概述

这个策略结合了三重指数移动平均线(TEMA)和Fisher Transform这两个技术指标,通过识别趋势和动量信号来确定入场和出场时机。TEMA作为一种低延迟的趋势跟踪指标,能够有效识别市场趋势方向,而Fisher Transform通过将价格变化转换为高斯正态分布,提供了更清晰的动量信号。策略采用交叉信号作为交易触发条件,结合了趋势跟踪和动量分析的优势。

策略原理

策略的核心逻辑建立在两个主要指标之上: 1. TEMA指标采用三重指数移动平均计算方法,通过”3×EMA - 3×EMA(EMA) + EMA(EMA(EMA))“的公式降低了传统移动平均线的滞后性,默认周期为21。 2. Fisher Transform指标将价格数据转换为正态分布,默认参数为10,通过对高低点价格进行标准化处理后应用对数变换,使得信号更加明确。

交易规则如下:

- 做多条件:价格上穿TEMA线且Fisher Transform上穿0轴

- 做空条件:价格下穿TEMA线且Fisher Transform下穿0轴

- 多单出场:价格下穿TEMA线或Fisher Transform下穿0轴

- 空单出场:价格上穿TEMA线或Fisher Transform上穿0轴

策略优势

- 信号可靠性高:通过结合趋势和动量指标,能够有效过滤虚假信号

- 延迟性低:TEMA相比传统移动平均线具有更快的响应速度

- 信号明确:Fisher Transform的正态分布特性使得交易信号更加清晰

- 风险控制完善:设置了明确的止损条件

- 参数可调:可根据不同市场环境调整指标参数

- 可视化效果好:提供了清晰的图表展示

策略风险

- 震荡市场风险:在横盘震荡行情下可能产生频繁的假突破信号

- 滞后性风险:虽然TEMA降低了滞后性,但仍然存在一定程度的延迟

- 参数敏感性:不同参数设置可能导致策略表现差异较大

- 市场环境依赖:策略在趋势明显的市场中表现更好

策略优化方向

- 引入波动率过滤:可以添加ATR指标过滤低波动率环境下的交易信号

- 优化出场机制:可以考虑加入移动止损或利润保护机制

- 增加时间过滤:可以根据不同时间段的市场特性调整交易策略

- 加入成交量确认:结合成交量指标提高信号可靠性

- 动态参数优化:根据市场状态动态调整指标参数

总结

这是一个结合趋势和动量分析的完整交易策略,通过TEMA和Fisher Transform的配合使用,既保证了趋势跟踪能力,又提供了清晰的动量确认信号。策略设计合理,具有较好的实用性,但在实际应用中需要注意市场环境的适应性,并根据具体情况进行参数优化。通过建议的优化方向,策略的稳定性和可靠性还可以进一步提升。

