概述

这是一个基于威廉指标(Williams %R)和相对强弱指数(RSI)双重动量突破确认的量化交易策略。该策略通过观察两个动量指标的交叉突破来确认交易信号,有效降低了假突破带来的风险。策略在超买超卖区域寻找交易机会,通过两个指标的共同确认来提高交易的准确性。

策略原理

策略使用30周期的Williams %R和7周期的RSI作为主要指标。当Williams %R向上突破-80且RSI同时向上突破20时,触发做多信号;当Williams %R向下突破-20且RSI同时向下突破80时,触发做空信号。这种双重确认机制能够有效过滤掉单一指标可能产生的虚假信号。策略在编程实现上采用了手动计算Williams %R的方式,通过计算周期内的最高价和最低价来得到更精确的指标值。

策略优势

- 双重确认机制显著提高了交易信号的可靠性

- 超买超卖区域的交易具有较高的胜率和盈利潜力

- 指标参数可根据不同市场情况灵活调整

- 策略逻辑简单清晰,易于理解和维护

- 手动计算指标值提供了更大的优化空间

策略风险

- 在震荡市场中可能产生过多交易信号

- 双重确认机制可能导致入场时机略有滞后

- 固定的超买超卖阈值在不同市场环境下可能需要调整

- 短周期RSI可能对价格波动较为敏感

- 需要考虑交易成本对策略收益的影响

策略优化方向

- 引入趋势过滤器,在强趋势市场中避免反趋势交易

- 添加移动止损机制以保护既有利润

- 开发自适应的超买超卖阈值计算方法

- 优化Williams %R和RSI的周期参数组合

- 考虑加入成交量指标作为辅助确认信号

总结

该策略通过Williams %R和RSI的协同作用,构建了一个稳健的交易系统。双重动量确认机制有效降低了假信号风险,超买超卖区域的交易具有良好的盈利潜力。通过合理的风险控制和持续优化,策略可以在不同市场环境下保持稳定表现。

策略源码

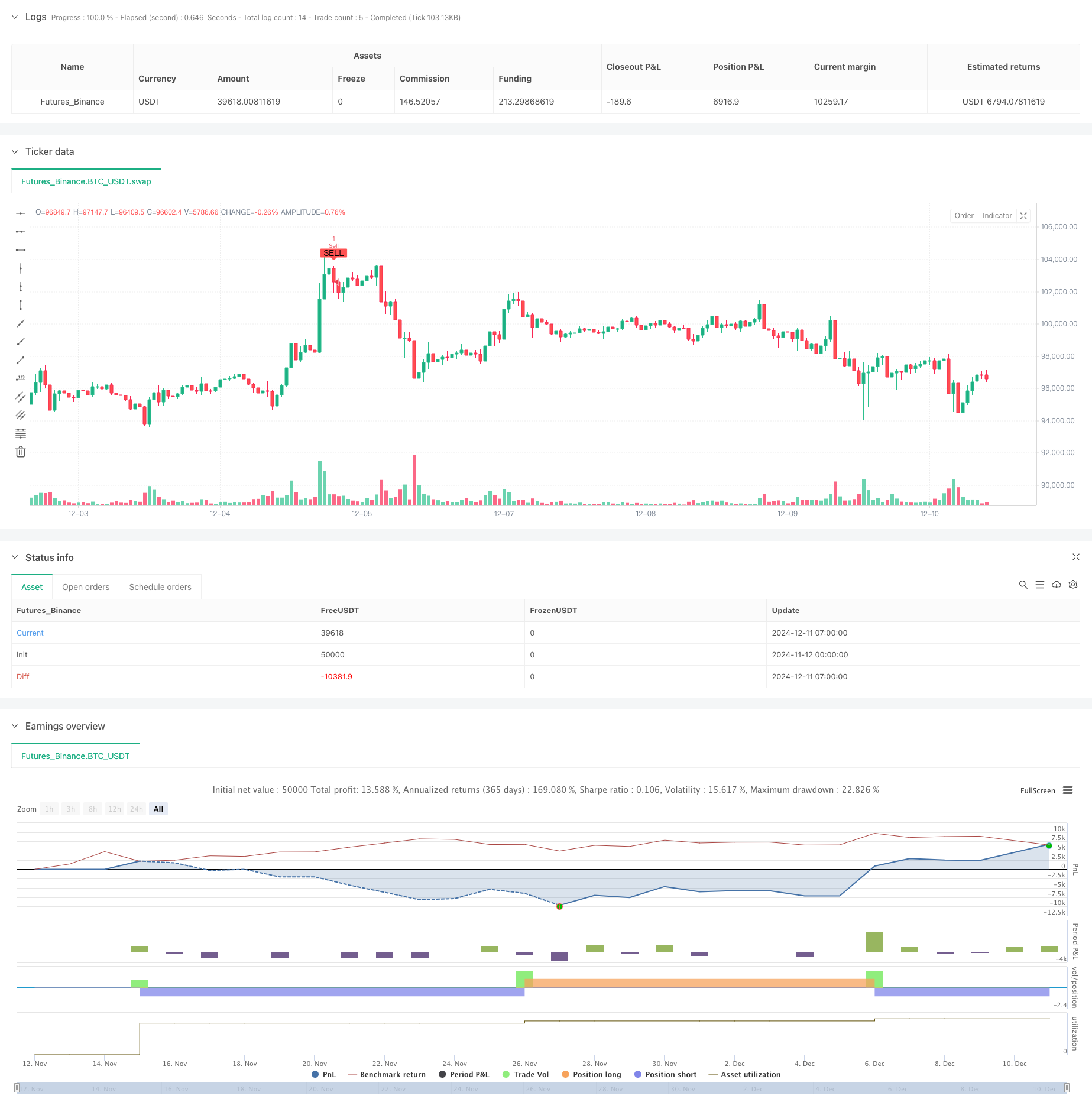

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Williams %R + RSI Strategy", overlay=true)

// Inputs for Williams %R

wpr_length = input.int(30, title="Williams %R Length", minval=1)

wpr_upper = input.int(-20, title="Williams %R Upper Band", minval=-100, maxval=0)

wpr_lower = input.int(-80, title="Williams %R Lower Band", minval=-100, maxval=0)

// Inputs for RSI

rsi_length = input.int(7, title="RSI Length", minval=1)

rsi_upper = input.int(80, title="RSI Upper Band", minval=0, maxval=100)

rsi_lower = input.int(20, title="RSI Lower Band", minval=0, maxval=100)

// Calculate Williams %R Manually

highest_high = ta.highest(high, wpr_length)

lowest_low = ta.lowest(low, wpr_length)

wpr = ((highest_high - close) / (highest_high - lowest_low)) * -100

// Calculate RSI

rsi = ta.rsi(close, rsi_length)

// Entry and Exit Conditions

longCondition = ta.crossover(wpr, wpr_lower) and ta.crossover(rsi, rsi_lower)

shortCondition = ta.crossunder(wpr, wpr_upper) and ta.crossunder(rsi, rsi_upper)

// Plot Buy/Sell Signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy Entry and Exit

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

相关推荐