A Retail Investor's Self-Discipline Journey: Using AI to Block 80% of Bad Trades

0

0

139

139

A Real Scenario

3 AM on Black Friday, you’re scrolling through your phone and see BTC breaking through new lows. Your heart races, your finger hovers over the “Buy” button. Countless thoughts flash through your mind:

- “If I don’t buy the dip now, it’ll be too late!”

- “What about the technicals? Forget it, no time to check”

- “How much money do I have left in my account? Whatever, buy first, think later”

You press the button. The next day you wake up to an 8% crash, liquidated and out of the game. This is the daily reality for 90% of retail traders. I was one of them, until I built this tool.

Core Concept: Adding a Gate Between Impulse and Order Execution

What this tool does is very simple:

Your trading impulse → Forced to write down reasons → AI rational analysis → Provides actionable plan → Records growth trajectory

The key lies in three unique design elements:

1. Forced to Write Down “Why”

The form requires filling in “trading rationale”. When you try to describe in words “why you want to make this trade”, many impulses naturally fade away.

❌ Vague impulse: "Feels like it's going up"

✅ Specific reasoning: "Breakout above 120-day MA + MACD golden cross + volume expansion"

2. AI Validates Your Logic from Multiple Dimensions**

The system automatically collects 4 types of data and conducts comprehensive analysis:

Data Collection:

Position Info ──┐

Sentiment Analysis ──┼──→ Data Merge → AI Analysis

Technical Indicators ──┤

Trading Rationale ──┘

AI’s 4 Analysis Dimensions:

- 0️⃣ Trading Logic Validation (most important): Identifies cognitive biases, verifies if logic holds

- 1️⃣ Technical Signal Verification: Whether MACD/RSI/ATR/OBV support your judgment

- 2️⃣ Emotional Risk Assessment: Is market sentiment greedy or fearful

- 3️⃣ Entry Timing Judgment: Enter now or wait for pullback/breakout

Outputs comprehensive analysis across multiple fields:

{

"original_rationale": "Down 5%, should be the bottom",

"rationale_evaluation": "Unreasonable",

"fatal_flaw": "Anchoring bias—5% drop doesn't mean sufficient",

"validation_result": "MACD=-213 deep bearish, RSI=31 no bullish divergence",

"execution_advice": "Abandon trade",

"suggested_entry_price": "Not recommended",

"stop_loss_price": "$115,000",

"take_profit_target_1_price": "$125,000",

// ...

}

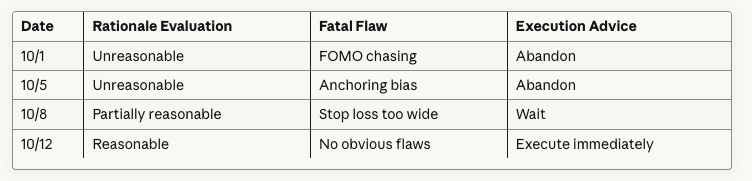

3. Trading Log Records Your Growth Journey

Each trading insight analysis is automatically saved to a CSV file. After a month, you’ll see:

This is your evolution from impulse to rationality.

