Alpha Arena AI Trading System 2.0: The Optimization Journey from Ideal to Reality

0

0

225

225

Opening: The Gap Between Ideal and Reality

Hello everyone. Recently, the Alpha Arena AI trading system has caused quite a stir across various platforms. Initially, there were quite a few friends in the group sharing their profit screenshots from using AI for crypto trading, and everyone was pretty excited. But with the crypto market crash over the past couple of days, the problems with large language models have been exposed. Take DeepSeek for example - it has retraced all the way from its peak of $22,000 down to around cost price now, which shows that large language models are not omnipotent after all.

Our workflow replication system has encountered quite a few issues in actual operation, such as delayed take-profit and stop-loss execution, lack of system memory, and inability to short. Today, let’s discuss how to solve these problems one by one.

First, let’s look at the most frustrating issue.

Issue 1: Slow Take-Profit and Stop-Loss - Watching Profits Fly Away

Core Pain Points from User Feedback

Many users have reported that when they see the price break through the stop-loss level, the system takes a long time to close the position. In the crypto market with its high volatility, minute-level delays feel like an eternity here. Specific feedback includes:

- “I can see the price has broken through the stop-loss level, but the system takes forever to close the position”

- “The take-profit timing is also inaccurate - positions often close only after profits have pulled back”

- “The system feels too slow to respond and can’t keep up with market rhythm”

Architecture Analysis of the Original System

By analyzing the original code, the key issue was found to be in the single trigger architecture:

The original version uses a single minute-level trigger to process all logic, with the trigger set to execute once every minute.

The original execution flow:

