概述

多维度自适应移动平均矩阵与ATR动态精准交易策略是一种为快速变化的市场条件而设计的高级量化交易系统。该策略核心在于结合多种类型的移动平均线与ATR(平均真实波幅)过滤器,形成一个高度灵活且自适应的交易矩阵。通过精确捕捉市场趋势和波动性,该策略能够在高频交易环境中识别高概率的入场和出场点,同时实施严格的风险控制措施。策略的显著特点是其多层次的适应性 - 从多种移动平均线类型的灵活选择到基于ATR的动态止损和获利目标设置,再到多时间框架趋势过滤,使其在各种市场环境下都能智能调整交易信号的生成方式。

策略原理

该策略的核心原理建立在几个关键组件的协同工作上:

高级移动平均线矩阵:策略实现了多达11种不同类型的移动平均线,包括SMA、EMA、SMMA、HMA、TEMA、WMA、VWMA、ZLEMA、ALMA、KAMA和DEMA。每种移动平均线都有其独特的计算方法和反应特性,可根据市场条件灵活选择。系统采用两条移动平均线(快速和慢速)作为主要趋势指标,它们的交叉和相对位置用于生成基础交易信号。

ATR为基础的风险管理:策略利用ATR指标测量市场波动性,并将其应用于多个方面:

- 波动性评估:将ATR与收盘价的比率用作波动性阈值筛选条件

- 入场过滤器:确保价格必须与慢速移动平均线保持足够距离(以ATR的倍数计算)才能入场

- 动态风险控制:基于ATR设置固定止损、目标利润和追踪止损,使风险管理适应当前市场波动性

多时间框架趋势过滤:策略通过查询更高时间框架(15分钟)的移动平均线趋势来增强信号可靠性,确保交易方向与更大的市场趋势保持一致。

成交量和时间窗口验证:交易仅在满足最小成交量要求、出现成交量突破且在预定义的交易时间窗口内执行,进一步提高了交易质量。

信号生成逻辑:

- 多头条件:价格高于快速和慢速移动平均线,快速移动平均线高于慢速移动平均线,同时满足ATR过滤器、成交量条件和时间窗口要求

- 空头条件:相反情况下的对应条件

综合退出逻辑:策略使用三层退出机制:固定止损(ATR的倍数)、目标利润(ATR的倍数)和追踪止损(基于ATR的动态调整),为每笔交易提供全面的风险保护。

策略优势

分析该策略代码,可以总结出以下显著优势:

卓越的适应性:通过可切换的多种移动平均线类型(从HMA到KAMA等),策略能够适应不同的市场条件。这种灵活性使交易者可以根据当前市场环境选择最佳指标,而无需重新编写整个策略。

动态风险管理:基于ATR的风险控制机制确保止损和获利目标会根据市场波动性自动调整。这种方法在波动较大的市场中提供了更好的保护,同时在趋势市场中允许捕获更多利润。

多层信号过滤:通过结合移动平均线交叉、成交量分析、波动性阈值和多时间框架趋势过滤,策略有效减少了错误信号,提高了交易质量。特别是15分钟时间框架的趋势过滤功能,显著降低了逆势交易的可能性。

精确的入场条件:该策略不仅依赖技术指标交叉,还要求价格与慢速移动平均线之间保持足够的ATR距离,这有助于避免在横盘市场中频繁交易,减少了假突破带来的亏损。

透明的性能监控:内置的仪表板提供关键绩效指标的实时显示,包括当前利润/亏损、股权、ATR(原始值和百分比)以及移动平均线之间的差距,使交易者能够随时评估策略状态。

策略风险

尽管该策略设计精良,但仍存在以下潜在风险:

参数优化陷阱:策略包含大量参数(移动平均线类型和周期、ATR周期和乘数等),过度优化可能导致曲线拟合,使策略在实盘交易中表现不佳。解决方法是进行稳健的跨市场和跨时间段测试,避免过度调整参数。

