A New Paradigm in Quantitative Trading: A Guide to Workflow Development on the FMZ Platform

0

0

200

200

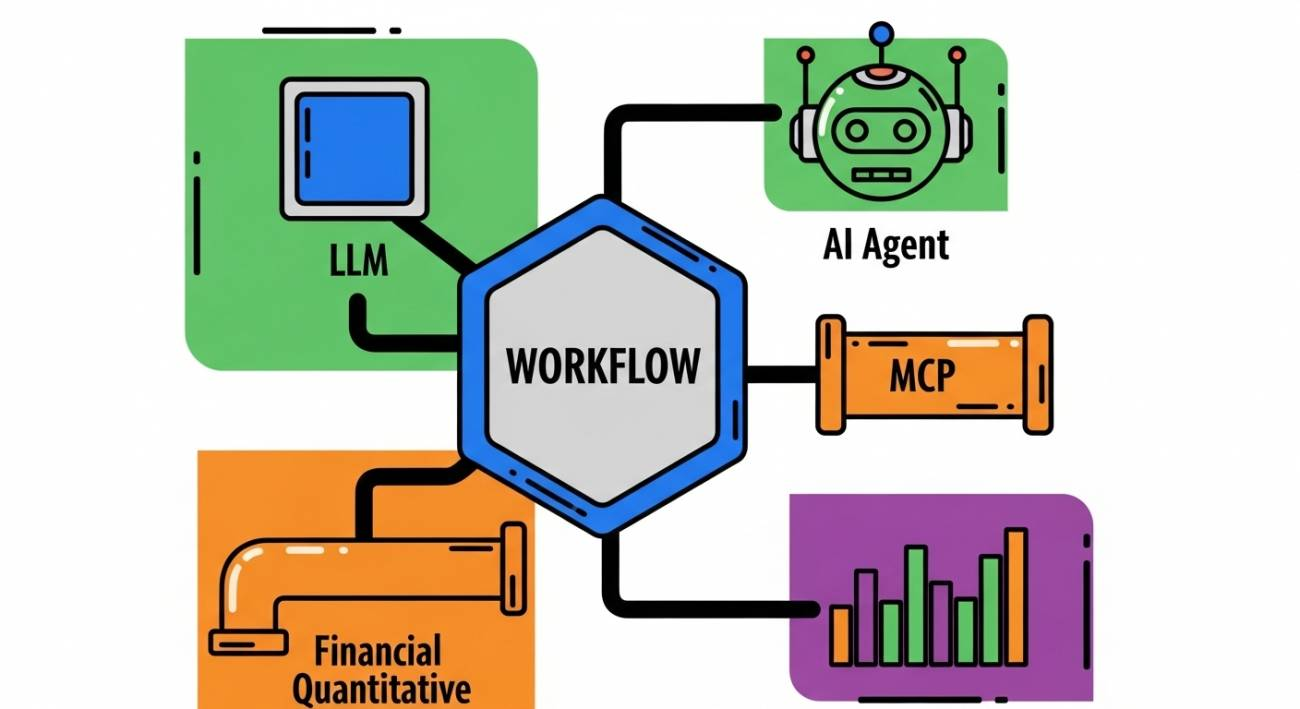

As AI technology continues to develop, quantitative trading is undergoing significant changes. The FMZ (Inventors Quantify) platform has integrated Workflow technology to provide users with a new approach to implementing quantitative trading strategies.

I. What is Workflow

Basic Concepts

Workflow is a visual programming tool that constructs automated processes by dragging and connecting different functional nodes. In quantitative trading, it helps users build trading systems more conveniently.

Main Features:

- Visual Interface: Build logic by dragging nodes and connecting lines

- Pre-built Nodes: Provides various commonly used functional nodes

- AI Model Support: Can integrate large language models like OpenAI and Claude, and supports MCP protocol, providing powerful intelligent capabilities for strategy analysis

- Code Extension Support: Can implement more complex functions through FMZ API functions

Role in Quantitative Systems

1. Bridge Connecting AI and Quantitative Trading

The most important role of workflow is to serve as a key bridge connecting AI technology and quantitative trading. It transforms AI from an independent analytical tool into a core component that can directly participate in trading decisions and execution. Through workflow, users can link the analytical capabilities of large language models, market data acquisition, technical indicator calculations, and trade execution to form a complete intelligent trading chain.

