概述

多时段多指标高频动态突破量化交易策略是一种针对高频短线交易(Scalping)设计的高性能交易系统。该策略基于Pine Script 5开发,结合了多种技术指标和时间过滤功能,用于识别市场突破信号并执行高速交易。核心原理是通过EMA、SMA、RSI等多重指标验证,配合价格突破检测和ATR动态风险管理,在特定交易时段内捕捉短线机会。该策略针对每个价格变动进行实时计算(calc_on_every_tick=true),特别适合在1-5分钟时间框架上应用,并通过PineConnector与MetaTrader 5实现自动化交易。

策略原理

该策略的核心逻辑基于多重条件确认的价格突破系统,具体实现机制如下:

技术指标组合:

- 使用快速EMA(34周期)和慢速EMA(63周期)判断趋势方向

- 利用SMA(34周期)作为价格过滤器

- 应用RSI(14周期)识别超买超卖区域

- 使用ATR(14周期)计算动态止损和获利水平

突破检测逻辑:

- 识别N周期(默认1)内的最高价作为阻力位

- 识别N周期(默认1)内的最低价作为支撑位

- 当价格突破阻力位且满足其他条件时触发做多信号

- 当价格跌破支撑位且满足其他条件时触发做空信号

多重条件确认:

- 做多条件:价格突破阻力位 + EMA快线在慢线上方 + RSI未超买 + 价格在SMA上方

- 做空条件:价格跌破支撑位 + EMA快线在慢线下方 + RSI未超卖 + 价格在SMA下方

时间过滤系统:

- 实现了4个可自定义的交易时段,可灵活设置交易窗口

- 优化的时间计算算法,将时间转换为分钟累计值提高处理效率

动态风险管理:

- 基于ATR的动态止损,默认为ATR的3倍

- 基于ATR的动态获利目标,默认为ATR的3倍

- 可选的追踪止损功能,根据市场波动性自动调整止损位置

性能优化设计:

- 预计算常量减少重复计算

- 缓存指标计算结果提高处理速度

- 使用数组存储时间过滤设置实现高效处理

策略优势

该策略具有以下显著优势:

高速执行能力:通过calc_on_every_tick=true设置,能够对每个价格变动立即响应,特别适合高频交易环境。代码中使用了常量预计算和指标缓存技术,进一步提高了执行速度。

多重确认机制:结合EMA、SMA、RSI等多种指标验证交易信号,显著降低虚假突破风险。该确认系统确保只有在多重条件同时满足时才会开仓,提高了交易质量。

灵活的时间过滤:通过四个可自定义交易时段,允许交易者专注于高流动性和高波动性的市场时段,避开低活跃度和不稳定的市场时段。

动态风险管理:基于ATR的动态止损和获利目标,使策略能够根据市场波动性自动调整风险参数,适应不同市场条件。

完整的自动化支持:通过PineConnector与MT5集成,实现全自动化交易,减少人为干预和情绪影响。代码中包含了完整的警报系统,支持快速执行模式。

资源使用优化:通过预计算常量和缓存指标结果,有效减少了计算资源消耗,保证在实时交易环境中的高效运行。

可视化辅助决策:策略内置了性能指标显示面板和位置标记,提供直观的交易状态和信号可视化,辅助人工监控和决策。

策略风险

尽管该策略具有诸多优势,但仍存在以下风险和挑战:

高频交易特有风险:在高频交易环境下,滑点、延迟和交易成本可能显著影响实际交易结果。代码中虽然实现了快速执行模式,但在真实交易环境中可能仍受限于交易平台和经纪商的执行速度。

假突破陷阱:尽管使用了多重确认机制,但在高波动市场中仍可能触发假突破信号,导致不必要的交易损失。特别是在参数设置不当或市场条件急剧变化时,这种风险更为显著。

过度优化风险:策略涉及多个参数(EMA、SMA、RSI等周期设置),存在过度优化(curve-fitting)的风险,可能导致策略在实盘中表现不佳。

时间过滤局限性:虽然时间过滤可以避开低效交易时段,但也可能错过特定时段外的有利交易机会,特别是在重大市场事件或新闻发布时。

ATR基础风险控制的局限性:在极端市场条件下,基于ATR的止损和获利目标可能不足以应对突发的大幅波动,导致止损失效或过早获利了结。

风险缓解措施: - 建议在实盘前进行充分的回测和模拟交易验证 - 针对不同市场条件调整参数设置,特别是ATR倍数和指标周期 - 考虑增加额外的市场状态过滤器,如波动性指标或交易量条件 - 实施资金管理规则,限制单笔交易风险 - 定期监控和评估策略表现,根据市场变化及时调整

