概述

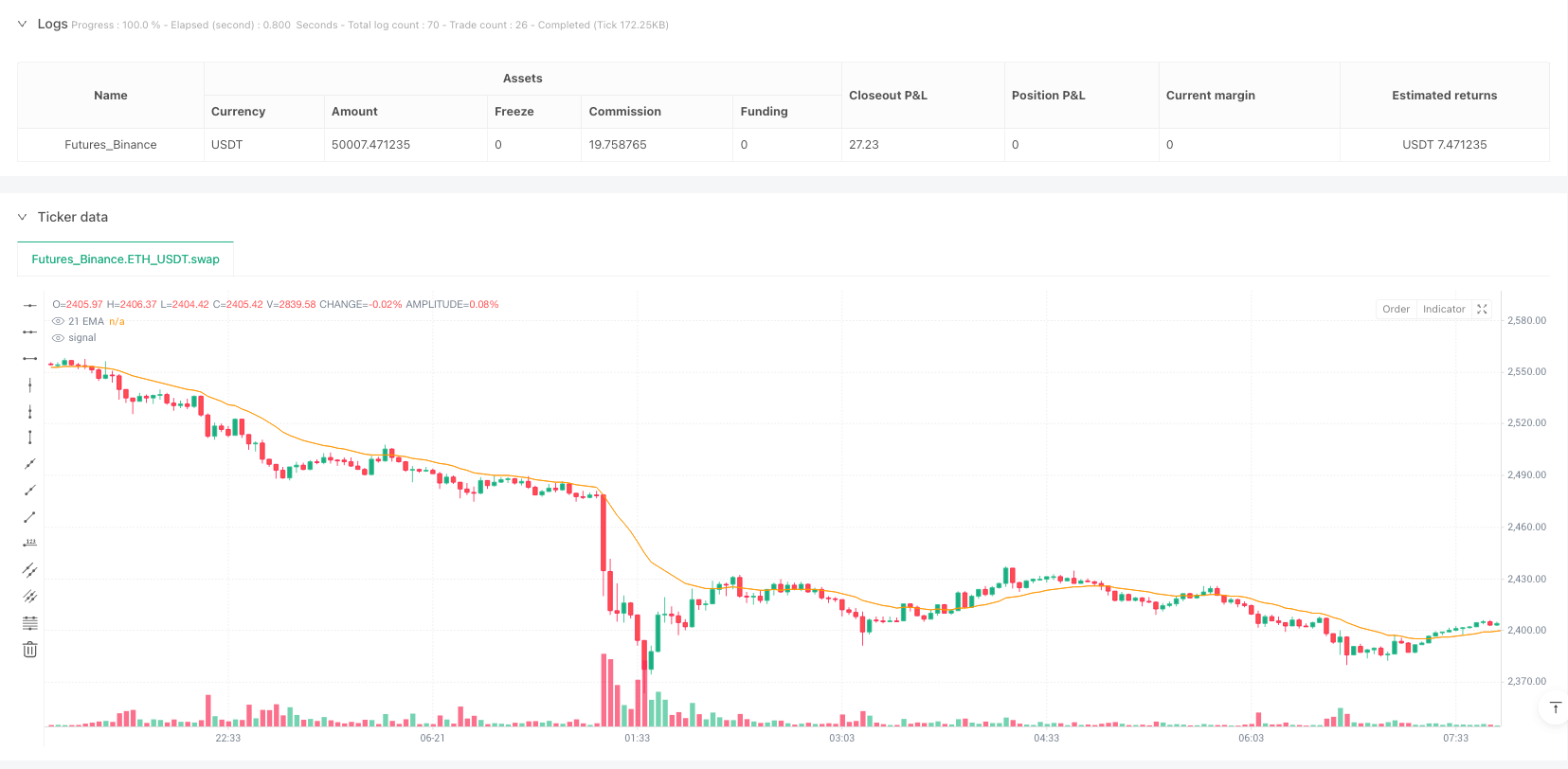

均线交叉动量翻转量化交易策略是一个基于规则的趋势跟踪系统,该系统核心逻辑围绕21周期指数移动平均线(21 EMA)展开。策略监测价格与21 EMA的关系,当价格收盘穿越均线上方时做多,穿越均线下方时做空,并在价格再次穿越均线时平仓并反向开仓。该策略还包含自定义的交易时段过滤、止盈止损设置、每日最大交易次数限制以及首次盈利后自动锁定交易等风控机制,旨在提供一个纪律严明、逻辑清晰的交易系统。

