概述

该策略是一个多指标综合交易系统,结合了指数移动平均线(EMA)、相对强弱指标(RSI)和平均真实波幅(ATR)等技术指标,并引入了平均趋向指数(ADX)来增强趋势判断的准确性。系统通过多重信号确认建仓时机,并利用ATR动态管理止损和止盈,实现风险的有效控制。

策略原理

策略核心是通过多重技术指标的配合来捕捉市场趋势并进行交易。具体包括: 1. 使用快速(20周期)和慢速(50周期)EMA判断趋势方向 2. 结合ADX(14周期)确认趋势强度,要求ADX>20才确认趋势有效 3. 利用RSI(14周期)寻找超买超卖机会,RSI突破30触发买入,跌破70触发卖出 4. 采用ATR(14周期)计算动态止损和止盈位置,风险收益比设定为2:1

策略优势

- 多重信号确认提高交易的准确性,避免虚假信号

- 引入ADX指标增强了趋势判断的可靠性

- 动态止损止盈机制适应市场波动性变化

- 严格的风险控制确保每笔交易风险可控

- 策略逻辑清晰,参数可调整性强

策略风险

- 多重指标可能导致信号滞后,影响入场时机

- 在震荡市场中可能产生频繁交易

- ADX指标在某些市场条件下可能产生延迟信号

- 参数设置需要针对不同市场环境进行优化

策略优化方向

- 考虑加入成交量指标以增强信号可靠性

- 引入市场波动率过滤器,在高波动期间调整仓位

- 开发自适应参数机制,根据市场状态动态调整

- 增加趋势强度分级,实现仓位动态管理

- 优化止损止盈逻辑,引入移动止损机制

总结

该策略通过多重技术指标的有机结合,构建了一个完整的趋势跟踪交易系统。策略在保证交易准确性的同时,通过严格的风险控制确保交易的安全性。虽然存在一定的优化空间,但整体框架具有良好的实用价值和扩展性。

