概述

该策略是一个基于多重技术指标的量化交易系统,核心由超级趋势(SuperTrend)指标驱动,结合ATR动态止损机制,通过MACD、ADX、RSI等指标进行多维度趋势确认和风险控制。策略采用六重过滤机制来识别高概率交易机会,同时引入三重背离检测以提前预警市场风险。

策略原理

策略以SuperTrend指标为核心,通过factor和ATR参数动态计算趋势方向。入场信号需同时满足以下条件: 1. SuperTrend方向指示 2. MACD柱状图位置验证 3. ADX趋势强度确认 4. K线形态确认 5. 成交量放大验证 6. 三重背离检测

系统通过ATR动态止损来控制风险,并结合趋势反转信号进行仓位管理。

策略优势

- 多维度指标融合提高了信号可靠性

- ATR动态止损机制能够自适应市场波动

- 三重背离检测系统提供了风险预警功能

- 成交量验证确保交易活跃度

- Gas费过滤机制降低了交易成本

- 完整的可视化系统便于策略监控

策略风险

- 多重过滤可能导致错过部分交易机会

- 参数优化存在过拟合风险

- 市场高波动期可能触发频繁止损

- Gas费波动可能影响策略收益

- 指标组合可能在横盘市场产生混沌信号

策略优化方向

- 引入市场周期识别模块,实现参数自适应

- 开发基于机器学习的信号权重系统

- 优化Gas费预测模型提高交易时机把握

- 增加交易成本计算模块

- 开发基于波动率的仓位管理系统

总结

该策略通过多维度指标融合和严格的风险控制,构建了一个稳健的量化交易系统。系统的模块化设计便于后续优化和扩展,但在实际应用中需要注意参数调优和市场适应性。三重背离预警和Gas费过滤等创新设计,进一步提升了策略的实用性。

