概述

该策略是一个基于相对强弱指标(RSI)的自适应交易系统。策略在M5时间周期上运行,通过监控RSI指标的超买超卖水平来识别潜在的交易机会。系统设置了固定的止损和止盈比例,并限制在特定的交易时段内执行。策略采用资金百分比管理方式,每次交易投入总资金的10%。

策略原理

策略的核心是利用RSI指标在14周期内的波动特征进行交易。当RSI低于30的超卖水平时,系统发出做多信号;当RSI高于70的超买水平时,系统发出做空信号。交易仅在6:00-17:00的时间窗口内执行,这有助于避开市场波动较大的时段。每笔交易都设置了1%的止损和2%的止盈水平,这种非对称的风险收益比有利于长期盈利。

策略优势

- 指标选择科学:RSI是一个经过市场验证的动量指标,能够有效捕捉价格超涨超跌的反转机会。

- 风险控制完善:策略采用固定百分比的止损止盈设置,可以有效控制每笔交易的风险。

- 时间管理合理:通过限制交易时间窗口,避免了市场流动性差的时段。

- 资金管理稳健:每次交易使用10%的资金比例,既保证了收益潜力,又避免了过度冒险。

策略风险

- 趋势市场风险:在强趋势市场中,RSI可能长期处于超买或超卖区间,导致假信号增多。

- 滑点风险:在行情剧烈波动时,实际成交价格可能与信号价格存在较大偏差。

- 固定参数风险:RSI的参数和超买超卖阈值固定,可能不适应所有市场环境。

策略优化方向

- 引入趋势过滤器:可以添加移动平均线等趋势指标,在主趋势方向上交易。

- 动态参数优化:考虑使用自适应的RSI周期和超买超卖阈值,以适应不同的市场环境。

- 优化交易时间:可以根据市场统计数据,进一步细化最佳交易时段。

- 完善资金管理:可以根据波动率动态调整持仓规模,实现更精细的风险控制。

总结

这是一个设计合理、逻辑清晰的交易策略。通过RSI指标捕捉市场超买超卖机会,结合严格的风险控制和时间管理,具有较好的实战应用价值。策略的主要优势在于系统的完整性和操作的明确性,但在实盘交易中仍需注意市场环境对策略表现的影响,并根据实际情况进行适当的参数优化。