策略源码

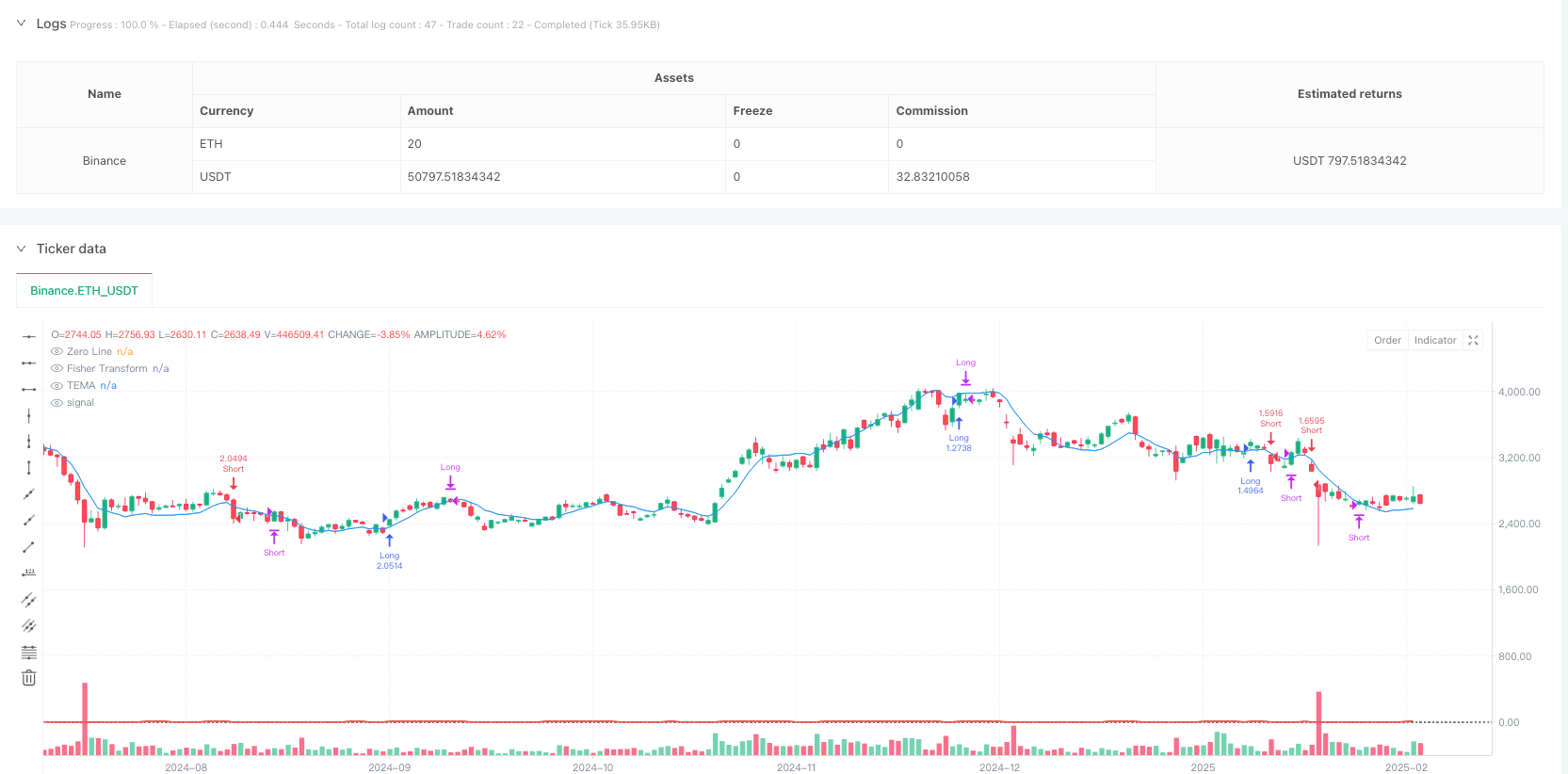

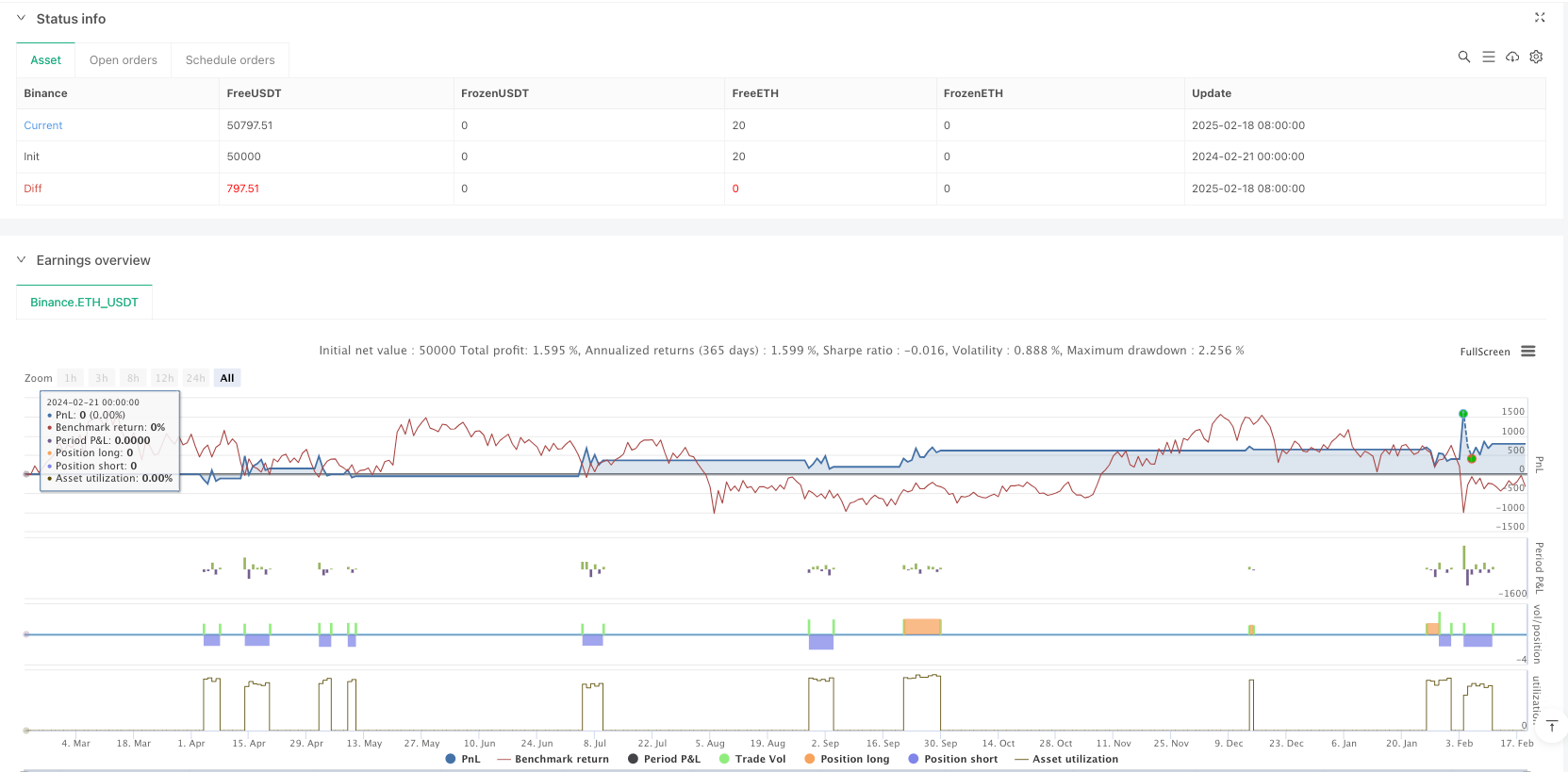

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-19 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Triple EMA (TEMA) + Fisher Transform Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ==== Triple EMA (TEMA) Settings ====

temaLength = input.int(21, title="TEMA Length", minval=1)

// Implementácia Triple EMA (TEMA)

// TEMA = 3 * EMA(close, length) - 3 * EMA(EMA(close, length), length) + EMA(EMA(EMA(close, length), length), length)

ema1 = ta.ema(close, temaLength)

ema2 = ta.ema(ema1, temaLength)

ema3 = ta.ema(ema2, temaLength)

tema = 3 * ema1 - 3 * ema2 + ema3

plot(tema, color=color.blue, title="TEMA")

// ==== Fisher Transform Settings ====

fisherLength = input.int(10, title="Fisher Length", minval=1)

fisherSmooth = input.int(1, title="Fisher Smoothing", minval=1) // Zvyčajne sa používa 1 alebo 2

// Výpočet Fisher Transform

// Krok 1: Normalizácia ceny

price = (high + low) / 2

maxPrice = ta.highest(price, fisherLength)

minPrice = ta.lowest(price, fisherLength)

value = 0.5 * (2 * ((price - minPrice) / (maxPrice - minPrice)) - 1)

value := math.min(math.max(value, -0.999), 0.999) // Orezanie hodnoty pre stabilitu

// Krok 2: Výpočet Fisher Transform

