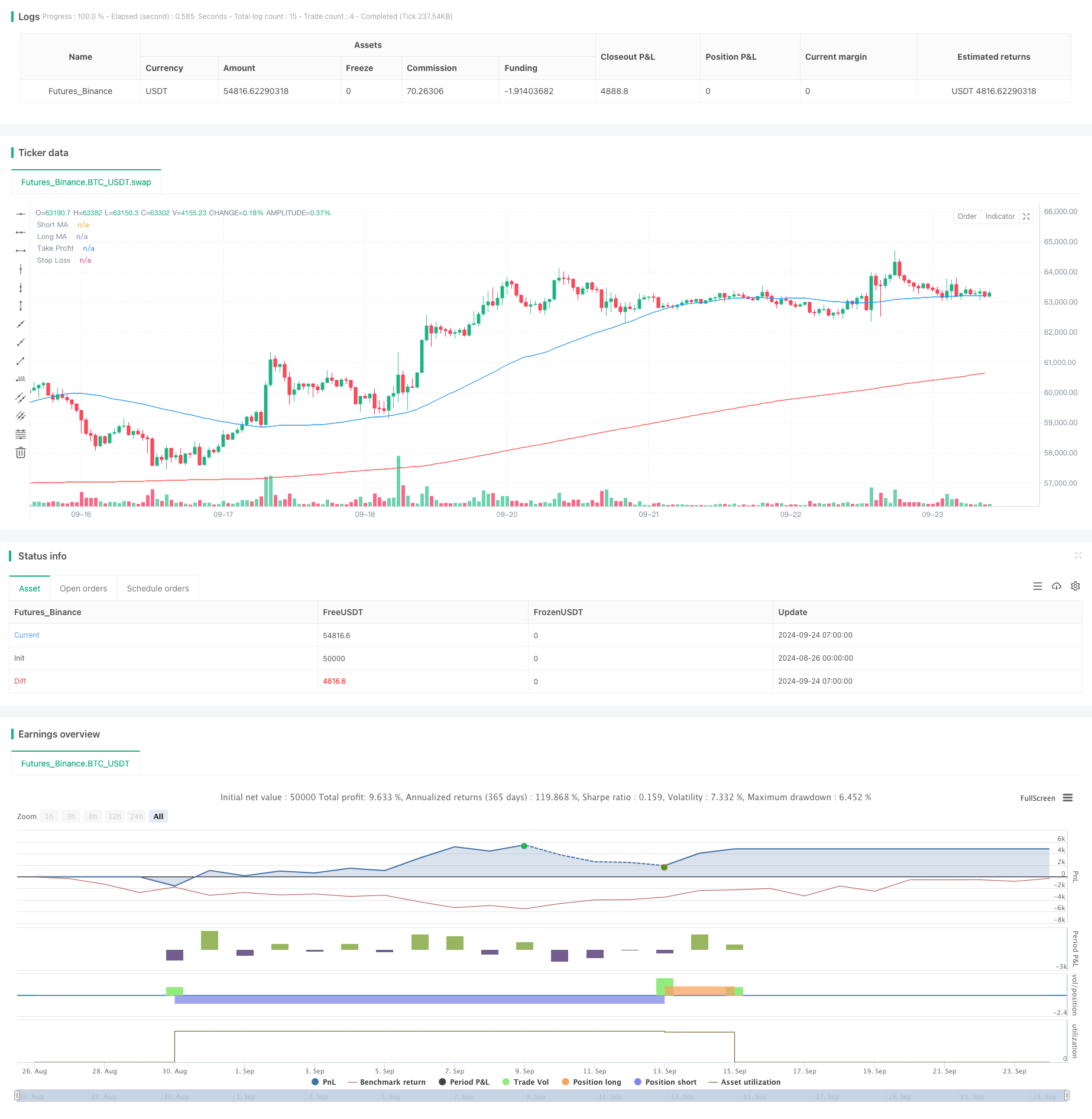

概述

本策略是一个基于双均线和通道的趋势跟踪系统。它利用短期和长期移动平均线的交叉信号,结合指数移动平均线(EMA)形成的通道,来捕捉市场趋势并进行交易。该策略同时适用于多头和空头市场,通过设置止损和止盈来管理风险和获利。