快速反转风险:尽管使用ATR动态止损,但在市场突然反转时(如重大新闻发布后),价格可能在止损触发前跳空,导致超出预期的损失。建议实施额外的夜间风险控制或在高波动性事件前暂停交易。

信号延迟:所有移动平均线本质上都有滞后性。即使像HMA或ZLEMA这样的低延迟变体也可能在快速市场中错过理想入场点。可以考虑结合动量或价格行为指标来补充现有的信号系统。

成交量依赖性:策略在成交量突增时发出信号,但在某些市场或时段,成交量可能具有误导性。必要时应调整成交量过滤器或考虑在特定市场条件下禁用此功能。

时间窗口限制:指定的交易时间窗口可能会错过重要的夜间或早盘机会。建议根据特定市场的最活跃时段调整交易时间设置。

策略优化方向

分析代码后,以下是几个可能的优化方向:

自适应参数调整:目前策略使用固定的参数设置。一个高级优化是实现基于市场状态(趋势、波动、范围)自动调整的参数。例如,在高波动期间可以自动增加ATR乘数,或在不同市场环境中切换移动平均线类型。

整合机器学习模型:通过引入机器学习层来预测哪种移动平均线类型在当前市场条件下可能表现最佳,从而自动选择最优的移动平均线组合。这可以通过分析历史数据中不同指标的相对表现来实现。

改进的趋势识别:除了现有的15分钟趋势过滤器外,还可以纳入更复杂的趋势识别算法,如Hurst指数或方向性运动指标(DMI),以更准确地确定趋势强度和持续性。

增强退出策略:当前的退出策略可以通过添加基于市场结构的退出信号进一步优化,如趋势线突破、关键支撑/阻力位或波动性急剧变化。这可以帮助在趋势结束前锁定利润。

风险调整的仓位规模:实现基于当前波动性和账户资金的动态仓位规模调整,而不是使用固定的交易数量。例如,在高波动期间减少仓位,在低波动期间适度增加仓位,以优化风险回报比。

相关市场过滤:通过监测相关市场(如股票指数交易时关注VIX)或跨资产关联性来增强信号质量。当相关市场显示一致的方向性移动时,可以增加交易的可信度。

总结

多维度自适应移动平均矩阵与ATR动态精准交易策略代表了一种全面而先进的量化交易方法。通过结合多种移动平均线类型的优势与严格的ATR基础风险控制,该策略能够在维持良好风险管理的同时适应不同的市场条件。其多层次的信号过滤机制、精确的入场条件和全面的退出逻辑共同创造了一个能够识别高概率交易机会的强大系统。

该策略的真正价值在于其灵活性和适应性,允许交易者根据特定市场和个人风险偏好进行定制。通过建议的优化方向,特别是自适应参数调整和机器学习整合,策略的性能还有进一步提升的潜力。

对于寻求在高频交易环境中运用技术性强且纪律严明的系统的交易者来说,这种策略提供了一个坚实的框架,结合了技术精度和风险控制,两者缺一不可。重要的是,交易者应当通过彻底的回测和模拟交易来验证该策略在其目标市场中的表现,并根据具体交易环境进行必要的调整。

