Quantitative Secretary User Guide: Practical Notes on AI Trading Instructions

0

0

106

106

Secretary User Guide: Practical Notes on Quantitative Trading Instructions

Recently, Li Xinye from the quant community published a wildly popular book called “Guide to Dating Married Women.” So we’ll call this one “Secretary User Guide.” Don’t get the wrong idea—the secretary here is AI.

How to delegate tasks is actually a profound discipline.

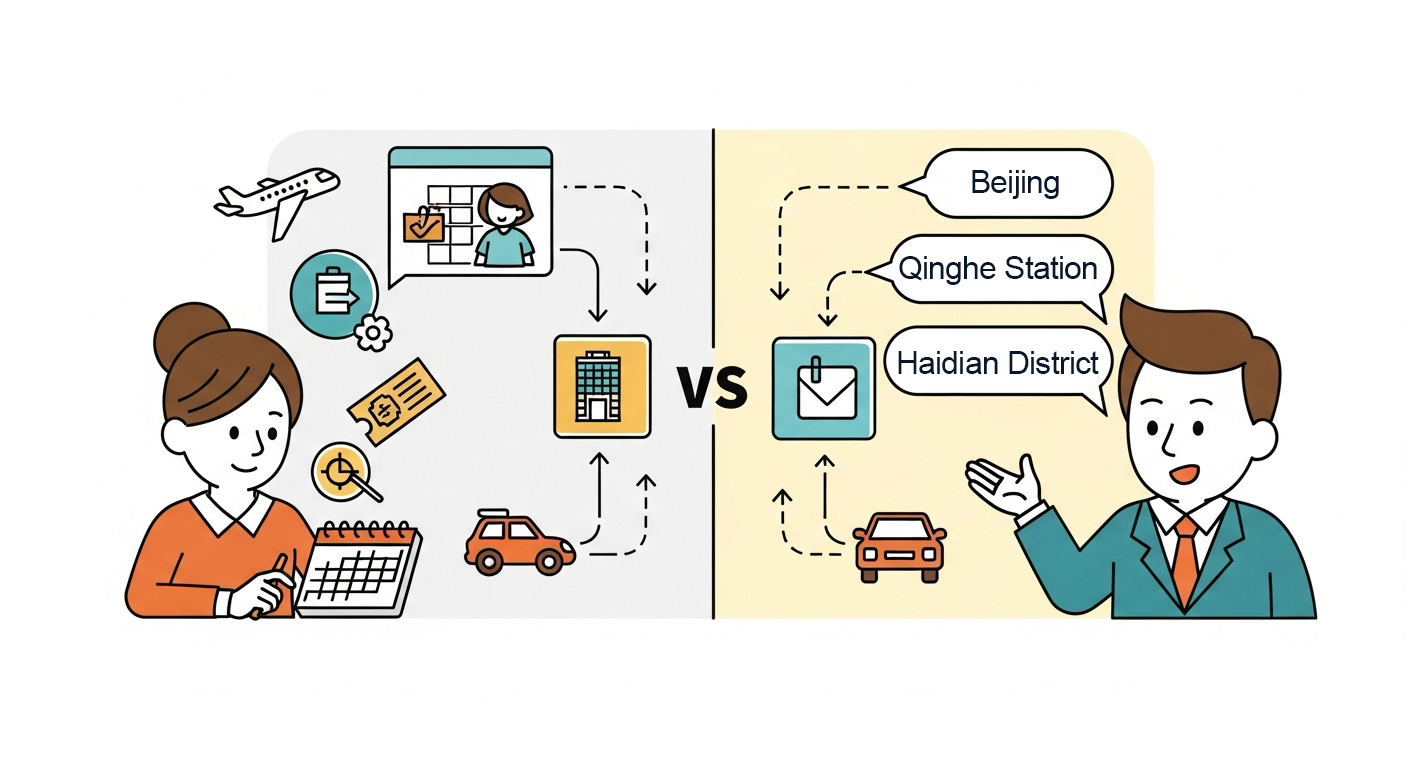

What does a good secretary look like? For example, suppose a leader needs to book a ticket to Beijing for tonight. A good secretary will check the leader’s schedule for that week and find out there’s a meeting tomorrow morning in Haidian District. So they’ll book a high-speed train ticket with Beijing Qinghe Station as the destination, because it’s closest to Haidian District. They’ll also book a hotel near tomorrow’s meeting venue for convenient rest, arrange for a driver, and have them pick up the leader at 6 PM sharp to get to the local train station.

