概述

本策略是一个基于双均线通道的动态趋势跟踪系统,结合了风险管理机制。该策略使用两条简单移动平均线(SMA)构建交易通道,其中上轨采用最高价计算的移动平均线,下轨采用最低价计算的移动平均线。系统通过连续五根K线收盘价突破上轨作为入场信号,通过连续五根K线收盘价跌破下轨或从最高点回撤25%作为出场信号,实现对趋势的动态跟踪和风险控制。

策略原理

策略的核心原理是通过双均线通道捕捉价格趋势,并建立严格的入场和出场机制: 1. 入场机制:要求价格连续五天保持在上轨之上,确保趋势的持续性和有效性 2. 出场机制:分为两个层面 - 趋势背离出场:当价格连续五天跌破下轨,表明趋势可能发生逆转 - 止损出场:当价格从最高点回撤25%时触发止损,防止过度损失 3. 仓位管理:采用账户总值的固定比例进行开仓,实现资金的有效配置

策略优势

- 趋势跟踪的稳定性:通过要求连续五天的突破确认,过滤掉假突破信号

- 风险控制的完整性:结合趋势背离和止损机制,构建双重保护

- 参数灵活可调:均线周期和止损比例可根据不同市场特征进行优化

- 执行逻辑清晰:入场和出场条件明确,减少主观判断带来的干扰

- 资金管理科学:采用账户比例仓位,而非固定手数,更好地控制风险

策略风险

- 震荡市场风险:在横盘震荡市场容易产生虚假信号,导致频繁交易

- 滑点风险:在快速行情中,止损执行价格可能与预期有较大偏差

- 参数依赖:不同市场环境下最优参数可能存在较大差异

- 趋势延迟:由于使用移动平均线,在趋势转折点存在一定滞后性

- 资金效率:持仓条件较为严格,可能错过部分盈利机会

策略优化方向

- 动态参数优化:开发自适应参数系统,根据市场波动率自动调整均线周期

- 市场环境过滤:增加趋势强度指标,在震荡市场自动降低交易频率

- 多时间周期确认:增加更长周期的趋势确认机制,提高信号可靠性

- 止损优化:引入动态止损机制,根据波动率自动调整止损比例

- 仓位管理优化:基于波动率和盈亏比动态调整开仓比例

总结

该策略通过双均线通道构建了一个完整的趋势跟踪交易系统,结合严格的入场确认和双重出场机制,实现了对趋势的有效跟踪和风险的有效控制。策略的优势在于执行逻辑清晰、风险控制完善,但仍需要针对不同市场环境进行参数优化,并可以通过增加市场环境过滤、多时间周期确认等方式进行进一步改进。整体而言,这是一个结构完整、逻辑严密的量化交易策略,适合在趋势明显的市场环境中应用。