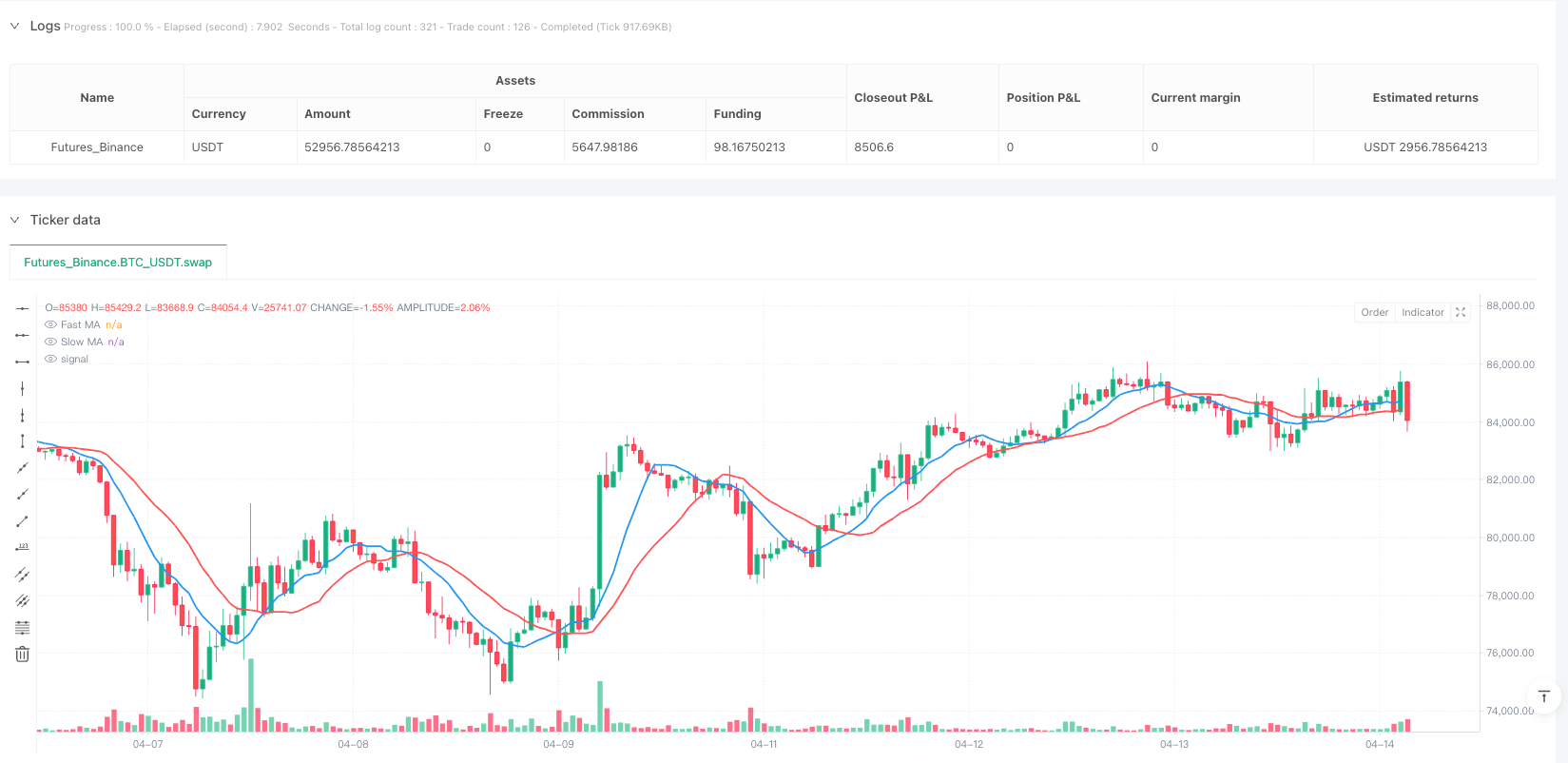

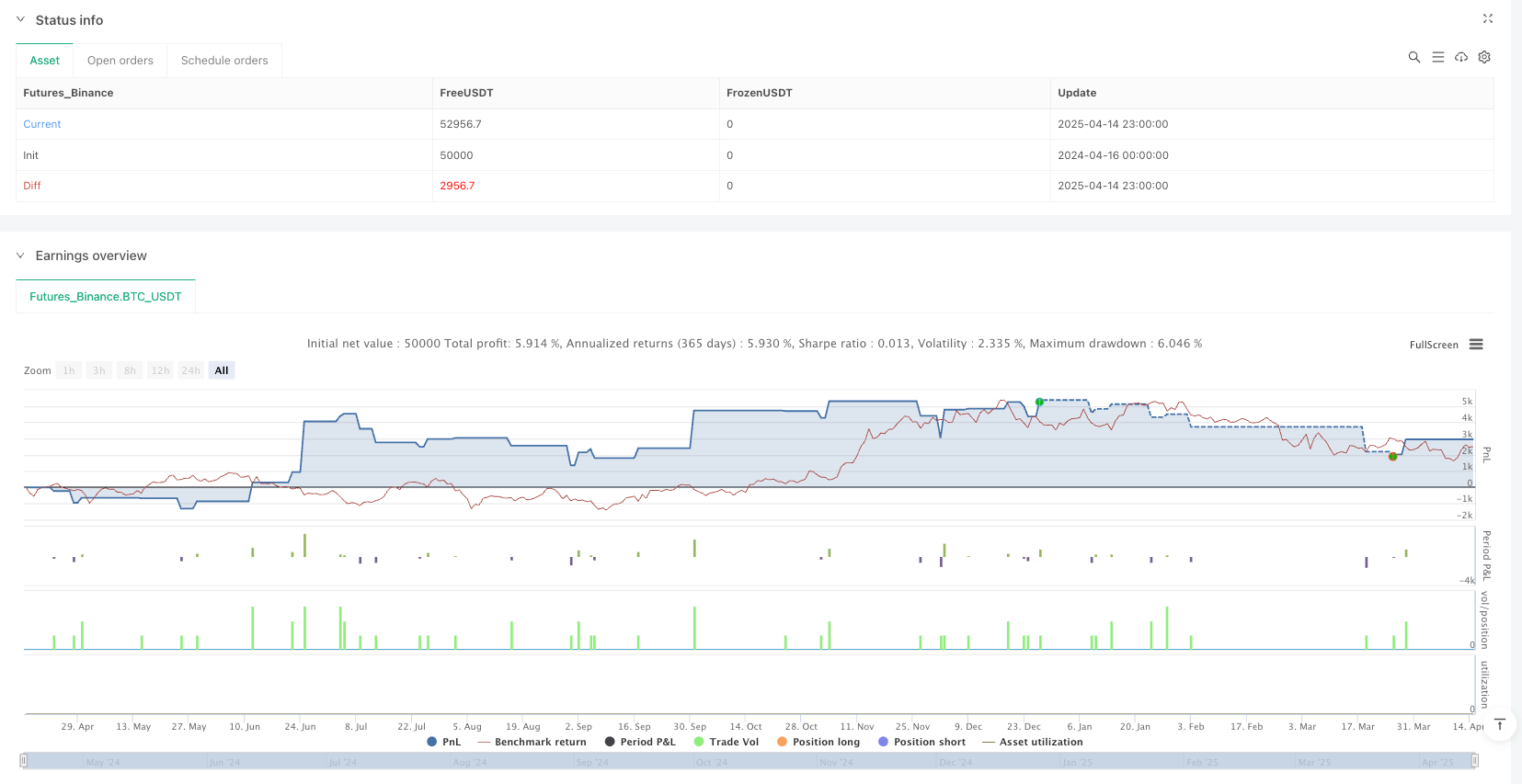

/*backtest

start: 2024-04-16 00:00:00

end: 2025-04-15 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Dskyz (DAFE) MAtrix with ATR-Powered Precision",

overlay=true,

default_qty_type=strategy.fixed,

initial_capital=1000000,

commission_value=0,

slippage=1,

pyramiding=10)

// ==================================================================

// USER-DEFINED FUNCTIONS

// ==================================================================

// Hull Moving Average (HMA)

hma(src, len) =>

halfLen = math.round(len * 0.5)

sqrtLen = math.round(math.sqrt(len))

wmaf = ta.wma(src, halfLen)

wmaFull = ta.wma(src, len)

ta.wma(2 * wmaf - wmaFull, sqrtLen)

// Triple Exponential Moving Average (TEMA)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * (ema1 - ema2) + ema3

// Double Exponential Moving Average (DEMA)

dema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

2 * ema1 - ema2

// VWMA - Volume Weighted Moving Average

vwma(src, len) =>

ta.vwma(src, len)

