概述

该策略结合了VWAP(成交量加权平均价)和超级趋势指标。通过比较价格与VWAP的相对位置,以及超级趋势指标的方向,来判断买卖信号。当价格上穿VWAP且超级趋势为正时,产生买入信号;当价格下穿VWAP且超级趋势为负时,产生卖出信号。该策略还通过记录上一次的信号状态,避免产生重复信号,直到出现相反方向的信号为止。

策略原理

- 计算VWAP指标,使用ta.vwap函数,可以自定义VWAP的长度。

- 计算超级趋势指标,使用ta.supertrend函数,可以自定义ATR周期和乘数。

- 判断买入条件:当前价格上穿VWAP,且超级趋势方向为正。

- 判断卖出条件:当前价格下穿VWAP,且超级趋势方向为负。

- 记录上一次信号状态,避免连续出现同向信号。只有当前信号与上一次信号不同时,才会产生新的交易信号。

策略优势

- 结合了VWAP和超级趋势两个指标,可以更全面地判断市场趋势和潜在的转折点。

- VWAP指标考虑了成交量因素,能够更好地反映市场的真实走势。

- 超级趋势指标具有趋势追踪和过滤震荡的特点,有助于捕捉主要趋势。

- 通过避免重复信号的机制,可以减少交易频率,降低交易成本。

策略风险

- 在市场波动较大或趋势不明确时,该策略可能会产生较多的虚假信号。

- 策略的表现依赖于VWAP和超级趋势参数的选择,不同的参数设置可能导致不同的结果。

- 该策略没有考虑风险管理和仓位控制,实际应用时需要结合其他措施来控制风险。

策略优化方向

- 加入趋势确认机制,例如使用均线或者其他趋势指标,以进一步过滤信号。

- 优化参数选择,通过对历史数据进行回测,找到最佳的VWAP长度、ATR周期和乘数组合。

- 引入风险管理措施,如设置止损和止盈,控制单笔交易风险。

- 考虑加入资金管理策略,如固定比例或者凯利公式,以优化仓位大小。

总结

VWAP与超级趋势买卖策略通过结合两个不同类型的指标,力求全面捕捉市场趋势和潜在转折点。策略逻辑清晰,易于实现和优化。但是,该策略的表现依赖于参数选择,且缺乏风险管理措施。在实际应用中,需要进一步优化和完善,以适应不同的市场环境和交易需求。

