Build Your Personal AI Trading Butler: The Perfect Combination of Intelligent Analysis and Human Decision-Making

0

0

107

107

The Dilemma of Trading

Anyone who has traded before knows how frustrating the market can be. If you choose manual trading, you’ll quickly realize that you often lack professional technical indicators and it’s difficult to continuously track shifts in market sentiment. Even worse, when the market skyrockets or crashes, emotions easily spiral out of control—you fear when you should be greedy, and become greedy when you should be cautious. And since the market runs 24⁄7, you simply can’t stare at the screen all the time.

What about algorithmic trading? It sounds great in theory, but in reality, traditional quantitative strategies rely on fixed logic. They often fail to adapt to sudden market changes. On top of that, they operate as a complete black box—you have no idea why the program buys or sells at a given moment. It’s like handing your money to a robot and just hoping for the best.

So is there a way to combine professional data analysis and AI-driven insights while still keeping full control over your trading decisions? My answer is yes—by building an AI Trading Butler system.

How the Trading Butler Works

Imagine hiring a professional investment advisor. At predetermined intervals, he automatically gathers all kinds of market data—technical indicators, price movements, news updates, and market sentiment. Then, based on this information, he conducts in-depth analysis and provides investment suggestions from multiple angles, such as trend direction, risk levels, and capital flows.

But the key point is: he never acts on his own. He explains why he’s making a recommendation, lays out the underlying logic, and then waits for your final approval. If you agree, he executes immediately; if you disagree, he respects your judgment and logs the decision. Even better, you can message him anytime from your phone: “What’s my current position?” “How’s my account performing?” “Buy 100 USD worth of BTC for me.” And he will respond instantly. This is exactly the kind of Trading Butler system we aim to build.

Building the System with FMZ Workflows

I chose to implement this Trading Butler using the workflow feature on the FMZ platform. FMZ is a quantitative trading platform whose workflow module provides a visual, drag-and-drop interface. You can connect functional nodes like building blocks—scheduled triggers, data acquisition, AI analysis, manual confirmation, trade execution, and more. It’s far more intuitive than traditional coding. Plus, FMZ already integrates with major exchanges’ APIs, so you don’t need to deal with low-level API handling yourself.