策略原理

策略的核心逻辑包括以下几个关键部分:

- 使用两条简单移动平均线(SMA)作为主要趋势指标,分别是55周期和300周期的SMA。

- 使用两条指数移动平均线(EMA)形成交易通道,分别是576周期和676周期的EMA。

- 当短期SMA上穿长期SMA或EMA时,触发做多信号;当短期SMA下穿长期SMA或EMA时,触发做空信号。

- 采用固定点数的止损和止盈策略,止损设置为入场价格的1/70,止盈设置为入场价格的1/140。

- 当盈利达到300点时,启动移动止损机制,以保护已获得的利润。

- 策略还包含了平仓条件,如当价格触及止损或止盈点位时自动平仓。

策略优势

- 多指标结合:通过结合多个移动平均线和EMA通道,增强了趋势判断的准确性。

- 双向交易:策略可以在多头和空头市场中都能获利,提高了资金利用效率。

- 风险管理:采用固定点数的止损和止盈,有效控制每笔交易的风险。

- 利润保护:使用移动止损机制,在趋势持续时锁定部分利润。

- 灵活性:策略参数可调整,适应不同市场条件。

策略风险

- 震荡市风险:在横盘震荡市场中,可能频繁触发假信号,导致连续亏损。

- 滑点风险:在高波动性市场中,实际成交价可能与理想价格有较大偏差。

- 过度交易:频繁的交易信号可能导致过高的交易成本。

- 参数敏感性:策略表现可能对参数设置高度敏感,不同市场环境可能需要频繁调整。

策略优化方向

- 引入波动率指标:考虑加入ATR(平均真实范围)来动态调整止损和止盈点位,以适应不同的市场波动情况。

- 增加趋势强度过滤:可以引入ADX(平均方向指数)来过滤弱趋势信号,减少假突破带来的损失。

- 优化入场时机:考虑结合RSI(相对强弱指标)或MACD(移动平均线趋同散度)来优化入场时机,提高胜率。

- 资金管理优化:实现动态仓位管理,根据账户净值和市场波动调整每次交易的资金比例。

- 回测周期扩展:对策略进行更长时间周期的回测,以验证其在不同市场环境下的稳定性。

总结

这个双均线通道趋势跟踪策略通过结合多个技术指标,提供了一个全面的交易系统。它不仅能够捕捉主要趋势,还具备风险管理和利润保护机制。虽然存在一些潜在风险,但通过持续优化和参数调整,该策略有潜力在各种市场条件下表现良好。未来的优化方向应该聚焦于提高信号质量、改进风险管理和增强策略的适应性。

策略源码

/*backtest

start: 2024-08-26 00:00:00

end: 2024-09-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RC BTC Vegas 5min free ", overlay=true )

// 定义输入参数

short_ma_length = input.int(55, title="Short MA Length")

long_ma_length = input.int(300, title="Long MA Length")

ema1_length = input.int(576, title="EMA 1 Length")

ema2_length = input.int(676, title="EMA 2 Length")

// 计算移动平均线

short_ma = ta.sma(close, short_ma_length)

long_ma = ta.sma(close, long_ma_length)

ema1 = ta.ema(close, ema1_length)

ema2 = ta.ema(close, ema2_length)

// 确定买入和卖出信号

enter_long = ta.crossover(short_ma +5 , ema1)

enter_long2 = ta.crossover(short_ma +5 , long_ma)

enter_long3 =ta.crossover(long_ma+5 , ema1)

exit_long = ta.crossunder(short_ma -5, ema1)

exit_long2 = ta.crossunder(short_ma -5, long_ma)

exit_long3 = ta.crossunder(long_ma-5 , ema1)

// 记录进场价格

var float long_stop_loss = na

var float long_take_profit = na

if (enter_long or exit_long )

long_stop_loss := close

if (enter_long or exit_long)

long_take_profit := close

// 根据进场价格计算止损和止盈点数

stop_loss_points = long_stop_loss /70

take_profit_points = long_take_profit /140

// 设置固定点数的止损和止

Along_stop_loss = close - stop_loss_points

Along_take_profit = close + take_profit_points

short_stop_loss = close + stop_loss_points

short_take_profit = close - take_profit_points

// 检查持仓利润是否达到300点

long_profit_target_reached = (strategy.position_size > 0 and (close - strategy.position_avg_price) >= take_profit_points)

short_profit_target_reached = (strategy.position_size < 0 and (strategy.position_avg_price - close) >= take_profit_points)

