概述

该策略是一个基于KDJ指标的高级交易系统,通过对K线、D线和J线的交叉形态进行深度分析来捕捉市场趋势。策略集成了自定义的BCWSMA平滑算法,通过对随机指标的优化计算提高了信号的可靠性。系统采用了严格的风险控制机制,包括止损和移动止损功能,以实现稳健的资金管理。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用自定义的BCWSMA(加权移动平均)算法计算KDJ指标,提高了指标的平滑性和稳定性 2. 通过RSV(未成熟随机值)的计算,将价格转化为0-100区间的数值,更好地反映价格在高低点之间的位置 3. 设计了独特的J线与J5线(衍生指标)交叉验证机制,通过多重确认提高交易信号的准确性 4. 建立了基于持续性的趋势确认机制,要求J线连续3天保持在D线上方才确认趋势的有效性 5. 集成了百分比止损和移动止损的复合风险控制系统

策略优势

- 信号生成机制先进:通过多重技术指标交叉验证,显著降低了虚假信号的影响

- 风险控制完善:采用多层次的风险控制机制,包括固定止损和移动止损,有效控制下行风险

- 参数可调性强:关键参数如KDJ周期、信号平滑系数等都可根据市场情况灵活调整

- 计算效率高:使用优化的BCWSMA算法,降低了计算复杂度,提高了策略执行效率

- 适应性好:可以适应不同的市场环境,通过参数调整优化策略表现

策略风险

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假突破信号,增加交易成本

- 滞后性风险:由于使用了均线平滑处理,信号可能出现一定程度的滞后

- 参数敏感性:策略效果对参数设置较为敏感,不当的参数设置可能导致策略效果显著降低

- 市场环境依赖:在某些特定市场环境下,策略表现可能不够理想

策略优化方向

- 信号过滤机制优化:可以引入成交量、波动率等辅助指标,提高信号的可靠性

- 动态参数调整:根据市场波动情况动态调整KDJ参数和止损参数

- 市场环境识别:增加市场环境判断模块,在不同市场环境下采用不同的交易策略

- 风险控制增强:可以添加最大回撤控制、持仓时间限制等额外的风险控制手段

- 性能优化:进一步优化BCWSMA算法,提高计算效率

总结

该策略通过创新的技术指标组合和严格的风险控制,构建了一个完整的交易系统。策略的核心优势在于多重信号确认机制和完善的风险控制体系,但也需要注意参数优化和市场环境适应性的问题。通过持续优化和改进,策略有望在不同市场环境下都能保持稳定的表现。