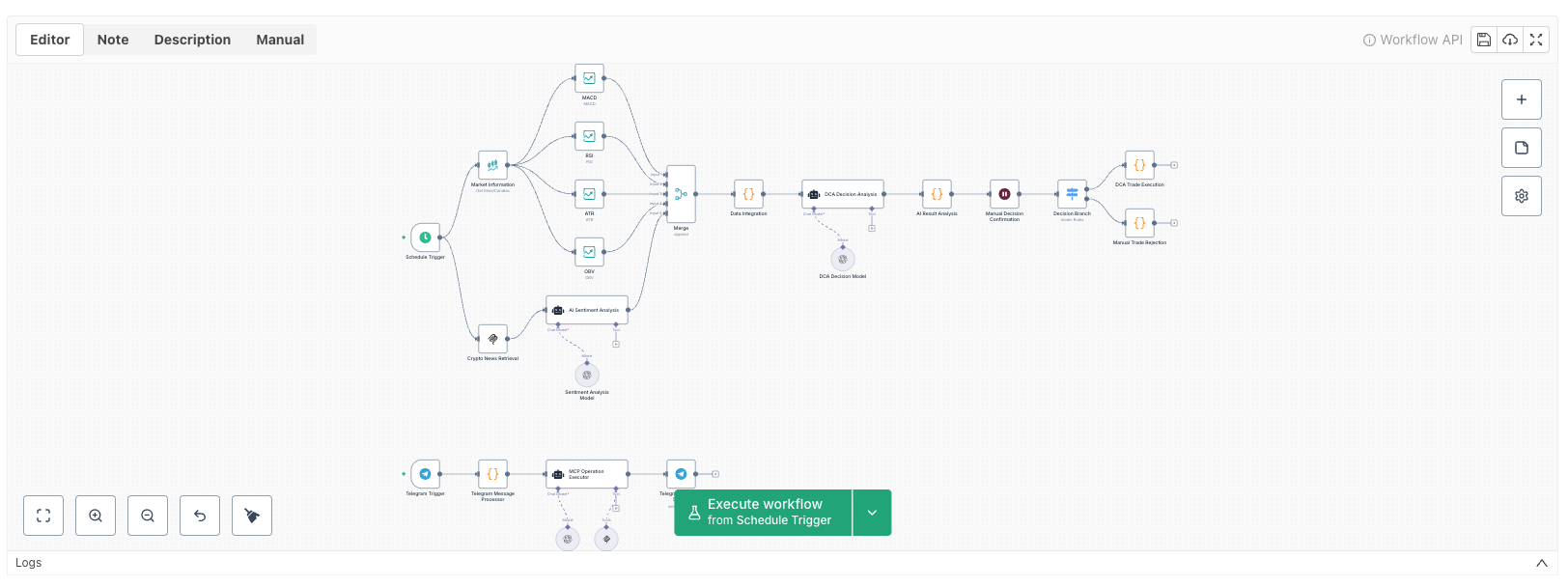

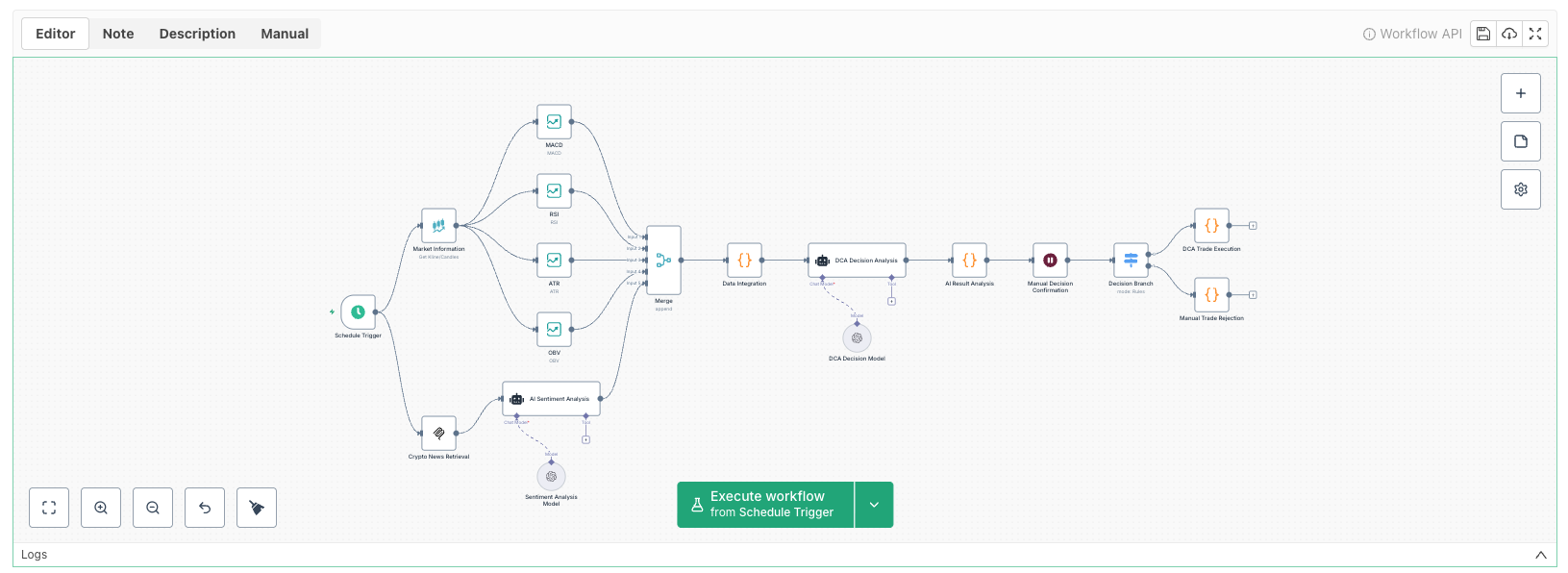

The entire workflow consists of two main pipelines:

The core DCA decision-making flow This handles periodic data collection, AI analysis, manual confirmation, and automated execution.