策略源码

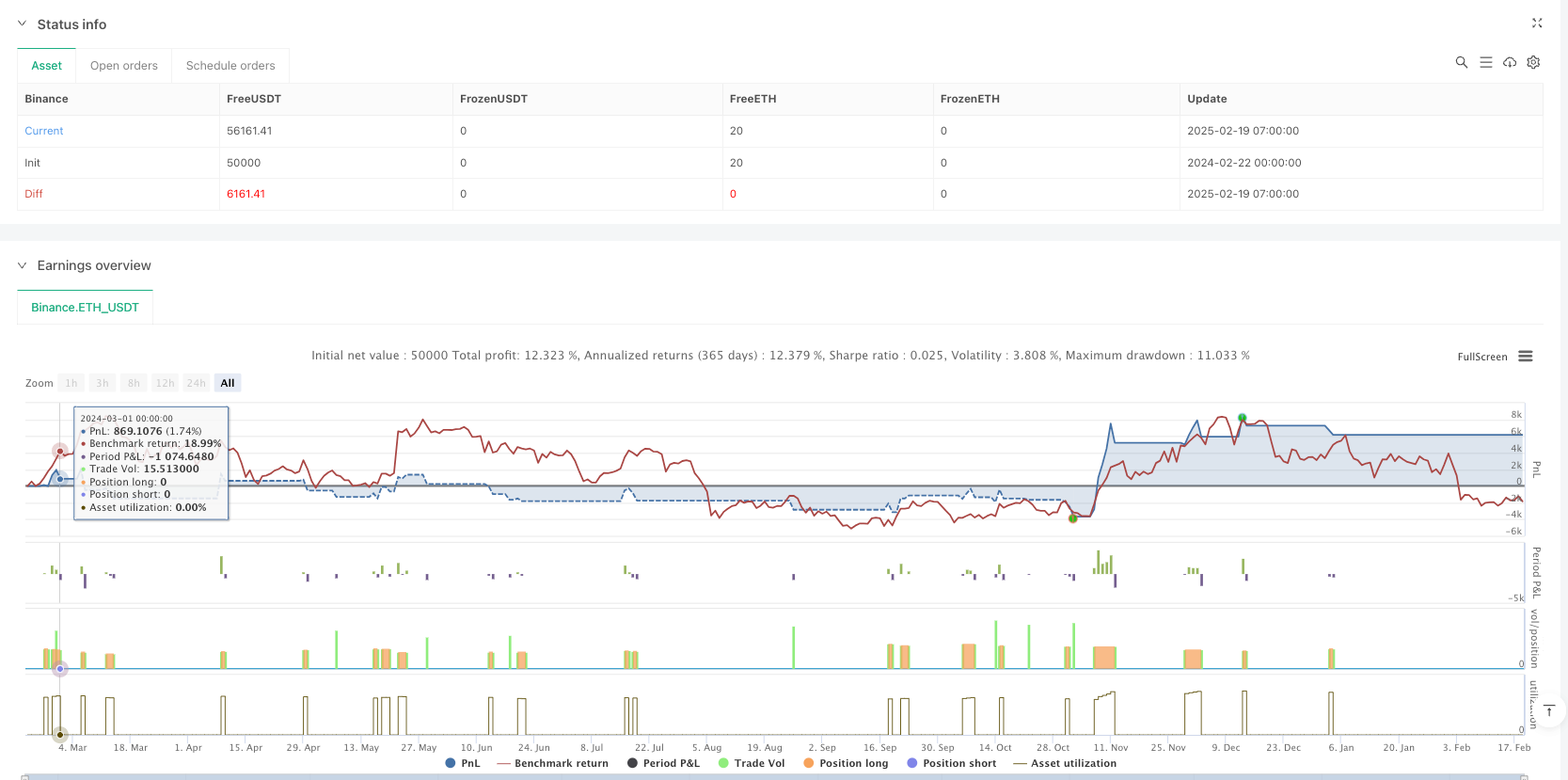

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("ETH 超级趋势增强策略-精简版", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// —————————— 参数配置区 ——————————

// 超级趋势参数

atrPeriod = input.int(8, "ATR周期(8-10)", minval=8, maxval=10)

factor = input.float(3.5, "乘数(3.5-4)", minval=3.5, maxval=4, step=0.1)

// MACD参数

fastLength = input.int(10, "MACD快线周期")

slowLength = input.int(21, "MACD慢线周期")

signalLength = input.int(7, "信号线周期")

// ADX参数

adxLength = input.int(18, "ADX周期")

adxThreshold = input.int(28, "ADX趋势阈值")

// 成交量验证

volFilterRatio = input.float(1.8, "成交量放大倍数", step=0.1)

// ATR止损

atrStopMulti = input.float(2.2, "ATR止损乘数", step=0.1)

// —————————— 核心指标计算 ——————————

// 1. 超级趋势(修复索引使用)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

plot(supertrend, color=direction < 0 ? color.new(color.green, 0) : color.new(color.red, 0), linewidth=2)

// 2. MACD指标

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

macdCol = histLine > histLine[1] ? color.green : color.red

// 3. ADX趋势强度

[DIMinus, DIPlus, ADX] = ta.dmi(adxLength, adxLength)

// 4. 成交量验证

volMA = ta.sma(volume, 20)

volValid = volume > volMA * volFilterRatio

// 5. ATR动态止损

atrVal = ta.atr(14)

var float stopPrice = na

// —————————— 三重背离检测 ——————————

// RSI背离检测

rsiVal = ta.rsi(close, 14)

priceHigh = ta.highest(high, 5)

rsiHigh = ta.highest(rsiVal, 5)

divergenceRSI = high >= priceHigh[1] and rsiVal < rsiHigh[1]

// MACD柱状图背离

macdHigh = ta.highest(histLine, 5)

divergenceMACD = high >= priceHigh[1] and histLine < macdHigh[1]

// 成交量背离

volHigh = ta.highest(volume, 5)

divergenceVol = high >= priceHigh[1] and volume < volHigh[1]

tripleDivergence = divergenceRSI and divergenceMACD and divergenceVol

// —————————— 信号生成逻辑 ——————————

// 多头条件(6层过滤)

longCondition =

direction < 0 and // 超级趋势看涨

histLine > 0 and // MACD柱在零轴上方

ADX > adxThreshold and // 趋势强度达标

close > open and // 阳线确认

volValid and // 成交量验证

not tripleDivergence // 无三重顶背离

// 空头条件(精简条件)

shortCondition =

direction > 0 and // 超级趋势看跌

histLine < 0 and // MACD柱在零轴下方

ADX > adxThreshold and // 趋势强度达标

close < open and // 阴线确认

volValid and // 成交量验证

tripleDivergence // 出现三重顶背离

// —————————— 交易执行模块 ——————————

if (longCondition)

strategy.entry("Long", strategy.long)

stopPrice := close - atrVal * atrStopMulti

if (shortCondition)

strategy.entry("Short", strategy.short)

stopPrice := close + atrVal * atrStopMulti

// 动态止损触发

strategy.exit("Exit Long", "Long", stop=stopPrice)

strategy.exit("Exit Short", "Short", stop=stopPrice)

// 趋势反转离场

if (direction > 0 and strategy.position_size > 0)

strategy.close("Long")

if (direction < 0 and strategy.position_size < 0)

strategy.close("Short")

// —————————— 可视化提示 ——————————

plotshape(longCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="买入信号")

plotshape(shortCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="卖出信号")

plot(strategy.position_size != 0 ? stopPrice : na, color=color.orange, style=plot.style_linebr, linewidth=2, title="动态止损线")

// —————————— 预警系统 ——————————

alertcondition(tripleDivergence, title="三重顶背离预警", message="ETH出现三重顶背离!")

longCondition := longCondition

相关推荐