概述

本策略是一个结合了相对强弱指数(RSI)、125日最高价突破和成交量过滤器的多维交易系统。该策略通过监控RSI超买超卖区域的交叉、价格对125日高点的突破以及成交量的显著增加来识别潜在的交易机会。这种多重确认机制有助于提高交易信号的可靠性。

策略原理

策略采用三重过滤机制来确认交易信号: 1. RSI指标用于识别超买超卖区域,当RSI从超卖区域(30以下)向上突破时产生做多信号,从超买区域(70以上)向下突破时产生做空信号。 2. 125日高点作为中长期趋势的重要参考,价格突破该水平视为强势信号,跌破该水平则视为弱势信号。 3. 成交量确认要求当前成交量至少是前一个周期成交量的2倍,以确保市场有足够的参与度支撑价格走势。

只有当这三个条件同时满足时,策略才会执行相应的交易操作。

策略优势

- 多重确认机制显著降低了虚假信号的风险,提高了交易的准确性。

- 成交量过滤器的引入确保了交易发生在市场流动性充足的环境下。

- 125日高点的使用有助于捕捉中长期趋势的转折点。

- RSI指标的应用可以及时发现超买超卖机会,有利于把握价格修正的时机。

- 策略逻辑清晰,参数可调整性强,适合不同市场环境。

策略风险

- 在横盘震荡市场中可能产生过多交易信号,增加交易成本。

- 对于低流动性品种,成交量条件可能较难满足,导致错过交易机会。

- 125日高点的跟踪可能在剧烈波动市场中产生滞后反应。

- RSI指标在强势趋势中可能产生频繁的超买超卖信号。

- 多重过滤条件可能导致错过一些潜在的交易机会。

策略优化方向

- 引入自适应的成交量倍数阈值,根据市场波动情况动态调整。

- 考虑添加趋势过滤器,在不同趋势环境下使用不同的参数设置。

- 优化RSI参数,可以考虑使用自适应周期来提高指标的灵敏度。

- 引入止损止盈机制,提高资金管理的有效性。

- 考虑添加时间过滤器,避免在市场开盘和收盘等波动较大的时段交易。

总结

该策略通过结合RSI、125日高点和成交量过滤器,构建了一个相对完善的交易系统。策略的多重确认机制有效降低了虚假信号的风险,而且各个组成部分都具有清晰的市场逻辑支撑。通过合理的参数优化和风险管理,该策略有望在实际交易中取得稳定的表现。

