概述

该策略是一个结合了相对强弱指标(RSI)、移动平均线趋同散度指标(MACD)、布林带(BB)和成交量(Volume)分析的综合交易系统。策略通过多维度技术指标的协同配合,在市场趋势、波动性和成交量等方面进行全方位分析,从而找出最佳的交易机会。

策略原理

策略的核心逻辑基于以下几个方面: 1. 使用RSI(14)判断市场超买超卖状态,RSI低于30视为超卖 2. 利用MACD(12,26,9)判断趋势方向,MACD金叉作为做多信号 3. 通过计算上升成交量与下降成交量之差(Delta Volume)来确认价格走势的有效性 4. 结合布林带来评估价格波动性,用于优化入场时机 5. 在满足RSI超卖、MACD金叉且Delta Volume为正的情况下,系统会发出最佳买入信号 6. 当MACD死叉或RSI超过60时,系统会自动平仓以控制风险

策略优势

- 多指标交叉验证提高了交易信号的可靠性

- 通过成交量分析来确认价格趋势的有效性

- 包含自适应的移动平均线类型选择,增强了策略的灵活性

- 具有完善的风险控制机制,包括止损和止盈设置

- 策略参数可根据不同市场情况进行优化调整

策略风险

- 多指标组合可能导致信号滞后

- 在横盘市场中可能产生虚假信号

- 参数优化过度可能导致过拟合

- 高频交易可能带来较高的交易成本

- 市场剧烈波动时可能造成较大回撤

策略优化方向

- 引入自适应参数机制,根据市场状态动态调整指标参数

- 增加趋势强度过滤器,减少横盘市场的虚假信号

- 优化止损止盈机制,提高资金利用效率

- 加入波动率过滤机制,在高波动率环境下调整仓位

- 开发智能资金管理系统,实现动态仓位控制

总结

这是一个融合多个技术指标的复合型交易策略,通过RSI、MACD、成交量等多维度分析来捕捉市场机会。策略具有较强的适应性和可扩展性,同时也有完善的风险控制机制。通过持续优化和改进,该策略有望在不同市场环境下保持稳定的表现。