策略源码

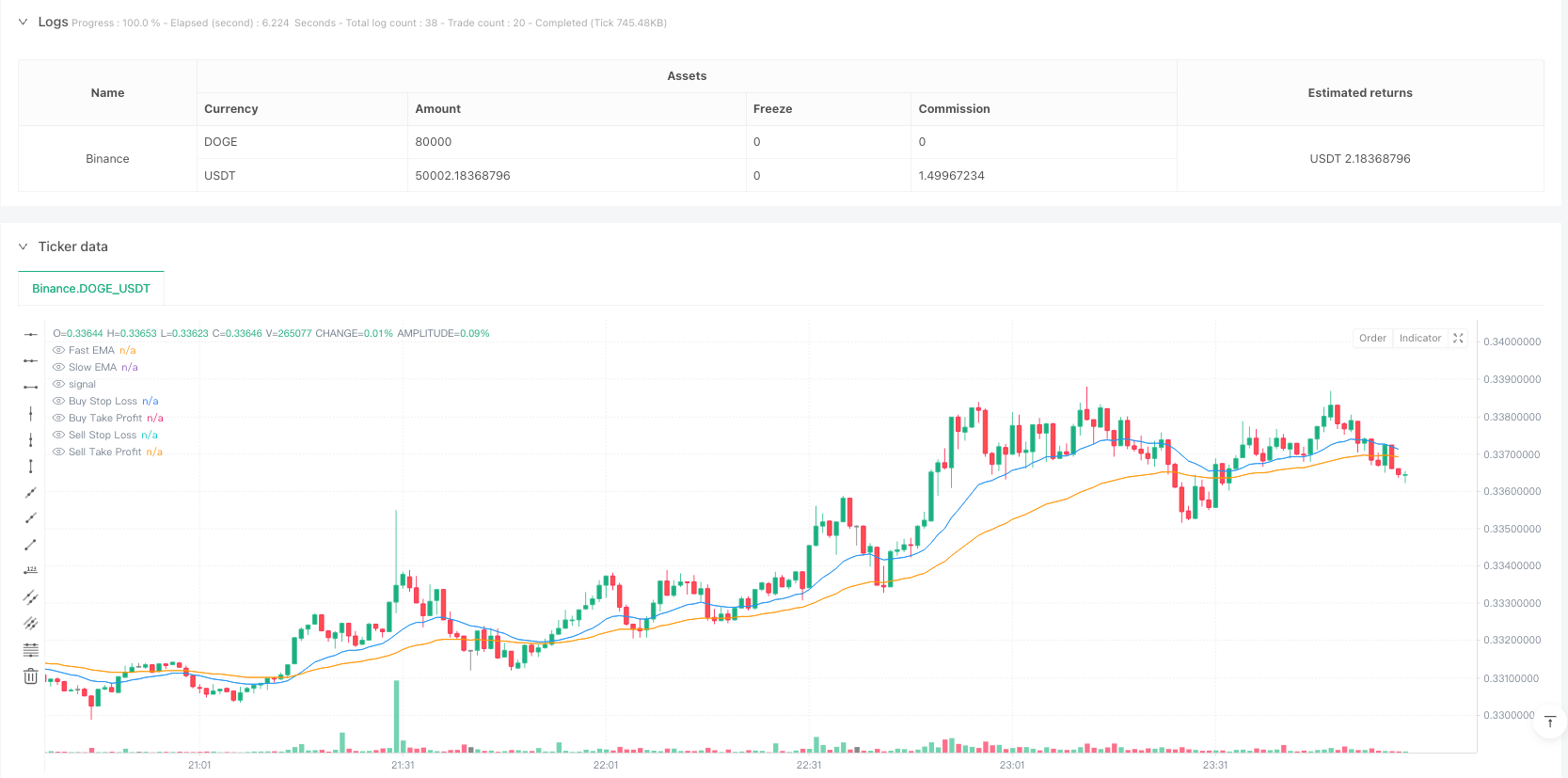

/*backtest

start: 2025-01-20 00:00:00

end: 2025-01-31 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Enhanced GBP/USD Strategy with ADX", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// === Input Parameters ===

emaFastLength = input.int(20, title="Fast EMA Length")

emaSlowLength = input.int(50, title="Slow EMA Length")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought")

rsiOversold = input.int(30, title="RSI Oversold")

atrLength = input.int(14, title="ATR Length")

adxLength = input.int(14, title="ADX Length")

riskToReward = input.float(2.0, title="Risk-Reward Ratio (R:R)")

slMultiplier = input.float(1.5, title="SL Multiplier (ATR)")

// === Indicator Calculations ===

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

rsi = ta.rsi(close, rsiLength)

atr = ta.atr(atrLength)

// === ADX Calculation ===

// Components of ADX

tr = ta.rma(ta.tr, adxLength) // True Range smoothed

plusDM = ta.rma(math.max(high - high[1], 0), adxLength) // +DM

minusDM = ta.rma(math.max(low[1] - low, 0), adxLength) // -DM

plusDI = (plusDM / tr) * 100

minusDI = (minusDM / tr) * 100

dx = math.abs(plusDI - minusDI) / (plusDI + minusDI) * 100

adx = ta.rma(dx, adxLength) // Final ADX value

// === Entry Conditions ===

isUptrend = emaFast > emaSlow and adx > 20

isDowntrend = emaFast < emaSlow and adx > 20

buySignal = isUptrend and ta.crossover(rsi, rsiOversold)

sellSignal = isDowntrend and ta.crossunder(rsi, rsiOverbought)

// === Stop-Loss and Take-Profit ===

slDistance = atr * slMultiplier

tpDistance = slDistance * riskToReward

buySL = buySignal ? close - slDistance : na

buyTP = buySignal ? close + tpDistance : na

sellSL = sellSignal ? close + slDistance : na

sellTP = sellSignal ? close - tpDistance : na

// === Execute Trades ===

if buySignal

strategy.entry("Buy", strategy.long)

strategy.exit("Buy TP/SL", from_entry="Buy", stop=buySL, limit=buyTP)

if sellSignal

strategy.entry("Sell", strategy.short)

strategy.exit("Sell TP/SL", from_entry="Sell", stop=sellSL, limit=sellTP)

// === Plotting ===

plot(emaFast, title="Fast EMA", color=color.blue)

plot(emaSlow, title="Slow EMA", color=color.orange)

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

plot(buySL, title="Buy Stop Loss", color=color.red, linewidth=1)

plot(buyTP, title="Buy Take Profit", color=color.green, linewidth=1)

plot(sellSL, title="Sell Stop Loss", color=color.red, linewidth=1)

plot(sellTP, title="Sell Take Profit", color=color.green, linewidth=1)

// === Alerts ===

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Detected!")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Detected!")

相关推荐