策略源码

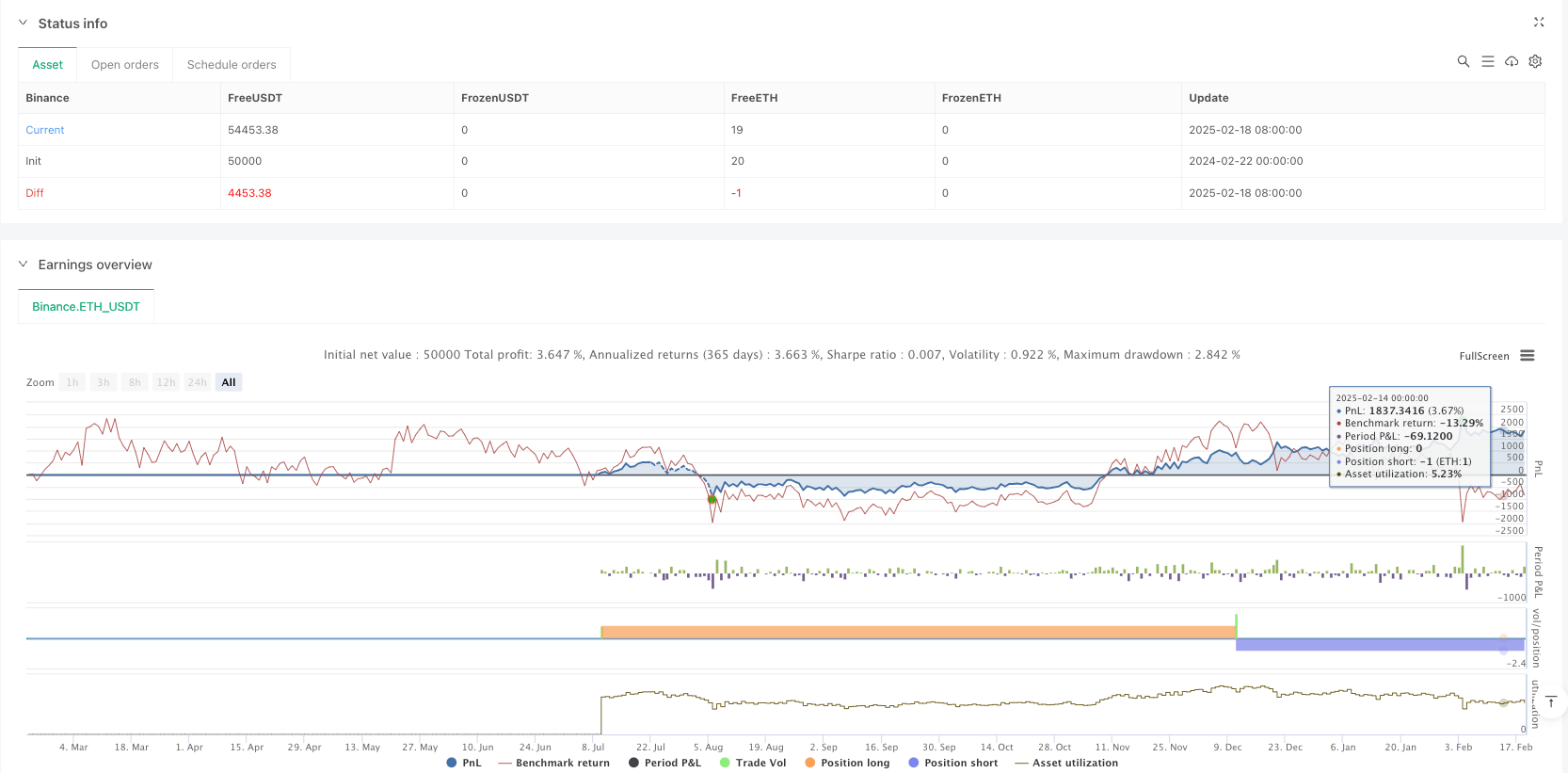

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("RSI Strategy with 125-Day High and Volume Filter", overlay=true)

// Input variables

length = input(14, title="RSI Length")

overSold = input(30, title="Oversold Level")

overBought = input(70, title="Overbought Level")

price = close

// RSI Calculation

vrsi = ta.rsi(price, length)

// Conditions for RSI crossover

co = ta.crossover(vrsi, overSold)

cu = ta.crossunder(vrsi, overBought)

// 125-day high calculation

high_125 = ta.highest(high, 125)

// Crossing conditions for 125-day high

cross_above_high_125 = ta.crossover(price, high_125)

cross_below_high_125 = ta.crossunder(price, high_125)

// Volume condition: Check if current volume is at least 2 times the previous volume

volume_increased = volume > 2 * volume[1]

// Entry logic for RSI and 125-day high with volume filter

if (not na(vrsi))

if (co and volume_increased)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (cu and volume_increased)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

// Entry logic for 125-day high crossing with volume filter

if (cross_above_high_125 and volume_increased)

strategy.entry("BuyHigh125", strategy.long, comment="BuyHigh125")

if (cross_below_high_125 and volume_increased)

strategy.entry("SellHigh125", strategy.short, comment="SellHigh125")

// Plot the 125-day high for visualization

plot(high_125, title="125-Day High", color=color.orange, linewidth=2, style=plot.style_line)

相关推荐