2. Integrating Multi-source Data for Rapid Response

Workflow can simultaneously process information from multiple different sources such as exchanges, news media, social platforms, and on-chain data, providing timely responses in rapidly changing market environments. Particularly in scenarios with frequent rotation of hot topics like MEME coins, the complete process from multi-source data analysis to trade execution can be completed quickly, helping capture fleeting market opportunities.

3. Providing New Methods of Quantitative Trading Execution

Workflow connects market analysis, signal generation, risk control, and trade execution into a complete system. Users can choose to execute workflows once, set up循环执行, or add manual confirmation at key decision points according to their needs, flexibly controlling the entire trading process. This visual, modular execution method changes the traditional development and operation mode of quantitative trading.

II. Workflow Nodes on the FMZ Platform

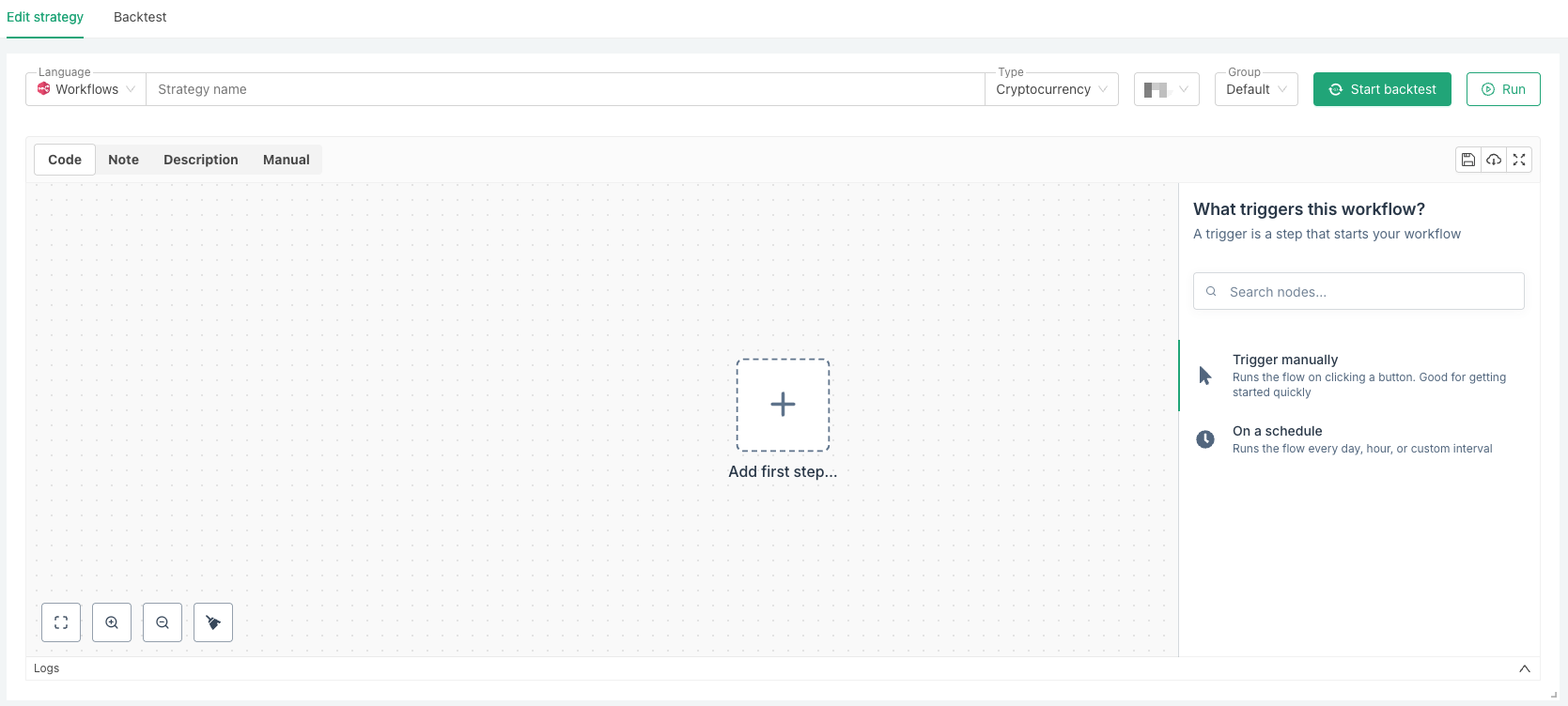

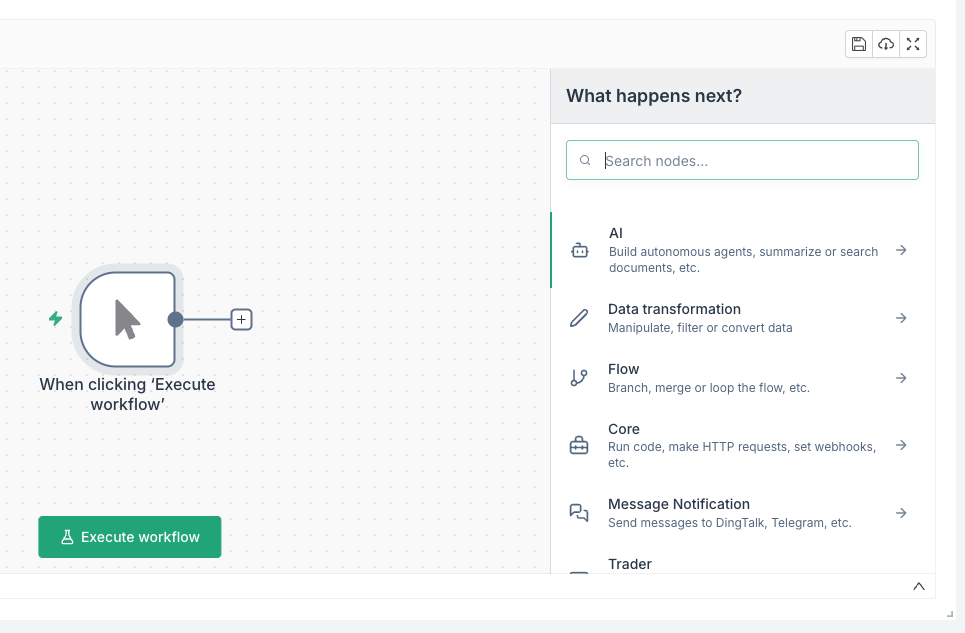

