Sma-BTC-Killer

Schriftsteller:ChaoZhang, Datum: 2022-05-17 11:23:58Tags:SMAATRADX

Hallo!

Ich habe eine schöne Strategie mit einem wahnsinnigen Gewinn gemacht mit nur LANGEN und SHORT-Orders Nun, diese Strategie ist für ------->>> BINANCE:

Die Strategie ist ganz einfach.

Strategie mit 3 verschiedenen SMA (7,21,55) zur Suche nach einem richtigen Trend Um viele falsche Signale zu vermeiden, habe ich zwei Indikatoren hinzugefügt:

ADX - ist einer der leistungsfähigsten und genauesten Trendindikatoren. ADX misst, wie stark ein Trend ist und kann wertvolle Informationen darüber geben, ob es eine potenzielle Handelsmöglichkeit gibt. CLOUD - Dies ist einer der Newset-Indikatoren, die ich verwende. Dieser Indikator hilft bei der Strategie, dieser Indikator ist darauf ausgelegt, den richtigen Markttrend anzuzeigen. Durch die Anwendung der großen Länge dieses Indikators kann ich eine Trendänderung etwas später, aber genauer bemerken.

Außerdem habe ich zum Maximalsicherheits-Stop-Loss hinzugefügt.

Um ehrlich zu sein, diese Strategie sieht wirklich gut aus, viele Trades, hoher Gewinn und eine kleine Anzahl von Indikatoren, die zukünftigen Gewinne könnte ähnlich sein

Die Verwendung dieser Kombinationen von SMA gibt mir erstaunliche schnelle Veränderungen, während sich der Trend auch schnell ändert, wie hier:

Schnappschuss

Leider war ich nicht in der Lage, 100% falsche Signale auf dem Flachdiagramm wie hier zu eliminieren:

Schnappschuss

Ich hoffe, dass diese Strategie für alle nützlich ist ;)

Immer im Arsch.

Genießen Sie es!