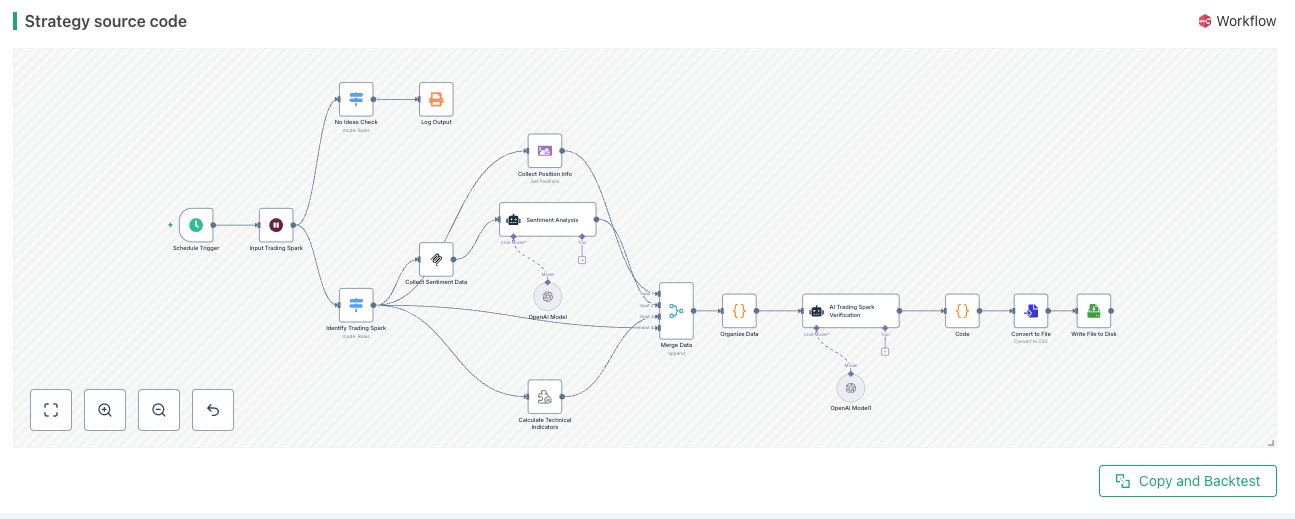

System Architecture

Complete Flow Diagram:

Workflow Trigger → Form Input → Null Value Check → [Data Collection] → Data Consolidation → AI Analysis → Storage → Export CSV

↓

┌───────────────────┼───────────────────┐

↓ ↓ ↓

Position Info Sentiment Analysis Technical Indicators

Layer 1: Trading Inspiration CaptureNode Name: Input Trading Spark

Type: Wait Node (Form Mode)

// Form field configuration

{

"tradingAsset": "text", // e.g., BTC

"tradingDirection": "dropdown", // LONG/SHORT/COVERLONG/COVERSHORT

"tradingQuantity": "number", // e.g., 1

"tradingRationale": "text" // Core! Must fill in reason

}

Key Design:

- Form is followed by Switch node to check if trading spark exists, then proceed to AI validation

Layer 2: Data Collection (3 Parallel Paths)

2.1 Position Information Collection

Node Name: Collect Position Information

Type: accountInfo Node

// Query current asset position

symbol: "{{ $json['tradingAsset'] }}_USDT.swap"

operation: "getPosition"

// Output example

{

"symbol": BTC, // Position asset

"amount": 0.5, // Position quantity

"price": 110003 // Direction

}

2.2 Sentiment Data Collection

Node Name: Collect Sentiment Data → Sentiment Information Analysis

Type: MCP Client + AI Agent

Step 1: Get News

// Alpha Vantage MCP interface

endpointUrl: "https://mcp.alphavantage.co/mcp?apikey='YOUR_KEY'"

tool: "NEWS_SENTIMENT"

tickers: "CRYPTO:{{ $json['tradingAsset'] }}"

Step 2: AI Extract Sentiment

// AI structured sentiment analysis output

{

"shortTermSentiment": {

"category": "Positive",

"score": 0.7,

"rationale": "Broke key resistance in 24 hours, social media heat rising"

},

"longTermSentiment": {

"category": "Neutral",

"score": 0.0,

"rationale": "Regulatory uncertainty persists, institutional entry slowing"

}

}

Why is sentiment data important? One of the biggest gaps between retail traders and institutions is information access capability. Through recent news sentiment analysis, we can timely understand:

- Mainstream media reporting bias on specific coins

- Market participant sentiment trend changes

- Major news event impact assessment

This fills critical information gaps.