The Telegram remote-control flow This allows you to check your account or execute trades anytime from your phone.

I chose DCA (Dollar-Cost Averaging) as the demonstration strategy primarily because it best showcases the value of the Trading Butler. Traditional long-term holders often use a fixed DCA method—such as buying 100 USD of BTC every week, regardless of market fluctuations. While this approach is simple, it lacks flexibility.

With the Trading Butler, however, you can maintain DCA discipline while dynamically adjusting investment amounts based on market conditions—increasing investment during periods of fear to buy the dip, reducing or pausing investment during overheated markets, and maintaining the standard amount during sideways consolidation. This intelligent capital allocation avoids blind dip-buying risks while still capturing real opportunities, ensuring every dollar is used efficiently.

Now let’s take a closer look at how the two workflow pipelines operate.

How the DCA Decision-Making Flow Works

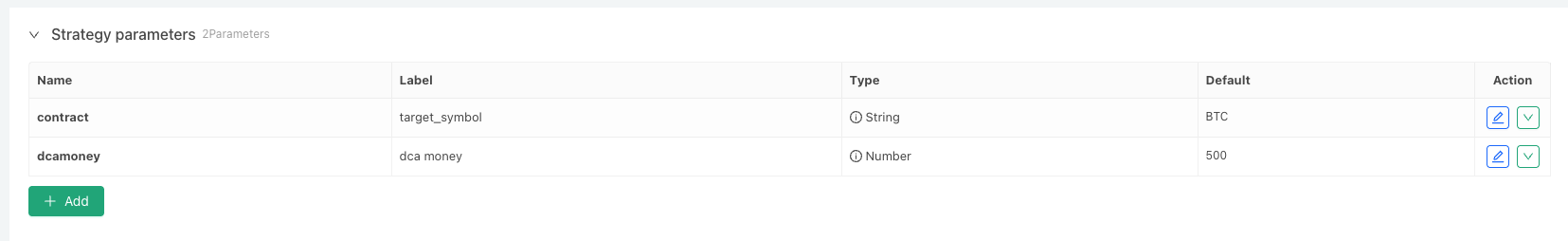

Before running the system, you need to configure two core parameters:

- contract – the asset you want to invest in, such as BTC or ETH

- dca_money – your baseline DCA investment amount, such as 100 USD

This baseline amount represents the standard investment size. The system will dynamically adjust it between 0× to 2× depending on market conditions. For example:

- During extreme fear, it may recommend investing 200 USD

- In overheated markets, it may suggest investing 0 USD (pause)

- In normal market conditions, the amount remains 100 USD

With these parameters set, you can proceed to configure the workflow.

Step 1: Data Collection

At fixed intervals, the system is triggered by a scheduler and automatically begins gathering market data. For technical indicators, it retrieves four core metrics: MACD, RSI, ATR, and OBV.

- MACD helps identify the strength and direction of market trends.

- RSI evaluates overbought and oversold conditions.

- ATR measures market volatility.

- OBV analyzes capital flows to validate the authenticity of price movements.

At the same time, the system fetches news data for the target asset via Alpha Vantage and passes it to the AI for sentiment analysis. The sentiment assessment covers two dimensions:

- Short-term sentiment – focusing on immediate market reactions and price fluctuations

- Long-term sentiment – evaluating fundamentals and long-term project outlook

Each dimension returns a sentiment category, numerical score, and detailed reasoning.