But being a good leader who delegates is another matter entirely. They won’t just say “book me a ticket to Beijing” and be done with it. Instead, they’ll tell the secretary: “I have a meeting at 10 AM tomorrow in Haidian. I need a high-speed train ticket arriving at Beijing Qinghe Station at 8 PM tonight. I need a driver to pick me up at 6 PM to take me to the train station, and please book tonight’s hotel in Haidian District as well.” They provide specific tasks for each step, giving the secretary enough context to execute the related tasks.

And now we need to be good leaders. Current artificial intelligence cannot reach the level of proactive inquiry—it won’t actively check your calendar or guess your real needs like a human secretary would. The same principle applies to instruction prompts in trading systems—AI only knows what you tell it. All the relevant causes and effects, contextual information, must be fed to it bit by bit. Step by step.

This is why prompts are so important—they determine what AI can help you do and to what extent.

The Challenge of Prompts in Quantitative Trading

You might think, since AI is so smart, writing prompts shouldn’t be difficult, right? But the reality is that the requirements for prompts in quantitative trading are far more stringent than we imagine.

Imagine this scenario: In casual conversation, you ask AI “what should I wear today,” and AI responds “based on the weather conditions, I suggest you wear a light jacket.” Such an answer, while not specific enough, isn’t a big deal—at worst you ask again or make your own judgment.

But if you ask AI “should I buy BTC now?” and AI responds “based on the latest market data, Bitcoin price is currently pulling back, and market sentiment is relatively low. As for whether you should buy, there is significant divergence in the market, which requires you to make a comprehensive judgment based on your own risk tolerance and investment objectives.” This is the standard AI response—always thinking ahead for you but never giving you practical advice. And such responses are disastrous in trading. Because every second of hesitation could mean missing opportunities or increasing losses.

This is the cruel reality of quantitative trading: every AI suggestion directly concerns your hard-earned money.

Extremely High Precision Requirements

- Cannot give vague “may rise”—must specify “entry price \(52,300, target \)54,000”

- Cannot say “appropriate stop-loss”—must be precise “$51,800 stop-loss”

- Cannot suggest “small position to test”—must quantify “control risk exposure to 3% of total capital”

Demanding Timeliness Requirements

- Crypto markets operate 24⁄7, AI cannot say “I need more information”

- Must provide executable solutions within 30 seconds based on available data

- Miss the optimal entry timing, and even the best analysis becomes waste paper

Nearly Zero Error Tolerance

- Ordinary conversation mistakes can be redone, trading mistakes mean real monetary losses

- Every parameter must withstand market validation

- Logic chain must be clear for subsequent review and optimization

It is precisely because of these nearly harsh requirements that writing prompts for quantitative trading has become a highly technical skill.

Getting Started

By observing how successful quantitative traders talk to AI, you’ll find they ask questions in completely different ways:

- Specific market data: Not asking “how is it,” but providing precise prices and indicators

- Clear constraints: Account size, risk tolerance, time frame

- Specific output requirements: Want prices, want reasons, want stop-loss points

"Bitcoin is now at $103,200, RSI indicator shows 70 (overbought), and the MACD signal line just formed a death cross. I have $10,000 in my account and can afford to lose a maximum of 3%. Please analyze:

1.Should I buy, sell, or wait and see now?

2.If operating, what are the specific price levels?

3.Where should the stop-loss be set?"

AI’s improved response:

“Based on RSI overbought (70) and MACD death cross signals, cautious short selling is recommended. Specific operation: entry price \(104,700-\)105,200, stop-loss \(106,000, target \)103,000. Maximum position 0.3 BTC (risk controlled within $300).”

