AI Trading Arena: Real-time Multi-Model Competition for Optimal Execution

0

0

167

167

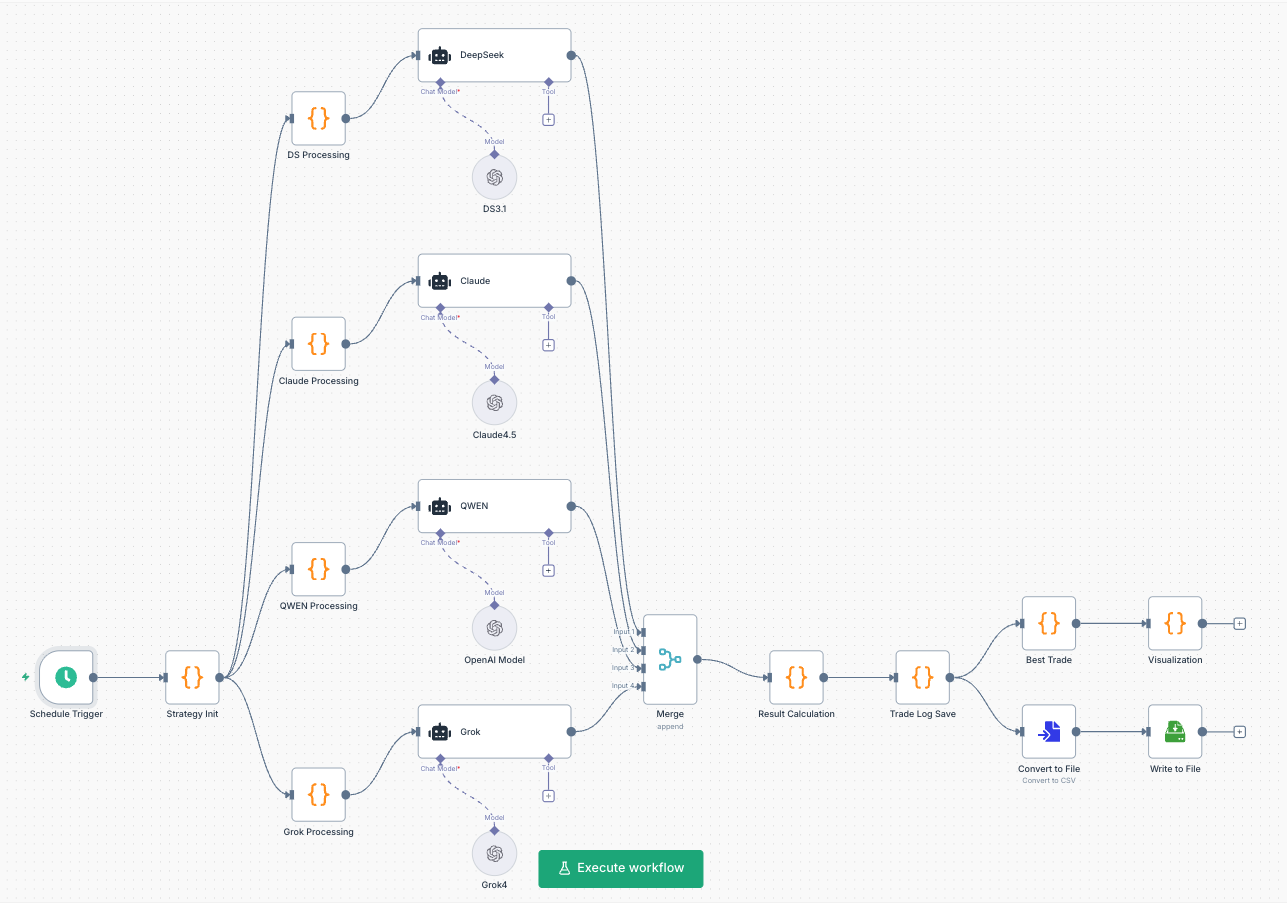

Introduction: The Evolution from Alpha Arena to Building Your Own Competition Arena

The emergence of Alpha Arena caused a stir in the quantitative trading community. Watching those AI models chase each other on the leaderboard—DeepSeek leading today, Qwen overtaking tomorrow, and Grok even dominating the early stages—this phenomenon sparked an interesting thought: since each AI has its own unique “personality” and strengths, why can’t we build a system that lets them compete in real-time within the same trading environment, then dynamically select the best-performing model to execute actual trades?

This idea sounds a bit crazy, but when you think about it carefully, it makes a lot of sense. Traditional quantitative strategies often rely on a single logical framework, while the diversity of AI models offers us new possibilities. Using the automation tools from the FMZ Quant (Inventor Quantitative Trading Platform) workflow, we implemented this idea and built a complete “AI Internal Competition Trading System.”