策略优化方向

基于代码分析,以下是该策略可以进一步优化的方向:

动态参数自适应:

- 实现EMA、SMA、RSI等指标参数的动态调整,根据市场状态自动优化参数

- 可考虑引入机器学习算法实现参数自适应,提高策略适应性

市场状态分类:

- 增加市场状态识别模块,区分趋势市和震荡市

- 根据不同市场状态应用不同的交易逻辑和风险参数

增强过滤系统:

- 引入交易量指标作为额外过滤条件,避免低流动性环境下的虚假突破

- 添加波动性过滤器,在过度波动或波动不足的市场条件下暂停交易

止损策略优化:

- 实现更复杂的止损策略,如基于支撑/阻力位的智能止损

- 添加部分获利功能,允许分批平仓以锁定部分利润

信号质量评估:

- 开发信号强度评分系统,根据多个因素对信号质量进行评级

- 基于信号强度动态调整仓位大小,实现更精细的资金管理

回撤控制:

- 添加最大回撤控制机制,在连续亏损达到阈值时暂停交易

- 实现盈利保护机制,确保不会从盈利状态回撤至亏损

优化计算效率:

- 进一步优化计算密集型操作,如使用查找表替代重复计算

- 实现更高效的时间过滤算法,减少每个柱状图的计算负担

这些优化方向不仅能提高策略的性能和稳定性,还能增强其适应不同市场条件的能力,实现更可持续的长期盈利。

总结

多时段多指标高频动态突破量化交易策略是一个针对短线交易者设计的综合性高频交易系统。该策略通过结合多重技术指标、价格突破识别、时间过滤和动态风险管理,构建了一个完整的交易框架。其核心优势在于高速执行能力、多重确认机制和灵活的自动化支持,使其特别适合在波动性资产的短时间框架上应用。

策略的主要技术特点包括EMA交叉判断趋势、SMA作为价格过滤器、RSI避免超买超卖区域交易,以及ATR动态风险管理。时间过滤系统和PineConnector集成进一步增强了策略的实用性和灵活性。

虽然该策略面临高频交易特有的风险和假突破陷阱等挑战,但通过合理的风险管理和参数优化,这些风险可以得到有效控制。未来的优化方向包括参数自适应、市场状态分类、增强过滤系统和智能止损策略等,这些改进将进一步提升策略的稳健性和盈利能力。