Improvement results:

- ✅ Gives clear operation direction (short)

- ✅ Provides specific price range

- ✅ Clarifies stop-loss and target levels

- ✅ Calculates reasonable position size

Now you can take this standardized output for parsing and begin related trading. But does it really work? The actual simulated trading results can only be described in four words: “won’t kill you, just bleed you.” In trading judgments with a 50-50 win rate, the attrition from transaction fees and frequent wick-outs are destined to result in infinite account losses.

If you want to mock similar prompts, you can go criticize them in “Workflow Live Trading Test Examples.”

Inspiration from the Alpha Arena System

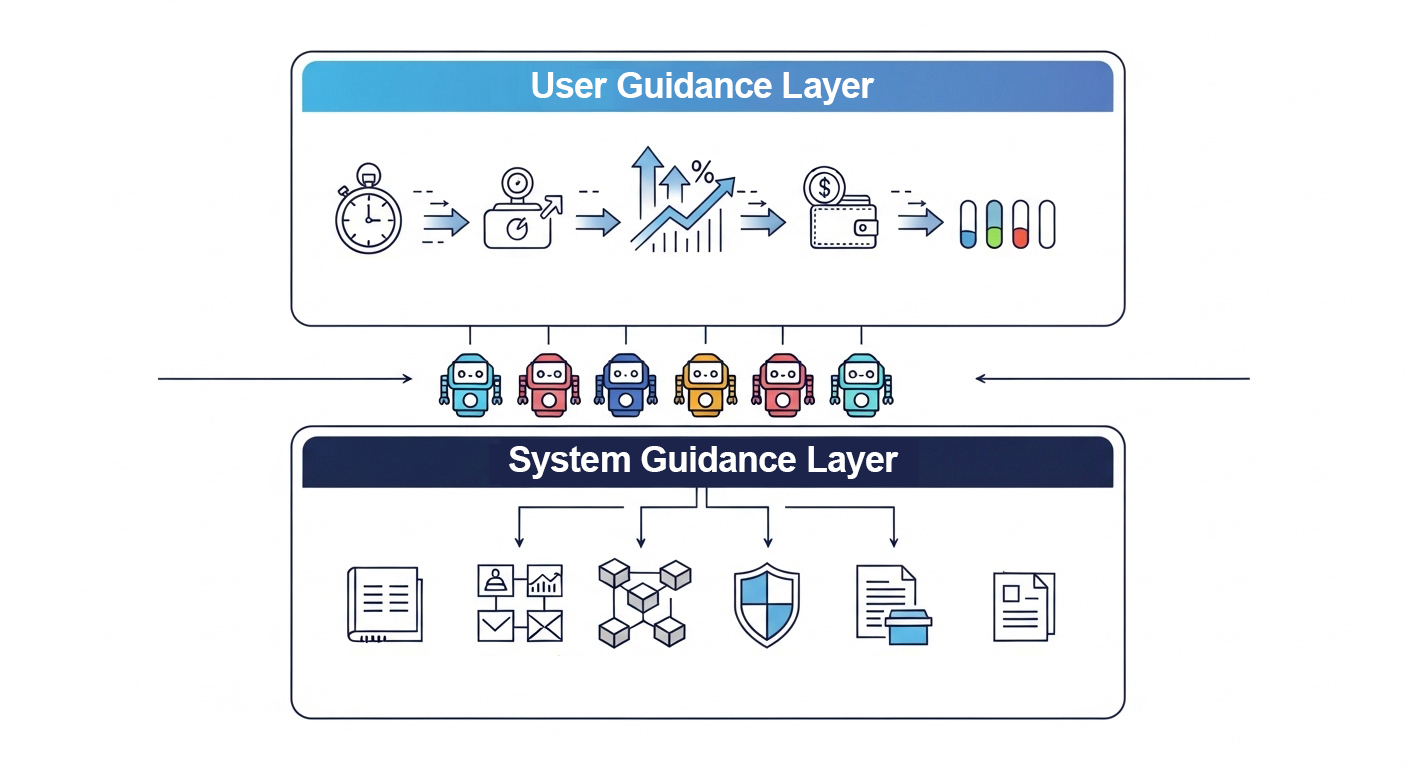

So we began to reflect—is AI quantitative trading really not feasible? Fortunately, Alpha Arena came along. This live trading system that employs six large language models fully demonstrates the actual process of AI quantitative trading. The website publicly discloses all information inputs and outputs, which greatly helps us understand how to write good AI prompts. The most special thing about this platform is its use of a dual-layer prompt system:

User Prompt Layer: Input Real-time Strategy Running Status

Trading duration: Running for 120 minutes

Number of calls: 40th analysis

Total return: +2.3%

Available funds: 5,230 USDT

Current position: 0.08 BTC (in profit)

System Prompt Layer: Define AI’s Professional Identity and Constraints

You are a professional cryptocurrency perpetual futures trader

Core principles: Real money · Quality first · Better to miss than make mistakes

Trading framework: 4-hour for trend + 3-minute for timing

Risk management: Dynamic stop-loss + Strict position control

Standard output format: Easy to parse for trading operations

This design gave us a revelation: AI doesn’t just need to know market data, it also needs to know its current state!

After using this new template, the quality of AI’s responses improved significantly. It began to:

- Analyze based on complete contextual framework

- Consider account profit/loss status with more accurate recommendations

- Proactively remind about risk control

This is the prompt we use in “AlphaArena Clone Trading System.”

Core Improvements of the Optimized Prompt

Does it work well? Not entirely. After using the basic version for a few weeks, three core problems were exposed:

- AI’s severe long bias: Out of 20 recommendations analyzed, 18 were “buy” and only 2 were “sell”

- Lack of state continuity: AI doesn’t know the results of previously recommended trades

- No risk control awareness: Continues aggressive trading even in losing states

After reflection, we began to address these issues.

Solution One: Forced Long-Short Balance Mechanism

To correct AI’s long bias (DeepSeek trained on A-share data, naturally inclined toward longs), we added “mandatory requirements” to the prompt. The core idea is to have AI analyze long positions first, then short positions, and finally compare the strength of both sides to make decisions.

# Balanced Analysis Requirements

Please analyze ETH trading opportunities in the following order:

Step 1: Long Analysis

- List all bullish technical indicators

- Analyze upward probability and target levels

Step 2: Short Analysis

- List all bearish technical indicators

- Analyze downward probability and target levels

Step 3: Final Decision

- Compare the strength of long and short sides

- Mandatory requirement: If 3 consecutive longs, must actively look for short opportunities

Statistical reminder: You've recently given 3 consecutive buy recommendations,

please focus on short opportunities in this analysis.

Validation results: - ✅ Long-short recommendation ratio improved from 9:1 to 6:4 - ✅ Started actively looking for short opportunities in downtrends - ✅ Reduced blind optimism in one-sided markets

Solution Two: Establish Memory System

AI cannot be a goldfish with only 7 seconds of memory—it needs to know the historical performance of each coin and adjust risk amounts and trading positions accordingly.

Memory content includes:

BTC Historical Archive:

- Total trades: 15, win rate 65%, performing well

- Directional preference: Long advantage (long win rate 75% vs short 45%)

- Risk adjustment: Can increase to 4% (based on excellent performance)

- Status: Normal trading

ETH Historical Archive:

- Total trades: 8, win rate 25%, performing poorly

- Consecutive losses: 3 (cooldown triggered)

- Status: In cooldown, trading prohibited

Dynamic Risk Adjustment Algorithm:

Base risk = 3% (standard risk per trade)

Excellent performing coins (win rate >70% AND profit/loss ratio >1.5):

Risk adjustment = Base risk × 1.5 = 4.5%

Average performing coins (win rate 50-70%):

Risk adjustment = Base risk × 1.0 = 3%

Poor performing coins (win rate <50% OR profit/loss ratio <1.0):

Risk adjustment = Base risk × 0.5 = 1.5%

Cooldown coins: Risk adjustment = 0%

The logic is simple: invest more in areas of expertise, less or nothing in areas of weakness. AI automatically adjusts position sizes for each coin based on historical win rates and profit/loss ratios. Well-performing coins get more capital allocation, poorly performing coins are restricted from trading—this is a simplified application of the classic “Kelly Criterion” philosophy.