Step 2: Data Integration

The raw data collected must be preprocessed before use. The system extracts the MACD histogram (a key indicator for detecting trend shifts) and filters out early-stage invalid values, keeping only the latest 30 data points to ensure analytical relevance.

The sentiment analysis results are also merged into the dataset, forming a complete market data report ready for AI evaluation.

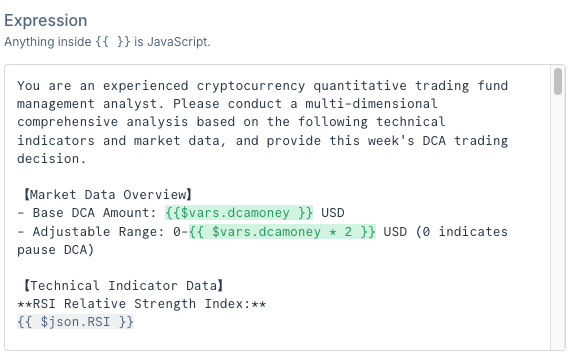

Step 3: AI Comprehensive Analysis

Once data integration is complete, the dataset is fed into an AI decision node for full-spectrum analysis. The AI evaluates the market across six dimensions:

- Trend Strength Analysis – using MACD to determine the current market phase

- Overbought/Oversold Assessment – identifying extreme sentiment via RSI

- Volatility Risk Evaluation – measuring uncertainty with ATR

- Capital Flow Health – validating trend sustainability with OBV

- Market Sentiment Weighting – combining short-term and long-term sentiment signals

- Risk–Reward Evaluation – assessing whether current conditions justify entering a position

Based on this multi-dimensional assessment, the AI outputs four types of recommendations:

- Aggressive Buying (1.5–2× the baseline amount, for extreme fear scenarios)

- Moderate Buying (1.2–1.49×, during corrections or pullbacks)

- Standard Investment (1×, for sideways or uncertain markets)

- Pause / No Investment (0×, when the market is overheated)

Each recommendation is accompanied by a detailed explanation, including:

- Current states of each technical indicator

- Confirmation or divergence between indicators

- The market cycle phase

- A balanced assessment of risks vs. opportunities

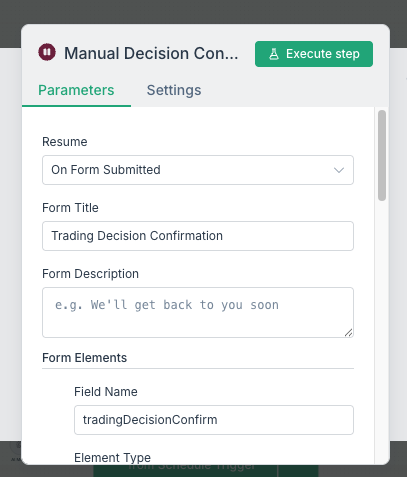

Step 4: Manual Confirmation

After the AI completes its analysis, the system sends the results to you—displaying the full reasoning behind the decision and the recommended investment amount—then waits for your confirmation. This is the most crucial part of the entire workflow: the final decision always remains in your hands.

You may approve the AI’s suggestion or reject it. The system also includes a fixed response timeout to ensure timely execution while still giving you enough room to think.