The FMZ platform is based on the N8N framework and has been optimized for quantitative trading scenarios, providing the following categories of nodes:

Main Node Types:

- AI Nodes: Used for document analysis, data summarization, and other intelligent analysis

- Data Transformation Nodes: Process operations to filter or transform data

- Flow Control Nodes: Implement strategic logic judgment and conditional branching

- Core Nodes: Support custom code and HTTP requests

- Notification Nodes: Send messages to DingTalk, Feishu, Telegram, etc.

- Trading Nodes: Interface with exchanges to obtain account and market data, and execute actual trading operations

III. Practical Application Examples

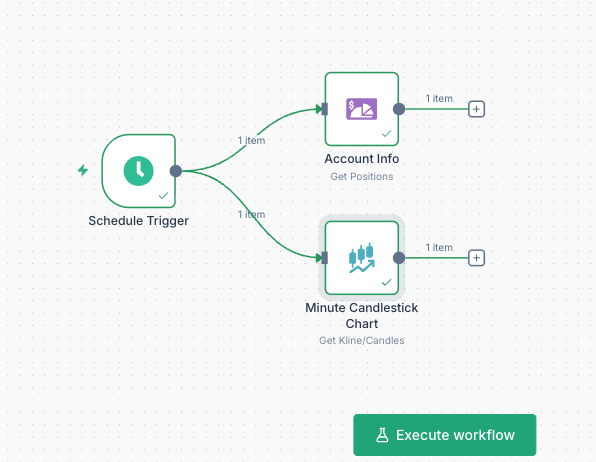

A Simple Workflow Implementation

Using workflow, you can:

- 1.Drag in trading nodes to obtain trading data

Trading nodes provide comprehensive market data acquisition capabilities, including real-time candlestick data and account position information. Through scheduled triggers, automated data collection is achieved, ensuring strategies make decisions based on the latest market conditions.