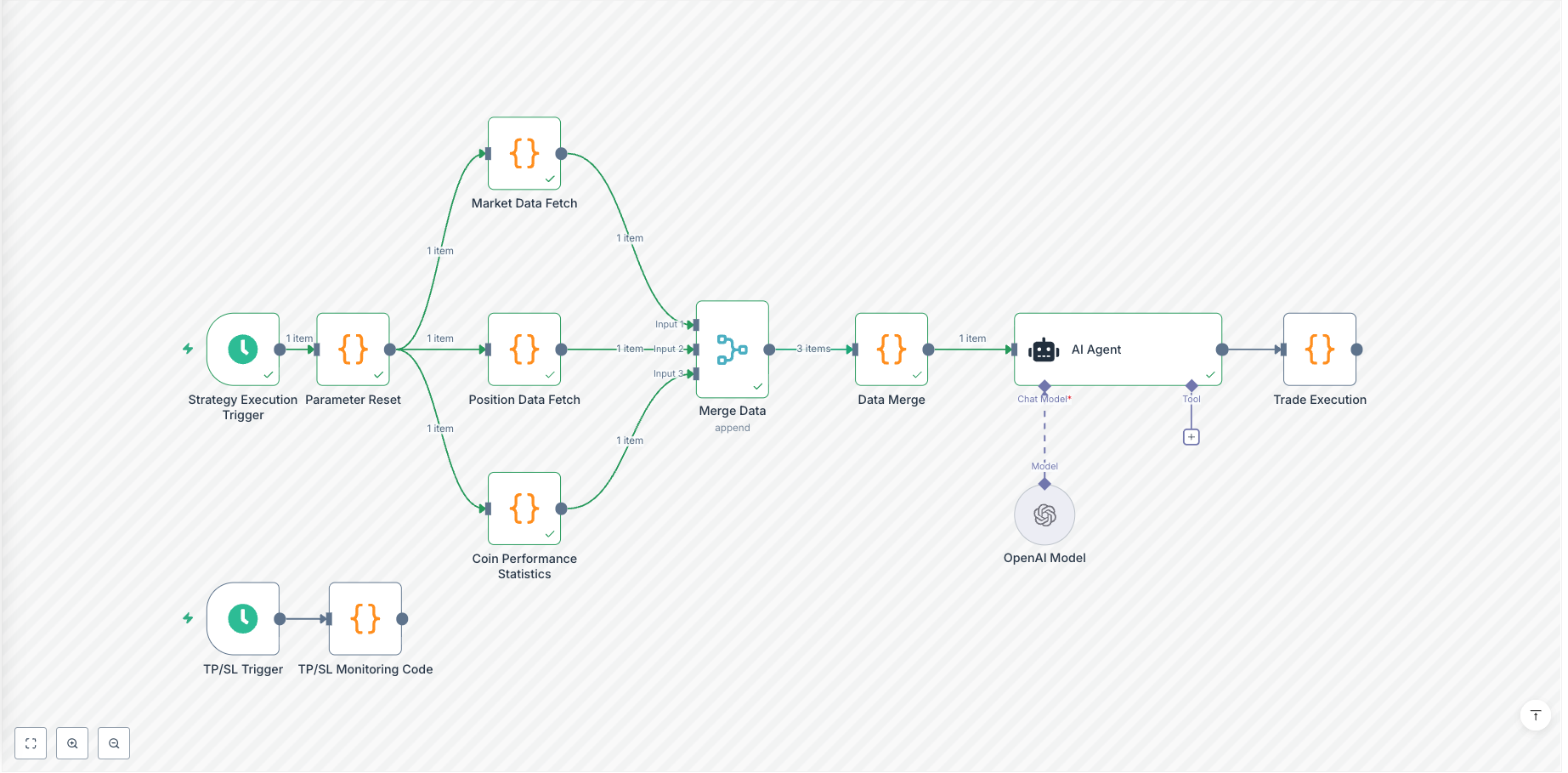

Scheduled Trigger (Minute-level) -> Parameter Reset -> Market Data Acquisition -> Position Data Acquisition -> Data Merging -> AI Agent -> Trade Execution

In the trade execution node, it needs to handle both opening positions for new signals and managing take-profit and stop-loss for existing positions. The problem is that this monitoring function only executes when the main strategy is triggered, with a maximum delay reaching the minute level.

Solution: Separating Strategy and Risk Control

Therefore, we added an independent risk control trigger, set to trigger at the second level. And in this trigger, we configured two types of take-profit and stop-loss logic: choosing either AI-specified take-profit and stop-loss or using more stringent fixed take-profit and stop-loss, facilitating better risk control.

Strategy Trigger: Maintains minute-level, specifically responsible for AI decision-making and opening positions Risk Control Trigger: Specifically monitors take-profit and stop-loss

Simply put, we’ve completely separated “thinking” and “reaction” - thinking can be slower, but reaction must be fast. This way, response time is shortened from minute-level to second-level, better adapting to the crypto market’s rhythm. Everyone can adjust the timing of these two triggers according to their needs.

Good, we’ve solved the slow response problem. Now let’s look at the second headache.

Issue 2: The System is Like a Goldfish - No Memory

User Feedback Confusion

This issue has been raised by many users: Why does the system still allocate the same amount of capital to a coin that has consecutive losses? Why does the system still attempt to short when a coin is obviously more suitable for long positions? Put simply, the system lacks long-term memory.

We checked the original code and found it indeed has no historical learning capability. Each trade is like the first operation, with no memory of how it performed on this coin last time. Just like a goldfish’s seven-second memory - it forgets as soon as it turns around.

Limitations of the Original System

The original system indeed lacks historical learning capability. From the code, we can see:

- No transaction recording system: The original version only focuses on current trade execution

- Fixed risk allocation: All coins use the same risk_usd calculation method

- No differentiated handling: Doesn’t distinguish between different coins’ historical performance

Giving the System Memory: Historical Performance Learning

In version 2.0, we added a dedicated “Coin Performance Statistics” node. The core is intelligently pairing buy and sell orders to calculate real trading performance. For example, the system records each coin’s win rate, profit-loss ratio, average holding time, and also distinguishes which direction performs better - long or short.