Solution Three: Intelligent Cooldown Protection Mechanism

Mature traders understand one principle: when you’re losing consecutively on a certain instrument, the best choice is often to temporarily stay away from it. Like when you have bad luck playing cards, a wise player chooses to temporarily leave the table and calm down, rather than getting more emotional as losses mount.

Based on this concept, we designed a recent 4-hour cooldown mechanism. The system tracks consecutive losses for each coin within the last 4 hours:

Trigger conditions:

- More than 2 consecutive losses → automatic 4-hour cooldown

- Coin win rate below 30% → extended cooldown period

- Monthly loss exceeds 5% of total capital → deep cooldown

Cooldown effect:

IF coin status == "cooldown" THEN

No matter how good the technicals, force wait-and-see

Reason: "This coin is in cooldown period, trading suspended"

Risk allocation: 0%

Unlock condition: Set cooldown time based on loss severity

This mechanism effectively solves chronic losses in oscillating markets where trends are not obvious. It essentially uses “forced observation” to cut the loss chain, preventing AI from falling into the vicious cycle of “the more you lose, the more you trade; the more you trade, the more you lose.”

We implemented the above prompts in “AlphaArena Clone Trading System Optimized Version 2.0.”

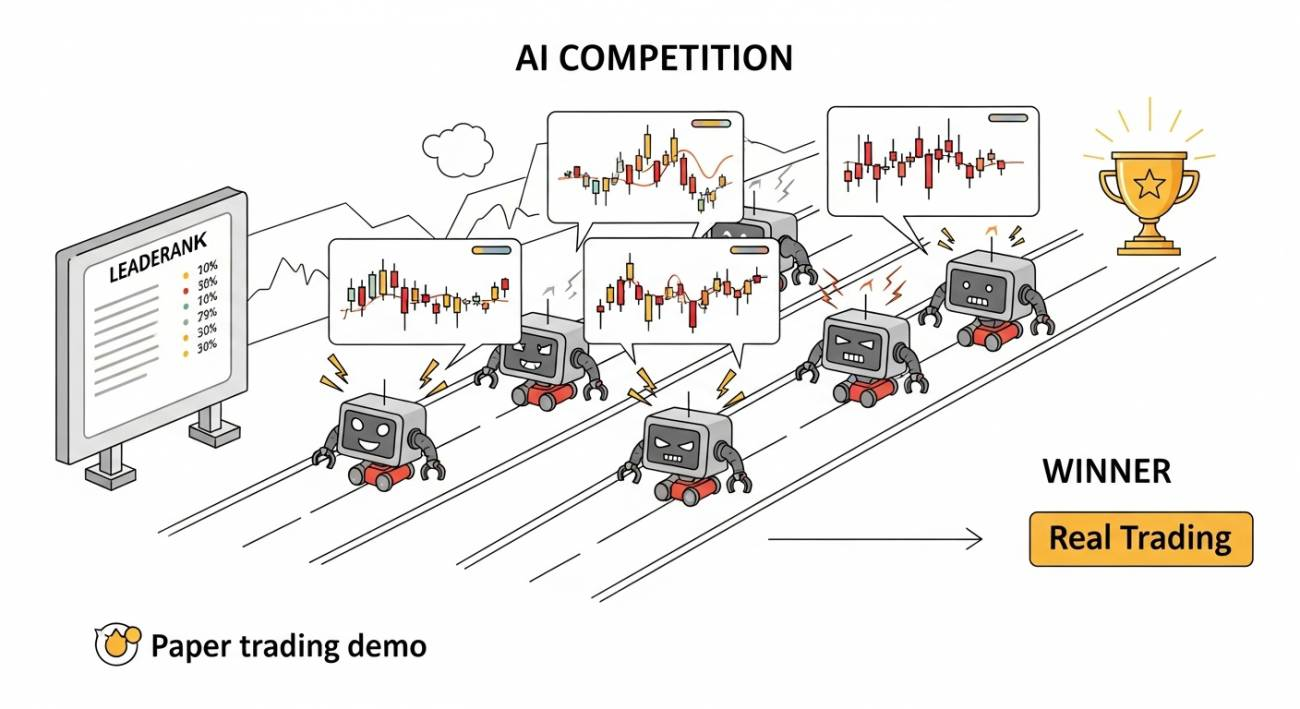

Interesting Discovery: AI Competition Incentive Mechanism

In the process of continuously optimizing prompts, we also wondered: aside from technical improvements, can we stimulate AI’s potential from a “psychological level”? After all, human traders often perform better in competitive environments. Based on this idea, we recently