// ZLEMA - Zero Lag EMA

zlema(src, len) =>

lag = math.floor((len - 1) / 2)

ta.ema(2 * src - src[lag], len)

// ALMA - Arnaud Legoux Moving Average

alma(src, len, offset=0.85, sigma=6) =>

ta.alma(src, len, offset, sigma)

// Custom Kaufman Adaptive Moving Average (KAMA)

kama(src, len) =>

fastSC = 2.0 / (2 + 1)

slowSC = 2.0 / (30 + 1)

change = math.abs(src - src[len])

volatility = 0.0

for i = 0 to len - 1

volatility += math.abs(src - src[i])

er = volatility != 0 ? change / volatility : 0.0

sc = math.pow(er * (fastSC - slowSC) + slowSC, 2)

var float kama_val = na

kama_val := na(kama_val) ? ta.sma(src, len) : kama_val + sc * (src - kama_val)

kama_val

// ==================================================================

// INPUTS

// ==================================================================

fastLength = input.int(9, "[MA] Fast MA Length", minval=1)

slowLength = input.int(19, "[MA] Slow MA Length", minval=1)

fastMAType = input.string("SMA", "Fast MA Type", options=["SMA", "EMA", "SMMA", "HMA", "TEMA", "WMA", "VWMA", "ZLEMA", "ALMA", "KAMA", "DEMA"])

slowMAType = input.string("SMA", "Slow MA Type", options=["SMA", "EMA", "SMMA", "HMA", "TEMA", "WMA", "VWMA", "ZLEMA", "ALMA", "KAMA", "DEMA"])

atrPeriod = input.int(14, "ATR Period", minval=1)

atrMultiplier = input.float(1.5, "ATR Multiplier for Filter", minval=0.1, step=0.1)

useTrendFilter = input.bool(true, "[Filter Settings] Use 15m Trend Filter")

minVolume = input.int(10, "Minimum Volume", minval=1)

volatilityThreshold = input.float(1.0, "Volatility Threshold (%)", minval=0.1, step=0.1) / 100

tradingStartHour = input.int(9, "Trading Start Hour (24h)", minval=0, maxval=23)

tradingEndHour = input.int(16, "Trading End Hour (24h)", minval=0, maxval=23)

trailOffset = input.float(0.5, "[Exit Settings] Trailing Stop Offset ATR Multiplier", minval=0.01, step=0.01)

profitTargetATRMult = input.float(1.2, "Profit Target ATR Multiplier", minval=0.1, step=0.1)

fixedStopMultiplier = input.float(1.3, "Fixed Stop Multiplier", minval=0.5, step=0.1)

fixedQuantity = input.int(2, "Trade Quantity", minval=1)

resetDashboard = input.bool(false, "Reset Dashboard Stats")

// ==================================================================

// CALCULATIONS

// ==================================================================

volumeOk = volume >= minVolume

currentHour = hour(time)

timeWindow = currentHour >= tradingStartHour and currentHour <= tradingEndHour

volumeSpike = volume > 1.2 * ta.sma(volume, 10)

// ATR Calculation

atr = ta.atr(atrPeriod)

volatility = nz(atr / close, 0)

volatilityOk = volatility <= volatilityThreshold

// ==================================================================

// MOVING AVERAGES CALCULATIONS

// ==================================================================

var float fastMA = na

var float slowMA = na

// Fast MA Logic

if fastMAType == "SMA"

fastMA := ta.sma(close, fastLength)

else if fastMAType == "EMA"

fastMA := ta.ema(close, fastLength)

else if fastMAType == "SMMA"

fastMA := ta.rma(close, fastLength)

else if fastMAType == "HMA"

fastMA := hma(close, fastLength)

else if fastMAType == "TEMA"

fastMA := tema(close, fastLength)

else if fastMAType == "WMA"

fastMA := ta.wma(close, fastLength)

else if fastMAType == "VWMA"

fastMA := vwma(close, fastLength)

else if fastMAType == "ZLEMA"

fastMA := zlema(close, fastLength)

else if fastMAType == "ALMA"

fastMA := alma(close, fastLength)

else if fastMAType == "KAMA"

fastMA := kama(close, fastLength)

else if fastMAType == "DEMA"

fastMA := dema(close, fastLength)

