概述

本策略是一个结合了多周期指数移动平均线(EMA)和成交量加权平均价格(VWAP)的日内交易策略。它主要利用8周期和21周期EMA的交叉来产生交易信号,同时使用55周期EMA作为趋势过滤器,并结合VWAP来确认交易方向。策略还包含了固定百分比的止损和止盈设置,以及日内平仓机制,旨在实现高胜率和稳定的交易表现。

策略原理

信号生成:当8周期EMA上穿21周期EMA时,产生买入信号;当8周期EMA下穿21周期EMA时,产生卖出信号。

趋势过滤:使用55周期EMA作为趋势过滤器。只有当价格位于55周期EMA之上时,才执行多头交易;反之亦然。

VWAP确认:买入信号要求价格位于VWAP之上,卖出信号要求价格位于VWAP之下,这有助于确保交易方向与大资金流向一致。

风险管理:策略采用0.5%的固定百分比止损和1.5%的固定百分比止盈,以控制每笔交易的风险。

日内交易:所有持仓在每个交易日结束前平仓,避免隔夜风险。

策略优势

多重确认机制:结合了短期、中期和长期EMA,以及VWAP,提高了交易信号的可靠性。

趋势跟随:通过55周期EMA的趋势过滤,确保交易方向与主趋势一致。

风险控制:固定百分比的止损和止盈设置,有效控制每笔交易的风险。

灵活性:策略参数可根据不同市场和交易品种进行调整。

日内交易:避免了隔夜持仓风险,适合风险承受能力较低的交易者。

策略风险

频繁交易:EMA交叉可能导致过度交易,增加手续费成本。

滞后性:EMA本质上是滞后指标,在剧烈波动的市场中可能产生滞后信号。

假突破:在横盘市场中,可能出现频繁的假突破信号。

固定止损:在高波动性市场中,固定百分比止损可能导致过早被触发。

依赖历史数据:策略效果可能受到过度拟合的影响,在未来市场中表现可能不如回测结果。

策略优化方向

动态参数:可以考虑根据市场波动性动态调整EMA周期和VWAP计算周期。

增加过滤器:引入其他技术指标如RSI或MACD作为额外的过滤条件,减少假信号。

自适应止损:根据市场波动性动态调整止损幅度,如使用ATR(平均真实波幅)来设置止损。

交易时间过滤:避开开盘和收盘前的高波动时段,可能有助于提高策略稳定性。

加入基本面因素:结合重要经济数据发布或公司财报等事件,优化交易决策。

总结

该多周期EMA交叉结合VWAP的高胜率日内交易策略,通过结合多个技术指标和严格的风险管理,旨在捕捉日内趋势性机会。策略的核心优势在于多重确认机制和严格的风险控制,但同时也面临着过度交易和信号滞后等挑战。未来的优化方向可以集中在参数动态调整、增加额外过滤条件以及引入更复杂的风险管理机制上。交易者在使用此策略时,需要根据具体交易品种和市场环境进行适当的参数调整和回测,以确保策略在实盘交易中的稳定性和盈利能力。