策略原理

该策略的核心原理是捕捉价格围绕21 EMA的动量变化,实现趋势跟随与反转交易。具体来说:

- 均线交叉信号生成:当价格从均线下方收盘于均线上方时触发做多信号;当价格从均线上方收盘于均线下方时触发做空信号。

- 交易执行机制:

- 系统会在均线交叉发生时立即开仓

- 可选择性地设置止盈(TP)和止损(SL)水平

- 当价格再次穿越均线时,系统会平仓现有头寸并反向开仓

- 交易限制条件:

- 交易只在用户定义的时间窗口内执行(默认为8:30至10:30)

- 每个交易时段最多执行5笔交易

- 在获得一笔盈利交易后,系统会自动停止当日交易

- 状态管理:系统通过变量跟踪当日交易次数、上一笔交易是否盈利、入场价格等状态信息,用于控制交易执行。

策略还整合了成交量加权平均价(VWAP)作为辅助参考指标,提供额外的市场背景信息。

策略优势

- 逻辑简明清晰:策略核心逻辑基于EMA交叉这一经典技术指标,规则直观易懂,避免了复杂算法带来的”黑箱”效应。

- 纪律严明:通过编程自动执行交易规则,消除了人为情绪干扰,尤其是首次盈利后锁定交易的机制有效防止了过度交易。

- 风险管理完善:

- 可选的止盈止损机制保护资金安全

- 每日交易次数限制防止过度交易

- 交易时间窗口限制避免低效率时段交易

- 适应性强:允许用户自定义交易时间段、止盈止损点位等参数,可根据不同市场和个人风险偏好进行调整。

- 视觉反馈清晰:策略在图表上显示关键指标(21 EMA和VWAP)和交易结果标签,使交易者能直观地理解市场状态和策略表现。

- 反向开仓机制:当趋势反转时,策略会平仓并立即反向开仓,这种”翻转”机制能够更好地捕捉市场动量变化。

策略风险

- 均线滞后性风险:EMA本质上是滞后指标,在快速变动的市场中可能导致入场或出场延迟,错过最佳交易时机或增加亏损。 解决方法:可考虑调整EMA周期或结合其他领先指标优化信号生成。

- 频繁交易风险:在震荡市场中,价格可能频繁穿越均线,导致过多交易并增加交易成本。 解决方法:可增加确认过滤器或延长观察周期,避免假突破信号。

- 单一指标依赖:策略主要依赖EMA交叉信号,缺乏多维度分析,可能在某些市场环境下表现不佳。 解决方法:考虑整合其他技术指标如RSI、MACD或成交量指标,构建多因子决策模型。

- 固定止盈止损不灵活:使用固定点数的止盈止损可能无法适应不同波动率环境。 解决方法:可实现基于ATR或历史波动率的动态止盈止损设置。

- 时间窗口限制过严:严格的交易时间窗口可能错过其他时段的优质交易机会。 解决方法:基于市场波动特征建立多时段交易模型,或动态调整交易窗口。

策略优化方向

- 动态参数优化:

- 将固定的EMA周期(21)改为可自适应参数,根据不同时间周期的市场特性动态调整

- 基于市场波动率动态设置止盈止损点位,如使用ATR倍数设置止损位置

- 信号确认机制增强:

- 增加成交量确认条件,仅在成交量显著放大时确认交叉信号

- 添加趋势强度过滤器,如ADX指标,仅在明确趋势环境中交易

- 风险管理优化:

- 实现动态仓位管理,根据市场波动率和账户净值比例调整交易规模

- 添加追踪止损功能,在趋势行情中锁定更多利润

- 多时间框架分析:

- 整合更长周期的趋势判断,仅在大趋势方向上开仓

- 利用较小时间框架精确入场,提高风险回报比

- 市场状态分类:

- 开发市场状态识别算法,区分趋势期和震荡期

- 在不同市场状态应用不同的交易策略参数或规则

- 机器学习优化:

- 利用历史数据训练模型,预测EMA交叉信号的有效性

- 构建特征工程,找出影响策略表现的关键因素

这些优化方向旨在提升策略的稳健性和适应性,减少假信号并提高盈利能力。

总结

均线交叉动量翻转量化交易策略是一个基于21 EMA交叉的趋势跟踪系统,具有逻辑清晰、规则严明的特点。通过监测价格与均线的关系,结合严格的风险管理机制,该策略能够有效捕捉市场趋势转变点,同时控制风险。

策略的主要优势在于其简明直观的交易逻辑和完善的纪律执行机制,尤其是首次盈利后锁定交易的设计有效防止了过度交易和利润回吐。然而,策略也存在均线滞后性、过度依赖单一指标等潜在风险。

未来优化方向应着重于参数动态化、多因子信号确认、风险管理增强以及市场状态分类等方面,以提升策略在不同市场环境下的适应能力。通过这些优化,该策略有望成为一个更加稳健、可靠的量化交易系统。

作为DSPLN方法的一部分,这一策略体现了”耐心倾听”(Do So Patiently Listening Now)的交易哲学,强调纪律性和系统性,为交易者提供了一个克服情绪干扰、专注于规则执行的交易框架。

策略源码

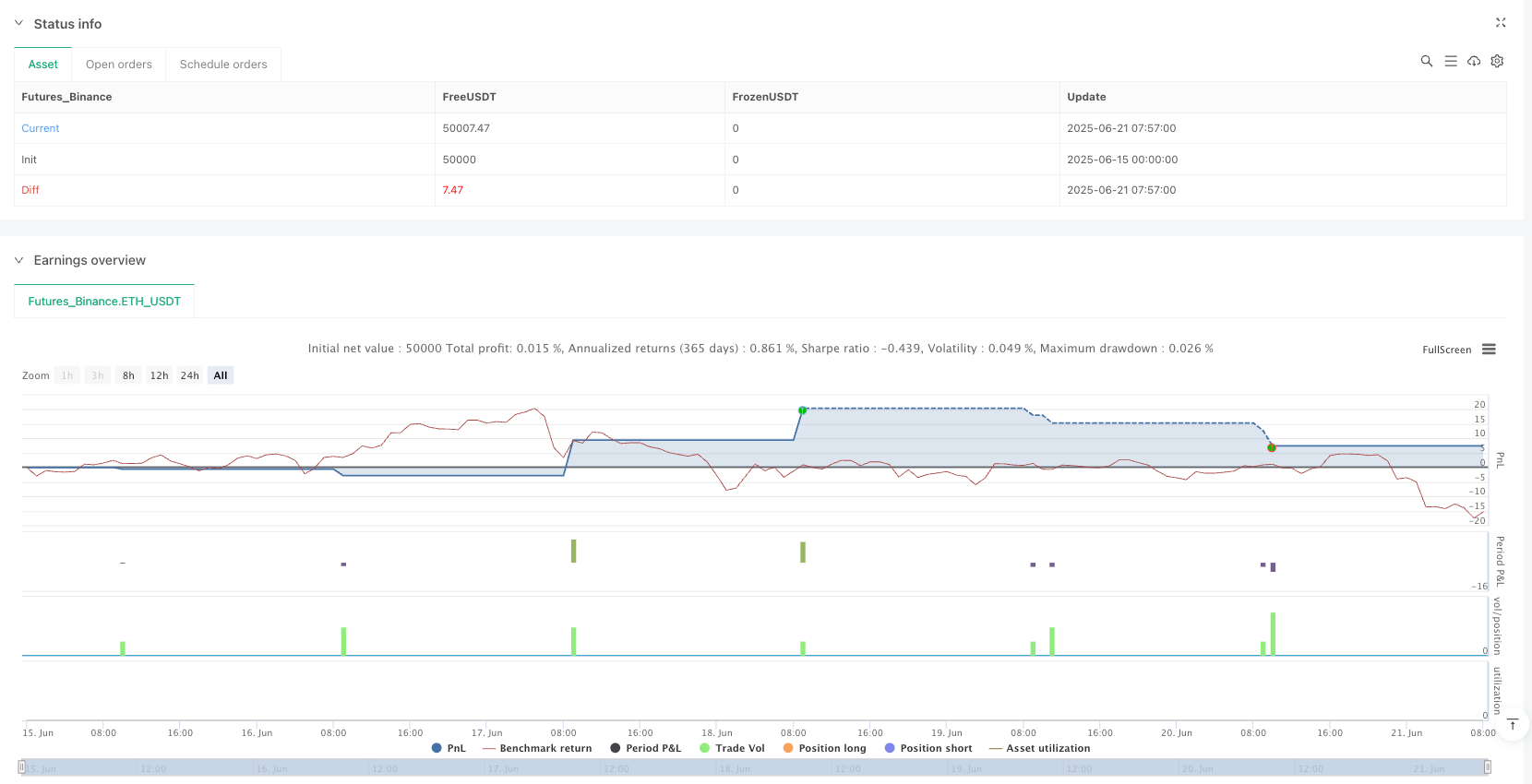

/*backtest

start: 2025-06-15 00:00:00

end: 2025-06-21 08:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © EnvisionTrades

//@version=5

strategy("DSPLN EMA Flip Strategy v6", overlay=true)

// 🔹 Inputs

startHour = input.int(8, "Start Hour")

startMinute = input.int(30, "Start Minute")

endHour = input.int(10, "End Hour")

endMinute = input.int(30, "End Minute")

useTPSL = input.bool(true, "Use TP/SL?")

tpPoints = input.int(40, "Take Profit (points)")

slPoints = input.int(20, "Stop Loss (points)")

// 🔹 Time Filter

isWithinTradingHours = (hour > startHour or (hour == startHour and minute >= startMinute)) and

(hour < endHour or (hour == endHour and minute < endMinute))

// 🔹 Indicators

ema21 = ta.ema(close, 21)

vwap = ta.vwap

plot(ema21, title="21 EMA", color=color.orange)

plot(vwap, title="VWAP", color=color.blue)

// 🔹 State Variables

var int tradesToday = 0

var bool lastTradeWon = false

var float entryPrice = na

var label winLabel = na

var int prevTradeCount = 0

// 🔹 Entry Conditions

longEntry = isWithinTradingHours and close > ema21 and close[1] <= ema21[1]

shortEntry = isWithinTradingHours and close < ema21 and close[1] >= ema21[1]

// 🔹 Exit Conditions