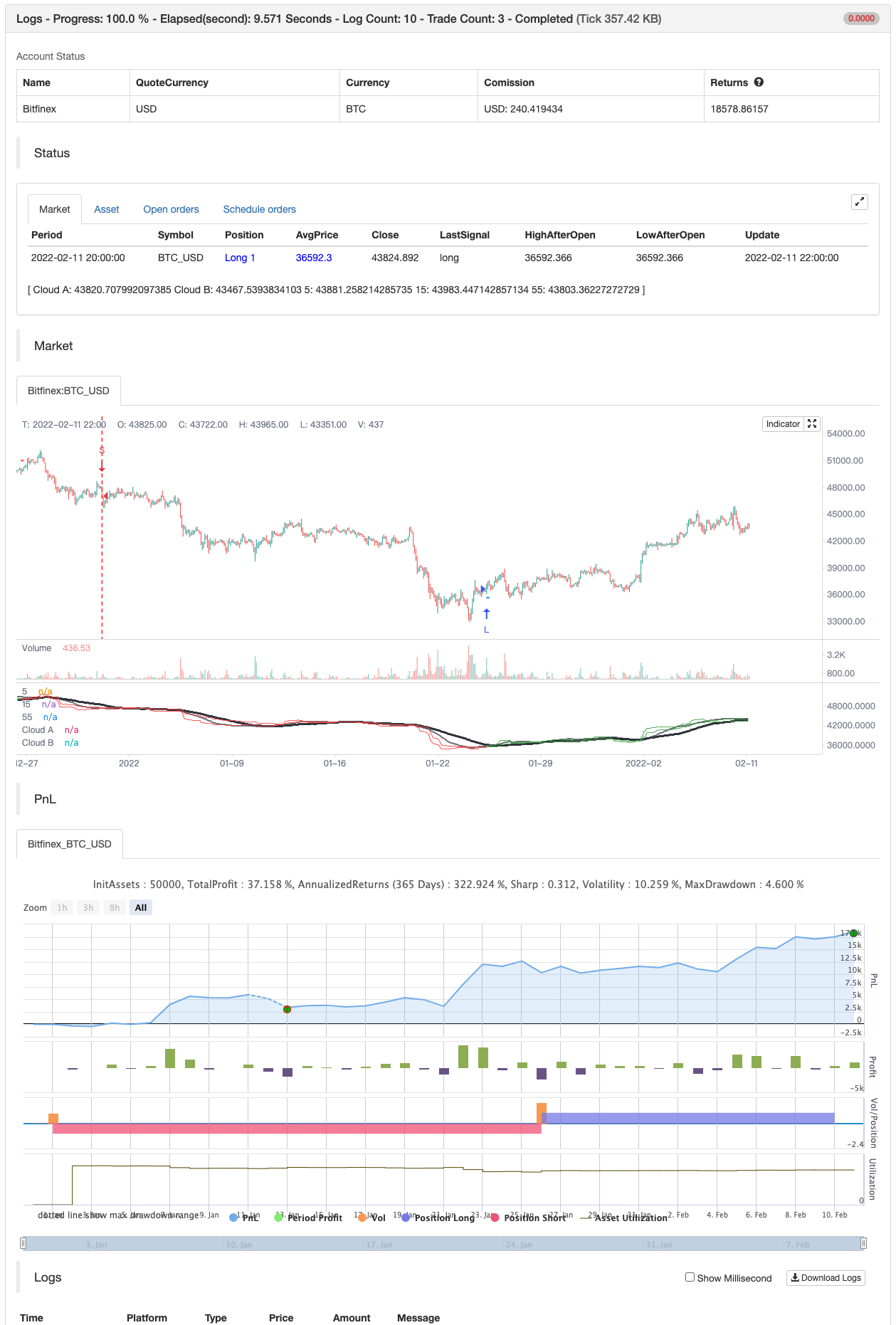

Zurückprüfung

/*backtest

start: 2022-01-01 00:00:00

end: 2022-02-11 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © wielkieef

//@version=4

src = close

//strategy("Sma BTC killer [60MIN]", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.04)

//SMAs -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Length1 = input(14, title=" 1-SMA Lenght", minval=1)

Length2 = input(28, title=" 2-SMA Lenght", minval=1)

Length3 = input(55, title=" 3-SMA Lenght", minval=1)

xPrice = close

SMA1 = sma(xPrice, Length1)

SMA2 = sma(xPrice, Length2)

SMA3 = sma(xPrice, Length3)

//Indicators Inputs -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ADX_options = input("MASANAKAMURA", title=" Adx Type", options = ["CLASSIC", "MASANAKAMURA"], group="Average Directional Index")

ADX_len = input(29, title=" Adx Lenght", type=input.integer, minval = 1, group="Average Directional Index")

th = input(21, title=" Adx Treshold", type=input.integer, minval = 0, group="Average Directional Index")

len = input(11, title="Cloud Length", group="Cloud")

// ATR Inputs -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

prd = input(18, title=" PP period", group="Average True Range")

Factor = input(5, title=" ATR Factor", group="Average True Range")

Pd = input(6, title=" ATR Period", group="Average True Range")

//Indicators -------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

calcADX(_len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, _len)

_plus = fixnan(100 * rma(plusDM, _len) / truerange)

_minus = fixnan(100 * rma(minusDM, _len) / truerange)

sum = _plus + _minus

_adx = 100 * rma(abs(_plus - _minus) / (sum == 0 ? 1 : sum), _len)

[_plus,_minus,_adx]

calcADX_Masanakamura(_len) =>

SmoothedTrueRange = 0.0

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementMinus = 0.0

TrueRange = max(max(high - low, abs(high - nz(close[1]))), abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1]) /_len) + TrueRange

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1]) / _len) + DirectionalMovementPlus

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1]) / _len) + DirectionalMovementMinus

DIP = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIM = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = abs(DIP-DIM) / (DIP+DIM)*100

adx = sma(DX, _len)

[DIP,DIM,adx]

[DIPlusC,DIMinusC,ADXC] = calcADX(ADX_len)

[DIPlusM,DIMinusM,ADXM] = calcADX_Masanakamura(ADX_len)

DIPlus = ADX_options == "CLASSIC" ? DIPlusC : DIPlusM

DIMinus = ADX_options == "CLASSIC" ? DIMinusC : DIMinusM

ADX = ADX_options == "CLASSIC" ? ADXC : ADXM

L_adx = DIPlus > DIMinus and ADX > th

S_adx = DIPlus < DIMinus and ADX > th

ADX_COLOR = L_adx ? color.lime : S_adx ? color.red : color.orange

PI = 2 * asin(1)

hilbertTransform(src) =>

0.0962 * src + 0.5769 * nz(src[2]) - 0.5769 * nz(src[4]) - 0.0962 * nz(src[6])

computeComponent(src, mesaPeriodMult) =>

hilbertTransform(src) * mesaPeriodMult

computeAlpha(src, fastLimit, slowLimit) =>

mesaPeriod = 0.0

mesaPeriodMult = 0.075 * nz(mesaPeriod[1]) + 0.54

smooth = 0.0

smooth := (4 * src + 3 * nz(src[1]) + 2 * nz(src[2]) + nz(src[3])) / 10

detrender = 0.0

detrender := computeComponent(smooth, mesaPeriodMult)