策略源码

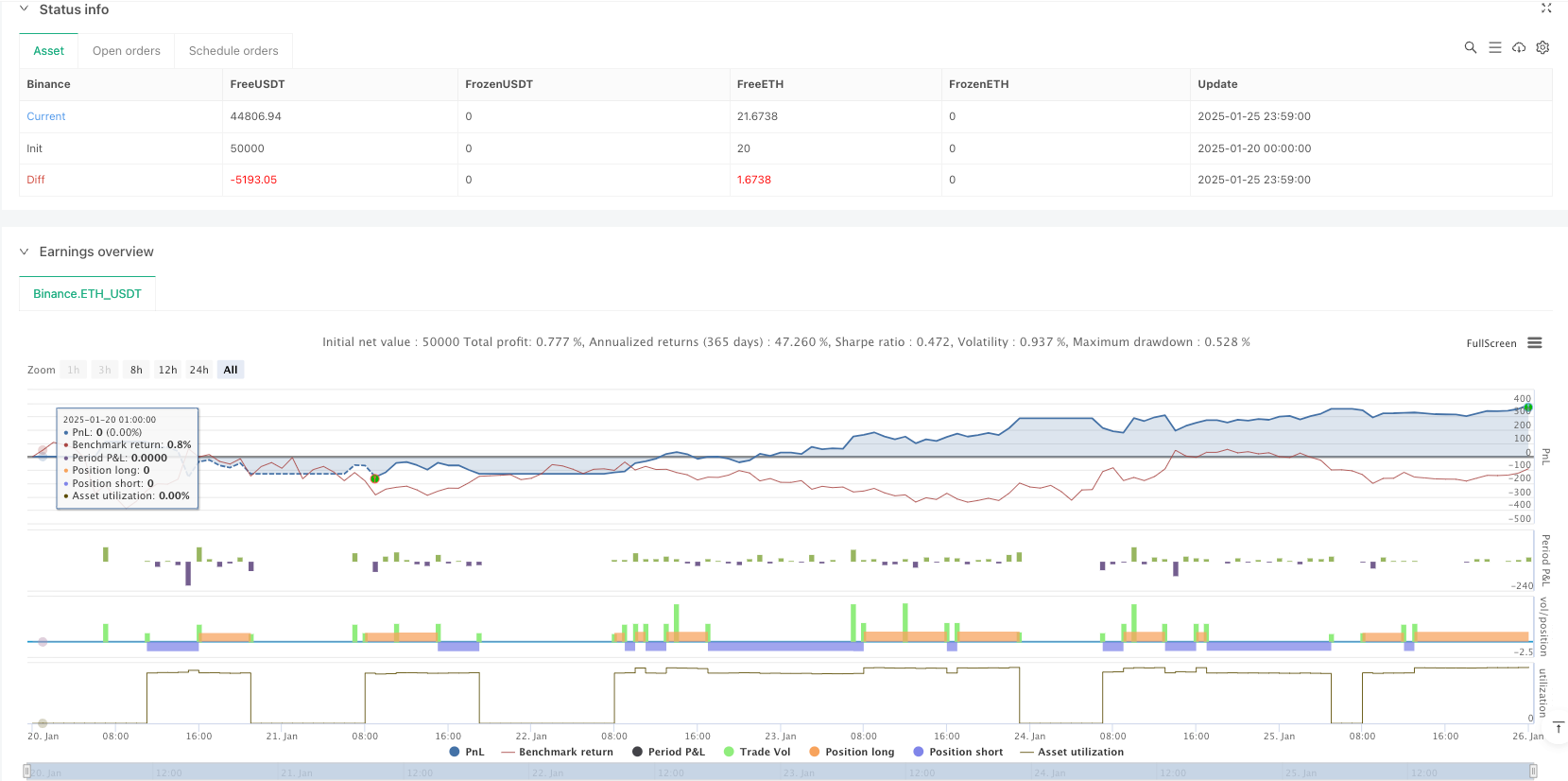

/*backtest

start: 2025-01-20 00:00:00

end: 2025-01-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Gold Trading RSI", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters configuration

rsi_length = input.int(14, title="RSI Period") // RSI period

rsi_overbought = input.int(70, title="RSI Overbought Level") // Overbought level

rsi_oversold = input.int(30, title="RSI Oversold Level") // Oversold level

sl_percent = input.float(1.0, title="Stop Loss (%)") / 100 // Stop loss percentage

tp_percent = input.float(2.0, title="Take Profit (%)") / 100 // Take profit percentage

capital = strategy.equity // Current equity

// Calculate RSI on the 5-minute timeframe

rsi_m5 = ta.rsi(close, rsi_length)

// Get the current hour based on the chart's timezone

current_hour = hour(time)

// Limit trading to the hours between 6:00 AM and 5:00 PM

is_trading_time = current_hour >= 6 and current_hour < 17

// Entry conditions

long_condition = is_trading_time and rsi_m5 < rsi_oversold

short_condition = is_trading_time and rsi_m5 > rsi_overbought

// Calculate Stop Loss and Take Profit levels

sl_long = close * (1 - sl_percent)

tp_long = close * (1 + tp_percent)

sl_short = close * (1 + sl_percent)

tp_short = close * (1 - tp_percent)

// Enter trade

if (long_condition)

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Buy", from_entry="Buy", stop=sl_long, limit=tp_long)

if (short_condition)

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Sell", from_entry="Sell", stop=sl_short, limit=tp_short)

相关推荐