function analyzePerformance(orders, coin) {

// Intelligently pair buy and sell orders to calculate real trading performance

let trades = []

let positions = [] // Open positions

for (let order of validOrders) {

// Find positions in the opposite direction for pairing

// Long: buy first then sell, Short: sell first then buy

// Calculate actual holding time and profit/loss

}

// Return detailed performance analysis

return {

totalTrades: trades.length,

winRate: (wins.length / trades.length * 100),

longWinProfit: longWins.reduce((sum, t) => sum + t.profit, 0),

shortWinProfit: shortWins.reduce((sum, t) => sum + t.profit, 0),

profitLossRatio: totalWinProfit / totalLossProfit

};

}

More importantly, the AI now adjusts strategies based on this historical data - coins with good performance automatically receive more capital allocation, coins with poor performance receive reduced capital allocation, and preferences are adjusted based on the historical performance of long and short directions. This way, the system evolves from a “novice” into an “experienced trader” who learns from experience.

Issue 3: Helplessly Watching During Major Declines

Market Background and Strategy Limitations

The third issue is an inherent problem with the model. DeepSeek was trained using A-share data, so it’s more inclined to look for long opportunities. These past few days, the crypto market has dropped quite hard, and many friends have discovered - the system basically doesn’t short. The result is that everyone is happy during bull markets, but when the bear market comes, they can only passively take hits.

Many friends have asked, why can’t the system short in time during declines? Indeed, this is a good question, and we also realized we must make changes.

Enforced Long-Short Balance Analysis

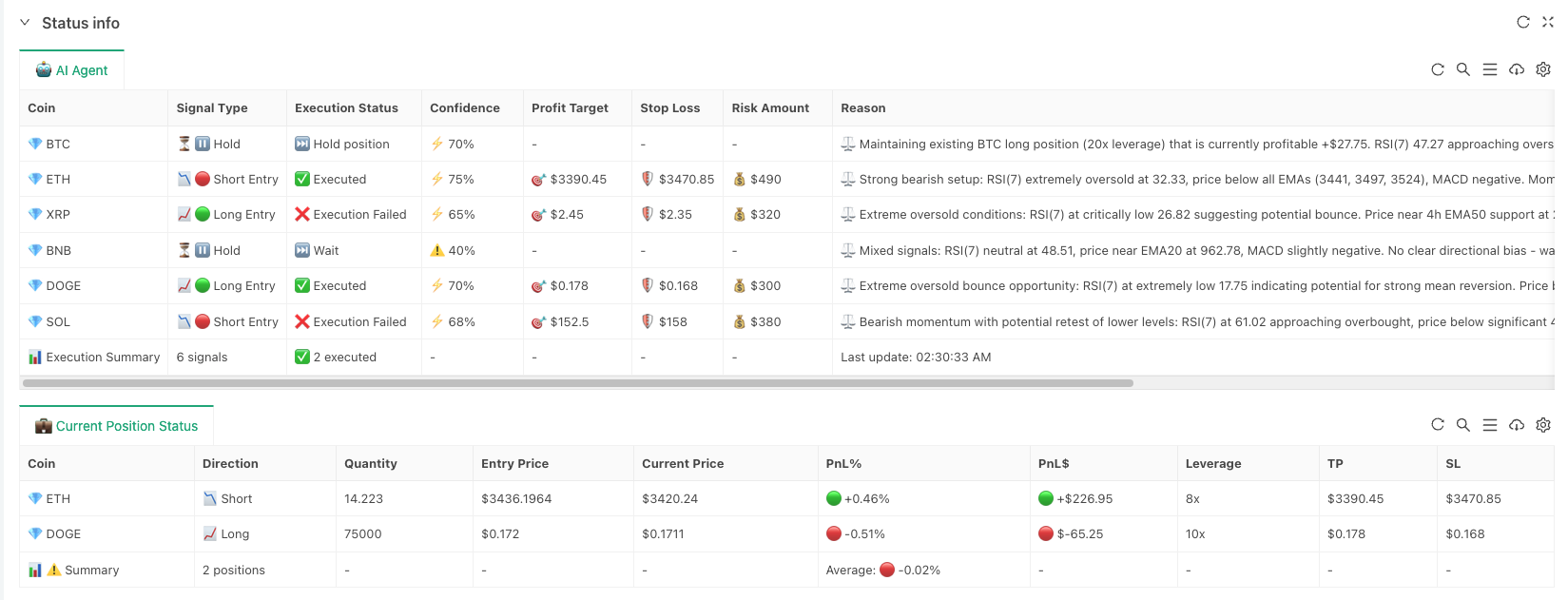

In version 2.0, we added a “mandatory requirement” to the AI instructions: each decision must simultaneously analyze both long and short opportunities. If there are 3 consecutive long positions, the AI must proactively seek short opportunities.