I1 = nz(detrender[3])

Q1 = computeComponent(detrender, mesaPeriodMult)

jI = computeComponent(I1, mesaPeriodMult)

jQ = computeComponent(Q1, mesaPeriodMult)

I2 = 0.0

Q2 = 0.0

I2 := I1 - jQ

Q2 := Q1 + jI

I2 := 0.2 * I2 + 0.8 * nz(I2[1])

Q2 := 0.2 * Q2 + 0.8 * nz(Q2[1])

Re = I2 * nz(I2[1]) + Q2 * nz(Q2[1])

Im = I2 * nz(Q2[1]) - Q2 * nz(I2[1])

Re := 0.2 * Re + 0.8 * nz(Re[1])

Im := 0.2 * Im + 0.8 * nz(Im[1])

if Re != 0 and Im != 0

mesaPeriod := 2 * PI / atan(Im / Re)

if mesaPeriod > 1.5 * nz(mesaPeriod[1])

mesaPeriod := 1.5 * nz(mesaPeriod[1])

if mesaPeriod < 0.67 * nz(mesaPeriod[1])

mesaPeriod := 0.67 * nz(mesaPeriod[1])

if mesaPeriod < 6

mesaPeriod := 6

if mesaPeriod > 50

mesaPeriod := 50

mesaPeriod := 0.2 * mesaPeriod + 0.8 * nz(mesaPeriod[1])

phase = 0.0

if I1 != 0

phase := (180 / PI) * atan(Q1 / I1)

deltaPhase = nz(phase[1]) - phase

if deltaPhase < 1

deltaPhase := 1

alpha = fastLimit / deltaPhase

if alpha < slowLimit

alpha := slowLimit

[alpha,alpha/2.0]

er = abs(change(src,len)) / sum(abs(change(src)),len)

[a,b] = computeAlpha(src, er, er*0.1)

mama = 0.0

mama := a * src + (1 - a) * nz(mama[1])

fama = 0.0

fama := b * mama + (1 - b) * nz(fama[1])

alpha = pow((er * (b - a)) + a, 2)

kama = 0.0

kama := alpha * src + (1 - alpha) * nz(kama[1])

L_cloud = kama > kama[1]

S_cloud = kama < kama[1]

float ph = pivothigh(prd, prd)

float pl = pivotlow(prd, prd)

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

center := (center * 2 + lastpp) / 3

Up = center - (Factor * atr(Pd))

Dn = center + (Factor * atr(Pd))

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

L_ATR = Trend == 1

S_ATR = Trend == -1

// Strategy logic ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

var bool longCond = na, var bool shortCond = na

var int CondIni_long = 0, var int CondIni_short = 0

var bool _Final_longCondition = na, var bool _Final_shortCondition = na

var float last_open_longCondition = na, var float last_open_shortCondition = na

var int last_longCondition = na, var int last_shortCondition = na

var int last_Final_longCondition = na, var int last_Final_shortCondition = na

var int nLongs = na, var int nShorts = na

Long_MA =L_adx and L_cloud and (SMA1 < close and SMA2 < close and SMA3 < close )

Short_MA =S_adx and S_cloud and (SMA1 > close and SMA2 > close and SMA3 > close )

longCond := Long_MA

shortCond := Short_MA

CondIni_long := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_long[1] )

CondIni_short := longCond[1] ? 1 : shortCond[1] ? -1 : nz(CondIni_short[1] )

longCondition = (longCond[1] and nz(CondIni_long[1]) == -1 )

shortCondition = (shortCond[1] and nz(CondIni_short[1]) == 1 )

var float sum_long = 0.0, var float sum_short = 0.0

var float Position_Price = 0.0

var bool Final_long_BB = na, var bool Final_short_BB = na

var int last_long_BB = na, var int last_short_BB = na

last_open_longCondition := longCondition or Final_long_BB[1] ? close[1] : nz(last_open_longCondition[1] )

last_open_shortCondition := shortCondition or Final_short_BB[1] ? close[1] : nz(last_open_shortCondition[1] )

last_longCondition := longCondition or Final_long_BB[1] ? time : nz(last_longCondition[1] )

last_shortCondition := shortCondition or Final_short_BB[1] ? time : nz(last_shortCondition[1] )