// Slow MA Logic

if slowMAType == "SMA"

slowMA := ta.sma(close, slowLength)

else if slowMAType == "EMA"

slowMA := ta.ema(close, slowLength)

else if slowMAType == "SMMA"

slowMA := ta.rma(close, slowLength)

else if slowMAType == "HMA"

slowMA := hma(close, slowLength)

else if slowMAType == "TEMA"

slowMA := tema(close, slowLength)

else if slowMAType == "WMA"

slowMA := ta.wma(close, slowLength)

else if slowMAType == "VWMA"

slowMA := vwma(close, slowLength)

else if slowMAType == "ZLEMA"

slowMA := zlema(close, slowLength)

else if slowMAType == "ALMA"

slowMA := alma(close, slowLength)

else if slowMAType == "KAMA"

slowMA := kama(close, slowLength)

else if slowMAType == "DEMA"

slowMA := dema(close, slowLength)

// ==================================================================

// TREND FILTER & SIGNAL LOGIC

// ==================================================================

// Retrieve 15-minute MAs for trend filtering

[fastMA15m, slowMA15m] = request.security(syminfo.tickerid, "15", [ta.sma(close, fastLength), ta.sma(close, slowLength)])

trend15m = fastMA15m > slowMA15m ? 1 : fastMA15m < slowMA15m ? -1 : 0

trendLongOk = not useTrendFilter or trend15m >= 0

trendShortOk= not useTrendFilter or trend15m <= 0

// ATR-based Price Filter

atrFilterLong = close > slowMA + atr * atrMultiplier

atrFilterShort = close < slowMA - atr * atrMultiplier

// Signal Logic: MA alignment + filters

maAbove = close > fastMA and fastMA > slowMA

maBelow = close < fastMA and fastMA < slowMA

longCondition = maAbove and trendLongOk and atrFilterLong and volumeOk and volumeSpike and timeWindow and volatilityOk

shortCondition= maBelow and trendShortOk and atrFilterShort and volumeOk and volumeSpike and timeWindow and volatilityOk

// ==================================================================

// ENTRY LOGIC

// ==================================================================

if strategy.position_size == 0 and longCondition

strategy.entry("Long", strategy.long, qty=fixedQuantity)

if strategy.position_size == 0 and shortCondition

strategy.entry("Short", strategy.short, qty=fixedQuantity)

// ==================================================================

// EXIT LOGIC

// ==================================================================

if strategy.position_size > 0

strategy.exit("Long Exit", "Long",

stop = strategy.position_avg_price - atr * fixedStopMultiplier,

limit = strategy.position_avg_price + atr * profitTargetATRMult,

trail_offset = atr * trailOffset,

trail_points = atr * trailOffset)

if strategy.position_size < 0

strategy.exit("Short Exit", "Short",

stop = strategy.position_avg_price + atr * fixedStopMultiplier,

limit = strategy.position_avg_price - atr * profitTargetATRMult,

trail_offset = atr * trailOffset,

trail_points = atr * trailOffset)

// ==================================================================

// VISUALS: PLOT MAs

// ==================================================================

plot(fastMA, color=color.blue, linewidth=2, title="Fast MA")

plot(slowMA, color=color.red, linewidth=2, title="Slow MA")

// ==================================================================

// METRICS CALCULATIONS (for Dashboard)

// ==================================================================

// Additional metrics:

atrPct = close != 0 ? (atr / close) * 100 : na // ATR as percentage of Close

maGapPct = (slowMA != 0) ? (math.abs(fastMA - slowMA) / slowMA) * 100 : na // % difference between MAs

// Open PnL Calculation

currentPnL = strategy.position_size != 0 ? (close - strategy.position_avg_price) * strategy.position_size : 0