- 2.Add data source nodes to subscribe to information

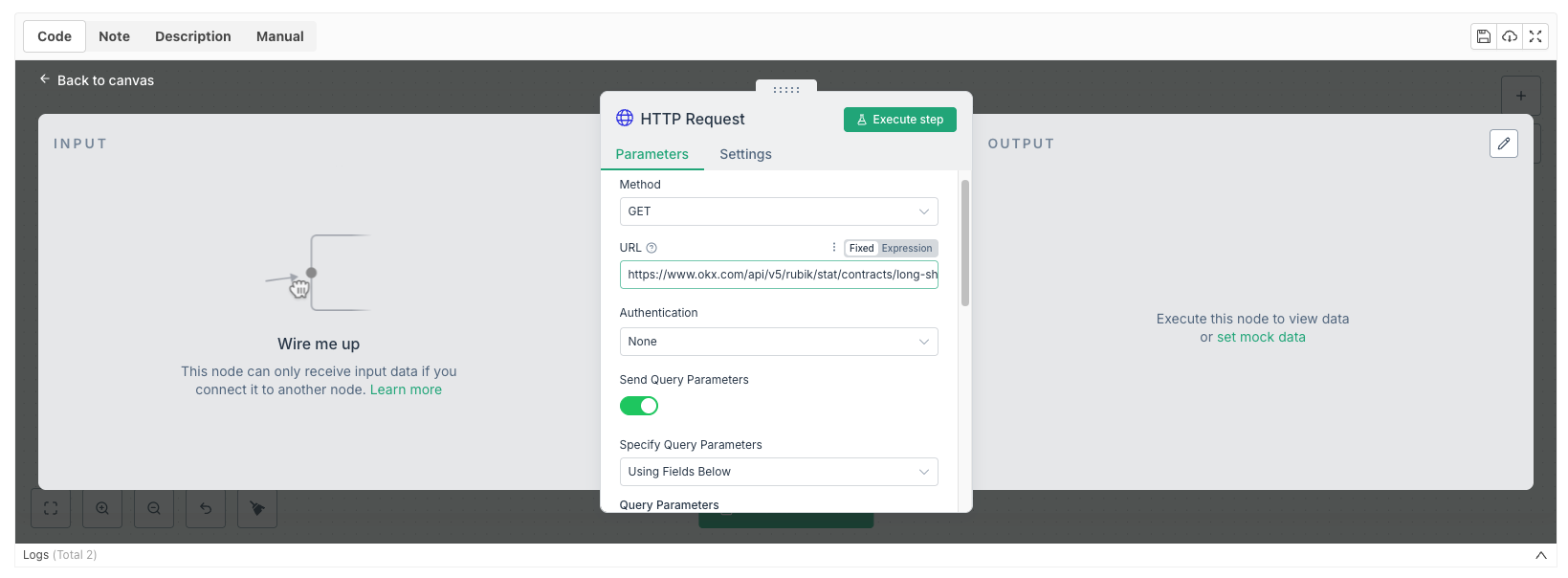

HTTP request functionality obtains external data sources through HTTPS protocol, supporting subscriptions to data from different interfaces, such as market sentiment indicators and funding data from exchange APIs, as well as supplementary information from KOLs (Key Opinion Leaders) and media sources.