// 即时止损和止盈检查

long_stop_loss_hit = (strategy.position_size > 0 and close <= strategy.position_avg_price - stop_loss_points)

long_take_profit_hit = (strategy.position_size > 0 and close >= strategy.position_avg_price + take_profit_points)

short_stop_loss_hit = (strategy.position_size < 0 and close >= strategy.position_avg_price + stop_loss_points)

short_take_profit_hit = (strategy.position_size < 0 and close <= strategy.position_avg_price - take_profit_points)

// 上一根K棒的止盈止损检查

long_stop_loss_hit_prev = (strategy.position_size > 0 and low[1] <= strategy.position_avg_price - stop_loss_points)

long_take_profit_hit_prev = (strategy.position_size > 0 and high[1]>= strategy.position_avg_price + take_profit_points)

short_stop_loss_hit_prev = (strategy.position_size < 0 and high[1] >= strategy.position_avg_price + stop_loss_points)

short_take_profit_hit_prev = (strategy.position_size < 0 and low[1] <= strategy.position_avg_price - take_profit_points)

// 创建警报条件

alertcondition(long_stop_loss_hit, title="Long Stop Loss Hit", message="Long position stop loss hit")

alertcondition(long_take_profit_hit, title="Long Take Profit Hit", message="Long position take profit hit")

alertcondition(short_stop_loss_hit, title="Short Stop Loss Hit", message="Short position stop loss hit")

alertcondition(short_take_profit_hit, title="Short Take Profit Hit", message="Short position take profit hit")

// 移动止损输入

initialProfitLevel = input.float(9, title="Initial Profit Level (points)")

trailingStopIncrement = input.float(3, title="Trailing Stop Increment (points)")

if (close - long_take_profit >= 150)

strategy.exit("多單移平", from_entry="Buy", trail_price=close+5 , trail_offset=5 )

if (close - long_take_profit <= -150)

strategy.exit("空單移平", from_entry="Sell", trail_price=close-5 , trail_offset=5)

// 执行多单交易

if (enter_long or enter_long2 )

strategy.entry("Buy", strategy.long, qty=1 , comment = "做多")

if (long_stop_loss_hit or long_take_profit_hit )

strategy.close("Buy",comment = "多單平倉")

//死亡交叉才跟著做空就打開

if (exit_long or exit_long2 )

strategy.entry("Sell" ,strategy.short, qty=1 , comment = "做空")

// 执行空单交易

if ( short_take_profit_hit or short_stop_loss_hit )

strategy.close("Sell",comment = "空單平倉")

// 绘制移动平均线

plot(short_ma, title="Short MA", color=color.blue)

plot(long_ma, title="Long MA", color=color.red)

// 绘制进场和出场点

plotshape(series=enter_long, location=location.belowbar, color=color.green, style=shape.labelup, text="做多")

plotshape(series=exit_long , location=location.abovebar, color=color.red, style=shape.labeldown, text="做空")

plotshape(series=long_take_profit_hit , location=location.abovebar, color=color.yellow, style=shape.labeldown, text="多單止盈")

plotshape(series=short_take_profit_hit , location=location.abovebar, color=color.yellow, style=shape.labeldown, text="空單止盈")

plotshape(series=short_stop_loss_hit , location=location.abovebar, color=color.black, style=shape.labeldown, text="空單止損")

plotshape(series=long_stop_loss_hit , location=location.abovebar, color=color.black, style=shape.labeldown, text="多單止損")

// 绘制止盈和止损点

plot(series=enter_long ? Along_take_profit : na, title="Take Profit", color=color.green, linewidth=2, style=plot.style_linebr)

plot(series=enter_long ? Along_stop_loss : na, title="Stop Loss", color=color.red, linewidth=2, style=plot.style_linebr)

相关推荐