策略源码

/*backtest

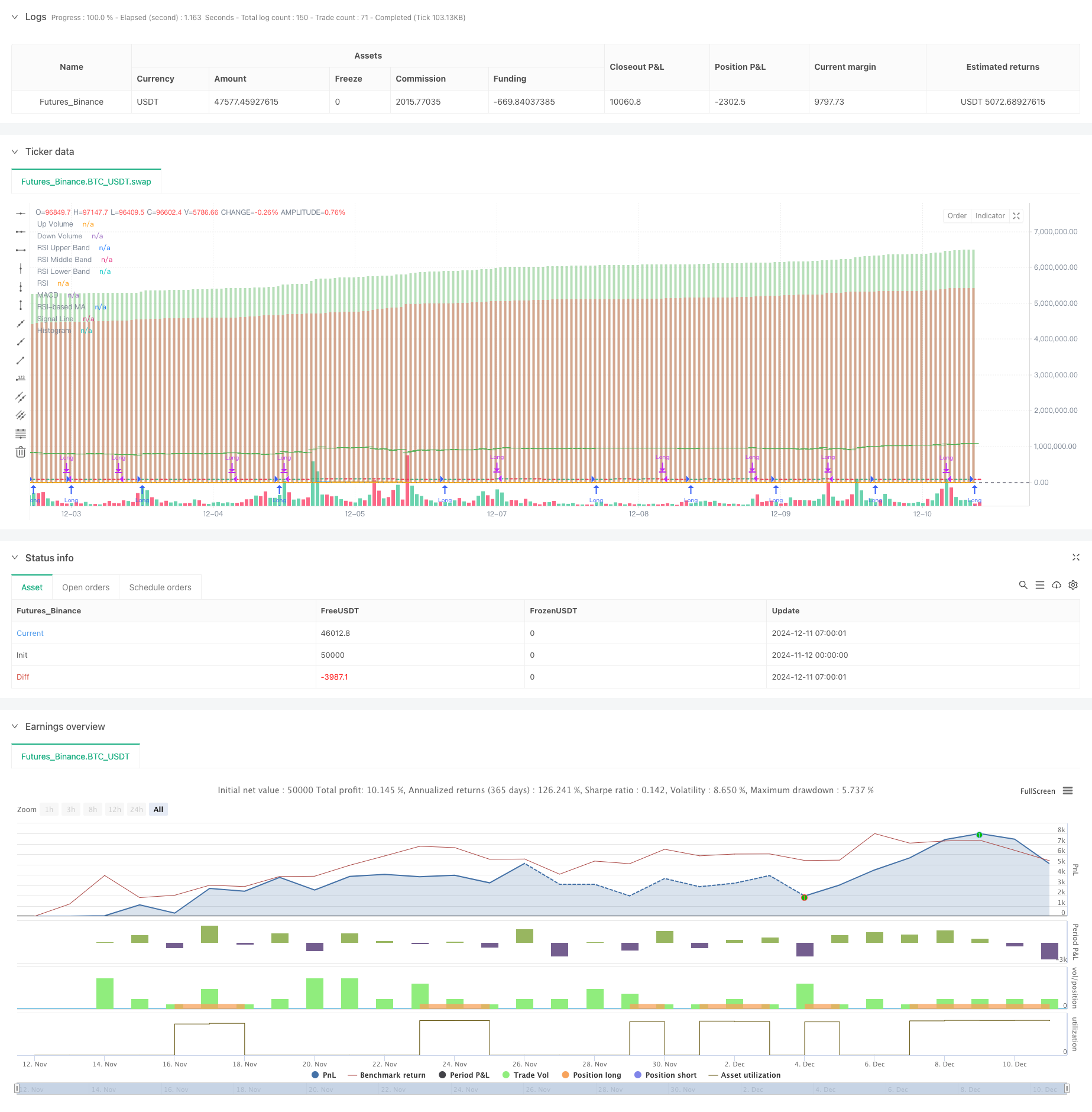

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Liraz sh Strategy - RSI MACD Strategy with Bullish Engulfing and Net Volume", overlay=true, currency=currency.NONE, initial_capital=100000, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Input parameters

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "RSI Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

fastLength = input.int(12, minval=1, title="MACD Fast Length")

slowLength = input.int(26, minval=1, title="MACD Slow Length")

signalLength = input.int(9, minval=1, title="MACD Signal Length")

startDate = input(timestamp("2018-01-01"), title="Start Date")

endDate = input(timestamp("2069-12-31"), title="End Date")

// Custom Up and Down Volume Calculation

var float upVolume = 0.0

var float downVolume = 0.0

if close > open

upVolume += volume

else if close < open

downVolume += volume

delta = upVolume - downVolume

plot(upVolume, "Up Volume", style=plot.style_columns, color=color.new(color.green, 60))

plot(downVolume, "Down Volume", style=plot.style_columns, color=color.new(color.red, 60))

plotchar(delta, "Delta", "—", location.absolute, color=delta > 0 ? color.green : color.red)

// MA function

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// RSI calculation

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

// MACD calculation

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

macd = fastMA - slowMA

signalLine = ta.sma(macd, signalLength)

hist = macd - signalLine

// Bullish Engulfing Pattern Detection

bullishEngulfingSignal = open[1] > close[1] and close > open and close >= open[1] and close[1] >= open and (close - open) > (open[1] - close[1])

barcolor(bullishEngulfingSignal ? color.yellow : na)

// Plotting RSI and MACD

plot(rsi, "RSI", color=#7E57C2)

plot(rsiMA, "RSI-based MA", color=color.yellow)

hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

hline(30, "RSI Lower Band", color=#787B86)

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title="Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title="Lower Bollinger Band", color=color.green)

plot(macd, title="MACD", color=color.blue)

plot(signalLine, title="Signal Line", color=color.orange)

plot(hist, title="Histogram", style=plot.style_histogram, color=color.gray)

// Best time to buy condition

bestBuyCondition = rsi < 30 and ta.crossover(macd, signalLine) and delta > 0

// Plotting the best buy signal line

var line bestBuyLine = na

if (bestBuyCondition )

bestBuyLine := line.new(bar_index[1], close[1], bar_index[0], close[0], color=color.white)

// Strategy logic

longCondition = (ta.crossover(macd, signalLine) or bullishEngulfingSignal) and rsi < 70 and delta > 0

if (longCondition )

strategy.entry("Long", strategy.long)

// Reflexive exit condition: Exit if MACD crosses below its signal line or if RSI rises above 60

exitCondition = ta.crossunder(macd, signalLine) or (rsi > 60 and strategy.position_size > 0)

if (exitCondition )

strategy.close("Long")

相关推荐