- 3.Connect AI nodes for analysis

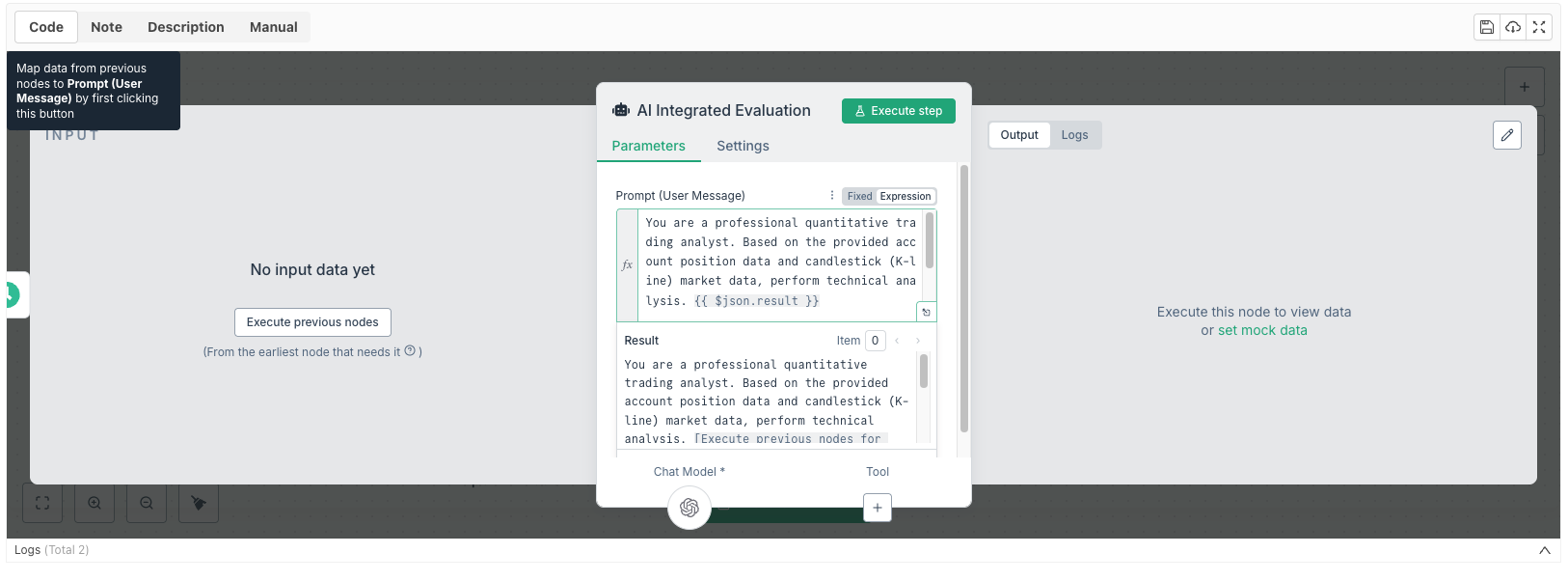

AI nodes serve as the core brain of the strategy, intelligently analyzing market data based on technical analysis methods. Through preset analytical frameworks (price action, volume, technical indicators, position status), they output standardized trading signals and can be combined with sentiment analysis nodes to convert complex analytical results into clear operational instructions.

- 4.Set up trade execution nodes

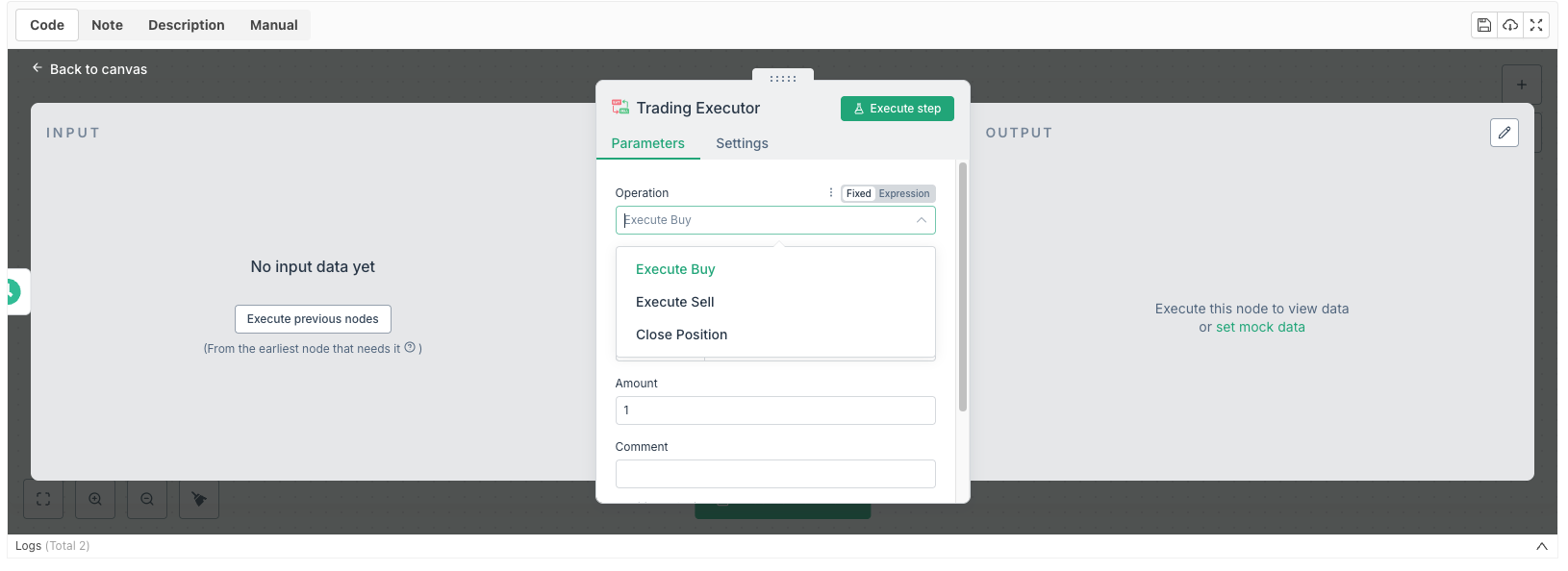

Trading nodes automatically execute corresponding trading operations (opening long, opening short, closing positions) based on AI analysis results.