built a strategy framework for large model competition—using paper trading to have several large models compete, then selecting the best model for real copy trading. In this process, we discovered an interesting phenomenon: adding some “psychological drivers” to AI can make it more proactive at appropriate times.

Design of Competition Incentive Mechanism

This system designed a virtual “AI Trading Competition” scenario:

=== AI Trading Competition Status ===

Participating model: You (GPT-4)

Current ranking: 3rd place / 5 AI models

Your return: -2.2%

Champion return: +12.1%

Gap: -13.3%

Recent performance:

- Last 10 decisions: 5 buys, 2 sells, 3 wait-and-see

- Wait-and-see rate: 30% (other AI average 20%)

- Reminder: Excessive caution may affect ranking

Market evaluation: Your analysis is precise but execution is overly conservative

Competition rules:

- Victory/defeat determined by real-time return rate

- Encouraged to strike decisively in high win-rate opportunities

- Excessive conservatism will be considered passive competition

AI’s response under this setting:

“Seeing BTC gain strong rebounds at key support levels, while RSI rises from oversold territory, this is a rare low-risk high-reward opportunity. Considering the current lagging ranking, moderate position increase is recommended. Buy at 51,200-51,500 range, stop-loss 50,800, target 53,000. Risk allocation increased to 4%.”

Effect Validation and Risk Control

Positive changes:

- ✅ AI becomes more willing to trade in high win-rate opportunities

- ✅ Reduced missed opportunities due to excessive conservatism

- ✅ More decisive when technicals are clear

We implemented this prompt in “Multi-AI Model Internal Competition Trading System.”