System Design: Building a Competition Stage for AIs

Multi-Model Parallel Decision-Making: Four AIs Competing on the Same Stage

The system selected four AI models with distinctly different personalities as trading participants:

- DeepSeek Chat V3.1: Born with quantitative competition pedigree, a rational analysis type with clear logic and methodical decision-making

- Claude 4.5: A balanced competitor, seeking optimal solutions between risk control and opportunity capture

- Qwen 3 Max: Representative from the Alibaba ecosystem, demonstrating stable performance in complex market environments

- Grok 4: Product from the world’s richest man Elon Musk, with thinking angles that are often unexpected

Each AI receives the same market data input but generates independent trading decisions based on their respective training backgrounds and reasoning approaches. This design ensures strategy diversification and avoids the cognitive blind spots that a single model might have.

Competition Ranking Mechanism: Driving Performance with “Vanity”

The core innovation of the system lies in introducing a real-time ranking mechanism. Each AI can see its current ranking among all models, and this “competitive pressure” is conveyed through carefully designed prompts:

- Leading position: “You’re currently performing well, keep actively trading to expand your profit advantage”

- Lagging position: “You’re currently behind, actively seek more quality trading opportunities to catch up and generate profits”

- Initial stage: “The competition just started! This is a great opportunity to build your profit foundation!”

This psychological suggestion mechanism allows AI models to exhibit different trading styles under varying pressure states, thereby increasing the strategy’s adaptability.

Virtual Positions and Live Trading Synchronization: Balancing Safety and Efficiency

The clever aspect of this design lies in adopting a dual-layer trading architecture:

Virtual Trading Layer: All AI models trade in a paper environment, calculating their respective profit/loss performance and ranking changes in real-time

Live Execution Layer: The system automatically identifies the best-performing model and synchronizes its virtual position state to the actual trading account

This design both ensures capital safety and achieves dynamic strategy optimization, avoiding the risk of letting unverified AI directly operate real funds.

Technical Implementation: The Complete Chain from Data to Decision

Multi-Timeframe Technical Analysis: Panoramic Market Perception

The system provides each AI with market data across three dimensions:

- Daily level: Captures long-term trends and major support/resistance levels

- Hourly level: Identifies medium-term trend changes and key turning points

- 5-minute level: Seeks precise entry and exit timing

Each timeframe contains the latest 10 values of core technical indicators including RSI, MACD, ATR, OBV, ensuring that AI can comprehensively understand the current market state and historical evolution process.

Standardized Decision Interface: Simplifying Complexity

To ensure decision consistency and comparability, the system defines five standardized trading actions:

const actions = [

"OPEN_LONG", // Open long position

"OPEN_SHORT", // Open short position

"CLOSE_LONG", // Close long position

"CLOSE_SHORT", // Close short position

"NO_ACTION" // No action for now

];

Each decision must be accompanied by a concise analytical rationale, which both allows tracking of the AI’s thinking process and provides data support for subsequent strategy optimization.

Dynamic Model Selection Algorithm: Survival of the Fittest Mechanism

The system continuously monitors the virtual trading performance of all AI models, employing a simple and effective survival-of-the-fittest mechanism:

// Find the currently best-performing model

let bestModel = null;

let bestPnl = currentThreshold;

models.forEach(model => {

if (model.realizedPnl > bestPnl) {

bestPnl = model.realizedPnl;

bestModel = model.name;

}

});

Once a new “champion” model is discovered, the system immediately switches the live trading following target, ensuring that capital always follows the best-performing strategy.

Practical Application

Diversified Decision-Making Styles

Through long-term observation, it was found that different AI models indeed exhibit distinct “personalities”:

- Risk preference differences: In ranging markets, conservative models tend to wait and observe, while aggressive models are more willing to try short-term opportunities

- Diverse analytical perspectives: Facing the same technical indicators, different models interpret them from completely different angles, and this diversity improves strategy robustness

- Obvious competitive effects: AI models that rank lower do become more aggressive, sometimes catching unexpected trading opportunities

Visualization Monitoring System

The system provides a real-time monitoring dashboard across four dimensions:

- Model Running Status: Displays real-time decisions and performance rankings of each AI

- Performance Comparison Analysis: Multi-dimensional evaluation of models’ historical performance and risk metrics

- Live Trading Status: Shows currently activated model and capital following situation

- Overall System Statistics: Provides global operational status and risk monitoring indicators

System Features: The Value of Innovation

Emotional Incentive Design

Introducing competitive psychology into the AI decision-making process is an interesting experiment. Through observation, it was found that this kind of “psychological suggestion” can indeed influence AI decision-making styles. Leading AIs behave more steadily, while lagging AIs exhibit stronger aggressiveness. If you’re interested in prompt design techniques, I could separately share some insights on “how to elegantly put pressure on AI.”