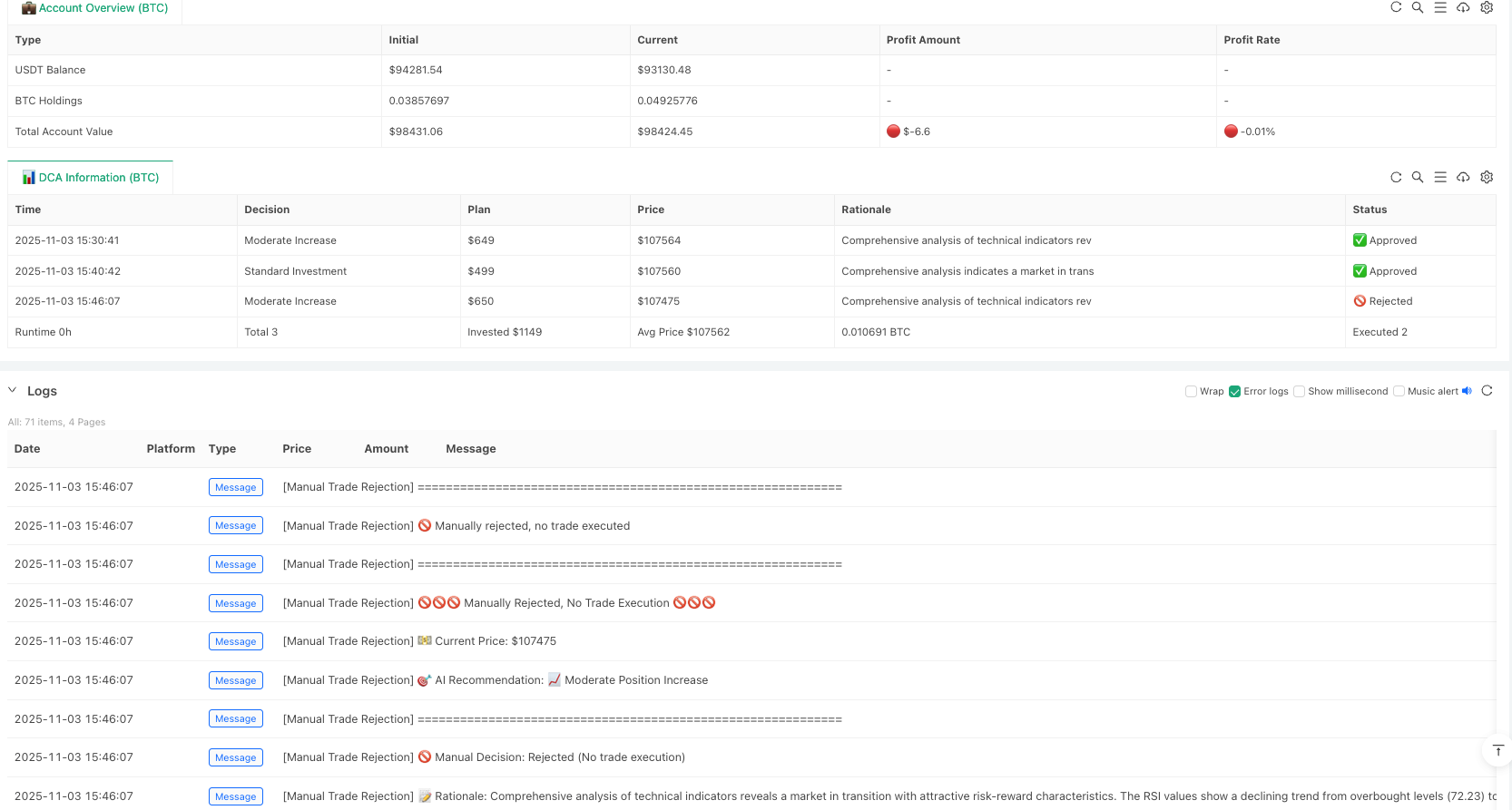

Step 5: Execution and Logging

Based on your decision, the system proceeds down different processing paths. If you approve the action, the system calls the exchange API to execute a spot buy order, records the actual filled amount, price, and cost, and updates the account’s statistical data. If you reject the suggestion, the system also logs the decision and the reason for the rejection, updates the statistics, but performs no trade.

Regardless of whether you approve or reject, every decision is fully stored in the historical records. The system continuously maintains an account overview, including:

- current holdings

- available balance

- profit/loss status

- DCA strategy statistics (duration of operation, total invested amount, average cost, current return rate)

All of this information is presented in a clear table format, making it easy to review at a glance.