longExit = strategy.position_size > 0 and close < ema21

shortExit = strategy.position_size < 0 and close > ema21

// 🔹 Trade Control

canTrade = tradesToday < 5 and not lastTradeWon

// 🔹 Entry Logic

if canTrade and strategy.position_size == 0 and longEntry

strategy.entry("Long", strategy.long)

entryPrice := close

if useTPSL

strategy.exit("TP Long", from_entry="Long", stop=close - slPoints * syminfo.mintick, limit=close + tpPoints * syminfo.mintick)

if canTrade and strategy.position_size == 0 and shortEntry

strategy.entry("Short", strategy.short)

entryPrice := close

if useTPSL

strategy.exit("TP Short", from_entry="Short", stop=close + slPoints * syminfo.mintick, limit=close - tpPoints * syminfo.mintick)

// 🔹 EMA Manual Exit Logic

if longExit

strategy.close("Long")

tradesToday += 1

lastTradeWon := close > entryPrice

if lastTradeWon

winLabel := label.new(bar_index, high, "✅ WIN - No More Trades", style=label.style_label_down, color=color.green)

if shortExit

strategy.close("Short")

tradesToday += 1

lastTradeWon := close < entryPrice

if lastTradeWon

winLabel := label.new(bar_index, low, "✅ WIN - No More Trades", style=label.style_label_up, color=color.green)

// 🔹 Detect Closed Trades (TP/SL exits)

tradeCount = strategy.closedtrades

if tradeCount > prevTradeCount

closedProfit = strategy.netprofit - strategy.netprofit[1]

tradesToday += 1

lastTradeWon := closedProfit > 0

if lastTradeWon

winLabel := label.new(bar_index, high, "✅ TP WIN - No More Trades", style=label.style_label_down, color=color.green)

prevTradeCount := tradeCount

// 🔹 Reset Daily

if (hour == endHour and minute == endMinute)

tradesToday := 0

lastTradeWon := false

entryPrice := na

prevTradeCount := 0

if not na(winLabel)

label.delete(winLabel)

相关推荐