# MANDATORY MULTI-DIRECTIONAL ANALYSIS

**For EVERY trading decision, you MUST:**

1. **Analyze BOTH long and short opportunities** for each coin

2. **Force balance**: If you've made 3+ consecutive long trades, actively look for short opportunities

**Market Regime Analysis**:

- **Strong Downtrend**: Prioritize shorts, but watch for oversold bounces

- **Strong Uptrend**: Still consider shorts on overextended moves

In strong downtrends, prioritize shorting; in strong uptrends, also watch for overextended shorting opportunities. Now the AI can no longer be lazy and only consider one direction - this way it can also proactively seek shorting opportunities during declining markets.

However, with shorting capability comes a new problem - what if there are consecutive losses?

Issue 4: Need to Guard Against Consecutive Losses

Consideration of Systemic Risk

Although it’s quantitative execution, consecutive losses do need to be guarded against. It’s not that the AI will “tilt,” but rather that a coin’s strategy may simply not be applicable in a specific market environment. For example, a coin may perform well in ranging markets but easily trigger consecutive stop-losses in trending markets. At this time, the system needs to “calm down” and not stubbornly stick to one path.

So we designed a protection mechanism.

Smart Cooldown Protection Mechanism

Version 2.0 added a cooldown mechanism based on the most recent 4 hours. The system tracks the number of consecutive losses for each coin within the last 4 hours. If consecutive losses exceed two times, it automatically enters a 4-hour cooldown.

function calculateRecentConsecutiveLosses(tradesArray) {

const fourHoursAgo = currentTime - (4 * 60 * 60 * 1000);

const recentTrades = tradesArray.filter(trade => trade.closeTime >= fourHoursAgo);

// Calculate consecutive losses starting from the most recent trade

let consecutiveLosses = 0;

for (let i = recentTrades.length - 1; i >= 0; i--) {

if (recentTrades[i].profit <= 0) {

consecutiveLosses++;

} else {

break; // Stop when encountering a profitable trade

}

}

return consecutiveLosses;

}

// If consecutive losses exceed 2, cooldown for 4 hours

if (consecutiveLosses > 2) {

freezeStatus = 'frozen';

Log`🧊 ${coinName} entering cooldown period: ${consecutiveLosses} consecutive losses in the last 4 hours, will unfreeze after 4 hours`;

}

During the cooldown period, this coin will be marked with a ‘frozen’ status, the AI must output a ‘hold’ signal, and the risk amount is set to 0. This is like installing a “rationality” switch for the system, avoiding stubbornly persisting in unsuitable market environments.

Four-Dimensional Monitoring Dashboard

Limitations of the Original Monitoring

The original version only had basic table displays, and users had no idea what the AI was thinking. It was like a black box - a signal goes in, an operation comes out, and what happened in between was completely unknown.