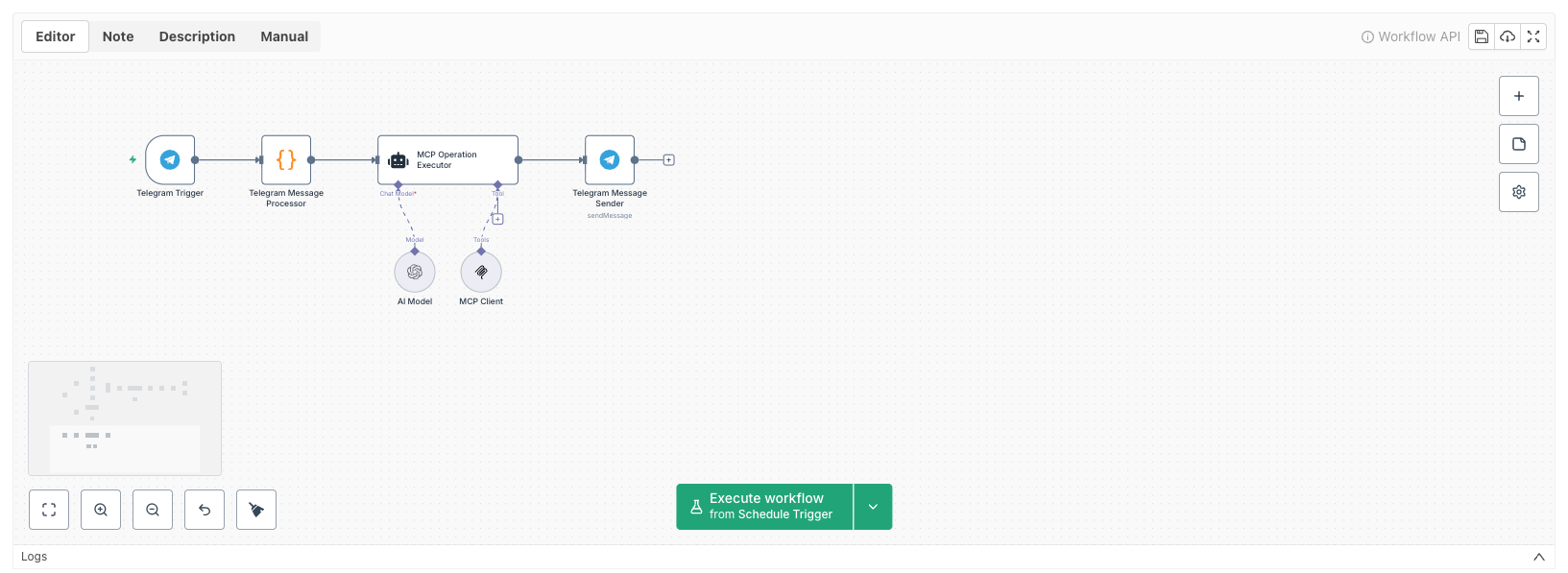

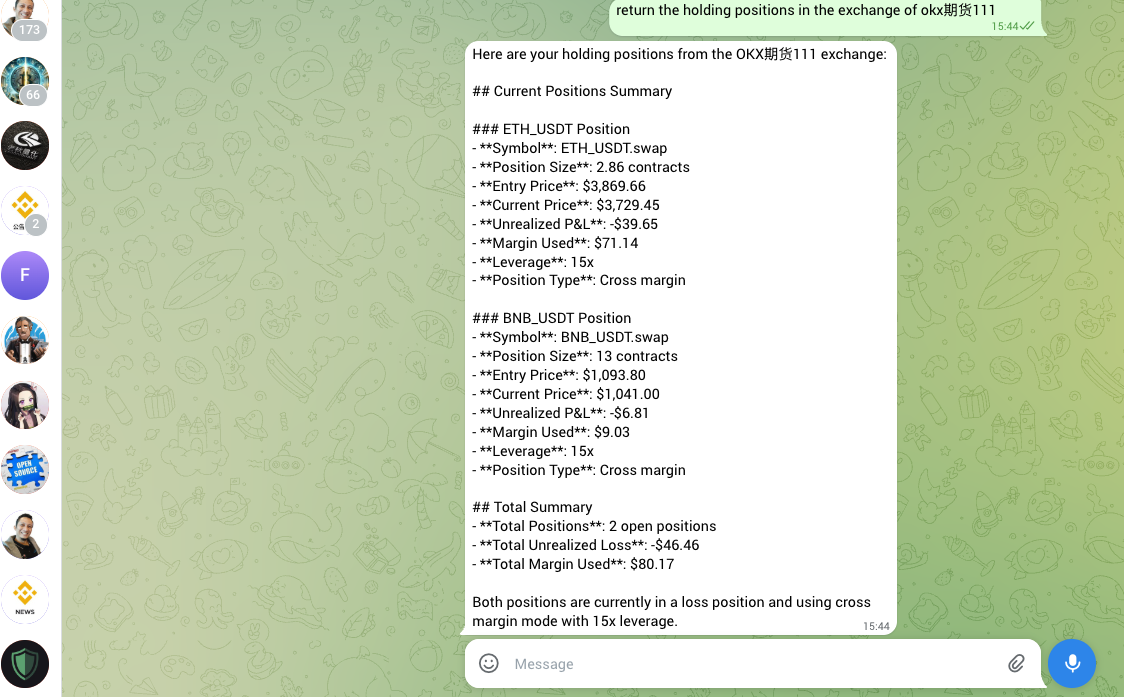

Telegram Remote-Control Workflow

In addition to the scheduled DCA workflow, the system also provides an always-available remote control interface. This feature is implemented through Telegram, allowing you to manage your trading account from your phone at any time.

The Telegram trigger checks for new messages every 30 seconds. You can send commands in natural language, such as:

- “Show my current BTC holdings”

- “What’s my account balance?”

- “Buy 100 USD of BTC”

- “What are my recent trades?”

- “What’s the current price of BTC?”

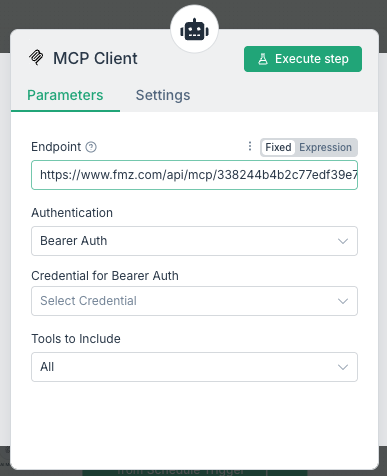

The core technology behind this is FMZ’s MCP service. MCP, short for Model Context Protocol, is a standardized protocol that allows AI to safely call exchange APIs. FMZ’s MCP comes with numerous built-in capabilities, including:

- querying account information

- retrieving real-time market data

- executing trade commands

- viewing historical orders

- managing strategy states

- and more

The handling process works like this: Once the system receives your Telegram message, it extracts the content and passes it to the AI to interpret your intent. The AI then calls the corresponding FMZ MCP function to perform the required action. After obtaining the result, the system formats it into readable text and sends it back to you via Telegram.

The entire process requires no knowledge of complex command syntax—it feels as natural as chatting with a real person. And thanks to the MCP protocol, every operation is executed with strict permission control, ensuring security throughout the workflow.

Practical Use Cases

In daily usage, the Trading Butler automatically collects and analyzes data at fixed times on weekdays, generates investment suggestions, and pushes the notification to your phone. You only need to spend a few seconds reviewing the AI’s analysis and recommended action. With a single tap—approve or reject—the system handles all follow-up operations and completes your scheduled investment routine.

When the market experiences sharp volatility, the Trading Butler may suggest an “Aggressive Buy.” It will also explain the reasoning in detail, such as: “RSI has dropped below 30, MACD shows a bullish crossover, market sentiment is fearful, but long-term fundamentals remain strong.” You can then combine this with your own judgment to decide whether to execute. Even if you reject the suggestion, the decision and reasoning are fully recorded for future review and learning.