var float fisher = na

fisher := 0.5 * math.log((1 + value) / (1 - value)) + 0.5 * nz(fisher[1])

fisher := fisherSmooth > 1 ? ta.sma(fisher, fisherSmooth) : fisher

plot(fisher, color=color.red, title="Fisher Transform", linewidth=2)

// ==== Strategie Podmienky ====

// Long Condition: Cena prekročí TEMA smerom nahor a Fisher Transform prekročí 0 smerom nahor

longCondition = ta.crossover(close, tema) and ta.crossover(fisher, 0)

if (longCondition)

strategy.entry("Long", strategy.long)

// Short Condition: Cena prekročí TEMA smerom nadol a Fisher Transform prekročí 0 smerom nadol

shortCondition = ta.crossunder(close, tema) and ta.crossunder(fisher, 0)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Long Condition: Cena prekročí TEMA smerom nadol alebo Fisher Transform prekročí 0 smerom nadol

exitLong = ta.crossunder(close, tema) or ta.crossunder(fisher, 0)

if (exitLong)

strategy.close("Long")

// Exit Short Condition: Cena prekročí TEMA smerom nahor alebo Fisher Transform prekročí 0 smerom nahor

exitShort = ta.crossover(close, tema) or ta.crossover(fisher, 0)

if (exitShort)

strategy.close("Short")

// ==== Voliteľné: Vykreslenie Zero Line pre Fisher Transform ====

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

相关推荐