策略源码

/*backtest

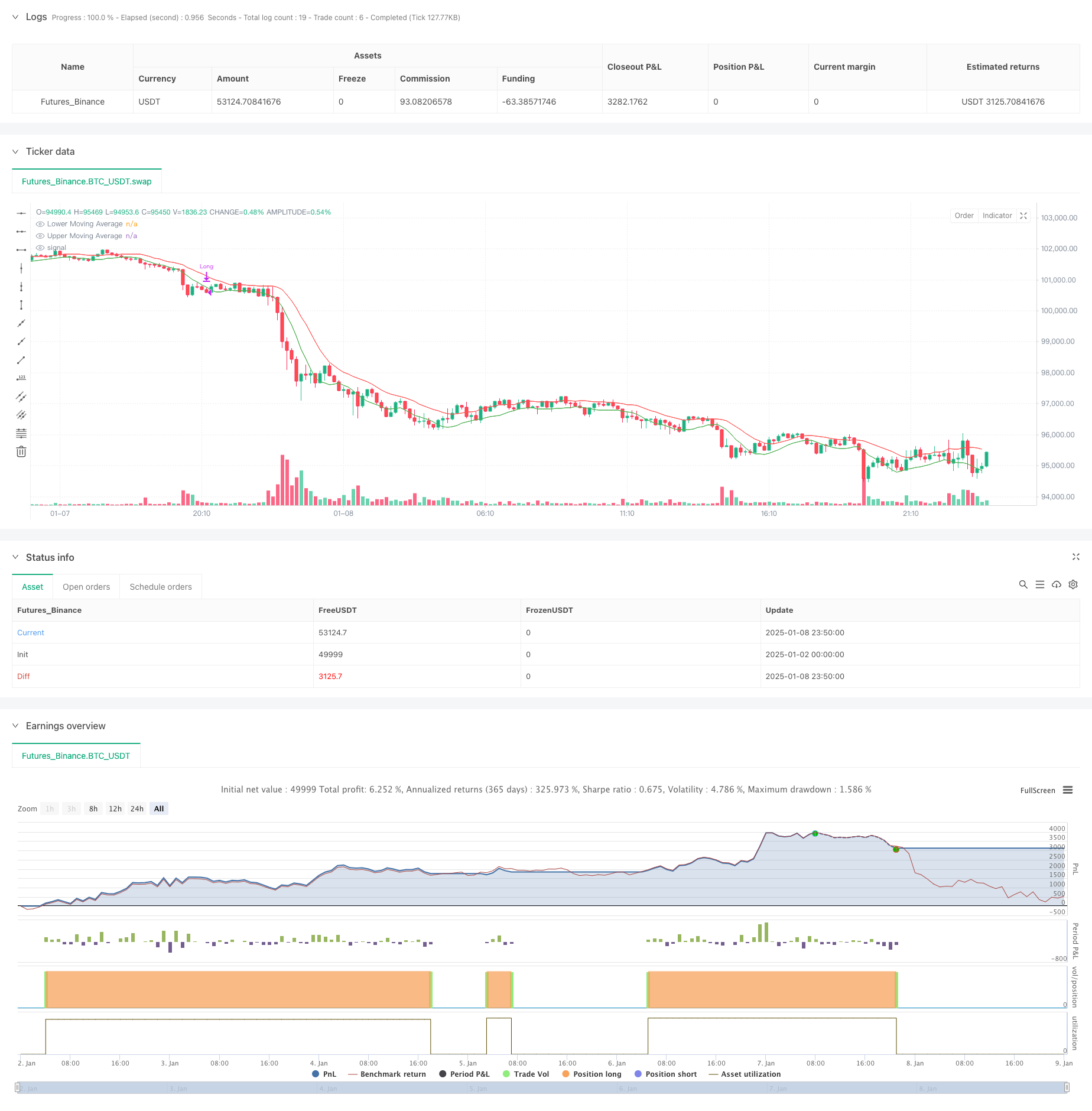

start: 2025-01-02 00:00:00

end: 2025-01-09 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Moving Average Channel (MAC)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Parameters for Moving Averages

upperMALength = input.int(10, title="Upper MA Length")

lowerMALength = input.int(8, title="Lower MA Length")

stopLossPercent = input.float(25.0, title="Stop Loss (%)", minval=0.1) / 100

// Calculate Moving Averages

upperMA = ta.sma(high, upperMALength)

lowerMA = ta.sma(low, lowerMALength)

// Plot Moving Averages

plot(upperMA, color=color.red, title="Upper Moving Average")

plot(lowerMA, color=color.green, title="Lower Moving Average")

// Initialize variables

var int upperCounter = 0

var int lowerCounter = 0

var float entryPrice = na

var float highestPrice = na

// Update counters based on conditions

if (low <= upperMA)

upperCounter := 0

else

upperCounter += 1

if (high >= lowerMA)

lowerCounter := 0

else

lowerCounter += 1

// Entry condition: 5 consecutive bars above the Upper MA

if (upperCounter == 5 and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

highestPrice := high // Initialize highest price

// Update the highest price after entry

if (strategy.position_size > 0)

highestPrice := na(highestPrice) ? high : math.max(highestPrice, high)

// Exit condition: 5 consecutive bars below the Lower MA

if (lowerCounter == 5 and strategy.position_size > 0)

strategy.close("Long", comment="Exit: 5 bars below Lower MA")

// Stop-loss condition: Exit if market closes below 25% of the highest price since entry

stopLossCondition = low < highestPrice * (1 - stopLossPercent)

if (stopLossCondition and strategy.position_size > 0)

strategy.close("Long", comment="Exit: Stop Loss")

相关推荐