对于寻求在短线交易中获取优势的交易者,该策略提供了一个技术先进、逻辑严谨的量化交易解决方案,特别适合对高速交易感兴趣且希望通过自动化技术提高交易效率的用户。

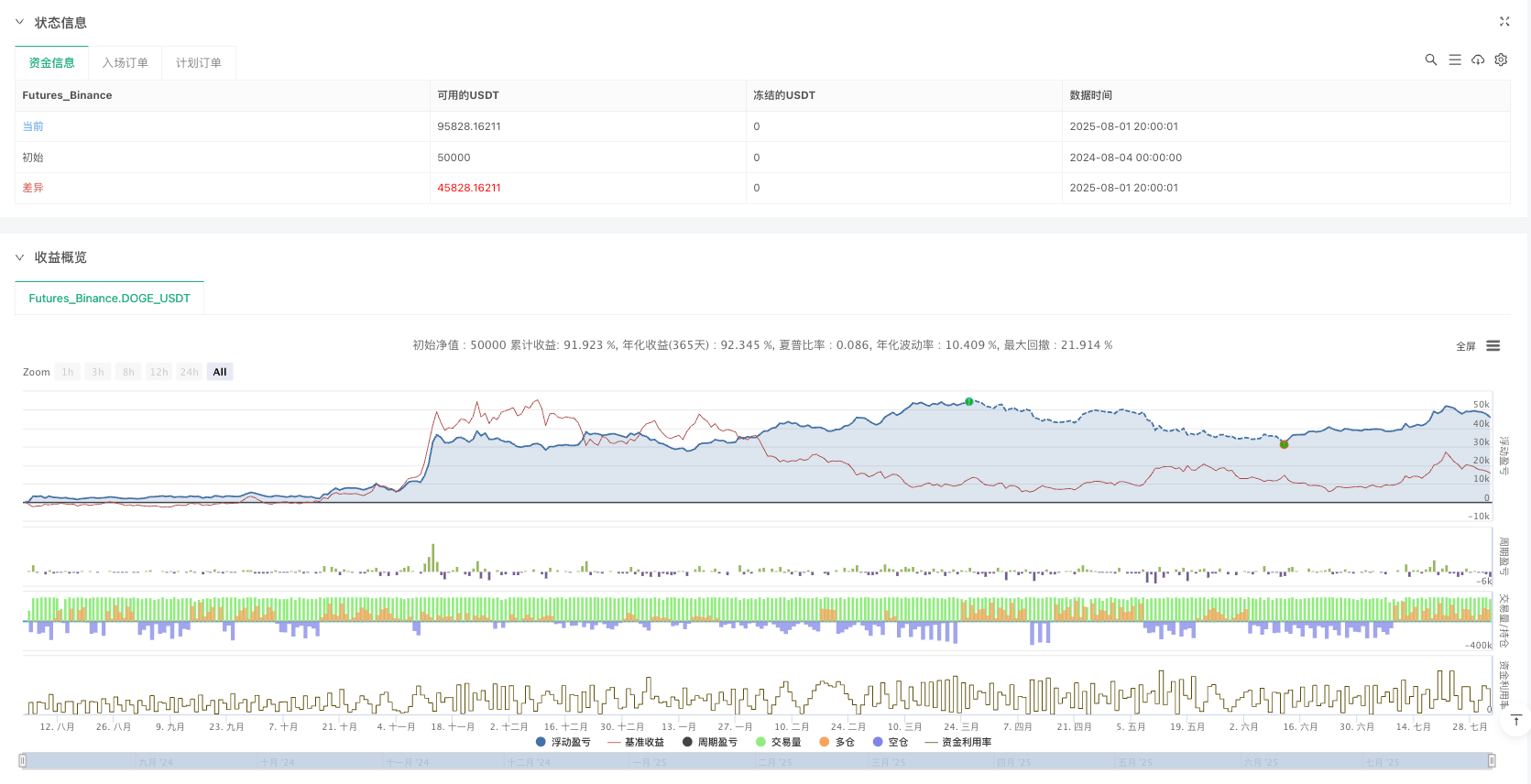

/*backtest

start: 2024-08-04 00:00:00

end: 2025-08-02 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Scalper TURBO", overlay=true, initial_capital=1000,

default_qty_type=strategy.percent_of_equity, default_qty_value=50,

calc_on_every_tick=true, process_orders_on_close=false)

// ==================== PERFORMANCE OPTIMIZATIONS ====================

// Pre-calculate constants to avoid repeated calculations

const int MINUTES_PER_HOUR = 60

// ==================== INPUT PARAMETERS ====================

// Technical Parameters

emaFastLen = input.int(34, "EMA Rápida", minval=1)

emaSlowLen = input.int(63, "EMA Lenta", minval=1)

smaLen = input.int(34, "SMA Filtro", minval=1)

rsiLen = input.int(14, "Periodo RSI", minval=1)

rsiOverbought = input.int(70, "RSI Sobrecompra", minval=1, maxval=100)

rsiOversold = input.int(30, "RSI Sobreventa", minval=1, maxval=100)

breakoutPeriod = input.int(1, "Periodos para Breakout", minval=1)

atrLen = input.int(14, "Periodo ATR", minval=1)

atrMultSL = input.float(3, "Multiplicador ATR Stop-Loss", step=0.1)

atrMultTrail = input.float(3, "Multiplicador ATR Trailing Stop", step=0.1)

// ==================== TIME FILTER SETTINGS ====================

var g_timefilters = "Time Filters"

// Time Filter Arrays for faster processing

useTimeFilter = array.new_bool(4)

startHour = array.new_int(4)

startMin = array.new_int(4)

endHour = array.new_int(4)

endMin = array.new_int(4)

// Time Filter 1

array.set(useTimeFilter, 0, input.bool(false, "Enable Time Filter 1", group=g_timefilters))

array.set(startHour, 0, input.int(9, "Start Hour", minval=0, maxval=23, group=g_timefilters, inline="tf1start"))

array.set(startMin, 0, input.int(0, "Start Minute", minval=0, maxval=59, group=g_timefilters, inline="tf1start"))

array.set(endHour, 0, input.int(11, "End Hour", minval=0, maxval=23, group=g_timefilters, inline="tf1end"))

array.set(endMin, 0, input.int(30, "End Minute", minval=0, maxval=59, group=g_timefilters, inline="tf1end"))