- 5.Run the workflow

The entire workflow supports multiple execution modes: one-time workflow execution for overall debugging and strategy logic verification, backtesting debugging to validate historical data performance, and live trading for fully automated trading. The workflow forms a complete closed-loop system from data acquisition, intelligent analysis to trade execution through real-time triggers. Core nodes handle data flow and logic control, ensuring stable collaboration and exception handling across all components.

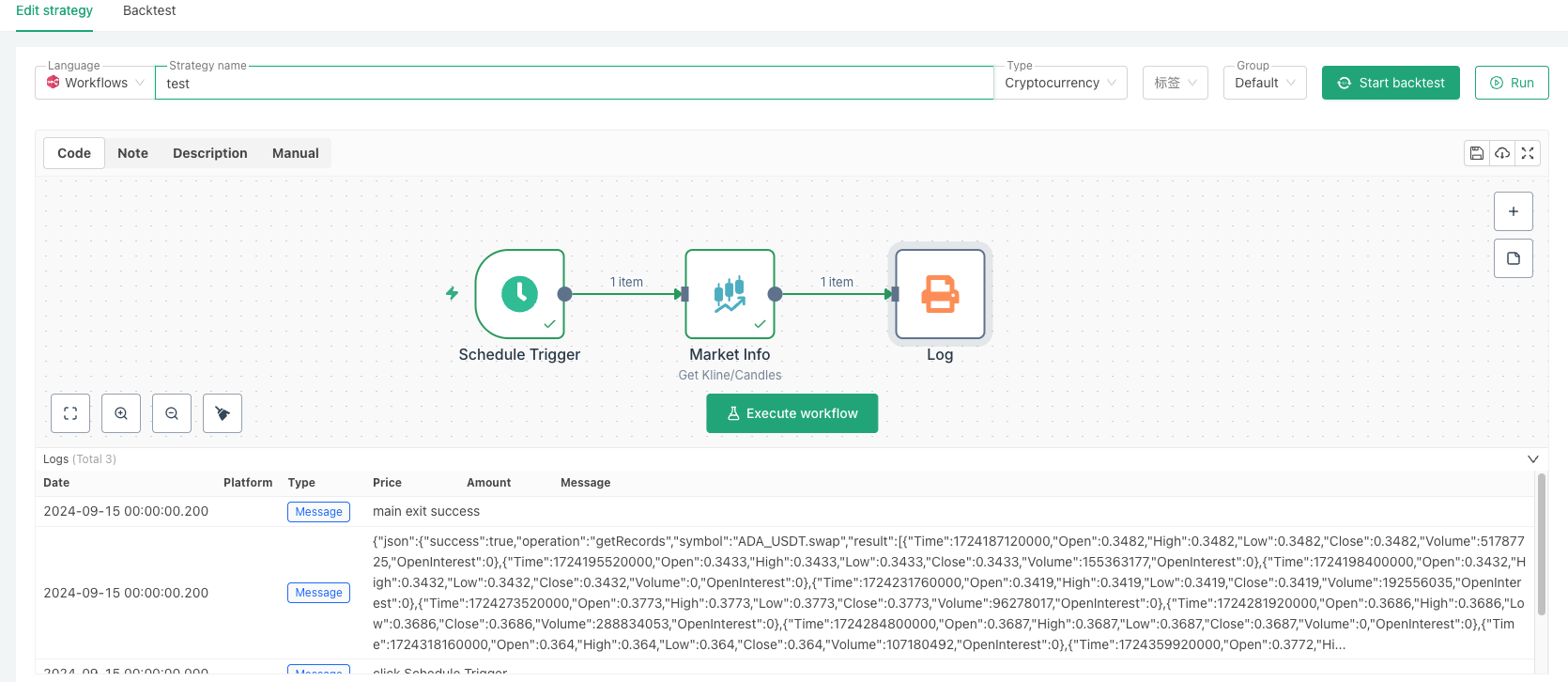

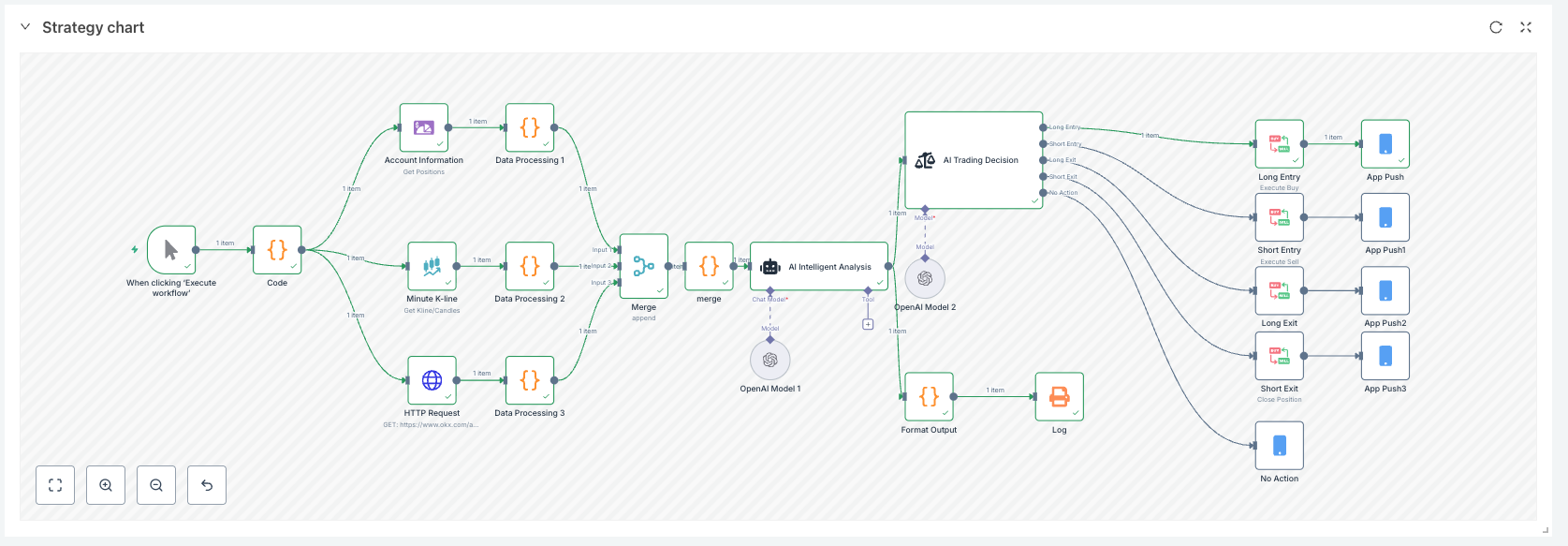

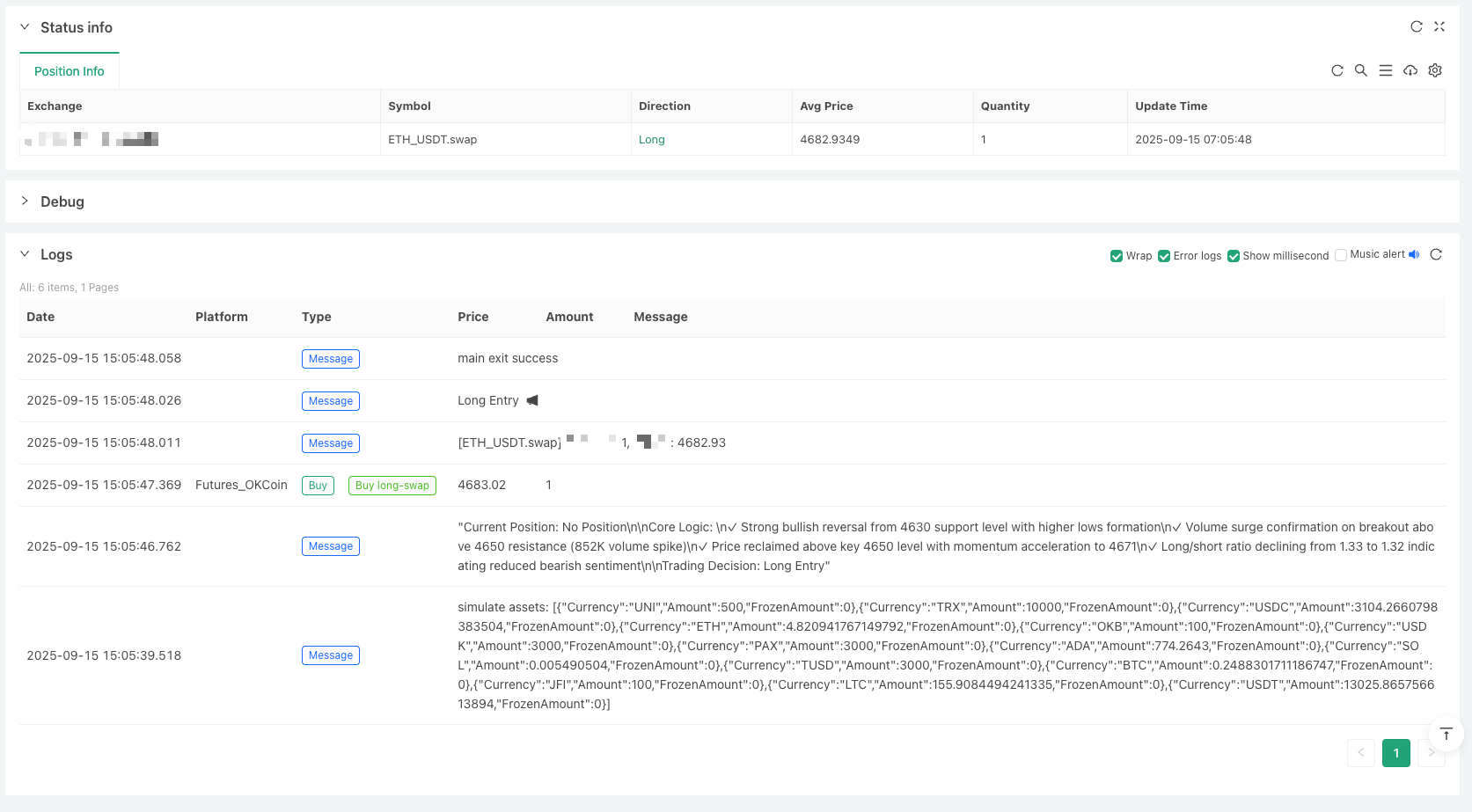

Actual Interface Display:

This demonstration workflow automatically retrieves account positions, candlestick data, and market sentiment data every 10 minutes through a scheduled trigger. After data processing and merging, the AI comprehensive analysis node uses the Claude model for technical analysis, then the AI trading decision node converts the