Self-Evolution Capability of Strategy

Compared to traditional static strategies, this system can automatically switch to the best-performing AI model according to market environment changes, achieving dynamic strategy evolution. This adaptability has important value in rapidly changing financial markets.

| Item | Status Description |

|---|---|

| DeepSeek | Daily MACD golden cross at bottom, clear trend, strategy is actively seeking major profit opportunities, strengthening leading advantage |

| Qwen | 15-minute MACD continues to strengthen, RSI not in overbought zone and OBV steadily rising. Shows strong intraday technical signals consistent with going long without current positions. Has favorable risk-reward ratio, aligns with goal of aggressively chasing gains |

| Claude | MACD turning positive, 5-minute MACD positive, RSI rising, current long position profitable. Continue holding to pursue more gains, maintain bullish tracking, catch up on ranking gap |

| Grok | Short-term MACD trend strongly positive (5.15) but insufficient confirmation, 5-minute RSI (58.65) but MACD ratio (27.27) shows weakening short-term rebound momentum, current long position floating profit about $111 USDT. With technical signals continuing upward, lock in profits, avoid giving back gains, lagging behind by 241 USDT, need to actively follow and compete for bottom rebound |

Transparency in Decision-Making Process

The decision rationale of each AI is fully recorded and displayed, breaking through the common “black box” problem in algorithmic trading. This transparency not only facilitates subsequent strategy optimization but also provides valuable data for understanding AI decision-making logic.

Limitations: Real-World Constraints in Technical Development

Considerations for Model Selection

The system currently employs four AI models, and this choice is mainly based on the following considerations:

- Response Speed: Although models like Gemini and GPT-5 are powerful in performance, they have high response latency and are unsuitable for real-time trading scenarios

- Stability Requirements: Selected models need to have good API stability and service availability

- Cost-Effectiveness: Control API calling costs while ensuring effectiveness

The system architecture supports flexible expansion and can add or replace AI models according to actual needs.

Latency Challenge

This is the biggest technical challenge currently faced. Each AI model requires several seconds to tens of seconds of inference time, which may miss the best entry timing in a fast-paced trading environment. In actual trading, there are often discrepancies between decision prices and execution prices. This problem needs to rely on overall improvements in AI inference speed and more efficient parallel processing mechanisms to resolve.

Application Scenario Positioning

The system is more suitable as a proof-of-concept and research tool rather than for direct use in large-scale live trading. Although it performs excellently in strategy testing and AI behavior analysis, practical application still needs to consider factors such as latency, cost, and stability.

Conclusion: A New Direction for AI-Driven Quantitative Trading

The multi-AI model competition trading system represents a meaningful exploration of the deep integration between quantitative trading and artificial intelligence. By having different AI models compete in a virtual environment, we can not only discover the unique advantages of each model but also build intelligent trading strategies that dynamically adapt to market changes. Although the current system still has technical limitations, this exploration provides valuable insights and experience for the future development of intelligent trading systems. With the continuous advancement of AI technology and the ongoing improvement of computing power, we believe such systems will play an increasingly important role in the field of quantitative trading.

For interested developers and researchers, you are welcome to further improve and experiment based on the open-source code. The charm of quantitative trading lies in the fact that there are always new possibilities waiting to be explored, and AI model competition is just an exciting starting point in this journey of exploration.

The Workflow Strategy: https://www.fmz.com/strategy/516727

- Rolling Position Strategy: Code Implementation and Application for Risk-Takers

- 冒险者的游戏:滚仓策略的代码实现和应用

- TradingView Signal Live Trading: New Version Solution

- Old Tree, New Blossoms: Equipping Moving Average Strategies with an AI Brain

- Crypto Spot-Futures Arbitrage in Practice: Lessons Learned from Theory to Reality

- 把TradingView策略接到实盘:从折腾到省心

- 老树开新花:给均线策略装个AI大脑

- 现货-交割套利策略的实践探索:从理想到现实的那些坑

- Quantitative Secretary User Guide: Practical Notes on AI Trading Instructions

- Workflow Hands-On: Mastering Equity Percentage Ordering and Auto TP/SL

- 量化秘书使用指南:AI 交易指导语实践笔记

- 工作流实战:轻松搞定权益百分比下单和自动止盈止损

- AI交易擂台赛:让多模型实时竞技择优执行

- Alpha Arena AI Trading System 2.0: The Optimization Journey from Ideal to Reality

- From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

- Alpha Arena AI交易系统2.0:从理想到现实的优化之路

- Build Your Personal AI Trading Butler: The Perfect Combination of Intelligent Analysis and Human Decision-Making

- 从想法到验证:让AI帮你快速验证量化因子的完整指南

- 打造你的专属AI交易管家:智能分析+人工决策的完美结合

- Making Traditional Strategies Smarter: Practical Applications of Workflow + AI