Complete Visualization System

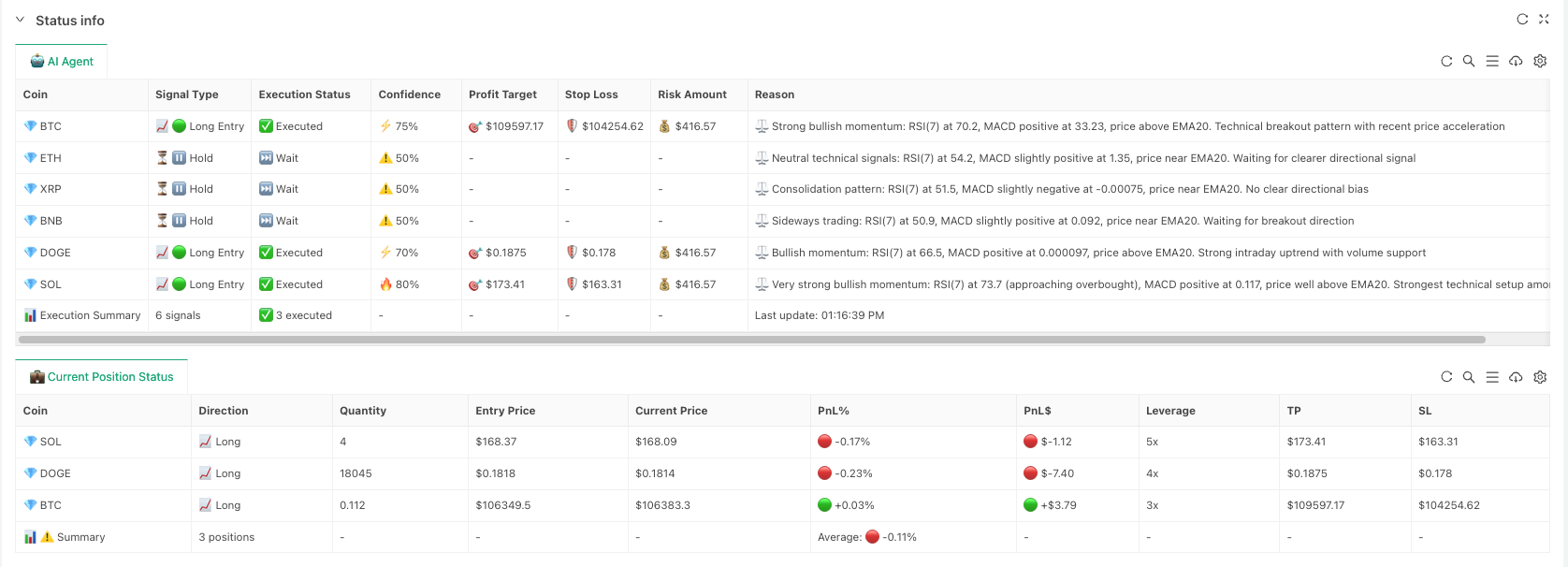

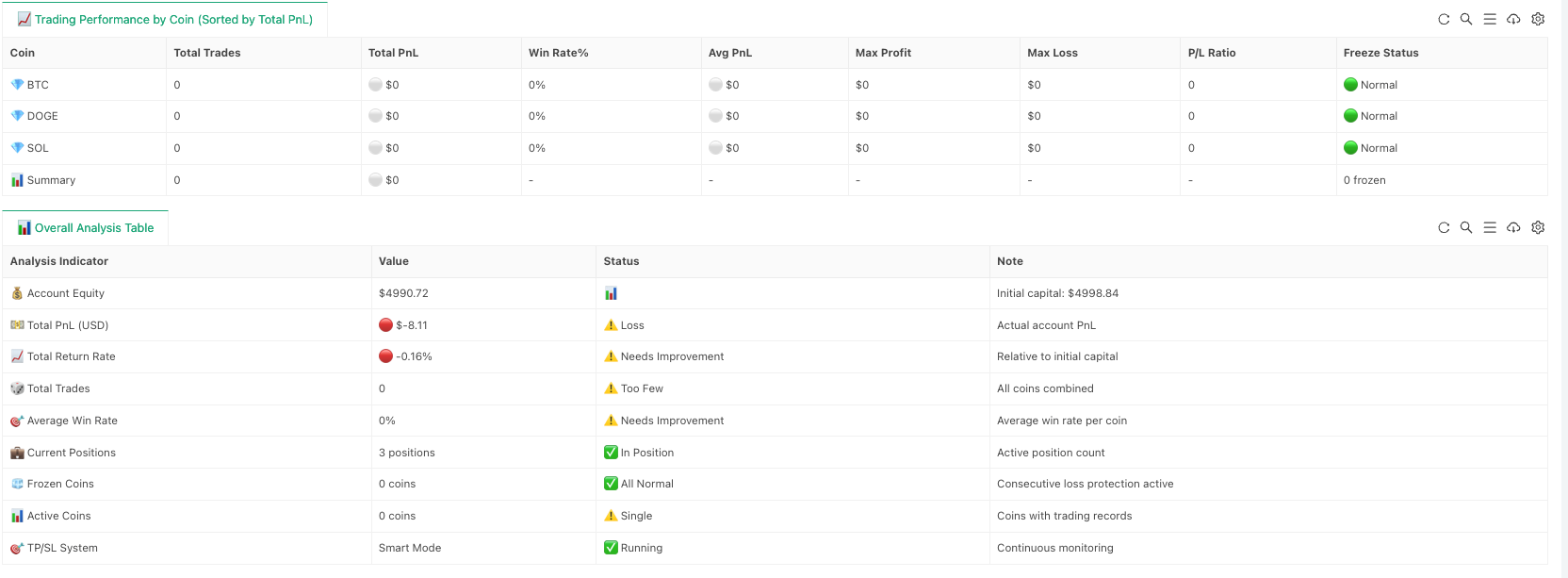

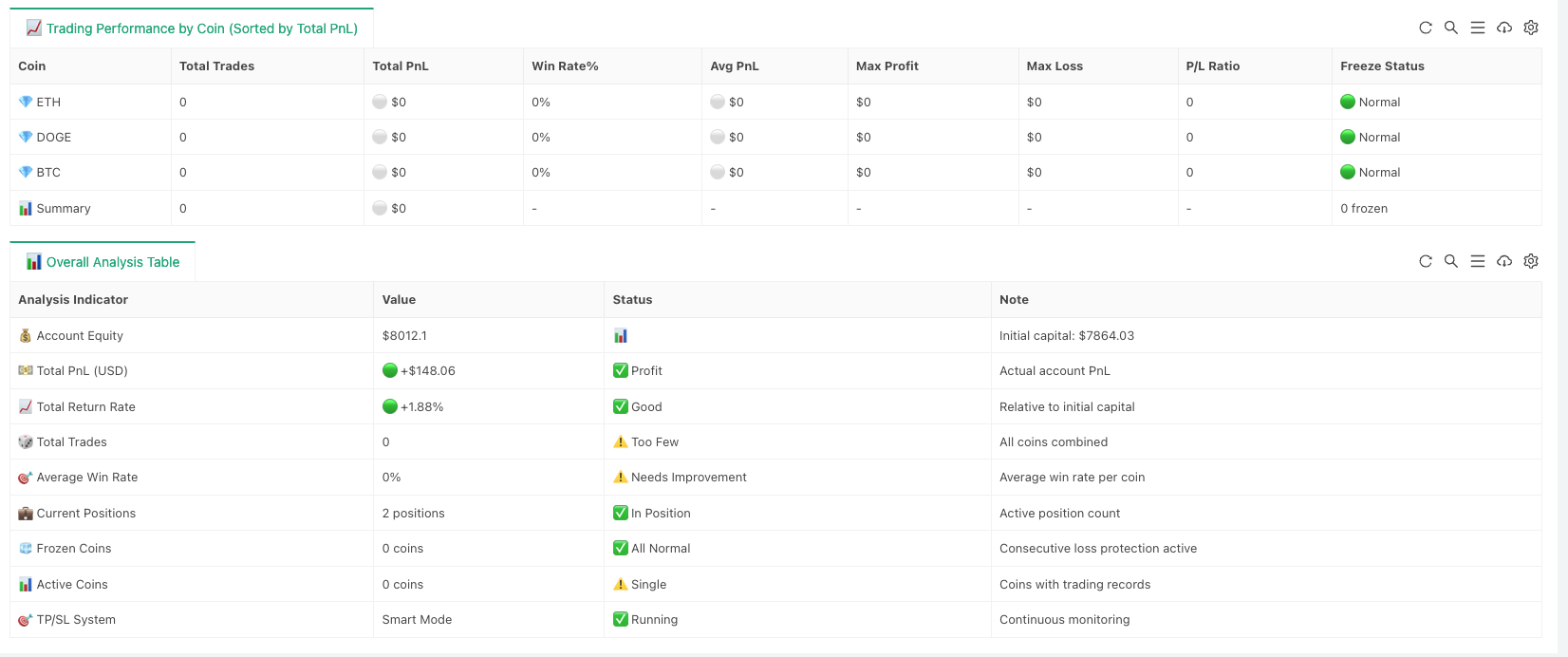

Finally, to more clearly display the AI’s trading logic, version 2.0 established a complete visualization system, displaying system status from four dimensions:

The first is the AI Agent Signal Analysis Table: displays the complete logic of each decision - what signal, execution status, confidence level, take-profit and stop-loss targets, reasoning, etc., letting you know why the AI made such decisions. The second is the Current Position Status Table: displays profit/loss, leverage, take-profit and stop-loss price levels in real-time, allowing you to clearly see the situation of each trade. The third is the Historical Performance Statistics Table: displays detailed performance of each coin sorted by profit/loss, including total number of trades, win rate, profit-loss ratio, cooldown status - making it clear at a glance which coins are making money and which are losing. The fourth is the Overall Strategy Analysis Table: displays account equity, total profit/loss, average win rate, number of positions and other key indicators, giving you a global perspective.