// Time Filter 2

array.set(useTimeFilter, 1, input.bool(false, "Enable Time Filter 2", group=g_timefilters))

array.set(startHour, 1, input.int(13, "Start Hour", minval=0, maxval=23, group=g_timefilters, inline="tf2start"))

array.set(startMin, 1, input.int(30, "Start Minute", minval=0, maxval=59, group=g_timefilters, inline="tf2start"))

array.set(endHour, 1, input.int(15, "End Hour", minval=0, maxval=23, group=g_timefilters, inline="tf2end"))

array.set(endMin, 1, input.int(0, "End Minute", minval=0, maxval=59, group=g_timefilters, inline="tf2end"))

// Time Filter 3

array.set(useTimeFilter, 2, input.bool(false, "Enable Time Filter 3", group=g_timefilters))

array.set(startHour, 2, input.int(16, "Start Hour", minval=0, maxval=23, group=g_timefilters, inline="tf3start"))

array.set(startMin, 2, input.int(0, "Start Minute", minval=0, maxval=59, group=g_timefilters, inline="tf3start"))

array.set(endHour, 2, input.int(18, "End Hour", minval=0, maxval=23, group=g_timefilters, inline="tf3end"))

array.set(endMin, 2, input.int(30, "End Minute", minval=0, maxval=59, group=g_timefilters, inline="tf3end"))

// Time Filter 4

array.set(useTimeFilter, 3, input.bool(false, "Enable Time Filter 4", group=g_timefilters))

array.set(startHour, 3, input.int(20, "Start Hour", minval=0, maxval=23, group=g_timefilters, inline="tf4start"))

array.set(startMin, 3, input.int(0, "Start Minute", minval=0, maxval=59, group=g_timefilters, inline="tf4start"))

array.set(endHour, 3, input.int(22, "End Hour", minval=0, maxval=23, group=g_timefilters, inline="tf4end"))

array.set(endMin, 3, input.int(30, "End Minute", minval=0, maxval=59, group=g_timefilters, inline="tf4end"))

// ==================== PINECONNECTOR SETTINGS ====================

var g_connector = "PineConnector Settings"

pcID = input.string(" ", "Pine Connector ID", group=g_connector)

symbolName = input.string("XAUUSD", "Symbol Name", tooltip="Symbol exactly as it appears in your MT5", group=g_connector)

lotSize = input.float(0.01, "Lot Size", step=0.01, group=g_connector)

enableRealTrading = input.bool(true, "Enable Real Trading", group=g_connector)

useFastExecution = input.bool(true, "Use Fast Execution Mode", group=g_connector)

showLabels = input.bool(true, "Show Info Labels", group=g_connector)

// Risk Management

useStopLoss = input.bool(true, "Use Stop Loss", group=g_connector)

useTakeProfit = input.bool(true, "Use Take Profit", group=g_connector)

useTrailingStop = input.bool(false, "Use Trailing Stop", group=g_connector)

stopLossATRMult = input.float(3, "Stop Loss ATR Multiple", step=0.1, group=g_connector)

takeProfitATRMult = input.float(3, "Take Profit ATR Multiple", step=0.1, group=g_connector)

trailingStopATRMult = input.float(3, "Trailing Stop ATR Multiple", step=0.1, group=g_connector)

// ==================== OPTIMIZED TIME FILTER FUNCTION ====================

// Cache current time components

currentHour = hour(time)

currentMin = minute(time)

currentTimeMinutes = currentHour * MINUTES_PER_HOUR + currentMin

// Optimized time check function

isTimeAllowed() =>

anyEnabled = false

timeOK = false

for i = 0 to 3

if array.get(useTimeFilter, i)

anyEnabled := true

startTimeMin = array.get(startHour, i) * MINUTES_PER_HOUR + array.get(startMin, i)

endTimeMin = array.get(endHour, i) * MINUTES_PER_HOUR + array.get(endMin, i)

inRange = startTimeMin <= endTimeMin ?