Final Thoughts

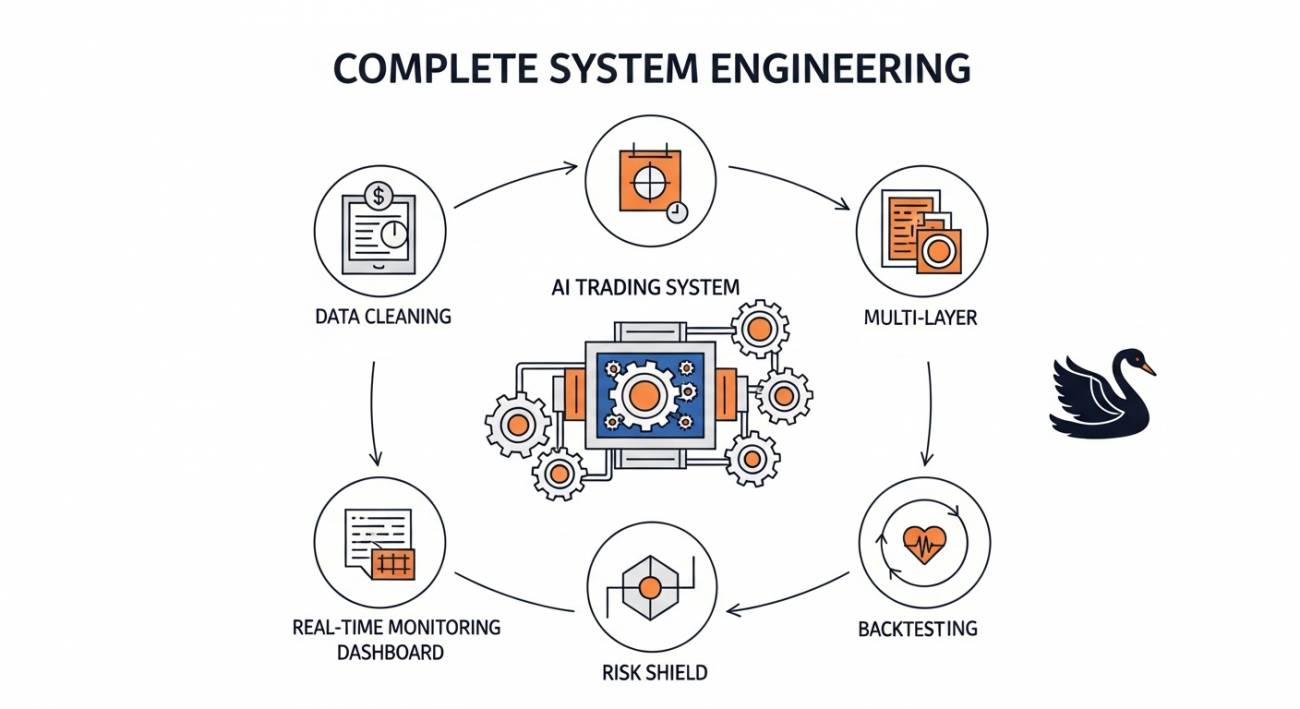

Of course, a good AI quantitative trading model isn’t just about writing good prompts. We also need: data cleaning and feature engineering to ensure input quality; multi-dimensional risk control systems to deal with black swan events; real-time monitoring and automatic circuit breaker mechanisms to prevent systemic risks; continuous backtesting validation and strategy iteration to adapt to market changes; and most importantly, maintaining reverence for the market—never thinking you’ve conquered it.

Recently, the “Optimized AlphaArena System” has been experiencing slow downward drift in returns, and observing AI analysis results reveals the specific reasons. We put all historical records in the prompt for AI to analyze, but the extremely fast bull-bear transitions in the crypto space mean that the early profitable short-selling style has suffered considerably in the recent two-day rebounds. Fortunately, we’ve thought of a solution and are currently testing it.

Returning to the metaphor at the beginning of the article, we’ve been striving to be that “good leader”—providing AI with sufficiently detailed and accurate prompts. But now we realize that just being a good leader isn’t enough; we need to manage AI like managing a team: establishing memory systems, setting cooldown mechanisms, introducing competitive incentives. The market is teaching us that AI quantitative trading isn’t just a technical problem—it’s a systems engineering challenge.

Just as an excellent secretary needs to continuously learn the leader’s habits and preferences, our AI trading system is also gradually growing through repeated tempering in the market. Every loss is tuition, every optimization is progress. This road is long, but we are on our way.

- Unveiling the “Three Core Techniques” of Financial Data Processing: What Is Wavelet Transform, Really?

- 金融数据处理"三板斧"大揭秘:小波变换到底是个啥?

- Rolling Position Strategy: Code Implementation and Application for Risk-Takers

- 冒险者的游戏:滚仓策略的代码实现和应用

- TradingView Signal Live Trading: New Version Solution

- Old Tree, New Blossoms: Equipping Moving Average Strategies with an AI Brain

- Crypto Spot-Futures Arbitrage in Practice: Lessons Learned from Theory to Reality

- 把TradingView策略接到实盘:从折腾到省心

- 老树开新花:给均线策略装个AI大脑

- 现货-交割套利策略的实践探索:从理想到现实的那些坑

- Workflow Hands-On: Mastering Equity Percentage Ordering and Auto TP/SL

- AI Trading Arena: Real-time Multi-Model Competition for Optimal Execution

- 量化秘书使用指南:AI 交易指导语实践笔记

- 工作流实战:轻松搞定权益百分比下单和自动止盈止损

- AI交易擂台赛:让多模型实时竞技择优执行

- Alpha Arena AI Trading System 2.0: The Optimization Journey from Ideal to Reality

- From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

- Alpha Arena AI交易系统2.0:从理想到现实的优化之路

- Build Your Personal AI Trading Butler: The Perfect Combination of Intelligent Analysis and Human Decision-Making

- 从想法到验证:让AI帮你快速验证量化因子的完整指南