analysis results into specific trading instructions. Finally, the corresponding trade executor automatically executes trades and sends push notifications, achieving a fully automated quantitative trading process from data collection to trade execution.

The specific configuration of the AI node needs to be filled in by you, supports OpenRouter.

Strategy Address: https://www.fmz.com/strategy/508658

Conclusion

Workflow provides a new implementation approach for quantitative trading. Through visual programming and modular design, it makes strategy development and automated trading more convenient. Whether professional traders or ordinary investors, everyone can use workflow to build their own trading systems. This modular, visual approach lowers the barrier to entry for quantitative trading while also providing advanced users with more expansion possibilities.

- AlphaArena大模型厮杀:手把手复刻DeepSeek领跑的AI量化交易系统

- 让传统策略更聪明:工作流+AI的实战玩法

- A Retail Investor's Self-Discipline Journey: Using AI to Block 80% of Bad Trades

- RWA New Strategy: A Step-by-Step Guide to Automated US Stock Token Trading with Inventor Workflow

- 一个散户的自我驯化实录:用AI拦下80%的烂交易

- RWA新玩法:手把手教你用发明者工作流自动交易美股代币

- From Manual Analysis to Automation: Building Aster Smart Money Tracking Tool on Inventor Platform

- 从手工分析到自动化:发明者平台搭建Aster聪明钱追踪工具

- Demystifying Crypto Influencers: A Professional Analysis System for Replicating Founder Workflows

- 祛魅加密货币大V:发明者工作流复现专业分析系统

- 量化交易新范式:发明者平台工作流开发指南

- Python Multi-Currency Quantitative Strategy Framework: Design Concepts and Implementation Details

- Python多币种量化策略框架:设计思路与实现详解

- FMZ Platform Gold Rush: Practical Analysis of a Highly Flexible Python Trend Trading Framework

- 发明者平台淘金记:高灵活性Python趋势交易框架实战解析

- A Brief Discussion on Several Grid Trading Strategies in the Digital Currency Field

- 浅谈数字货币领域几种网格策略

- Data Stream Acceleration Guide Implementing Protobuf in FMZ Platform

- From Fixed Weights to Neural Networks Machine Learning for a Pine Strategy

- 从固定权重到神经网络:一个Pine策略的机器学习改造实践