2.3 Technical Indicators Calculation

Node Name: Signal Indicators Calculation

Type: tradingPlugin Node

function main(inputData) {

const symbol = inputData + "_USDT.swap"

const records = exchange.GetRecords(symbol)

// Data validation

if (records.length <= 10) {

Log("Error: Insufficient data");

return null;

}

// Calculate technical indicators (using talib library)

const macd = talib.MACD(records);

const rsi = talib.RSI(records, 14);

const atr = talib.ATR(records, 14);

const obv = talib.OBV(records);

// Get last 10 values

function getLast10Values(arr) {

if (!arr || arr.length === 0) return [];

return arr.slice(-10);

}

return {

MACD: {

macd: getLast10Values(macd[0]),

signal: getLast10Values(macd[1]),

histogram: getLast10Values(macd[2])

},

RSI: getLast10Values(rsi),

ATR: getLast10Values(atr),

OBV: getLast10Values(obv)

};

}

Returned Technical Indicators:

- MACD (Trend Indicator): Golden cross/Death cross/Divergence

- RSI (Oscillator): Overbought (>70)/Oversold (<30)

- ATR (Volatility): For dynamic stop loss

- OBV (Volume): Capital flow direction

2.4 Trading Intention

Directly passed from form, including asset, direction, quantity, trading rationale.

Layer 3: Data Consolidation

Node Name: Data Consolidation

Type: Code Node (JavaScript)

// Initialize containers

let posData = null;

let contentData = null;

let technicalIndicators = null;

let tradeIdea = null;

// Iterate through all inputs from merge node

for (const item of items) {

// =============== Position Data ===============

if (item.json.operation === 'getPosition' && item.json.result !== undefined) {

posData = item.json.result;

// Key conversion: numbers → readable text

posData.amount = posData.amount == 0 ? "No position" :

posData.amount > 0 ? "Long position" : "Short position";

}

// =============== Sentiment Analysis Results ===============

if (item.json.output !== undefined) {

try {

contentData = JSON.parse(item.json.output);

} catch (e) {

contentData = item.json.output;

}

}

// =============== Technical Indicator Data ===============

if (item.json.MACD !== undefined || item.json.RSI !== undefined) {

technicalIndicators = {

"Trend Indicator MACD": item.json.MACD,

"Oscillator RSI": item.json.RSI,

"Volatility Indicator ATR": item.json.ATR,

"Volume Analysis OBV": item.json.OBV

};

}

// =============== Trading Intention ===============

if (item.json["tradingAsset"] !== undefined) {

tradeIdea = {

"tradingAsset": item.json["tradingAsset"],

"tradingDirection": item.json["tradingDirection"],

"tradingQuantity": item.json["tradingQuantity"],

"tradingRationale": item.json["tradingRationale"] // Core!

};

}

}

// =============== Return Aggregated Results ===============

return [{

json: {

"positionData": posData,

"sentimentAnalysis": contentData,

"technicalIndicators": technicalIndicators,

"tradingIntention": tradeIdea

}

}];

Why do we need this node?

- Four data streams have inconsistent formats, need standardization

- Position values need conversion to readable text

- Technical indicators add Chinese descriptions for AI understanding

Layer 4: AI Trading Spark Validation

Node Name: AI Trading Spark Validation

Type: Agent Node

This is the soul of the entire system. The prompt design includes a strict analysis framework:

Analysis Framework (4 Dimensions):

0️⃣ Trading Logic Validation (Highest Priority)

- Is this reasoning valid? (Verify with technical indicators + sentiment data)

- Are there cognitive biases? (FOMO/Anchoring bias/Gambler’s fallacy)

- Is risk-reward ratio reasonable? (At least 2:1)

1️⃣ Technical Signal Verification

- Does MACD direction support trading direction?

- Is RSI overbought/oversold?

- Is OBV diverging from price?

2️⃣ Emotional Risk Assessment

- Short-term sentiment score? (>0.6 extreme greed/<-0.6 extreme fear)

- Are there black swan events?

3️⃣ Entry Timing Judgment

- Is current price level reasonable?

- Should wait for pullback/breakout?