If you suddenly want to check your account status on the go—say, on the subway—just open Telegram and send: “Check BTC holdings.” The Trading Butler instantly returns the details. You can follow up with “What’s the current price?” or even issue a direct command like “Buy 50 USD of BTC.” The system executes immediately and reports the result back to you.

Advantages of This System

Compared to manual trading, this system provides professional, multidimensional data analysis, so you no longer rely purely on intuition to make decisions.

Compared to traditional algorithmic strategies, it preserves flexible decision-making, avoiding rigid execution of fixed logic. All decisions are completely transparent—you can always see the analytical basis, decision logic, execution records, and profit/loss statistics behind each recommendation.

The position management mechanism is fully adaptive:

- During fear → it recommends increasing investment to buy the dip

- During sideways markets → it sticks to the standard DCA amount

- During overheated markets → it suggests pausing investment

This level of flexibility is something hardcoded strategies cannot achieve.

And with Telegram remote control, you can manage your account anytime, anywhere—without opening a computer or logging into an exchange.

More importantly, long-term use of this system gradually teaches you:

- what each indicator represents

- how market sentiment influences price

- when to be greedy and when to be cautious

- how to balance risk and reward

It becomes a valuable learning tool, helping you evolve from relying on the system to becoming a trader capable of independent judgment.

In short, this AI Trading Butler frees your time, improves decision quality, preserves your authority, offers convenient account management, and supports continuous learning. It’s not a cold trading bot—it’s a helpful assistant that understands your needs and strikes the perfect balance between automation and human control. Whether you’re a beginner or an experienced trader, this kind of tool can help you make more rational investment decisions. In a highly volatile market, having a reliable trading assistant may be one of the keys to success.

Appendix: Full Source Code & Resources

Full source code:

FMZ Quant Platform: https://www.fmz.com/strategy/515399 Supports replacing AI models and choosing different assets for validation.

Risk Disclaimer

This article is for technical learning only and does not constitute investment advice. Cryptocurrency trading is highly risky and may result in the loss of all principal. Always perform thorough testing before using real funds.

- 现货-交割套利策略的实践探索:从理想到现实的那些坑

- Quantitative Secretary User Guide: Practical Notes on AI Trading Instructions

- Workflow Hands-On: Mastering Equity Percentage Ordering and Auto TP/SL

- AI Trading Arena: Real-time Multi-Model Competition for Optimal Execution

- 量化秘书使用指南:AI 交易指导语实践笔记

- 工作流实战:轻松搞定权益百分比下单和自动止盈止损

- AI交易擂台赛:让多模型实时竞技择优执行

- Alpha Arena AI Trading System 2.0: The Optimization Journey from Ideal to Reality

- From Idea to Validation: A Complete Guide to Rapidly Validating Quantitative Factors with AI

- Alpha Arena AI交易系统2.0:从理想到现实的优化之路

- 从想法到验证:让AI帮你快速验证量化因子的完整指南

- 打造你的专属AI交易管家:智能分析+人工决策的完美结合

- Making Traditional Strategies Smarter: Practical Applications of Workflow + AI

- AlphaArena AI Model Battle: A Hands-On Guide to Replicating DeepSeek's Leading AI Quantitative Trading System

- AlphaArena大模型厮杀:手把手复刻DeepSeek领跑的AI量化交易系统

- 让传统策略更聪明:工作流+AI的实战玩法

- A Retail Investor's Self-Discipline Journey: Using AI to Block 80% of Bad Trades

- RWA New Strategy: A Step-by-Step Guide to Automated US Stock Token Trading with Inventor Workflow

- 一个散户的自我驯化实录:用AI拦下80%的烂交易

- RWA新玩法:手把手教你用发明者工作流自动交易美股代币