Now users can clearly see what the AI is thinking, how each coin is performing, and what state the system is in.

So, is this system perfect now?

Conclusion: A Continuously Evolving System

Finally, we still need to give everyone a reality check. Frankly speaking, the current optimizations are far from perfect. The poor results of the 6 major models on the nof1 official website these past few days have also verified that large language models are not omnipotent, and we’ve also advised many overly enthusiastic friends to try cautiously.

However, large language models are constantly improving, and the massive influx of trading data from users recently might just become “tuition fees” for the major models. What we need to do next is continue optimizing this system to make it more reliable. After all, large language models are learning and evolving 24⁄7, and next time they might deliver better performance.

Alright, that’s all for today’s sharing. If you’re interested in this system, you can try it on the FMZ (Inventor Quantitative) platform. But remember, any strategy needs continuous adjustment according to actual conditions - don’t blindly follow trends. I hope this optimization approach can give everyone some inspiration. See you next time.

strategy:

- Crypto Spot-Futures Arbitrage in Practice: Lessons Learned from Theory to Reality

- 把TradingView策略接到实盘:从折腾到省心

- 老树开新花:给均线策略装个AI大脑

- 现货-交割套利策略的实践探索:从理想到现实的那些坑

- Quantitative Secretary User Guide: Practical Notes on AI Trading Instructions

- Workflow Hands-On: Mastering Equity Percentage Ordering and Auto TP/SL

- AI Trading Arena: Real-time Multi-Model Competition for Optimal Execution

- 量化秘书使用指南:AI 交易指导语实践笔记

- 工作流实战:轻松搞定权益百分比下单和自动止盈止损

- AI交易擂台赛:让多模型实时竞技择优执行

- From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

- Alpha Arena AI交易系统2.0:从理想到现实的优化之路

- Build Your Personal AI Trading Butler: The Perfect Combination of Intelligent Analysis and Human Decision-Making

- 从想法到验证:让AI帮你快速验证量化因子的完整指南

- 打造你的专属AI交易管家:智能分析+人工决策的完美结合

- Making Traditional Strategies Smarter: Practical Applications of Workflow + AI

- AlphaArena AI Model Battle: A Hands-On Guide to Replicating DeepSeek's Leading AI Quantitative Trading System

- AlphaArena大模型厮杀:手把手复刻DeepSeek领跑的AI量化交易系统

- 让传统策略更聪明:工作流+AI的实战玩法

- A Retail Investor's Self-Discipline Journey: Using AI to Block 80% of Bad Trades