// Persistent variable for highest equity (for drawdown calculation)

var float highestEquity = strategy.equity

highestEquity := math.max(highestEquity, strategy.equity)

totalDrawdown = strategy.equity - highestEquity

// Reset dashboard metrics if reset toggle is on.

if resetDashboard

highestEquity := strategy.equity

// ==================================================================

// DASHBOARD: WATERMARK LOGO (Bottom-Right)

// ==================================================================

var table watermarkTable = table.new(position.bottom_right, 1, 1, bgcolor=color.rgb(0, 0, 0, 80), border_color=color.rgb(0, 50, 137), border_width=1)

if barstate.islast

table.cell(watermarkTable, 0, 0, "⚡ Dskyz - DAFE Trading Systems", text_color=color.rgb(159, 127, 255, 80), text_size=size.large)

// ==================================================================

// DASHBOARD: METRICS TABLE (Bottom-Left)

// ==================================================================

var table dashboard = table.new(position.middle_right, 2, 12, bgcolor=color.new(#000000, 29), border_color=color.rgb(80, 80, 80), border_width=1)

if barstate.islast

// Row 0 – Dashboard Title (duplicated in both columns to simulate spanning)

table.cell(dashboard, 0, 0, "⚡(DAFE) Trading Systems", text_color=color.rgb(135, 135, 135), text_size=size.small)

// Row 1 – Position

table.cell(dashboard, 0, 1, "Position", text_color=color.gray)

positionText = strategy.position_size > 0 ? "Long" : strategy.position_size < 0 ? "Short" : "Flat"

table.cell(dashboard, 1, 1, positionText, text_color=strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.blue)

// Row 2 – Current PnL

table.cell(dashboard, 0, 2, "Current P/L", text_color=color.gray)

table.cell(dashboard, 1, 2, str.tostring(currentPnL, "#.##"), text_color=(currentPnL > 0 ? color.green : currentPnL < 0 ? color.red : color.gray))

// Row 3 – Equity

table.cell(dashboard, 0, 3, "Equity", text_color=color.gray)

table.cell(dashboard, 1, 3, str.tostring(strategy.equity, "#.##"), text_color=color.white)

// Row 4 – Closed Trades

table.cell(dashboard, 0, 4, "Closed Trades", text_color=color.gray)

table.cell(dashboard, 1, 4, str.tostring(strategy.closedtrades), text_color=color.white)

// Row 5 – Title Step

table.cell(dashboard, 0, 5, "Metrics", text_color=color.rgb(76, 122, 23))

// Row 6 – Fast MA

table.cell(dashboard, 0, 6, "Fast MA", text_color=color.gray)

table.cell(dashboard, 1, 6, str.tostring(fastMA, "#.##"), text_color=color.white)

// Row 7 – Slow MA

table.cell(dashboard, 0, 7, "Slow MA", text_color=color.gray)

table.cell(dashboard, 1, 7, str.tostring(slowMA, "#.##"), text_color=color.white)

// Row 8 – ATR (Raw)

table.cell(dashboard, 0, 8, "ATR", text_color=color.gray)

table.cell(dashboard, 1, 8, str.tostring(atr, "#.##"), text_color=color.white)

// Row 9 – ATR (%)

table.cell(dashboard, 0, 9, "ATR (%)", text_color=color.gray)

table.cell(dashboard, 1, 9, str.tostring(atrPct, "#.##") + "%", text_color=color.white)

// Row 10 – MA Gap (%)

table.cell(dashboard, 0, 10, "MA Gap (%)", text_color=color.gray)

table.cell(dashboard, 1, 10, na(maGapPct) ? "N/A" : str.tostring(maGapPct, "#.##") + "%", text_color=color.white)

// Row 11 – Volatility (%)

table.cell(dashboard, 0, 11, "Volatility (%)", text_color=color.gray)

table.cell(dashboard, 1, 11, str.tostring(volatility * 100, "#.##") + "%", text_color=color.white)