_med1 and ta.change(close) < 0) ) and strategy.position_size > 0

codiff = compra ? 1 : venda ? -1 : na

plotarrow(codiff, colorup=#00c3ff, colordown=#ff0062,title="Compra", maxheight=20, offset=0)

相关推荐