策略源码

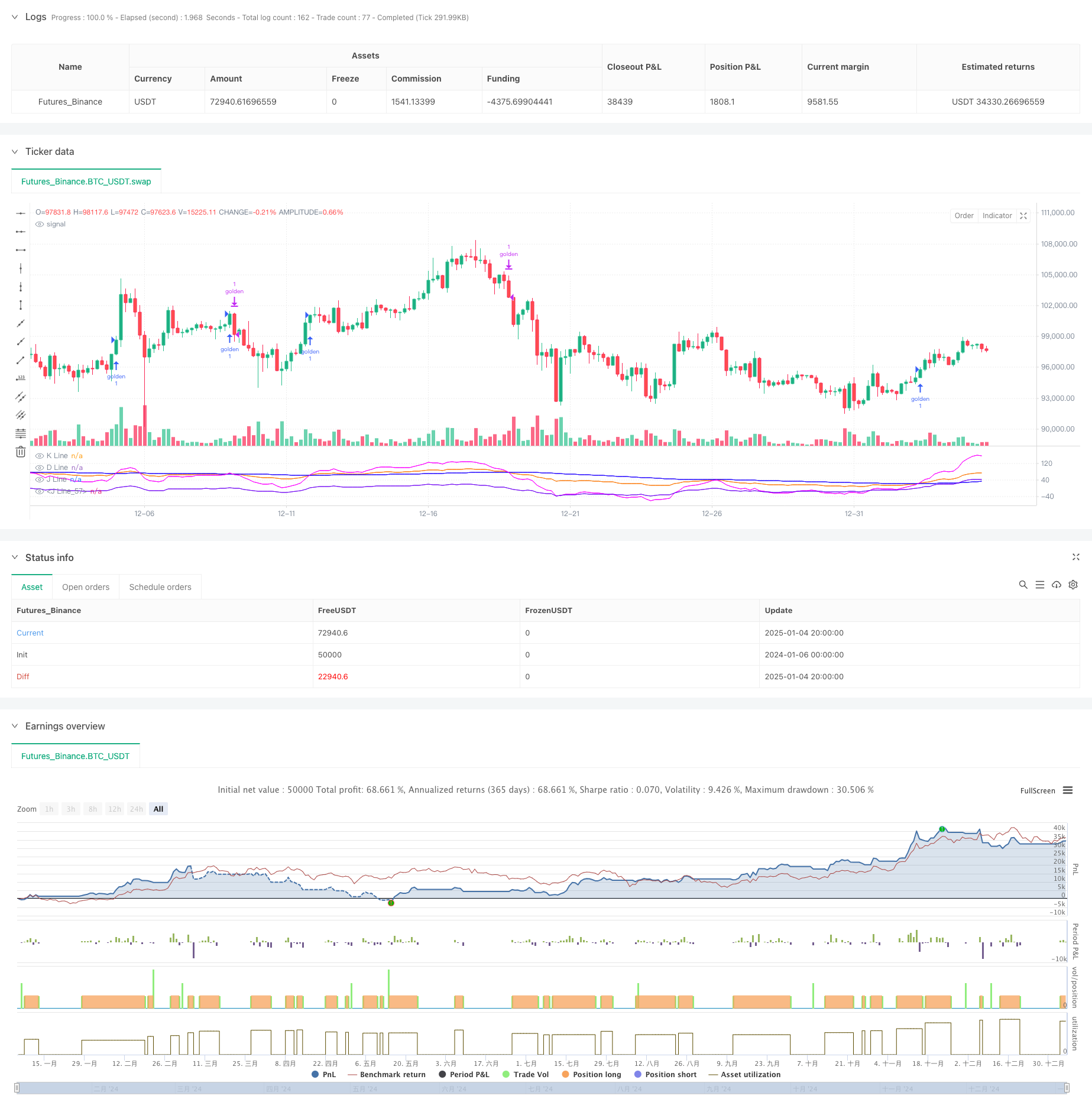

/*backtest

start: 2024-01-06 00:00:00

end: 2025-01-05 00:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hexu90

//@version=6

// Date Range

// STEP 1. Create inputs that configure the backtest's date range

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 Jan 2020"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("15 Dec 2024"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

// STEP 2. See if current bar falls inside the date range

inTradeWindow = true

//KDJ strategy

// indicator("My Customized KDJ", shorttitle="KDJ")

strategy("My KDJ Strategy", overlay = false)

// Input parameters

ilong = input(90, title="Period")

k_isig = input(3, title="K Signal")

d_isig = input(30, title="D Signal")

// Custom BCWSMA calculation outside the function

bcwsma(source, length, weight) =>

var float prev = na // Persistent variable to store the previous value

if na(prev)

prev := source // Initialize on the first run

prev := (weight * source + (length - weight) * prev) / length

prev

// Calculate KDJ

c = close

h = ta.highest(high, ilong)

l = ta.lowest(low, ilong)

RSV = 100 * ((c - l) / (h - l))

pK = bcwsma(RSV, k_isig, 1)

pD = bcwsma(pK, d_isig, 1)

pJ = 3 * pK - 2 * pD

pJ1 = 0

pJ2 = 80

pJ5 = (pJ-pK)-(pK-pD)

// Plot the K, D, J lines with colors

plot(pK, color=color.rgb(251, 121, 8), title="K Line") // Orange

plot(pD, color=color.rgb(30, 0, 255), title="D Line") // Blue

plot(pJ, color=color.new(color.rgb(251, 0, 255), 10), title="J Line") // Pink with transparency

plot(pJ5, color=#6f03f3e6, title="J Line") // Pink with transparency

// Background color and reference lines

// bgcolor(pJ > pD ? color.new(color.green, 75) : color.new(color.red, 75))

// hline(80, "Upper Band", color=color.gray)

// hline(20, "Lower Band", color=color.gray)

// Variables to track the conditions

var bool condition1_met = false

var int condition2_met = 0

// Condition 1: pJ drops below pJ5

if ta.crossunder(pJ, pJ5)

condition1_met := true

condition2_met := 0 // Reset condition 2 if pJ drops below pJ5 again

if ta.crossover(pJ, pD)

condition2_met += 1

to_long = ta.crossover(pJ, pD)

var int consecutiveDays = 0

// Update the count of consecutive days

if pJ > pD

consecutiveDays += 1

else

consecutiveDays := 0

// Check if pJ has been above pD for more than 3 days

consPJacrossPD = false

if consecutiveDays > 3

consPJacrossPD := true

// Entry condition: After condition 2, pJ crosses above pD a second time

// if condition1_met and condition2_met > 1

// strategy.entry("golden", strategy.long, qty=1000)

// condition1_met := false // Reset the conditions for a new cycle

// condition2_met = 0

//

if ta.crossover(pJ, pD)

// and pD < 40 and consPJacrossPD

// consecutiveDays == 1

// consecutiveDays == 3 and

strategy.entry("golden", strategy.long, qty=1)

// to_short =

// or ta.crossunder(pJ, 100)

// Exit condition

if ta.crossover(pD, pJ)

strategy.close("golden", qty = 1)

// Stop loss and trailing profit

trail_stop_pct = input.float(0.5, title="Trailing Stop activation (%)", group="Exit Lonng", inline="LTS", tooltip="Trailing Treshold %")

trail_offset_pct = input.float(0.5, title="Trailing Offset (%)", group="Exit Lonng", inline="LTS", tooltip="Trailing Offset %")

trail_stop_tick = trail_stop_pct * close/100

trail_offset_tick = trail_offset_pct * close/100

sl_pct = input.float(5, title="Stop Loss", group="SL and TP", inline="LSLTP")

// tp_pct = input.float(9, title="Take Profit", group="SL and TP", inline="LSLTP")

long_sl_price = strategy.position_avg_price * (1 - sl_pct/100)

// long_tp_price = strategy.position_avg_price * (1 + tp_pct/100)

strategy.exit('golden Exit', 'golden', stop = long_sl_price)

// trail_points = trail_stop_tick, trail_offset=trail_offset_tick

相关推荐