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

last_Final_longCondition := longCondition ? time : nz(last_Final_longCondition[1] )

last_Final_shortCondition := shortCondition ? time : nz(last_Final_shortCondition[1] )

nLongs := nz(nLongs[1] )

nShorts := nz(nShorts[1] )

if longCondition or Final_long_BB

nLongs := nLongs + 1

nShorts := 0

sum_long := nz(last_open_longCondition) + nz(sum_long[1])

sum_short := 0.0

if shortCondition or Final_short_BB

nLongs := 0

nShorts := nShorts + 1

sum_short := nz(last_open_shortCondition)+ nz(sum_short[1])

sum_long := 0.0

Position_Price := nz(Position_Price[1])

Position_Price := longCondition or Final_long_BB ? sum_long/nLongs : shortCondition or Final_short_BB ? sum_short/nShorts : na

ATR_L_STOP = ssignal and in_longCondition

ATR_S_STOP = bsignal and in_shortCondition

// Plots and colors 010101010101010010101010101010101010101001010101010101001010101001010100101100111100101010010100110110010011100101010101010010101010101001011110011010101010101001010100101100110101010001001010101001010101001110110010101010100101010101010100111110101010101010101010100101010101100

colors = (in_longCondition ? color.green : in_shortCondition ? color.red : color.orange)

bgcolor(color=colors)

//barcolor (color = colors)

plotshape(longCondition, title="Long", style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.small , transp = 0 )

plotshape(shortCondition, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small , transp = 0 )

mama_p = plot(mama, title="Cloud A", style= plot.style_stepline, color=colors )

fama_p = plot(fama, title="Cloud B", style= plot.style_stepline, color=colors )

fill (mama_p,fama_p, color=colors )

plot(SMA1, color=color.white,style= plot.style_stepline, title="5", linewidth=1)

plot(SMA2, color=color.gray,style= plot.style_stepline, title="15", linewidth=2)

plot(SMA3, color=color.black,style= plot.style_stepline, title="55", linewidth=3)

plotshape(ATR_L_STOP, title = "ATR LONG CLOSE", style=shape.arrowdown, location=location.abovebar, color=color.red, size=size.small , text="ATR LONG CLOSE", textcolor=color.red, transp = 0 )

plotshape(ATR_S_STOP, title = "ATR SHORT CLOSE", style=shape.arrowup, location=location.belowbar, color=color.blue, size=size.small, text="ATR SHORT CLOSE", textcolor=color.blue, transp = 0 )

// Strategy -----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

if Long_MA

strategy.entry ("L", strategy.long)

if Short_MA

strategy.entry ("S", strategy.short)

strategy.close_all( when = ATR_L_STOP or ATR_S_STOP)

// By wielkieef

- Holen Sie sich Ihren Trend.

- Volumenbasierte dynamische DCA-Strategie

- Elliott-Wellen-Theorie 4-9 Impulswellen automatische Detektion Handelsstrategie

- Willkommen auf dem Bärenmarkt.

- Handelsstrategie für eine skalierbare Volatilität innerhalb des Tages

- Supertrend+4bewegt

- Alpha-Trend

- Linienanzeiger folgen

- Konzept Dual SuperTrend

- Echtzeit-Trendlinie-Handel auf Basis von Pivot-Punkten und Neigung

- RISOTTO

- EMA-Intraday-Strategie in der Cloud

- Supertrend des Drehpunkts

- Supertrend+4bewegt

- Momentum-basierte ZigZag

- VuManChu-Chiffer B + Divergenzstrategie

- Konzept Dual SuperTrend

- Super Scalper

- Zurückprüfung - Indikator

- Trendylich

- ML-Warnungsvorlage

- Fibonacci-Progression mit Pausen

- RSI MTF Ob+Os

- Fukuiz Octa-EMA + Ichimoku

- MTF Ob+Os der KMU

- Ein intelligenter MACD

- Strategie des OCC R5.1

- Willkommen auf dem Bärenmarkt.

- - Ich weiß.

- Drehpunkte Hoch-Niedrig-Multi-Zeitrahmen