Output Requirements: Complete Analysis Fields

{

"analysisTime": "2025-10-11T10:30:00.000Z",

"tradingAsset": "BTC",

"tradingDirection": "LONG",

"tradingQuantity": "1",

"originalRationale": "Down 5%, should be the bottom",

"rationaleEvaluation": "Unreasonable",

"validationResult": "MACD=-213 deep bearish, RSI=31 no bottom divergence, OBV continuous outflow",

"fatalFlaw": "Anchoring bias—5% drop doesn't constitute reversal reason",

"executionAdvice": "Abandon trade",

"confidence": "High",

"basis_logicValidation": "Trading logic has serious flaws",

"basis_technicals": "MACD/RSI/OBV all show bearish trend not ended",

"basis_riskPoints": "Blind bottom fishing may encounter double bottom, potential loss 15%+",

"suggestedEntryPrice": "Not recommended",

"suggestedEntryCondition": "Trading logic has major flaws",

"suggestedEntryTime": "Abandon current plan",

"stopLossPrice": "$115,000",

"stopLossReason": "Break below key support",

"takeProfit1_price": "$125,000",

"takeProfit1_position": "50%",

"takeProfit1_reason": "Backtested resistance",

"takeProfit2_price": "$132,000",

"takeProfit2_position": "Remaining position",

"takeProfit2_reason": "Key round number",

"coreRisk": "Currently in mid-downtrend, bottom fishing too early may trigger stop loss",

"riskRewardRatio": "0.5:1",

"potentialReturnPercent": "5%",

"maxLossPercent": "10%",

"riskLevel": "High risk",

"operationSummary": "Abandon bottom fishing plan, wait for MACD golden cross + RSI bottom divergence",

"decisionValidity": "Until technicals show clear reversal signal",

"reviewCondition": "MACD golden cross or RSI forms bottom divergence or volume surge"

}

Field Analysis

- Covers all key elements of trading decisions

- Completely flattened for easy CSV storage

- Each field is actionable with clear trigger conditions

Special Case Handling Rules:

The prompt specifically defines 3 special cases:

1、When “trading rationale” is clearly unreasonable

- Execution suggestion must be set to “Abandon trade”.

- Fatal flaw must clearly specify the type of cognitive bias.

- Suggested entry price should be written as “Not recommended to enter”.

2、When market is extremely volatile

- Risk level marked as “Extremely high risk”.

- Decision validity period shortened to “Valid within 1 hour”.

3、When technical indicators contradict

- Confidence level marked as “Low”.

- Execution suggestion prioritized as “Wait to enter”.

Layer 5: Storage and Export

5.1 Save Analysis Results

Type: Code Node

const rawData = $input.first().json.output;

// Function to extract JSON content (handles possible markdown wrapping)

function extractJSON(outputString) {

const jsonMatch = outputString.match(/```json\n([\s\S]*?)\n```/);

if (jsonMatch && jsonMatch[1]) {

return JSON.parse(jsonMatch[1]);

}

// If no markdown wrapping, parse directly

return JSON.parse(outputString);

}

const result = extractJSON(rawData);

Log("Current trade analysis:", result);

// Use _G global storage function (key!)

let tradelog = _G('tradelog') || []; // Initialize fallback

// Add latest record

tradelog.push(result);

// Persistent save

_G('tradelog', tradelog);

return tradelog;

Value of _G Function:

- Data persistent storage, exists after workflow restart

- Can share data across workflows

- Perfect for recording historical trading decisions

5.2 Convert to CSV

Type: convertToFile Node

Converts JSON array to CSV format, including all fields.

5.3 Save to Local

Type: writeFile Node

Saves to local tradelog.csv.

Long-term Value of CSV File:

This file records your trading mindset evolution:

Week 1: 10 ideas → 7 "unreasonable" → Cognitive bias: FOMO

Week 2: 8 ideas → 5 "unreasonable" → Starting to realize problems

Week 4: 6 ideas → 3 "unreasonable" → Learning to wait for technical signals

Week 8: 5 ideas → 1 "unreasonable" → Thinking starts maturing

...

This is a trading master’s growth diary.