策略源码

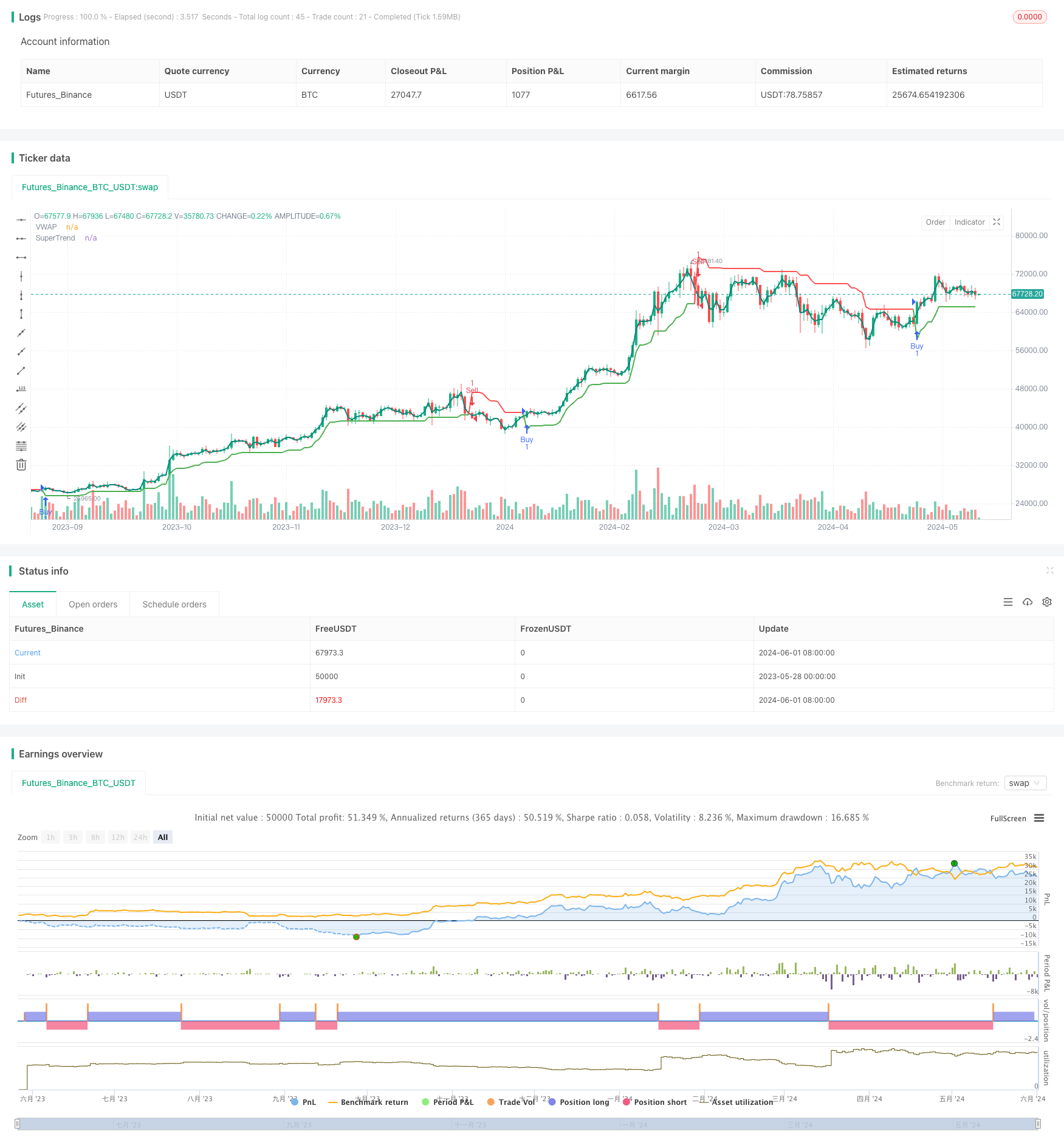

/*backtest

start: 2023-05-28 00:00:00

end: 2024-06-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="VWAP and Super Trend Buy/Sell Strategy", shorttitle="VWAPST", overlay=true)

//===== VWAP =====

showVWAP = input.bool(title="Show VWAP", defval=true, group="VWAP")

VWAPSource = input.source(title="VWAP Source", defval=hl2, group="VWAP")

VWAPrice = ta.vwap(VWAPSource)

plot(showVWAP ? VWAPrice : na, color=color.teal, title="VWAP", linewidth=2)

//===== Super Trend =====

showST = input.bool(true, "Show SuperTrend Indicator", group="Super Trend")

Period = input.int(title="ATR Period", defval=10, group="Super Trend")

Multiplier = input.float(title="ATR Multiplier", defval=2.0, group="Super Trend")

// Super Trend ATR

Up = hl2 - (Multiplier * ta.atr(Period))

Dn = hl2 + (Multiplier * ta.atr(Period))

var float TUp = na

var float TDown = na

TUp := na(TUp[1]) ? Up : close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

var int Trend = na

Trend := na(Trend[1]) ? 1 : close > TDown[1] ? 1 : close < TUp[1] ? -1 : Trend[1]

Tsl = Trend == 1 ? TUp : TDown

linecolor = Trend == 1 ? color.green : color.red

plot(showST ? Tsl : na, color=linecolor, style=plot.style_line, linewidth=2, title="SuperTrend")

// Buy/Sell Conditions

var bool previousBuysignal = false

var bool previousSellsignal = false

buysignal = not previousBuysignal and Trend == 1 and close > VWAPrice

sellsignal = not previousSellsignal and Trend == -1 and close < VWAPrice

// Ensure the signals are not repetitive

if (buysignal)

previousBuysignal := true

previousSellsignal := false

else if (sellsignal)

previousBuysignal := false

previousSellsignal := true

// Execute buy and sell orders

if (buysignal)

strategy.entry("Buy", strategy.long)

if (sellsignal)

strategy.entry("Sell", strategy.short)

// Plot Buy/Sell Labels

//plotshape(buysignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", textcolor=color.white, size=size.normal)

//plotshape(sellsignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", textcolor=color.white, size=size.normal)

相关推荐