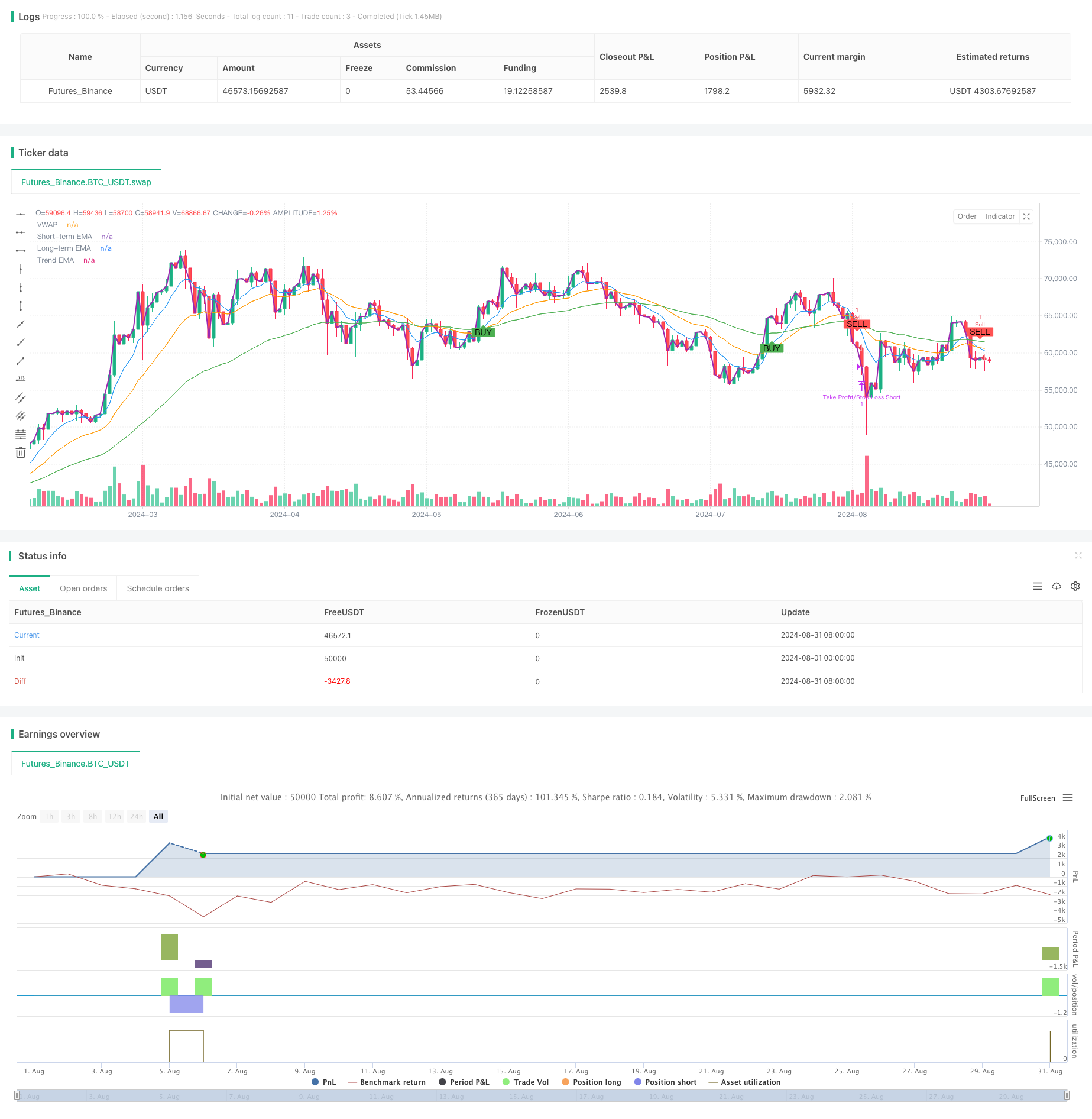

/*backtest

start: 2024-08-01 00:00:00

end: 2024-08-31 23:59:59

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("High Win Rate EMA VWAP Strategy with Alerts", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Inputs

emaShort = input.int(8, title="Short-term EMA", minval=1)

emaLong = input.int(21, title="Long-term EMA", minval=1)

emaTrend = input.int(55, title="Trend EMA", minval=1)

stopLossPerc = input.float(0.5, title="Stop Loss Percentage", minval=0.1, step=0.1)

takeProfitPerc = input.float(1.5, title="Take Profit Percentage", minval=0.1, step=0.1)

// Calculate EMAs and VWAP

shortEMA = ta.ema(close, emaShort)

longEMA = ta.ema(close, emaLong)

trendEMA = ta.ema(close, emaTrend)

vwap = ta.vwap(close)

// Trend Filter: Only trade in the direction of the trend

isBullishTrend = close > trendEMA

isBearishTrend = close < trendEMA

// Generate Buy and Sell Signals with Trend Confirmation

buySignal = ta.crossover(shortEMA, longEMA) and close > vwap and isBullishTrend

sellSignal = ta.crossunder(shortEMA, longEMA) and close < vwap and isBearishTrend

// Strategy Execution

if (buySignal and strategy.opentrades == 0)

strategy.entry("Buy", strategy.long, qty=1)

if (sellSignal and strategy.opentrades == 0)

strategy.entry("Sell", strategy.short, qty=1)

// Stop Loss and Take Profit (Signal-Based)

if (strategy.position_size > 0) // Long position

strategy.exit("Take Profit/Stop Loss Long", from_entry="Buy", stop=strategy.position_avg_price * (1 - stopLossPerc / 100), limit=strategy.position_avg_price * (1 + takeProfitPerc / 100))

if (strategy.position_size < 0) // Short position

strategy.exit("Take Profit/Stop Loss Short", from_entry="Sell", stop=strategy.position_avg_price * (1 + stopLossPerc / 100), limit=strategy.position_avg_price * (1 - takeProfitPerc / 100))

// Close All Trades at End of Day

if (hour == 15 and minute == 59) // Adjust this time according to your market's closing time

strategy.close("Buy")

strategy.close("Sell")

// Plot Buy/Sell Signals on the chart

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot the EMAs and VWAP

plot(shortEMA, color=color.blue, title="Short-term EMA")

plot(longEMA, color=color.orange, title="Long-term EMA")

plot(trendEMA, color=color.green, title="Trend EMA")

plot(vwap, color=color.purple, title="VWAP", linewidth=2)

// Alert Conditions

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Triggered")