Part 4: Realistic Expectations

This tool is not omnipotent:

❌ Cannot predict the future: AI based on historical data, fails when black swans arrive ❌ Cannot replace intuition: Veteran traders’ “market sense” is hard to quantify ❌ Cannot guarantee profits: Can only improve decision quality, not guarantee every trade wins ❌ Cannot fight extreme markets: When market goes crazy, rational analysis might backfire

But it can:

✅ Let you know the risk of every trade ✅ Help identify cognitive biases ✅ Record your growth trajectory ✅ Avoid the most basic mistakes

Part 5: Evolution Direction

Short-term Optimization:

- Connect more data sources (on-chain data, funding rates)

- Add historical backtesting module

- Use ATR for dynamic stop loss calculation

Further Improvements:

- Connect exchange API for semi-automatic order placement

- Multiple AI Agents voting (aggressive vs conservative)

- Adjust sentiment/technical weights based on market environment

Part 6: Usage Guide

6.1 Copy Strategy

Click the strategy link at the end of the article, click copy strategy.

6.2 Configuration

Need to configure 3 APIs:

1、Alpha Vantage (sentiment data): Configure in MCP client node 2、OpenAI (AI model): Configure in two OpenAI model nodes 3、Exchange (position query, needed for live trading): Configure in exchange section

6.3 View Trading Log

tradelog.csv location:

# 1. Enter custodian log directory

cd ~/logs/storage

# 2. Find your strategy ID directory (e.g., 620669)

cd 620669/files

# 3. View trading log

cat tradelog.csv

6.4 Best Practices

Fill out the form every time you have a trading impulse, let AI help you analyze calmly. Suggest reviewing tradelog.csv every weekend to see which mistakes you make most often (FOMO? Blind bottom fishing?). After 1-2 months of continuous use, you’ll clearly see your evolution from impulse to rationality.

Part 7: Final Thoughts

The greatest value of this tool is not how much money it helped you make, but:

It forces you to ask yourself before every order: Why am I making this trade?

- If you can’t answer → this is gambling.

- If you can answer but AI points out flaws → this is learning.

- If both you and AI consider it reasonable but still lose → this is normal trial and error.

The ultimate goal of trading is not to beat the market, but to understand yourself. Understand your greed, fear, and self-righteousness. This trading log file is your path to self-awareness.

Appendix

Technical Support: Welcome to discuss in comments

Disclaimer: Tool for learning only, trading has risks, please make careful decisions

If this article helped you, feel free to share with friends also struggling on the trading path. We all need a calm voice to say when impulse arrives: “Wait, are you sure?”

Strategy Link: https://www.fmz.com/strategy/511853

Note: This framework is just an initial implementation, needs more bug fixes and feature improvements.

- Alpha Arena AI Trading System 2.0: The Optimization Journey from Ideal to Reality

- From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

- Alpha Arena AI交易系统2.0:从理想到现实的优化之路

- Build Your Personal AI Trading Butler: The Perfect Combination of Intelligent Analysis and Human Decision-Making

- 从想法到验证:让AI帮你快速验证量化因子的完整指南

- 打造你的专属AI交易管家:智能分析+人工决策的完美结合

- Making Traditional Strategies Smarter: Practical Applications of Workflow + AI

- AlphaArena AI Model Battle: A Hands-On Guide to Replicating DeepSeek's Leading AI Quantitative Trading System

- AlphaArena大模型厮杀:手把手复刻DeepSeek领跑的AI量化交易系统

- 让传统策略更聪明:工作流+AI的实战玩法

- RWA New Strategy: A Step-by-Step Guide to Automated US Stock Token Trading with Inventor Workflow

- 一个散户的自我驯化实录:用AI拦下80%的烂交易

- RWA新玩法:手把手教你用发明者工作流自动交易美股代币

- From Manual Analysis to Automation: Building Aster Smart Money Tracking Tool on Inventor Platform

- 从手工分析到自动化:发明者平台搭建Aster聪明钱追踪工具

- Demystifying Crypto Influencers: A Professional Analysis System for Replicating Founder Workflows

- 祛魅加密货币大V:发明者工作流复现专业分析系统

- A New Paradigm in Quantitative Trading: A Guide to Workflow Development on the FMZ Platform

- 量化交易新范式:发明者平台工作流开发指南

- Python Multi-Currency Quantitative Strategy Framework: Design Concepts and Implementation Details