(currentTimeMinutes >= startTimeMin and currentTimeMinutes <= endTimeMin) :

(currentTimeMinutes >= startTimeMin or currentTimeMinutes <= endTimeMin)

if inRange

timeOK := true

break

not anyEnabled or timeOK

// ==================== CACHED INDICATOR CALCULATIONS ====================

// Calculate indicators only once per bar

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

sma34 = ta.sma(close, smaLen)

rsi = ta.rsi(close, rsiLen)

atr = ta.atr(atrLen)

// Support/Resistance with caching

var float resistenciaReciente = na

var float soporteReciente = na

if barstate.isconfirmed

resistenciaReciente := ta.highest(high, breakoutPeriod)[1]

soporteReciente := ta.lowest(low, breakoutPeriod)[1]

// ==================== SIGNAL CONDITIONS ====================

// Pre-calculate all conditions

tendenciaAlcista = emaFast > emaSlow

tendenciaBajista = emaFast < emaSlow

rsiNotOverbought = rsi < rsiOverbought

rsiNotOversold = rsi > rsiOversold

priceAboveSMA = close > sma34

priceBelowSMA = close < sma34

timeAllowed = isTimeAllowed()

// Breakout conditions

breakoutUp = close > resistenciaReciente

breakoutDown = close < soporteReciente

// Final entry conditions - simplified logic

longSignal = breakoutUp and tendenciaAlcista and rsiNotOverbought and priceAboveSMA and timeAllowed

shortSignal = breakoutDown and tendenciaBajista and rsiNotOversold and priceBelowSMA and timeAllowed

// ==================== POSITION MANAGEMENT ====================

// Efficient position tracking

var int currentPosition = 0 // 1 = long, -1 = short, 0 = flat

var bool positionChanged = false

var string pendingAlert = ""

// Detect position changes

newLong = longSignal and currentPosition <= 0

newShort = shortSignal and currentPosition >= 0

// ==================== OPTIMIZED ALERT SYSTEM ====================

// Pre-build alert components for faster execution

stopPips = useStopLoss ? str.tostring(math.round(atr * stopLossATRMult * 100)) : ""

tpPips = useTakeProfit ? str.tostring(math.round(atr * takeProfitATRMult * 100)) : ""

trailPips = useTrailingStop ? str.tostring(math.round(atr * trailingStopATRMult * 100)) : ""

// Build risk management string once

riskParams = useStopLoss ? ",sl=" + stopPips : ""

riskParams += useTakeProfit ? ",tp=" + tpPips : ""

riskParams += useTrailingStop ? ",trailingstop=" + trailPips : ""

// ==================== FAST EXECUTION MODE ====================

if enableRealTrading

// LONG ENTRY

if newLong

// Close short first if needed

if currentPosition < 0

alert(pcID + ",closeshort," + symbolName, alert.freq_once_per_bar)

// Enter long

strategy.entry("Long", strategy.long)

longAlert = pcID + ",buy," + symbolName + ",risk=" + str.tostring(lotSize) + riskParams

alert(longAlert, useFastExecution ? alert.freq_once_per_bar : alert.freq_once_per_bar_close)

currentPosition := 1

// SHORT ENTRY

else if newShort

// Close long first if needed

if currentPosition > 0

alert(pcID + ",closelong," + symbolName, alert.freq_once_per_bar)

// Enter short

strategy.entry("Short", strategy.short)

shortAlert = pcID + ",sell," + symbolName + ",risk=" + str.tostring(lotSize) + riskParams

alert(shortAlert, useFastExecution ? alert.freq_once_per_bar : alert.freq_once_per_bar_close)

currentPosition := -1

else

// Backtest mode

if newLong

strategy.entry("Long", strategy.long)

currentPosition := 1

else if newShort

strategy.entry("Short", strategy.short)

currentPosition := -1

// ==================== STOP LOSS MANAGEMENT ====================

// Calculate stops only when in position

if currentPosition != 0

if currentPosition > 0

stopLong = strategy.position_avg_price - atr * atrMultSL

strategy.exit("Exit Long", "Long", stop=stopLong, trail_points=atr * atrMultTrail, trail_offset=atr * atrMultTrail)

else

stopShort = strategy.position_avg_price + atr * atrMultSL

strategy.exit("Exit Short", "Short", stop=stopShort, trail_points=atr * atrMultTrail, trail_offset=atr * atrMultTrail)

// Detect exits

if strategy.position_size == 0 and currentPosition != 0

if enableRealTrading

exitAlert = currentPosition > 0 ? pcID + ",closelong," + symbolName : pcID + ",closeshort," + symbolName

alert(exitAlert, alert.freq_once_per_bar)

currentPosition := 0